1) Felix Industries Limited

- Business Overview – Felix Industries is a leading provider of comprehensive water and environmental solutions. The company offers advanced technologies, including Zero Liquid Discharge, Reverse Osmosis, and Nano Membrane systems. With a diverse portfolio of over 450 proprietary technologies, Felix is committed to sustainable practices that ensure water sufficiency for future generations.

- Recent Filings – Company has announced Preferential Allotment of 3,60,580 fully paid-up Equity Shares upon conversion of equal number of convertible Warrants at a price of Rs. 175 including premium of Rs. 165 per equity share.

- Outlook –

- Company to utilize IPO proceeds for growth, repayment of debt, strengthening the balance sheet, and reducing finance costs.

- Company holds expectations of maintaining sales growth and increasing EBITDA in FY25 and FY26.

- Looking to expand fleet rental services, already acquired two hydraulic, two pullers, and 18 axles.

- Following recent quarter results, Company fulfilled 26,460 orders, served 940 customers with average revenue per order at INR 86,373, and thereby targeting a revenue growth of 31% each year for FY ’25 and ’26.

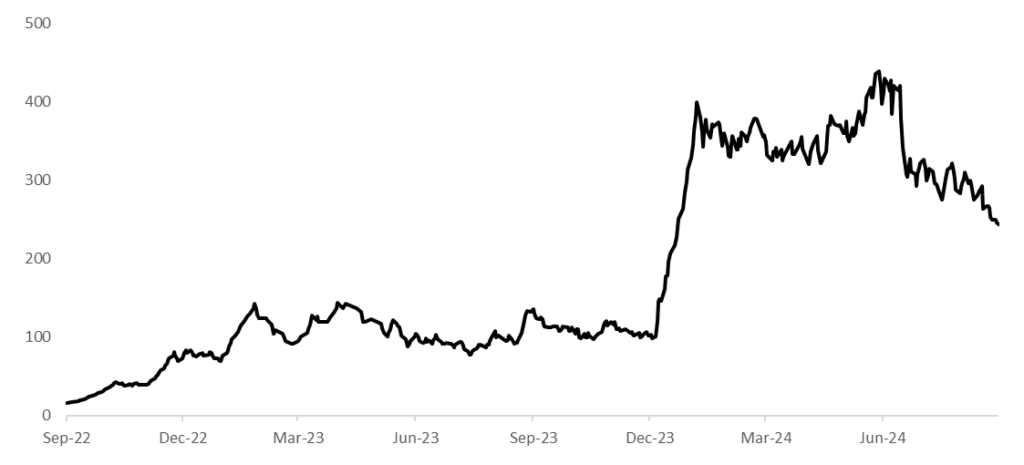

- 2Y Price Chart –

2) IBL Finance Limited

- Business Overview – IBL Finance Limited started its lending operations in 2019 targeting self-employed professionals and small business owners. It transitioned to a fintech-based platform in 2020, utilizing technology and data science for efficient lending. The company offers instant personal loans through a mobile app, making the process nearly fully digital.

- Recent Filings – The company’s finance committee has authorized the issuance of 35,500 unlisted, senior, secured, taxable, redeemable non-convertible debentures (NCDs) with a face value of ₹1,000 each. These debentures will be issued at an issue price of ₹1,000 each, totaling ₹3.55 crore. The allotment will be done on a private placement basis.

- Recent Updates –

- In FY24, the company’s revenue from operations increased to ₹14.12 crore, up from ₹13.30 crore in FY23.

- The company’s Profit After Tax (PAT) for FY24 was ₹2.28 crore, compared to ₹2.04 crore in FY23.

- Revenue from operations grew by 6.14% compared to the previous year.

- The company’s PAT margin was 16.16% in FY24, up from 14.49% in FY23.

