/

Research and Report by: Kartikey Chug

Desvelado India

Imagine a world where companies pretend to be something they’re not, all to make money. Well, that’s exactly what happened with Add-Shop E-Retail Limited and White Organics Agro Limited, and the truth has finally come to light.

Two companies, Add-Shop E-Retail Limited and White Organics Agro Limited, were caught in a web of deceit. They were accused of not being honest about how they do business and how well they are doing. This is a big problem because when companies lie, it can hurt the people who invest their money in them.

These companies tried to make themselves look better than they really were. It’s like when someone wears a fancy costume to a party to impress others. Add-Shop E-Retail Limited and White Organics Agro Limited were pretending to be successful and well-run companies when, in reality, they were not doing things the right way.

Thankfully, there are rules in place to make sure companies play fair. The authorities, like the Securities and Exchange Board of India, found out about the companies’ tricks. They noticed that something wasn’t right with how these companies were behaving. Just like how a detective solves a mystery, the authorities investigated and uncovered the truth.

Lets Understand

Dummy Companies and inflating Sales (Case Study)

Dummy companies, often referred to as shell companies, are entities that exist only on paper with no significant operations, employees, or assets. Dummy companies can be used for a variety of purposes, including money laundering, tax evasion, fraud, and hiding the true ownership of assets. Goods or services are “sold” to the dummy companies at the end of a reporting period to artificially boost sales figures temporarily. These goods or services are often returned or the transactions are reversed after the reporting period ends.

Mechanism of Dummy companies to inflate numbers –

- Creation of Dummy companies – Companies set up multiple shell entities with minimal legal and operational footprints. These entities typically have basic documentation, such as registration papers, but lack actual business operations, employees, or tangible assets.

- Fictitious Sales Transactions – The primary company generates fake invoices for sales to these dummy companies. These sales are recorded in the primary company’s books as legitimate revenue.

- Circular transactions and round tripping – Money is moved between the primary company and its dummy companies in a circular manner. The primary company might record a sale to a dummy company, which then transfers the same money back to the primary company through a series of complex transactions.

- Channel Stuffing – Goods or services are “sold” to the dummy companies at the end of a reporting period to artificially boost sales figures temporarily. These goods or services are often returned, or the transactions are reversed after the reporting period ends.

- Complex Network of Transactions – Multiple dummy companies can be created to form a complex web, making it difficult for auditors and regulators to trace the transactions and uncover the fraud.

We will discuss the situation with example of Satyam Computers

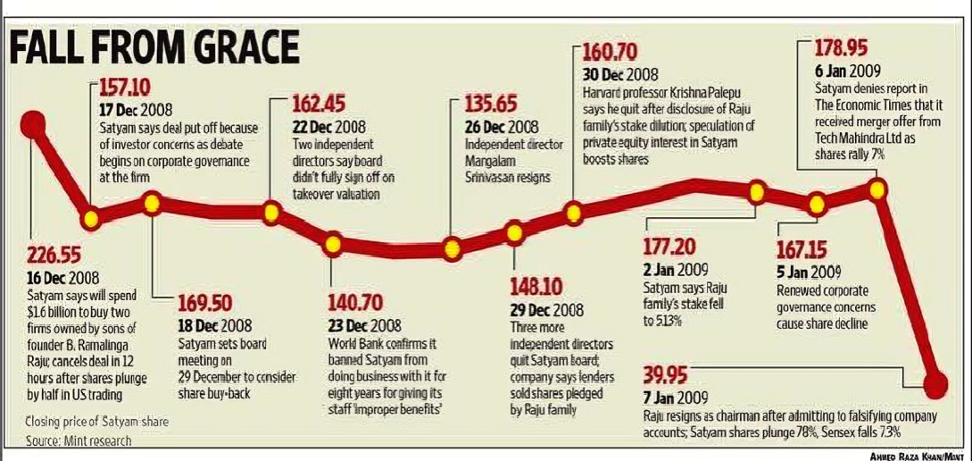

In the Satyam Computers scandal, the company’s management executed a massive financial fraud by manipulating accounting records and creating fictitious revenue. They established a network of dummy companies and fabricated invoices for services that were never provided. The false transactions were recorded as sales, significantly inflating the company’s revenue and profit figures. This deception allowed Satyam to present an image of rapid growth and strong financial health, attracting investors and boosting its stock price.

