In the vast realm of investment, understanding the fundamentals is paramount to success. Fundamental analysis, a cornerstone of investment research, offers a deep dive into the core factors shaping a company’s value. From dissecting financial statements to evaluating qualitative aspects like management quality, this method provides investors with invaluable insights into the health and potential of their investments. Let’s explore the essence of fundamental analysis and how it empowers investors to make informed decisions in the dynamic world of finance.

What is fundamental analysis?

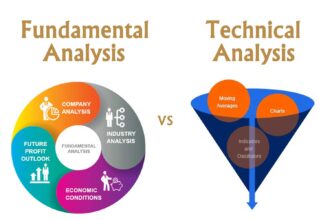

- Fundamental analysis is a method of evaluating securities by examining the underlying factors that affect their intrinsic value.

- It differs from technical analysis which focuses on price movements and historical trading data.

What are the key components of fundamental analysis, and how are they used to evaluate a company’s financial health?

- Key components include analysing financial statements (such as income statements, balance sheets, and cash flow statements), assessing business operations, and evaluating industry trends.

- These components help analysts gauge a company’s profitability, growth potential, debt levels, and overall financial stability.

Fundamental analysis is similar to conduct a health check-up for a company. By examining its financial statements and operations, analysts can diagnose strengths, weaknesses, and potential risks, providing insights into its overall well-being.

How do fundamental analysts assess the intrinsic value of a stock and what factors do they consider in this process?

- Fundamental analysts estimate a stock’s intrinsic value by projecting future cash flows and discounting them back to present value.

- Factors considered include earnings growth, dividends, interest rates, and the company’s competitive position within its industry.

What role do qualitative factors such as management quality and industry dynamics play in fundamental analysis?

- Qualitative factors provide context and insight into a company’s operations and future prospects.

- Factors like strong leadership, innovative products, and favorable industry trends can positively impact a company’s long-term performance.

Conclusion

- Investors can use fundamental analysis to identify undervalued stocks with growth potential or overvalued stocks to avoid.

- It helps investors make informed decisions based on a company’s financial health, competitive position, and growth prospects.

In the world of investing, fundamental analysis serves as a beacon of insight, illuminating the path to informed decision-making. By peeling back the layers of financial data, analysts gain a deep understanding of a company’s intrinsic value, empowering investors to navigate the markets with confidence. Through careful examination of financial statements, consideration of qualitative factors, and estimation of intrinsic value, fundamental analysis provides a comprehensive framework for evaluating investment opportunities. Armed with this knowledge, investors can unlock the secrets of successful investing, making choices that align with their financial goals and risk tolerance.