Contents

1) Newjaisa Technologies Limited

- Business Overview – Newjaisa Technologies Ltd is an India-based technology company specializing in direct-to-consumer refurbished IT electronics. The company offers a range of products, including laptops, Chromebooks, desktops, monitors, and accessories, catering to a Pan India customer base through e-commerce platforms. Key customer segments include students, home users, SMEs, and working professionals. The company focuses on providing affordable IT solutions across various industries.

- Recent Filings – Newjaisa Technologies Ltd has successfully allotted 30,42,000 equity shares at an issue price of INR 98 each, with a face value of INR 5 and a premium of INR 93 per share. This allotment amounts to a total equity share subscription consideration of INR 29,81,16,000, received from investors under the non-promoter category.

- Future Outlook –

- Target high-double-digit growth with a minimum CAGR of 50%.

- Aim to increase direct corporate purchases to 40%-45% of total sales.

- Double current capacity within the next 6 months.

- Provide monthly updates for investors, enhance e-commerce customer service, optimize working capital, and maintain an EBITDA margin of 14-15%.

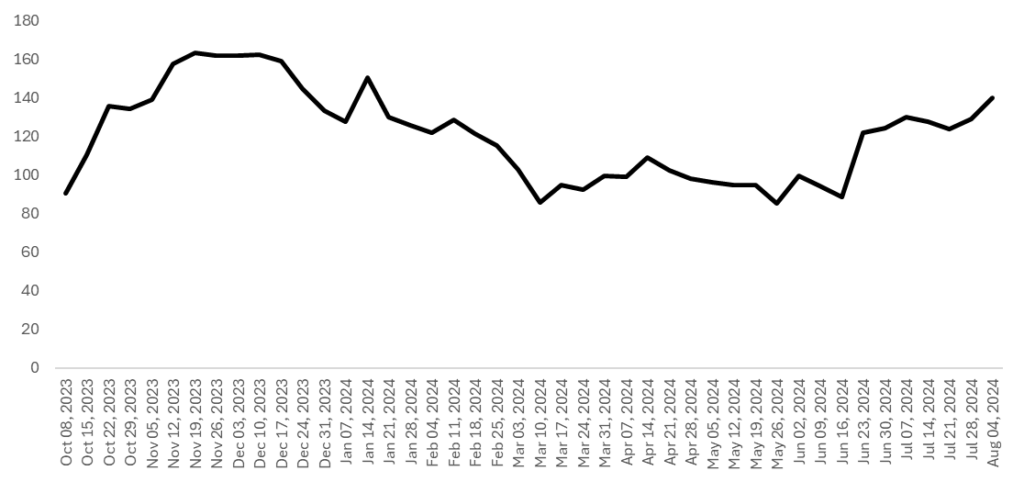

- Price Chart since listing –

2) A B Infrabuild Limited

- Business Overview – A B Infrabuild Ltd is a premier civil construction firm focusing on roads, railways, bridges, and infrastructure projects. Recognized as a Grade “AA” contractor by the Municipal Corporation of Greater Mumbai and a Class 1(A) contractor by the Maharashtra Public Works Department, it holds OHSAS 18001:2007, ISO 14001:2015, and ISO 9001:2015 certifications. The company’s services include building Road Over Bridges (ROB), Foot Over Bridges (FOB), station infrastructure, and various types of bridges and roads. Notable projects include ROBs and FOBs in Mumbai and the Gopal Krishna Gokhale Bridge reconstruction. With clients like Western Railway and MRVC, it derives 99% of its revenue from contract sales and recently moved to the NSE and BSE Main Board in May 2023, highlighting its growth and quality commitment.

- Recent Filings – A B Infrabuild Limited informed the exchange about the Board Meeting on August 16, 2024, to discuss strategic initiatives, potential business opportunities, and operational updates. This include the reconstitution of Board committees to strengthen governance with their strategic efforts to boost growth and market position.

- Recent Update –

- The Rights Issue of the Company, initially set to open on June 7, 2024, and close on June 21, 2024, has been extended. The Rights Issue Committee will notify eligible shareholders of the revised schedule once finalized. The offer price and rights entitlement ratio will remain unchanged from the earlier approval communicated to the stock exchange. (3th June, 2024)

