Research By: Yug Goyal

Beta is the measure of systematic risk.

Before moving on to beta, it is important to understand the 2 types of risk- systematic and unsystematic.

- Systematic risk refers to the risk inherent to the entire market or market segment. Systematic risk, also known as undiversifiable risk, volatility risk, or market risk, affects the overall market, not just a particular stock or industry. Systematic risk, also known as market risk, cannot be reduced by diversification within the stock market. Sources of systematic risk include: inflation, interest rates, war, recessions, currency changes, market crashes and downturns plus recessions.

- Unsystematic risk, also known as company-specific risk, represents risks of a specific corporation, such as management, sales, market share, product recalls, labor disputes, and name recognition. This type of risk is peculiar to an asset, a risk that can be eliminated by diversification.

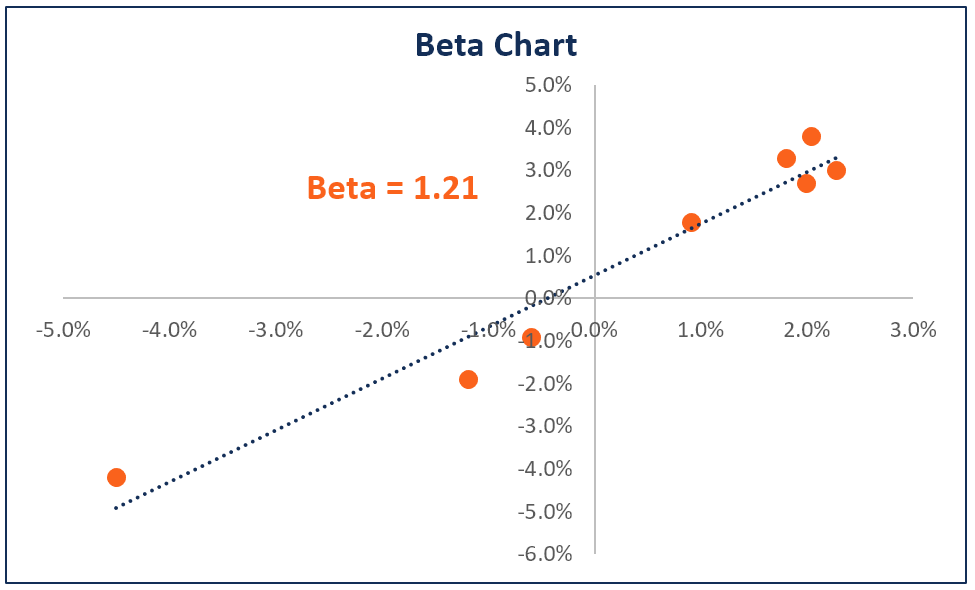

So, beta measures the systematic risk of the company. It measures the volatility of the stock with respect to the market. The market, often represented by a major index like S&P 500 in US or Nifty 50 in India, has a beta of 1.

Some interpretations of beta are –

A beta of 1 indicates that the stock has same volatility as the market and tends to move in the same direction.

A beta of -1 indicates that though the volatility is quite similar, the stock moves in the opposite direction as the overall market.

Beta higher than 1 or -1 indicates higher volatility than the market whereas -1 < beta < 1 indicates lower volatility.

Beta of 0 indicates that the stock has no correlation with the market movements.

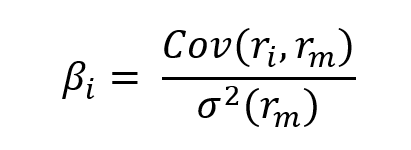

Formula of Beta

where ri is return of stock and rm is return of market.

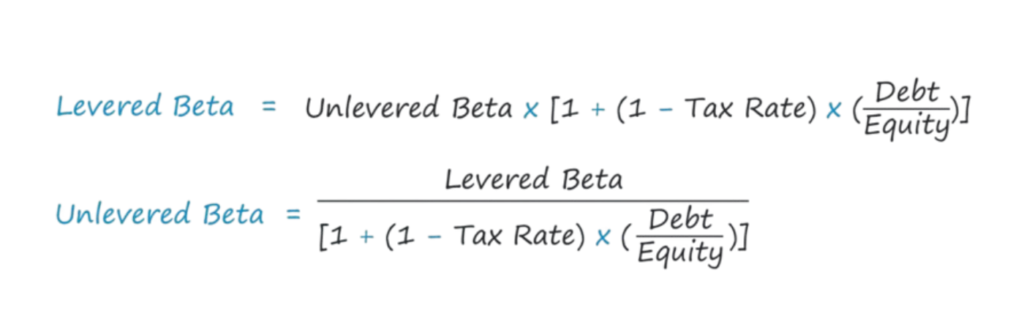

The company’s capital structure also affects beta and thus, the beta can be divided into levered and unlevered beta.

1. Levered Beta

Levered beta is the beta of the company taking into consideration the debt taken by the company. Though cost of debt is said to be cheaper and thus benefit the companies in years of good earnings, but it is an obligation of the company to pay interest and principal of debt. So in years of low earnings, debt proves to be a burden and therefore increases the risk factor in the company. Therefore, higher debt increases the beta of the company.

2. Unlevered Beta

Sometimes, analysts want to compare the the companies purely on the basis of business risk, keeping aside their capital structures. Hence comes the need for unlevered beta.

Unlevered beta = Levered beta/(1+(1-tax)*(debt to equity))

Uses of Beta

Beta is a very useful tool and is an important part of Capital Asset Pricing Model (CAPM) which is used to calculate cost of equity.

One of the main benefits of using beta in portfolio management is the capacity to diversify risk. By adding assets with varying betas to a portfolio, investors can distribute risk across different investments, minimizing the influence of any single asset’s performance on the entire portfolio. For instance, a portfolio made up entirely of high-beta stocks would be more exposed to market downturns. Conversely, by including assets with lower betas, such as bonds or low-beta stocks, the portfolio becomes less affected by market volatility and offers a more consistent return profile.

Beta also helps in performance evaluation. Investors use beta to compare the performance of stock or portfolio to the market. By examining the beta-adjusted performance, investor can assess whether they are being adequately compensated for the risk they are taking.

Beta can also be used to time the market. During a boom phase, some investors prefer to invest more in high beta stocks to capture the upward trend. Similarly, during downturn, they may shift to low-beta stocks.

Industries like FMCG, utilities, consumer staples generally have lower beta than the market and are hence considered less volatile. Therefore, adding such stocks can reduce the portfolio beta or volatility. Similarly, industries like Technology and biotech, Consumer discretionary , Energy and Auto may have higher beta.