The fraud was meticulously concealed through complex financial maneuvers and document falsifications, making it challenging for auditors and regulators to detect. However, the deceit eventually unravelled in 2009 when the company’s chairman, Ramalinga Raju, confessed to the fraud, revealing the extent of the manipulation. The fallout was catastrophic, leading to a sharp decline in the company’s market value, legal action against its executives, and a severe loss of investor trust.

The below timeline shows how the stock price of Satyam computers plunged 78% when the news of fraudulent activities came out.

Key metrices for assessment

What factors and metrics, an investor can see and analyse to avoid such situations and plan their entry or exit points.

- Inventory turnover ratio – Inventory turnover ratio is a vital metric used to assess how efficiently a company manages its inventory. It tells how many times a company can turn its inventory around in a year. With increasing sales but constant or decreasing turnover ratio, there can be an indication of violation or misrepresentation.

- Sales, Trade Receivables, Bad debts, and Debtor Ageing – Trade receivable represents the credit sales that the company did in the financial year. Bad debts represents the part of trade receivables that the company don’t expect to receive. Debtor ageing is a schedule that track the monetary value of their accounts receivable, so they know how much money is at risk of not being paid. An investor should monitor these numbers closely. If the company relies heavily on credit sales and its debtors are not paying, as reflected in the debtor schedule, it could indicate potential manipulation in the accounts.

- Purchase & Sales authenticity by Auditor – The auditor documents all findings and provides remarks based on the company’s accounting policies in the audit report. They verify and authenticate whether purchase and sale orders have been properly executed. If the auditor identifies any irregularities, they include their observations in the report.

- Capex and Depreciation – Proper alignment ensures that long-term investments (CapEx) result in corresponding depreciation over time, reflecting accurate asset utilization. Significant discrepancies, such as high CapEx without corresponding depreciation increases, or vice versa, can signal improper capitalization practices or underinvestment in the business. This analysis helps ensure the company’s financial health and accounting integrity.

Add Shop E Retail Ltd. used Dada Organics as its dummy company who also tried to make merry by raising money via IPO on the back of its rising sales and filed a DRHP with exchanges; however, it could not succeed and withdrew the DRHP.

Related to the concepts, we have looked before, a complaint dated September 2023, against Add Shop E Retail Ltd and White Organics Ltd for alleging irregularities pertaining to related party transactions, fake announcements regarding supply orders etc., SEBI initiated an investigation for the period April 1, 2020, to March 31, 2023.

Interim Order by SEBI:

Details of all the parties involved in the matter and their business is mentioned below –

- Add Shop E Retail Ltd. (A) – Promoters: Mr. Dineshbhai Pandya, Ms. Jayshree Pandya. Business – Manufacturing, marketing, and distribution of products in ayurveda products, food supplement products, agricultural products, animal feed supplement products and personal care products. (Listed)

- White Organics Agro Ltd. (B) – Promoters: Mr. Darshak Rupani. Business – Organic food items (Listed)

- Dada Organics Ltd. (C) – Promoters: Mr. Dineshbhai Pandya (Proprietor), Ms. Jayshree Pandya

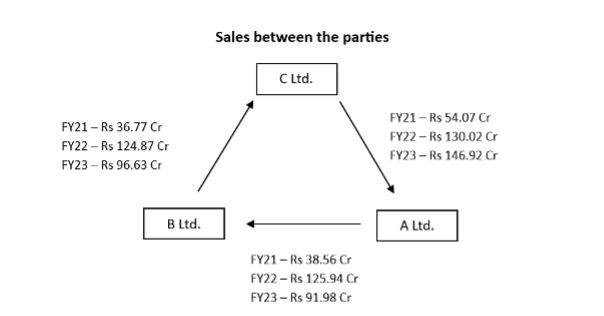

The case was a high budget Bollywood movie with many subplots which were mostly backdated and had no substance proof. Summarizing the case, the whole arrangement was a sham to inflate the sales and purchases of B Ltd. There was no movement of goods between the parties involved. The sale/purchase transactions among A Ltd, C Ltd and B Ltd did not have any commercial substance since all three companies were merely booking fictitious purchase and sales entries in their books of accounts in circular manner without any movement of stock of goods among themselves.

Depicting the arrangement in a pictorial format, it is evident that there was circular transaction between the parties.

The complaint was filed by a third party was lodged, but there can be various suspects that could have initiated the enquiry by SEBI. Some of them are –

- E Waybills – A document required to be carried by a person in charge of the conveyance carrying any consignment of goods of value exceeding fifty thousand rupees. In this case there was no actual movement of goods. A Ltd was supplying AFS (Animal Feed Supplements) and in return was supplied AFS by C Ltd. No evidence of these bills could be a trigger for enquiry.