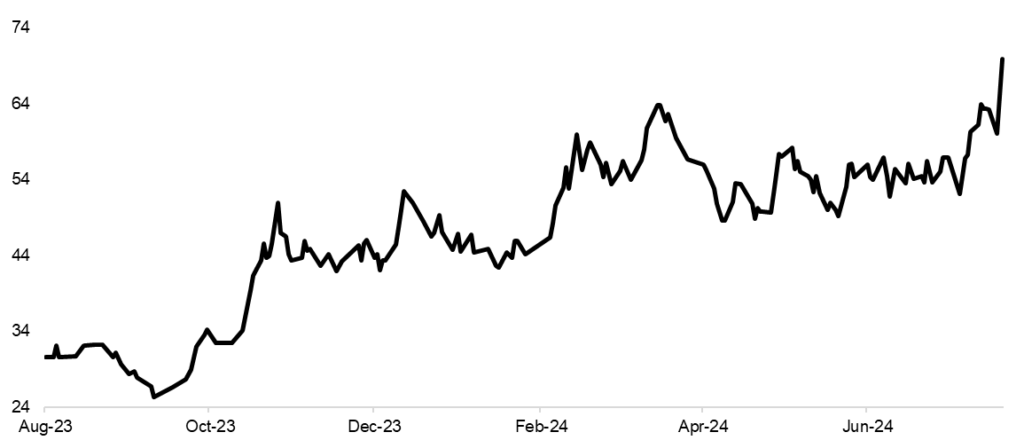

- 1Y Price Chart –

3) Mangalam Worldwide Limited

- Business Overview – Incorporated in 1995, Mangalam Worldwide Ltd (MWL) is a multifaceted company that manufactures and trades steel products, including stainless steel billets and flat bars, from its facilities in Halol and Changodar, Gujarat. The company also offers consultancy services and manufactures SS round bars and SS bright bars through third-party manufacturers. Additionally, MWL trades in steel scrap and ferro alloys. Promoted by the Ahmedabad-based Mangalam Group, MWL is an ISO-9001:2015, ISO-14001:2015, ISO 45001:2018, and QMS certified multi-location, fully integrated stainless steel mill, underscoring its commitment to quality and environmental standards.

- Recent Filings – Manglam Worldwide Limited’s Sales have increased by 13.8% YOY from Rs. 201.37 cr to Rs. 229.15 cr and net profit increased by the 100% from Rs. 2.97 cr to Rs.6.28 cr.

- Future Outlook –

- Sale of 48,000 shares worth ₹ 6711780 by Om Prakash Mangal belonging to promoter group through Market Sale. (18h June 2024)

- Successful execution of pilot orders for the Grid Controller of India and ONGC underscores the company’s growing footprint in the cyber security sector, with additional participation in tenders for government organizations, potentially expanding market share.

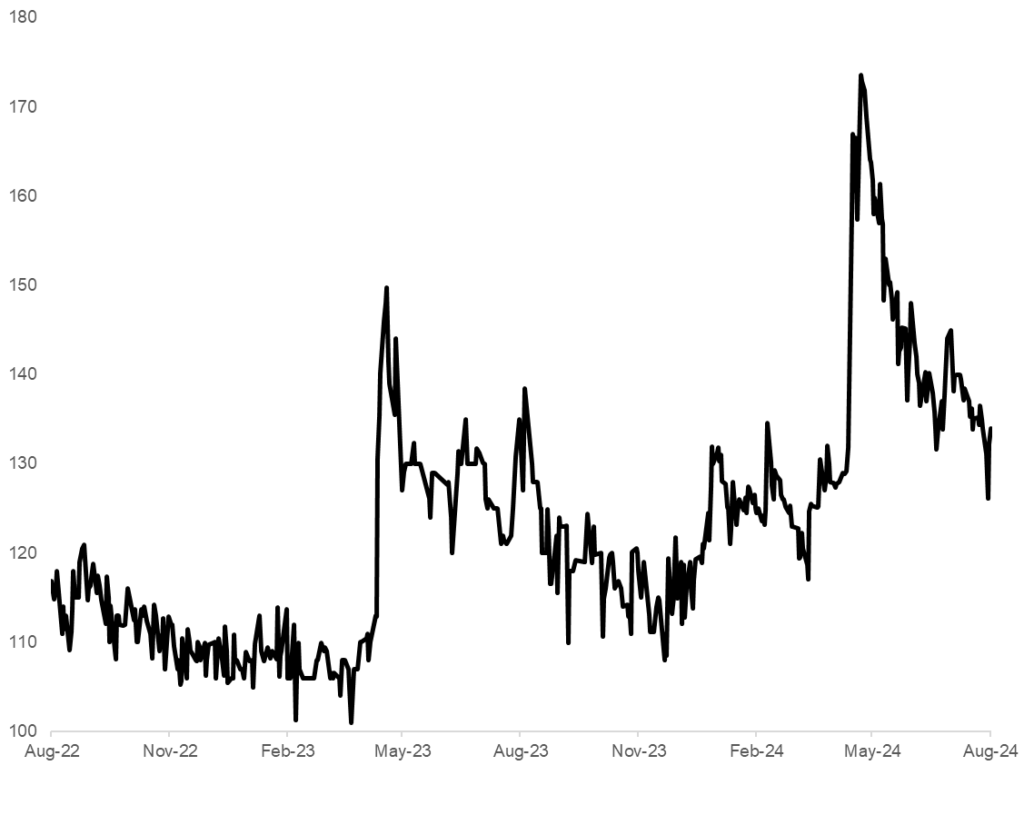

- 2Y Price Chart –

4) PG Electroplast Limited

- Business Overview – PG Electroplast Limited is the flagship company of PG Group, formally set up in 2003 and is a leading, diversified Indian Electronic Manufacturing Services provider. It specializes in Original Design Manufacturing (ODM), Original Equipment Manufacturing (OEM) and Plastic Injection Molding, catering to 50+ leading Indian and Global brands.

