Research By: Saizal Agarwal

Investing is always about purchasing assets with the intention of earning the highest potential return on your money. Investing in the stock market offers a variety of strategies, each geared to individual investor preferences, risk tolerances, and financial objectives. Growth and value investing are two of the most prevalent strategies.

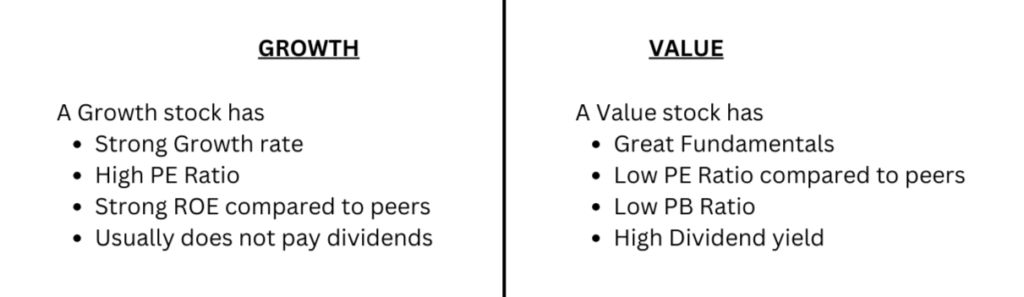

Growth investing is an investment strategy that seeks to acquire new, early-stage companies that are experiencing rapid increases in profitability, revenue, or cash flow. Investors favor capital appreciation—or persistent rise in the market value of their investments—over the consistent streams of dividends sought by income investors.

It is based on the philosophy “The future will be better than the present” and objective of capital appreciation through investing in companies with high earnings growth potential.

Understanding a company’s life cycle is critical for expansion investment. In the early days of a new company, business may be developing rapidly, resulting in dramatic increases in sales and profits. At this point in its life cycle, a company’s profits are often reinvested back into the business to drive future growth, rather than paid out as dividends.

As the company and its markets mature, revenue and profit growth slows. Growth slows even more as the company matures. At this stage in the cycle, many companies begin to pay profits to investors in the form of dividends as investment prospects in their markets dwindle.

The main risk of investing in growth stocks is the possible volatility in stock performance, particularly in the short term. Also, in many circumstances, growth stocks may be fresh market entrants with little or no historical trends to support the assumption of future growth.

Example:

Zomato has recently completed its first public offering (IPO). The table below provides Zomato’s annual revenue, growth, net profit, and dividend payout figures for the fiscal years 2016 to 2021:

| FY19 | FY20 | FY21 | FY22 | FY23 | FY24 | |

| Revenue (Cr) | ₹1,313 | ₹2,605 | ₹1,994 | ₹41,92 | ₹7,079 | ₹12,114 |

| Growth | 98% | -23% | 110.23% | 68.87% | 71.10% | |

| Net Profit (Cr) | (₹964) | (₹2,367) | (₹812) | (₹1,220) | (₹971) | ₹351 |

| DPS | 0 | 0 | 0 | 0 | 0 | 0 |

According to Zomato data, despite rising sales, the company did not make a profit until 2023. Also, the company has not given any dividends to its stockholders in the last six years.

However, an investor adopting the growth approach would instead focus on Zomato’s potential to become a more prominent player in the food delivery market in the future while remaining very profitable.

Value investing, on the other hand, targets companies that appear undervalued by the market. The philosophy is rooted in the belief that market inefficiencies can cause stocks to be mispriced, allowing investors to purchase shares at a discount to their intrinsic value. Over time, as the market recognizes the true worth of these companies, their stock prices should increase.

It is based on the philosophy of “Buy low, sell high” and based on the objective of capital appreciation with a focus on downside protection by buying stocks with a margin of safety.

Example:

Intel Corporation (INTC), trading at a low P/E ratio compared to its industry peers, Intel is undervalued despite strong financials and consistent dividend payments. While facing competition and technological delays, Intel offers potential for long-term appreciation if its turnaround strategy succeeds, making it attractive to value investors.

| Characteristic | Growth Investing | Value Investing |

| Meaning | Growth investing involves buying stocks of companies that are expected to grow faster than others. Investors believe these companies will see strong and steady growth in earnings, sales, and cash flow. These companies, often found in both small and large sectors, tend to outperform competitors with innovative products and pricing strategies. | Value investing involves finding and buying stocks of companies that are currently undervalued or experiencing slow growth but still have strong fundamentals. These companies often have lower stock prices than their peers, possibly due to a tough economic environment or the cyclical nature of their industry. Value stocks tend to be less volatile in both good and bad markets. |

| Approach | Growth investors usually target young or small businesses that are expected to grow faster than others in their industry or the market as a whole. | Value investors look for established, financially stable companies that are priced lower than their true worth. They aim to buy these stocks at a discount, believing they will rise to their intrinsic value over time. |

| Focus | Companies with high growth potential. | Companies that are undervalued or distressed but have solid fundamentals. |

| Risk | Growth investing is often riskier and more volatile than other types of investments. | Value investing generally carries lower to medium risk, though there’s still a chance of losing money. |

| Expense | Growth stocks tend to be more expensive. | Value stocks are typically cheaper. |

| Horizon | Growth investments are usually made with a longer-term outlook. | Value investments often have a shorter-term focus. |

| Dividends | Growth stocks usually have low dividend payouts. | Value stocks often have higher dividend yields. |

| P/E Ratio | High. | Low. |

| P/B Ratio | High. | Low. |

| Stock Movements | Growth stocks can experience big price swings. | Value stocks tend to have more stable prices. |

Conclusion:

When deciding between growth and value investing, it’s essential to consider financial goals, risk tolerance, and investment horizon. Growth investing offers the potential for high returns, driven by companies that are expected to grow rapidly. However, this approach comes with higher risk and price volatility, making it more suitable for investors who are comfortable with the possibility of significant price swings and have a longer time frame to ride out market fluctuations.

On the other hand, value investing focuses on finding undervalued companies that are often more established and financially stable. While the potential for massive returns may be lower compared to growth stocks, value investing typically offers more stability and a margin of safety, appealing to investors who prioritize capital preservation and steady, long-term gains.

Many investors find that a balanced approach, incorporating both growth and value stocks, allows them to capture the benefits of both strategies while mitigating some of the risks. Ultimately, the best strategy depends on individual’s unique investment profile and how they wish to navigate the ups and downs of the stock market.

Valuation methods are necessary. Investors should use the GGM with caution, understanding its assumptions and limitations, and complement it with other valuation techniques to obtain a more comprehensive view of a company’s intrinsic value.