- GST evasion from transactions with farmers – According to the agreement A Ltd was to exchange AFS for AFG (Animal feed grains) through barter system. There could be an evasion of tax by the parties involved, as farmers produce falls under 0% tax.

- Rally of A Ltd stock price – Stock price of A Ltd rallied from 30.8 in Mar 20 to 321 in Dec 21. It was mainly backed by retail participation, misleading financial statements and false announcements by the company. SEBI could have suspected manipulation and started inspecting after the complaint.

To have a better understanding of the transactions, major suppliers and buyers list is provided in tabular form below –

Buyers and suppliers of A Ltd

| Particulars (in Cr) | FY21 | % of Total S/P | FY22 | % of Total S/P | FY23 | % of Total S/P |

| Major Suppliers | ||||||

| Dada Organics (C Ltd) | 54.07 | 96.06% | 130.02 | 99.03% | 146.92 | 91.77% |

| Marss Herbal’s | 1.24 | 2.20% | 0.8 | 0.61% | 0.61 | 0.38% |

| Ketan Pharma | 0.23 | 0.41% | 0.11 | 0.08% | 0 | 0.00% |

| Anupam’s Lab | 0.26 | 0.46% | 0.25 | 0.19% | 0 | 0.00% |

| Rexroth Pharma | 0.05 | 0.09% | 0.06 | 0.05% | 0 | 0.00% |

| Others | 0.44 | 0.78% | 0.05 | 0.04% | 12.56 | 7.85% |

| Total Purchase | 56.29 | 131.29 | 160.09 | |||

| Major Buyers | ||||||

| White Organics (B Ltd) | 38.56 | 49.08% | 125.94 | 78.89% | 91.98 | 46.02% |

| Panchalingeswar Enterprises | 15.92 | 20.26% | 16.5 | 10.34% | 13.06 | 6.53% |

| Sasha Impex Pvt. Ltd. | 4.41 | 5.61% | 0 | 0.00% | 0 | 0.00% |

| Sri Sai Enterprises | 3.86 | 4.91% | 2.97 | 1.86% | 2.06 | 1.03% |

| Ohm Sai Health Care | 1.77 | 2.25% | 1.36 | 0.85% | 0.66 | 0.33% |

| Others | 14.05 | 17.88% | 12.88 | 8.07% | 92.12 | 46.09% |

| Total Sales | 78.57 | 159.65 | 199.88 |

Buyers and suppliers of B Ltd

| Particulars (in Cr) | FY21 | % of Total S/P | FY22 | % of Total S/P | FY23 | % of Total S/P |

| Major Suppliers | ||||||

| Add Shop E Retail (A Ltd) | 38.56 | 48.99% | 127.31 | 82.32% | 91.98 | 57.80% |

| Sarveshwar Foods | 6.09 | 7.74% | 10.22 | 6.61% | 6.98 | 4.39% |

| Mubarak Overseas Pvt Ltd | 5.88 | 7.47% | 0 | 0.00% | 0 | 0.00% |

| T. Bhimjiyani Warehousing | 5.32 | 6.76% | 0 | 0.00% | 0 | 0.00% |

| M.G. Enterprises | 5.01 | 6.37% | 0 | 0.00% | 0 | 0.00% |

| Others | 17.85 | 22.68% | 17.13 | 11.08% | 60.18 | 37.82% |

| Total Purchases | 78.71 | 154.66 | 159.14 | |||

| Major Buyers | ||||||

| Dada Organics (C Ltd) | 36.77 | 46.68% | 124.87 | 84.35% | 96.63 | 55.69% |

| Suumaya Agro Ltd | 8.19 | 10.40% | 0 | 0.00% | 0 | 0.00% |

| SC Gupta and Co | 6.29 | 7.99% | 0 | 0.00% | 0 | 0.00% |

| Khanak International | 5.88 | 7.46% | 0 | 0.00% | 0 | 0.00% |

| PJS Overseas Ltd | 5.04 | 6.40% | 0 | 0.00% | 0 | 0.00% |

| Others | 16.6 | 21.07% | 23.17 | 15.65% | 76.88 | 44.31% |

| Total Sales | 78.77 | 148.04 | 173.51 |

Observations from the tables are as such –

- A Ltd. Was buying 100% of Animal food supplements from C Ltd and selling it to B Ltd. (69% in FY21, 90% in FY22 and 49% in FY23)

- C Ltd. had purchased 72.21%, 100% and 70.8% of the total multigrain purchased during FY 21, 22 & 23 respectively from B Ltd.

