1) Systematix Corporate Services Limited

- Business Overview – Established in 1985, Company provides investment management and advisory services in the financial markets and investment solutions for a broad array of investors including FIIs, DFI, Insurance companies among other Financial institutions.

- Recent Filings – Company announced a fund raise of ₹103.12 Cr through preferential allotment of equity shares at ₹1531 per share.

- Outlook –

- Company has also approved stock split on 26th September 2024.

- The two AIF – Category I and Category II will Accelerate the growth of IB and ECM businesses

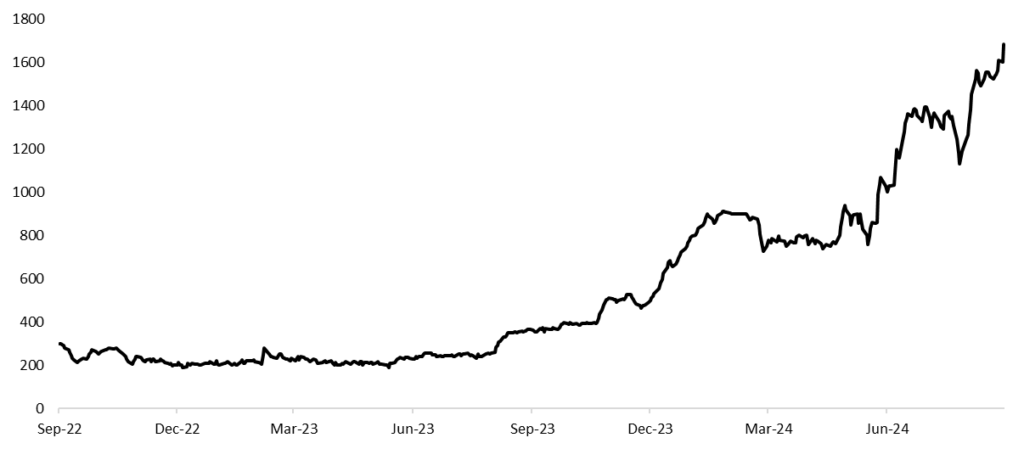

- 2Y Price Chart –

2) Veefin Solutions Limited

- Business Overview – Veefin Solutions Limited, based in Mumbai, specializes in Digital Lending and Supply Chain Finance technology. They provide innovative solutions to a global clientele, including banks, NBFIs, fintech companies, marketplaces, and corporates. Their user-focused, data-driven products are developed by experts with extensive banking experience.

- Recent Filings – In the past three months, the company has acquired three firms for INR 400 crore, including Epiklndifi for ₹125 Cr. through cash and equity swap. This is expected to expand its client base tenfold, create a new revenue stream through digital retail lending alongside supply chain finance, and enhance its global presence and revenue potential.

- Outlook –

- The company expects to sustain robust annual growth over the next three to five years, with projected revenues of INR 50 crore for FY 2025 and INR 110 crore for FY 2026.

- Veefin plans to diversify its product line beyond supply chain finance by adding trade finance and digital lending. They aim to offer existing clients additional products, such as loan origination systems and collection modules.

- The company expects its client base and revenues to continue growing, supported by new partnerships with banks and corporates.

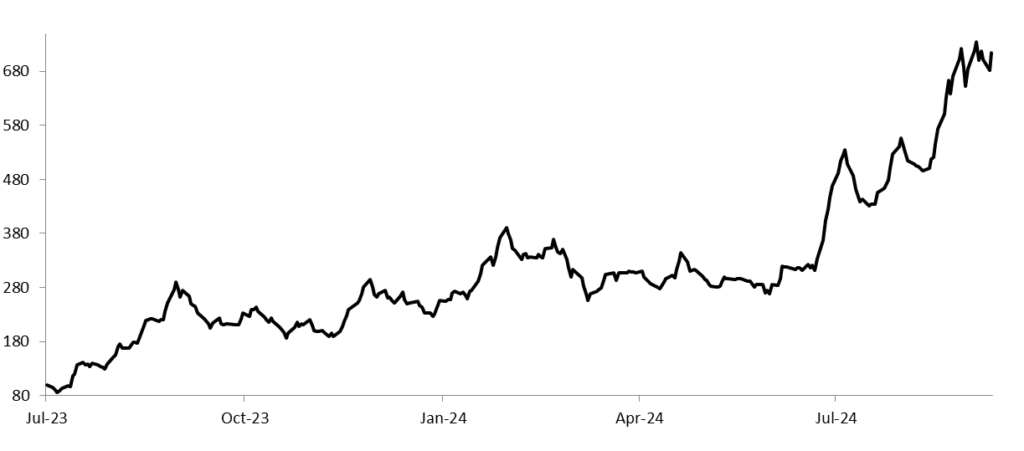

- Price Chart Since Listing –

3) Droneacharya Aerial Innovations Limited

- Business Overview – Droneacharya Aerial Innovations Limited offers high-end solutions for drone surveys, data processing, pilot training, and GIS training. The company derives 97% of its revenue from drone training and other services, and 3% from drone sales. It was listed on the BSE SME Platform on December 23, 2022. The company has offices in North Carolina, Amsterdam, Dubai, and Thailand, and is expanding to Qatar, Malaysia, Philippines, and Tunisia.

