Gensol Engineering is facing serious financial troubles as credit rating agency ICRA downgraded its rating to [ICRA] D, citing delays in debt payments. The downgrade follows feedback from the company’s lenders, who reported ongoing issues with timely repayments. ICRA also raised concerns about the company’s corporate governance, alleging that some documents shared by Gensol regarding its debt payments may have been falsified. This move comes just a day after CARE Ratings also downgraded Gensol for similar reasons.

The stock market has reacted sharply to these developments. On Tuesday, Gensol’s shares dropped 20%, and by Wednesday, they fell another 10% as the stock’s circuit limit was revised downward. The continuous decline in share price is adding to the company’s financial stress.

ICRA also noted an increase in the number of shares pledged by the company’s promoters. In February 2025, 85.5% of the promoter’s holdings were pledged, up from 79.8% in September 2024. This increase, combined with the falling stock price, has raised concerns about Gensol’s ability to raise funds for its future expansion plans.

Another challenge for Gensol is its connection to Blusmart Mobility Pvt. Ltd., a loss-making company in its promoter group. Blusmart recently defaulted on its non-convertible debenture (NCD) payments, and ICRA fears this could further hurt Gensol’s ability to secure funding.

Despite these financial challenges, Gensol had claimed in a recent investor call that it had ₹250 crore in liquidity, along with access to working capital limits. The company had also been submitting “no-default” statements to ICRA at the start of each month, indicating that debt payments were being made on time. However, the recent lender feedback contradicts these claims, leading to further doubts.

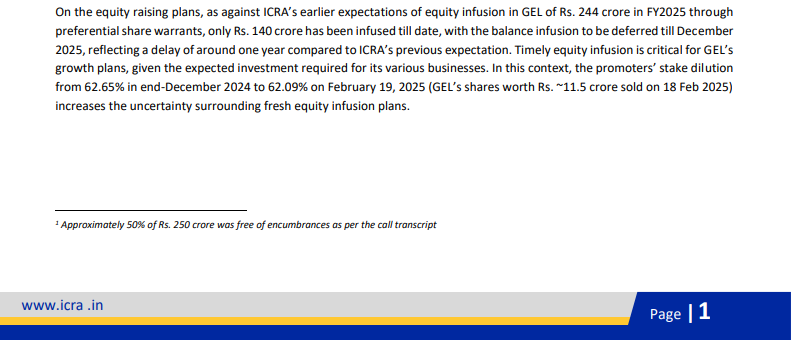

ICRA also highlighted delays in a planned equity infusion. Gensol was expected to receive ₹244 crore in fresh capital through preferential share warrants in this financial year. However, only ₹140 crore has been infused so far, and the remaining ₹104 crore is now expected only by December 2025 – about a year later than originally planned. The delay raises concerns about whether Gensol will be able to secure the necessary funds for growth.

Gensol currently has an order book worth over ₹7,000 crore, which is set to be executed over the next 12 to 18 months. While this provides revenue visibility, ICRA has questioned whether the company has enough funds to execute such large projects.

With Gensol’s stock now down 67% from its peak of over ₹1,100, the company faces financial uncertainty.