- During the investigation, it was observed that B Ltd. claimed to have sold multigrain to C Ltd., yet B Ltd.’s purchase register revealed that it had never purchased any multigrain from any party. Similarly, B Ltd. claimed to have purchased AFS from A Ltd, but B Ltd.’s sales register showed no record of selling any AFS to any party. Furthermore, the stock details provided by B Ltd. for various quarters indicated that B Ltd. never had any stock of AFS or multigrain at the end of any quarter during the investigation period.

Above we discussed how to combine analyse sales, trade receivables and debtor ageing, lets do the similar analysis in case of A Ltd

The company’s revenue went from INR 78 Crores in FY21 to INR 200 Crores in FY23. It was mainly artificially inflated. With revenue trade receivables also increased indicating focus of company on credit sales. Debtor days also skyrocketed indicating the inefficiency of the company to recover money from debtors.

The below data shows the major suppliers and buyers of A Ltd and B Ltd. From the data, it is evident that A Ltd is suppling AFS (Animal Feed Supplements) to B Ltd, which in turn supply the same product under the name AFG (Multigrain) to C Ltd. So B Ltd have both sales and purchase inflated because C Ltd supply Multigrain to A Ltd in the form of AFS. So A Ltd get back the same product by just making entries in a circular manner.

False Announcements

The companies manipulated their stock prices not only by falsifying accounts but also by issuing misleading corporate statements to project a positive future outlook. This strategy was intended to attract retail investors, enabling the promoters to sell their stakes and exit. Announcements are mentioned below –

- Aug 20 – B Ltd have received supply order worth Rs. 55.7 Cr from Mizoram State Health Department. (With total value of health care supply orders being Rs 111.4 Cr)

- But the disclosures did not contain details such as counterparty name, time period in which the orders were to be executed etc. Further, these disclosures contained a disclaimer that the company undertook no obligation to publicly update these forward-looking statements to reflect subsequent events or circumstances (violation of Regulation 30(7) of LODR Regulations, 2015.)

- On analyzing Purchase orders (PO) copy of B Ltd, it was observed that the POs signed by B Ltd and Suumaya Industries Limited (SIL) in August 2020 were printed on the letter head of SIL. Whereas the company renamed it from Suumaya Lifestyle Limited to Suumaya Industries Limited in Nov 2020. So, the PO submitted was fraud and backdated.

- In the announcement, B Ltd said that they were supplying to Mizoram State Health Department (who was the consignee) and no mention of SIL was made in the disclosure to the public.

- On receiving clarification, SIL replied that the said POs were terminated and had “cancelled” printed on it. But B Ltd did not disclose this on their website or to the exchange.

A new agreement came into existence

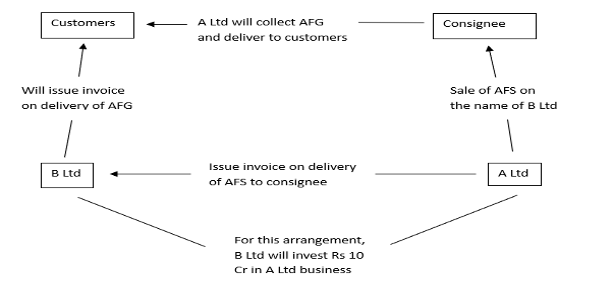

When the Managing Directors (MDs) of A Ltd and B Ltd were summoned on February 7, 2024, to appear in person before the Investigation Authority (IA), they presented a new agreement executed between them in FY20, which even the auditors were previously unaware of. The story and observation about the same are discussed below –

Provisions of agreement –

- A Ltd. shall make sale of AFS (Animal Feed Supplements) to B Ltd, at the rate mutually decided from time to time, which shall be delivered by A Ltd. to consignees (dealers, distributors, franchisee and customers of A LTD. who are by and large farmers)

- A Ltd shall issue the sales invoice to B LTD. on delivery of the AFS to consignees.

- A LTD. shall arrange and put efforts to clear and collect dues from consignees of the value of AFS delivered to them, which shall be in form of Animal Food Grains (“AFG” or “multigrain”) and shall arrange to get the same delivered at the premises of the customer of B LTD. on their behalf

- B LTD. shall issue the sales invoice and necessary documents to its customers on delivery of AFG.

