1) VR Infraspace Limited

- Business Overview – VR Infraspace, a well-established construction and real estate development firm located in Vadodara, Gujarat, specializes in both residential and commercial projects. Catering to middle and high-income groups, they provide a variety of housing options. Their residential apartments are equipped with amenities such as security systems, sports facilities, play areas, and electricity backup, offering luxurious yet affordable living in Vadodara.

- Recent Filings – The company has secured its two work orders, totaling Rs. 2.77 cr from Integrity Infrabuild Developers Limited. In contrast, its peers* have not reported any significant orders in the past one year, highlighting the company’s strong position in the market.

- Outlook –

- ICRA maintains a Stable outlook on the construction sector. The coverage metrics are expected to remain comfortable with interest cover likely to remain above 4.0 times.

- Ind-Ra expects EPC players to post a healthy performance in FY25, albeit with a moderation in the revenue growth rate, accompained with a modest uptick in operating margins while maintaining adequate liquidity buffers.

- The current shortage of housing in urban areas is estimated to be ~10 million units. An additional 25 million units of affordable housing are required by 2030 to meet the growth in the country’s urban population.

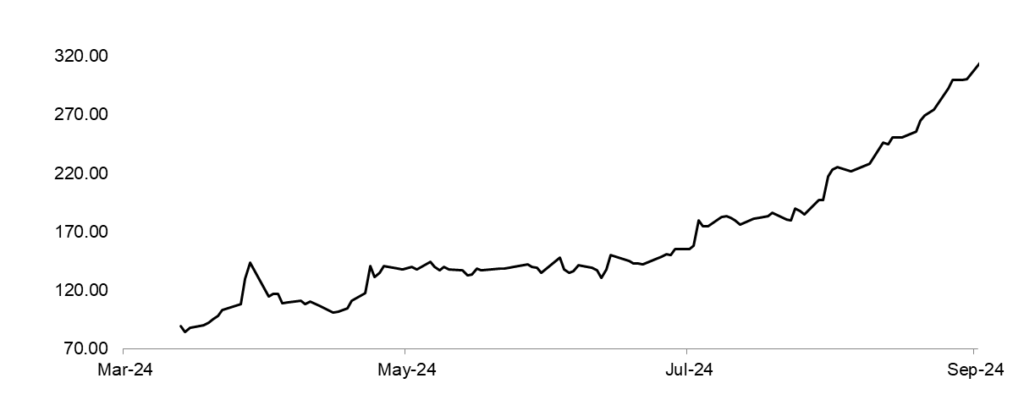

- Price Chart since listing –

2) VA Tech Wabag Limited

- Business Overview – The company specializes in designing, developing, and testing electronic hardware for ASIC construction and embedded solutions. It also provides services in the design, manufacturing, distribution, assembly, and repair of electronic products across various sectors, including defense, aerospace, industrial, and medical applications.

- Recent Filings – The company wins an order from Saudi Water Authority worth USD 317 Million (~SAR 1,190 Million / ~INR 2,700 Crores) towards a 300 MLD Mega Sea Water Desalination Plant in the Kingdom of Saudi Arabia. This victory strengthens the position in the desalination sector and will further enhance WABAG’s global leadership in desalination.

- Outlook –

- Strong Revenue Growth driven by India & MEA over the next 3-5 Years with a CAGR of 15 – 20 %

- EBITDA Margins to sustain in the 13% – 15% range

- Mix of >50% International Projects, 30% Industrial Customers and 1/3 of EPC being EP Projects

- Continue to focus on O&M business to reach target number of 20% of Total Revenue

- Will continue to pursue Advance Technology Projects and remain Asset Light

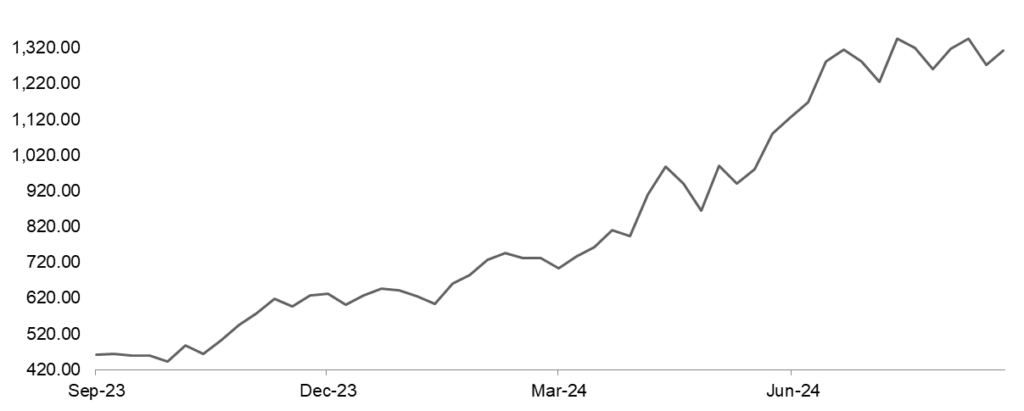

- 2Y Price Chart –

Past Coverages

| Coverage Date | Company | LTP on Coverage Date | Current LTP | % change since coverage | Recent Filings |

| 1/08/24 |

PNGS Gargi Fashion Jewellery Ltd. |

₹841 |

₹871 |

3.6% |

EXCELLENT RESULTS For Q1 FY24, sales surged 2.1x YoY to INR 13.7 Cr (INR 44 Cr under FOFO model), with profit before tax up 93% to INR 2.9 Cr.(01st August) |

|

08/08/24 |

PG Electroplast Ltd. |

₹423 |

₹572 |

35.2% |

ORDER On August 5, 2024, the company allotted 6,56,000 equity shares to the ‘PG Electroplast Limited Employees Welfare Trust’ under the 2020 Employee Stock Options Scheme.(08th August) |

|

13/08/24 |

Hi-Tech Pipes Ltd. |

₹162 |

₹187.9 |

16.0% |

GOOD TO EXCELLENT RESULTS For Q1 FY24, sales rose 35% YoY to INR 867 Cr, with net profit up 2.3x to INR 18 Cr. QoQ, sales increased 27%, and net profit jumped 64%. (13th August) |

|

14/08/24 |

Bondada Engineering Ltd |

₹3250 |

₹700 |

-0.3% |

ORDER For Q1 FY24, sales surged 2.2x YoY, and net profit jumped 3.6x. QoQ, sales were flat, while net profit declined 26%. (14th August) |

|

8/07/24 |

Dynamic Services & Security Ltd |

₹276 |

₹267 |

-3.3% |

Share Repurchase Agreement The company has agreed to repurchase 49% of Nacof Nithin Sai Green Energy’s shares from an existing shareholder. |