Written By: Archit Jain

Investing is a journey that can help you achieve your financial goals, build wealth, and secure your future. However, understanding the forces that govern this journey is crucial for success. Here, we explore five powerful forces that influence investing: Time, Risk, Market Cycles, Discipline, and Diversification. These concepts are straightforward yet profound, and understanding them can make a significant difference in your investment outcomes.

The Force of Time: The Power of Compounding

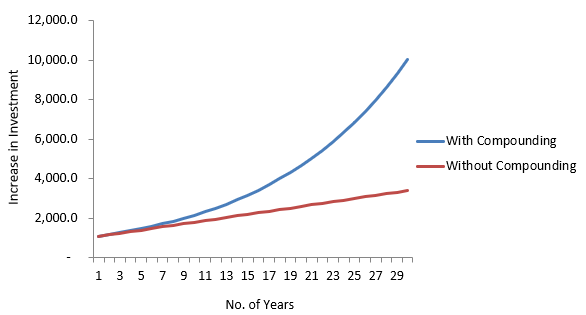

Time is often considered the most powerful force in investing. When you invest money, it doesn’t just sit idle; it grows through a process called compounding. Compounding means earning returns on both your initial investment and the returns that accumulate over time. The earlier you start investing, the more time your money has to grow. Even small, regular investments can lead to significant wealth accumulation over decades.

Warren Buffett, one of the world’s most successful investors, started investing at the age of 11. By letting his investments compound over decades, he has built a fortune worth billions. Remarkably, most of his wealth was accumulated after he turned 50, demonstrating the exponential power of time in growing wealth. His patience and early start allowed him to harness the full potential of compounding.

Start investing as early as possible, even if the amount is small. The longer your money stays invested, the larger your potential returns. Delays in investing can mean missing out on years of compounding growth.

The Force of Risk: Balancing Returns

Risk is an inherent part of investing. Every investment comes with some level of uncertainty about its returns. Understanding your risk tolerance—how much risk you can comfortably handle—is essential for choosing the right investments.

Types of Risks:

- Market Risk: The chance of losing money due to market fluctuations, which affects stocks, bonds, and other assets.

- Inflation Risk: The risk that your investment returns won’t keep up with the rising cost of living, eroding your purchasing power over time.

- Credit Risk: The risk that a company or government won’t repay its debts, impacting investments in bonds and fixed-income securities.

Real-Life Example: The Dot-Com Bubble (1997-2000)

During the late 1990s, technology stocks soared, and many investors poured money into internet companies without assessing the risks. When the bubble burst, the NASDAQ Index fell by nearly 80%, wiping out billions of dollars in investments. Many investors learned the hard way that high returns often come with high risks.

Strategies to Manage Risk:

– Diversify your portfolio across different asset classes.

– Regularly review your investments to ensure alignment with your risk tolerance.

– Avoid investing in overly speculative assets without understanding them.

Never invest in something you don’t understand. Balance high-risk investments with safer options like bonds or index funds to protect your portfolio. Diversifying across asset classes can also mitigate risk.

The Force of Market Cycles

Markets move in cycles of growth and decline. These cycles are influenced by economic conditions, interest rates, and investor sentiment. Understanding these cycles can help you make better investment decisions, though predicting exact timings is challenging.

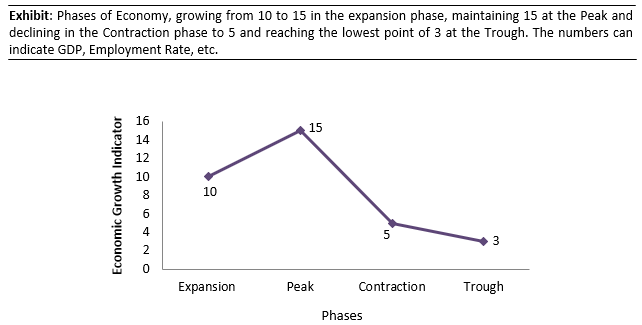

The Phases of Market Cycles:

- Expansion: Markets rise with increasing investor confidence, driven by strong economic growth.