- Recent Filings – Company in its meeting held on Monday, August 05, 2024, allotted 6,56,000 Equity Shares of Rs. 1/- each to the ‘PG Electroplast Limited Employees Welfare Trust’ under PG Electroplast Employees Stock Options Scheme -2020.

- Future Outlook –

- Company’s Revenue guidance is of at least Rs. 3650 Cr which is a growth of 32.9% over FY24 Revenues of Rs. 2746 Cr. This is despite TV business revenues shifting to JV company Goodworth Electronics Ltd.

- Net profit guidance of Rs. 216 Cr which is a growth of 57.7% over FY24 net profit of Rs. 137 Cr.

- In FY2025, Management expects EBITDA margins to have slight upward bias.

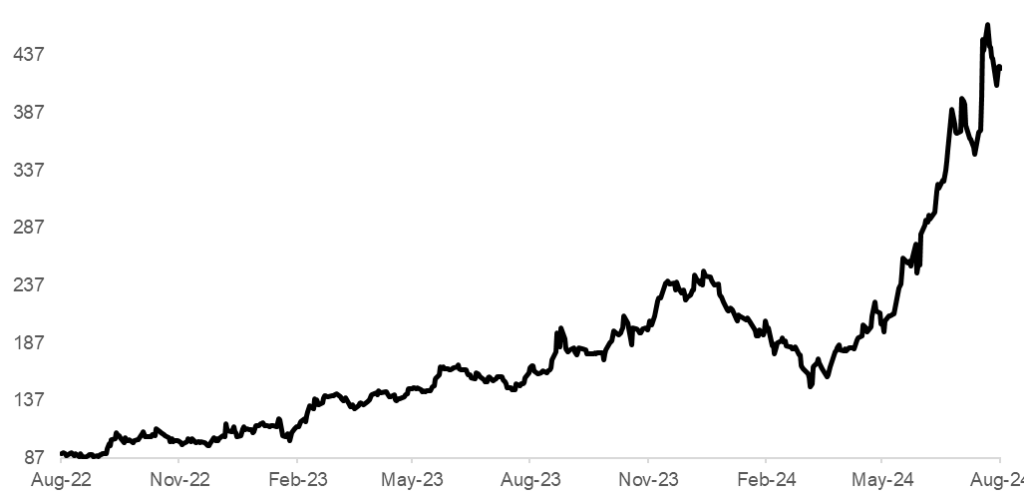

- 1Y Price Chart –

Past Coverages

| Coverage Date | Company | LTP on Coverage Date | Current LTP | % change since coverage | Recent Filings |

| 9/07/24 | Emerald Finance Ltd. | ₹42 | ₹71.2 | 66.7% | Recent Concall Anticipates its book size to grow by 8 to 10 times over the next three years. (16th July) |

| 22/07/24 | EMS Ltd. | ₹684 | ₹837.85 | 18.3% | New Order Company received a LoA worth INR 535 Cr for Development of Water Supply and Sewerage System with 18 years O&M in Vikas Nagar Dehradun, Uttarakhand. (19th July) |

| 8/07/24 | Dhabriya Polywood Ltd. | ₹379 | ₹437.85 | 26.5% | New Order Company received two work orders aggregating to INR 5.2 Cr on 4th July. |

| 19/07/24 | Shakti Pumps Ltd. | ₹3,901 | ₹4276 | 20.1% | EXCELLENT Q1FY25 RESULT For Q1FY25, Sales up 5x YoY and Net Profit up 93x. (20th July) |

| 19/07/24 | Anant Raj Ltd. | ₹480.7 | ₹555 | 10.9% | Entered a MoU Anant Raj Cloud Pvt Ltd, a wholly-owned subsidiary of Anant Raj, entered into a MOU with Google LLC. (20th July) |

| 8/07/24 | Dynamic Services & Security Ltd | ₹276 | ₹275.6 | 5.4% | Share Repurchase Agreement Company has entered a Share Repurchase Agreement with the existing shareholder of Nacof Nithin Sai Green Energy to acquire 49% of the outstanding share capital of the Target Company. |