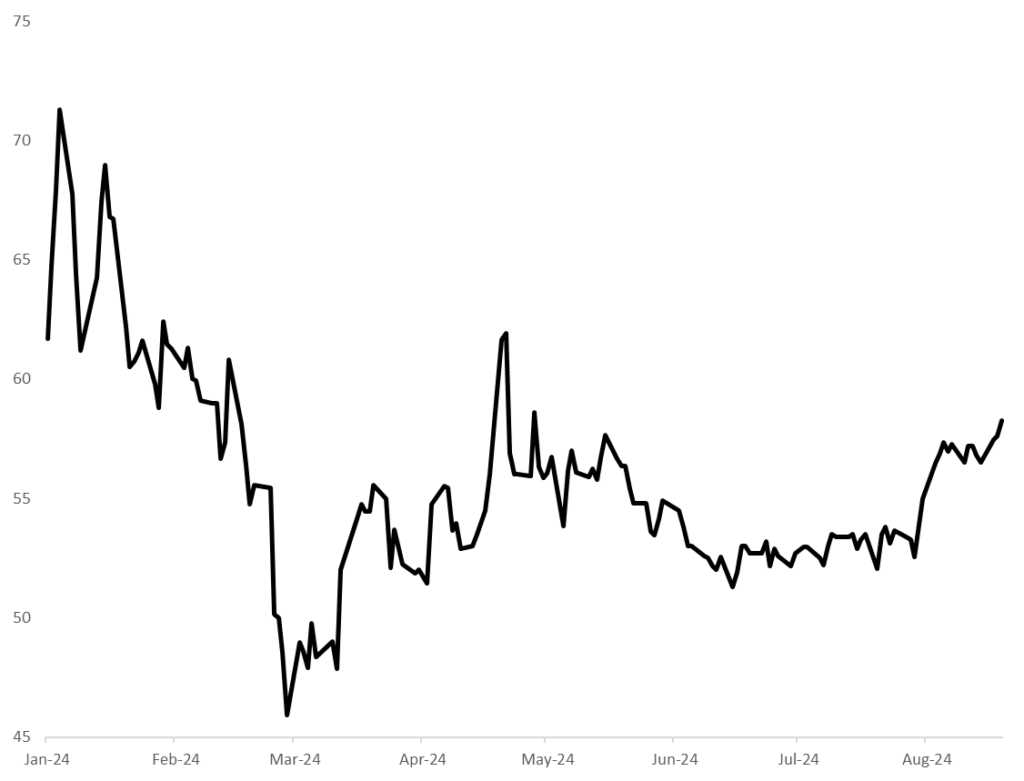

- Price Chart since listing –

3) Chavda Infra Limited

- Business Overview – Chavda Infra Limited operates in the civil construction sector, delivering a wide array of construction and related services for residential, commercial, and institutional projects. The company offers comprehensive services across the entire construction value chain, including planning, design, construction, and post-construction activities.

- Recent Filings – Chavda Infra has secured a work order worth INR 59.36 Crores for construction of a Residential Building, to be completed within 24 months. The current order book stands at INR 1044 Crores, with an unexecuted order value of INR 663 Crores as of 2nd September 2024.

- Recent Outlook –

- Chavda Infra is identifying lucrative opportunities in the growing real estate market of Ahmedabad and surrounding regions, with an emphasis on quality projects and timely execution.

- It is also strengthening its order book through upcoming projects in GIFT City and other developing areas

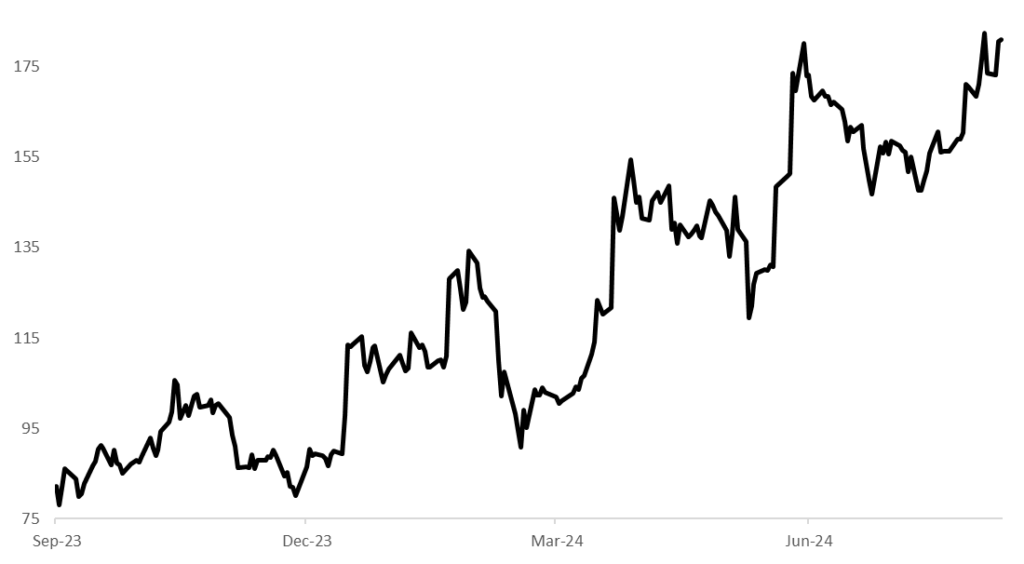

- 2Y Price Chart –

Past Coverages

| Coverage Date | Company | LTP on Coverage Date | Current LTP | % change since coverage | Recent Filings |

| 1/08/24 |

PNGS Gargi Fashion Jewellery Ltd. |

₹841 |

₹880 |

4.6% |

EXCELLENT RESULTS For Q1 FY24, sales surged 2.1x YoY to INR 13.7 Cr (INR 44 Cr under FOFO model), with profit before tax up 93% to INR 2.9 Cr.(01st August) |

|

08/08/24 |

PG Electroplast Ltd. |

₹423 |

₹538 |

27.2% |

ORDER On August 5, 2024, the company allotted 6,56,000 equity shares to the ‘PG Electroplast Limited Employees Welfare Trust’ under the 2020 Employee Stock Options Scheme.(08th August) |

|

13/08/24 |

Hi-Tech Pipes Ltd. |

₹162 |

₹185.2 |

14.3% |

GOOD TO EXCELLENT RESULTS For Q1 FY24, sales rose 35% YoY to INR 867 Cr, with net profit up 2.3x to INR 18 Cr. QoQ, sales increased 27%, and net profit jumped 64%. (13th August) |

|

14/08/24 |

Bondada Engineering Ltd |

₹3250 |

₹680 |

-1.3% |

ORDER For Q1 FY24, sales surged 2.2x YoY, and net profit jumped 3.6x. QoQ, sales were flat, while net profit declined 26%. (14th August) |

|

8/07/24 |

Dynamic Services & Security Ltd |

₹276 |

₹260 |

-5.8% |

Share Repurchase Agreement The company has agreed to repurchase 49% of Nacof Nithin Sai Green Energy’s shares from an existing shareholder. |