- Peak: Overheated markets with high valuations and widespread optimism.

- Contraction: Markets decline due to economic slowdown or external shocks.

- Trough: The bottom of the cycle, where prices stabilize before recovery begins.

Real-Life Example: The 2008 Financial Crisis

The U.S. housing market reached unsustainable highs before collapsing in 2008, triggering a global financial crisis. Investors who recognized the signs of a bubble and adjusted their strategies were better positioned to weather the downturn. Those who stayed invested during the trough also benefited significantly as markets recovered in the following years.

Strategies for Navigating Market Cycles:

– Maintain a long-term perspective to avoid panic selling.

– Rebalance your portfolio periodically to align with your investment goals.

– Stay informed about economic indicators and trends.

Don’t try to time the market perfectly. Instead, focus on long-term trends and avoid making impulsive decisions based on short-term market movements.

The Force of Discipline: Staying the Course

Discipline is crucial in investing. Emotional decisions, such as selling in a panic during a downturn or chasing high returns during a boom, can derail your long-term strategy. A disciplined approach ensures that you remain consistent in your investments, regardless of market conditions.

Strategies for Discipline:

- Set Clear Goals: Define why you are investing—be it for retirement, education, or other financial goals.

- Avoid Emotional Decisions: Base your actions on logic and data rather than fear or greed.

- Regular Contributions: Adopt a systematic investment plan, like investing a fixed amount each month, to build wealth steadily.

- Review Progress: Periodically review your portfolio to ensure it aligns with your objectives.

Real-Life Example: Jack Bogle’s Vanguard Approach

Jack Bogle, the founder of Vanguard and creator of the first index fund, advocated for disciplined investing through low-cost index funds. His strategy emphasized patience, avoiding market timing, and consistent investments over the long term. Investors following this approach, particularly during volatile markets, benefited from steady returns and lower costs.

Key Takeaway:

Stay focused on your long-term goals and avoid being swayed by short-term market noise. Regularly reviewing your portfolio can also help you stay on track.

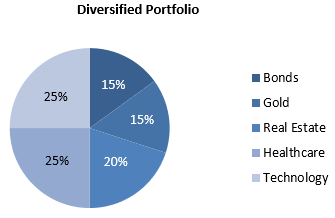

The Force of Diversification: Don’t Put All Your Eggs in One Basket

Diversification involves spreading your investments across different asset classes, industries, and geographies to reduce risk. This strategy ensures that a downturn in one area won’t devastate your entire portfolio.

Benefits of Diversification:

- Reduces Risk: Balances losses in one sector with gains in another, reducing overall volatility.

- Stabilizes Returns: Provides more consistent performance over time by mitigating the impact of individual asset fluctuations.

- Enhances Opportunities: Exposes you to various growth areas, increasing the chances of high returns in some segments.

Real-Life Example: The COVID-19 Pandemic

During the pandemic, technology stocks surged while travel and hospitality sectors struggled. Investors with diversified portfolios were able to offset losses in adversely affected sectors with gains in thriving ones. This demonstrated the resilience of a well-diversified investment approach.

Strategies for Effective Diversification:

– Invest in multiple asset classes, including stocks, bonds, and real estate.

– Diversify within asset classes by selecting different industries and geographic regions.

– Regularly review and adjust your portfolio to maintain optimal diversification.

Key Takeaway:

Diversify your investments across various asset classes, such as stocks, bonds, real estate, and international markets. This strategy protects your portfolio from unforeseen events and market downturns.

Conclusion

Investing is both an art and a science. By understanding and leveraging the forces of Time, Risk, Market Cycles, Discipline, and Diversification, you can make smarter investment decisions and achieve your financial goals. The key to success lies in starting early, staying disciplined, and continuously learning from market dynamics and real-life examples.

Adopting these principles requires patience and perseverance, but the rewards can be life-changing. Whether you are just starting your investment journey or are a seasoned investor, applying these concepts will help you navigate the complexities of financial markets with greater confidence.