- B LTD. shall expand the business of AFS in PAN India multiple states and for that purpose shall also make investment in developing market, infrastructure and business (A LTD.) up to sum of Rs.10 Crore (Rupees Ten Crore Only) within one year from the completion of the tenure of 2 years from the date of first sale of AFS.

Observation and findings from the agreement –

- B Ltd. Was required to issue invoices to its customers for the AFG delivery but they issued invoices to C Ltd. And not to its customers.

- As per the agreement, a sum of Rs 10 Cr was to be invested by B Ltd but A Ltd.’s bank statement never reflected the amount despite lapse of more than a year since the end of the agreement.

- Exchange of AFS and AFG with farmers was through barter system. However, the books of A Ltd. And C Ltd. Did not record any sale and transactions with the farmers and the same was not reflected in their bank statements.

- Genuineness of the agreement is also a question as no proof of communication was provided and it appears to be a backdated agreement which was prepared post initiation of investigation in the matter as a cover-up.

The above depicts how the arrangement was between the parties. They tried adapting a complex structure to inflate sales.

Concern with Audit Committee

Under LODR Regulations, 2015, the responsibilities of members of the Audit Committee (AC) in an listed company include oversight of the listed entity’s financial reporting process and the disclosure of its financial information to ensure that the financial statement is correct, sufficient, and credible. Further, they have a duty of approving and reviewing the disclosure of any related party transaction. They are expected to be independent, vigilant, and cautious against any fraudulent acts committed by the company and raise their concerns. Hence, members of AC have a responsibility of reviewing and approving the financial statements before they are placed before the Board for approval.

- As per the annual reports of A Ltd, Mr. Rajeshkumar Parekh, Mr. Vivek Dadhania and Mr. Rushabh Vora were members of Audit Committee during investigation period. And they added that all audit committee meetings happened as required by law and the members attended it.

- But when Mr Rajeshkumar Parekh and Mr. Rushabh Vora were summoned, they were not even aware that they were made part of the audit committee. Company had used their name as an audit committee chairman without informing as well as members in several other committees.

- So, SEBI decided to go high-tech in its investigation and asked telecom companies for the location of the cell phones of audit committee members during that time when Add-Shop had said that it conducted audit committee meetings.

- With the help of technology, SEBI found that the independent directors of Add-Shop were right, and they were at faraway places than Add-Shop’s office at those times. So they concluded that meetings never happened.

Pirce manipulation by promoters

A Ltd

During the investigation period, the promoter’s shareholding percentage significantly dropped from 63% in March 2021 to 36% in March 2023, and further decreased to 27.2% in December 2023. Additionally, the promoters did not participate in the rights issue by the company for Rs. 48.33 Cr, which was supported by retail investors. This behaviour reflects the level of trust the promoters had in the company and its operations. They knew that there was hardly any real business on the ground and the sales were fake. Moreover, A LTD. issued two bonus shares within approximately 18 months: one in the ratio of 3:4 bonus equity shares of Rs 10 each on 23/07/2020, and another in the ratio of 7:10 bonus equity shares of Rs 10 each on 17/01/2022.

An interesting fact – Why rights issue was kept below Rs 50 Cr. This was because if it had increased the issue size to more than ₹50 Cr, then it had to take approval from SEBI, which would have asked hard questions, and the entire game would have gotten over in SEBI’s scrutiny of its rights iss

Comparison of share price of A Ltd with Sensex and FMCG Index

Observations –

- Revenue grew gradually every quarter with a CAGR of 71% p.a. But if we observe, their revenue excluding the sales of B Ltd. Then the revenue was on declining trend QoQ which shows the inflated revenue figures. And corresponding to the misleading and inflated figures, the scrip price increased indicating pump and dump strategy by the company.

- During this period, public shareholding % increased to 64% from 37% and the number of public shareholders of ASERL increased from 77 as on March 31, 2020 to 46,884 as on March 31, 2023.

B Ltd.

Comparison of share price of B Ltd with Sensex and FMCG Index

- A similar inference can be made here as with A Ltd. From Q2 to Q4 FY22, despite a decrease in real sales (excluding those to C Ltd), the stock price nearly doubled. The main reasons were the quarter-on-quarter sales growth and false announcements.

C Ltd

The other two companies were listed and benefited from the rising stock prices, but why was C Ltd involved in this scheme? Firstly, C Ltd was a dummy company with the same promoters as A Ltd and was used to circulate transactions. Additionally, C Ltd attempted to raise money through an IPO, leveraging its rising sales, and filed a DRHP with the exchanges. However, it failed and eventually withdrew the DRHP.