- Recent Filings – DAAI Ltd. secured a $240,000 USD (INR ~2 Cr) export order from Lithuania’s MB Darvilis for heavy payload drone components. Fulfillment is due in 40 days. This order represents ~5% of FY24 topline and may open new international opportunities innovation and driving revenue growth.

- Outlook –

- Targeting a 200% increase in revenue, EBITDA, and PAT by FY 2024-25, driven by product diversification and global expansion efforts

- Aiming for a 400% growth in the number of DGCA-certified drone pilot training centers, which will contribute to revenue from training services

- Tapping into the growing CubeSat industry, projected to rise from USD 316.83 million in 2024 to USD 1,045.5 million by 2032 globally

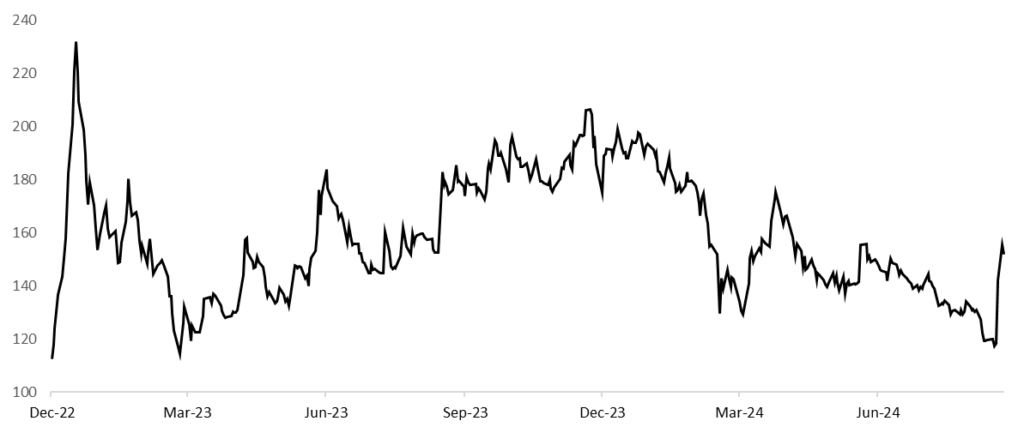

- Price Chart since listing –

Past Coverages

| Coverage Date | Company | LTP on Coverage Date | Current LTP | % change since coverage | Recent Filings |

| 1/08/24 |

PNGS Gargi Fashion Jewellery Ltd. |

₹841 |

₹878 |

4% |

EXCELLENT RESULTS For Q1 FY24, sales surged 2.1x YoY to INR 13.7 Cr (INR 44 Cr under FOFO model), with profit before tax up 93% to INR 2.9 Cr.(01st August) |

|

08/08/24 |

PG Electroplast Ltd. |

₹423 |

₹612.95 |

45% |

ORDER On August 5, 2024, the company allotted 6,56,000 equity shares to the ‘PG Electroplast Limited Employees Welfare Trust’ under the 2020 Employee Stock Options Scheme.(08th August) |

|

13/08/24 |

Hi-Tech Pipes Ltd. |

₹162 |

₹170.7 |

4.93% |

GOOD TO EXCELLENT RESULTS For Q1 FY24, sales rose 35% YoY to INR 867 Cr, with net profit up 2.3x to INR 18 Cr. QoQ, sales increased 27%, and net profit jumped 64%. (13th August) |

|

14/08/24 |

Bondada Engineering Ltd |

₹3250 |

₹601 |

-81.5% |

ORDER For Q1 FY24, sales surged 2.2x YoY, and net profit jumped 3.6x. QoQ, sales were flat, while net profit declined 26%. (14th August) |

|

8/07/24 |

Dynamic Services & Security Ltd |

₹276 |

₹271 |

-2% |

Share Repurchase Agreement The company has agreed to repurchase 49% of Nacof Nithin Sai Green Energy’s shares from an existing shareholder. |