Written By: Soumya Singhal

TIPS are a unique type of U.S. government bond designed to protect investors from inflation. Introduced in 1997 by the U.S. Department of the Treasury, unlike regular bonds, where the principal remains fixed, TIPS automatically adjusts its principal value based on changes in the Consumer Price Index (CPI), through this, TIPS safeguards against the eroding effects of inflation.

This feature ensures that the purchasing power of the investment remains intact over time. Given the growing concerns over inflation and economic uncertainty, TIPS has gained popularity among conservative investors, retirees, and institutional investors looking for stable, real returns.

How TIPS Work:

TIPS function differently from traditional fixed-income securities in two primary ways:

1. Inflation-Linked Principal Adjustment

– The face value (or principal) of TIPS increases with inflation and decreases with deflation, as measured by the CPI.

– If inflation rises by 3% in a given year, the principal amount of the TIPS will also increase by 3%. Conversely, if there is deflation, the principal will decrease accordingly.

– At maturity, investors receive either the inflation-adjusted principal or the original face value, whichever is higher. This guarantees that investors do not lose their initial investment due to deflation.

2. Variable Interest Payments

– TIPS pays interest twice a year at a fixed rate, determined at issuance.

– However, since the interest is calculated as a percentage of the adjusted principal, the actual interest payments fluctuate based on inflation.

– If inflation increases, the adjusted principal grows, leading to higher interest payments. If deflation occurs, interest payments decrease.

How to Invest in TIPS:

Investors can purchase TIPS in several ways:

1. Directly from the U.S. Treasury

TIPS can be bought at auction directly through Treasury, the U.S. government’s official online platform for purchasing Treasury securities.

2. Secondary Market

Investors can buy and sell previously issued TIPS through brokerage accounts in the secondary market, where prices fluctuate based on inflation expectations and interest rates.

3. TIPS Mutual Funds and ETFs

Exchange-traded funds (ETFs) and mutual funds specializing in TIPS offer an alternative way to invest in inflation-protected securities. These funds provide diversification and professional management but may come with management fees.

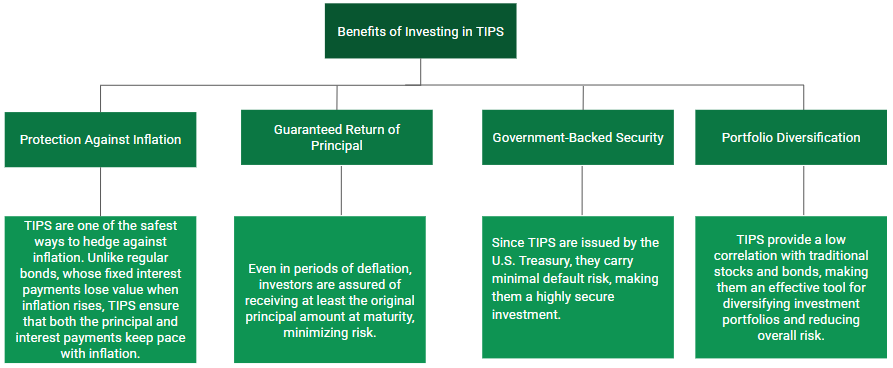

Benefits of investing in TIPS:

Risks and Drawbacks of TIPS:

Despite their benefits, TIPS are not without risks and limitations:

1. Lower Yields Compared to Regular Treasury Bonds

The fixed interest rate on TIPS is generally lower than that of conventional U.S. Treasury bonds of similar maturity. Investors pay for inflation protection by accepting a lower base yield.

2. Interest Rate Risk

If interest rates rise, the market price of TIPS may decline, similar to other fixed-income securities. However, this only affects investors who sell before maturity.

3. Tax Implications

TIPS principal increases with inflation, growing the bond’s value over time. TIPS pays interest semiannually, although investors don’t receive this increased principal until maturity or sale, the IRS (Saving accounts in the US) treats it as taxable income each year, creating a tax liability without immediate cash flow.

This concept, known as phantom income which makes holding TIPS tax-advantaged accounts, also applies to reinvested earnings in investments like partnerships, REITs, and mutual funds.

4. Potential Losses During Deflation

During a prolonged period of deflation, where the minimum is zero, the principal of TIPS can decline, leading to reduced interest payments. However, the original principal amount remains protected and will not fall below its initial value at maturity.

EXAMPLE:

For instance, if an investor buys a $1,000 10-year TIPS with an annual fixed interest rate of 0.5%, and inflation rises by 3% per year, the bond’s principal will adjust accordingly.

- Year 1: Principal increases to $1,030 (3% inflation adjustment). Interest is now 0.5% of $1,030 = $5.15.

- Year 2: If inflation is again 3%, the principal rises to $1,060.90, and interest is $5.30.

At maturity, the investor receives the inflation-adjusted principal, ensuring protection against rising prices. If inflation were negative (deflation), the principal would decrease, but the investor is still guaranteed to receive at least the original $1,000 investment.

TIPS are regularly auctioned by the U.S. Treasury in maturities of 5, 10, and 30 years, making them a flexible option for long-term inflation protection.

EXAMPLE:

Now, let’s consider a corporate inflation-protected bond with a variable interest rate tied to inflation. Suppose an investor buys a $1,000 bond from a company that offers a base rate of 1% + inflation rate (variable rate).

- Year 1: If inflation is 3%, the interest rate becomes 1% + 3% = 4%, and the investor earns $40 in interest.

- Year 3: If inflation drops to 2%, the rate adjusts to 1% + 2% = 3%, and interest falls to $30.

Unlike TIPS, where only the principal adjusts, inflation-protected corporate bonds with variable rates adjust both the principal and interest payments, providing a direct hedge against rising inflation but also introducing credit risk from the issuing company.

Comparison of TIPS with Other Inflation Hedges:

While TIPS are a reliable inflation hedge, they are not the only option. Other common inflation hedges include:

- Gold and Commodities

- Gold and commodities serve as effective inflation hedges due to their intrinsic value, which is not tied to any specific currency, making them a safe haven during inflationary periods. Their finite supply prevents devaluation, unlike fiat currency, which central banks can print freely. Historically, gold has maintained its role as a store of value, consistently appreciating during inflation. However, these assets come with risks—price volatility, influenced by geopolitical events and market speculation, can lead to fluctuations. Additionally, gold does not generate passive income like TIPS or real estate, and storage and transaction costs can make it less convenient than financial instruments.

- Real Estate

- Real estate is a tangible asset that serves as a strong inflation hedge, as property values typically appreciate over time, especially in high-demand areas. Additionally, rental income tends to rise with inflation, allowing landlords to adjust lease rates and maintain profitability. Investors can also leverage financing (mortgages) to amplify returns, benefiting from property value increases during inflationary periods. However, real estate comes with challenges—high entry costs, including down payments, maintenance, and taxes, make it less accessible than TIPS. It is also illiquid, as selling property takes time, unlike easily tradable financial instruments. Moreover, real estate values fluctuate with market cycles, interest rates, and economic conditions, making it subject to periodic downturns.

- Inflation-Protected Corporate Bonds

- Inflation-protected corporate bonds function similarly to TIPS, as their payments adjust with inflation, helping investors preserve purchasing power. However, they offer higher yields than TIPS due to the additional credit risk associated with corporate issuers. Unlike government-backed TIPS, these bonds depend on the financial stability of the issuing company, meaning investors face the risk of default. Additionally, corporate bonds are more sensitive to market fluctuations, with their value influenced by interest rate changes, company performance, and credit ratings, making them a higher-risk but potentially higher-reward inflation hedge.

- Stocks

- Stocks offer long-term growth potential and can act as an inflation hedge, as companies often pass rising costs onto consumers, boosting revenues and stock prices. Certain sectors, such as energy, consumer staples, and technology, tend to perform well during inflationary periods. Historically, the stock market has outpaced inflation, delivering strong real returns over time. However, stocks come with high volatility, experiencing significant short-term fluctuations. They are also subject to market cycles, meaning prices can decline during economic downturns, even amid rising inflation. Unlike TIPS, stocks are not a direct inflation hedge, as some companies may struggle to maintain profitability, making careful stock selection essential.

TIPS are an essential tool for investors seeking protection against inflation while ensuring a stable, government-backed return. Their ability to adjust for inflation makes them unique among fixed-income securities, offering a reliable hedge against rising prices. However, lower yields, tax implications, and interest rate risks must be carefully considered before investing. By understanding how TIPS function and how they compare to other inflation-hedging assets, investors can make informed decisions to preserve and grow their wealth in an inflationary environment.