Research By: Saizal Agarwal

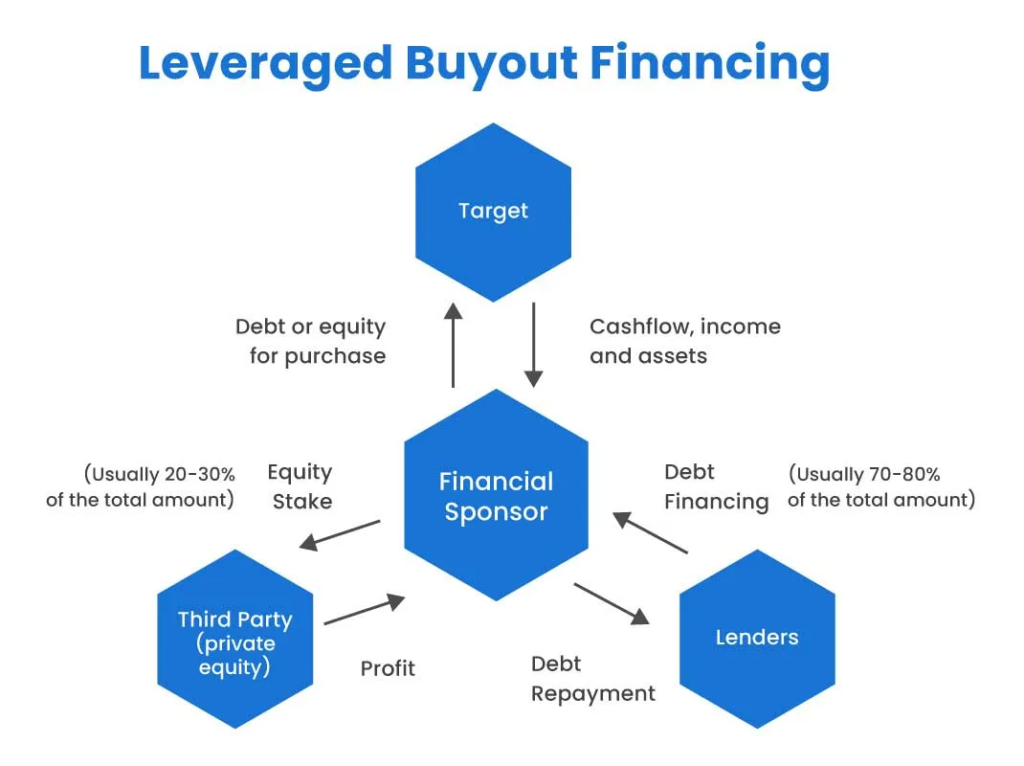

A leveraged buyout (LBO) is the acquisition of one company by another using a significant amount of borrowed money to meet the cost of acquisition. The borrowed money can be in the form of bonds or loans. The assets of the company being acquired are often used as collateral for the loans along with the assets of the acquiring company. In a leveraged buy-out (LBO), the ratio is usually 90% of debt vs. 10% of equity. Although an acquisition by means of a loan can be complex and take time, it can benefit both the buyer and the vendor if it is done correctly.

Purpose: The purpose of leveraged buyouts is to allow companies to make large acquisitions without having to commit a lot of capital.

How does a leveraged buyout (LBO) work?

The main steps in an LBO investment would typically include:

1. Screening: To find a good candidate for an LBO, public companies are screened by PE firms or LBO specialized firms.

2. Due diligence and modeling: To determine whether the target company could sustain the required debt load, a PE firm would carry out due diligence on the business and create financial models.

3. Strategy: A comprehensive, end-to-end plan would be created. To pay off the debt, this would entail buying the business, getting funding from equity investors, getting loan obligations, and figuring out what can be sold or split off.

4. Approach: In order to acquire a target, the PE sponsor would make contact with them.

5. Capital raise: Funding would be obtained from investors and a partnership would be formed.

6. Execution: The investor carries out the purchase and any necessary follow-up plans.

7. Liquidation: The investor either starts an IPO or sells the business.

Businesses with steady and predictable cash flows, little debt, and little capital expenditures are attractive candidates for leveraged buyouts (LBOs) since the latter’s capacity to sustain its debt load is essential to its success. That usually refers to established, very profitable, non-cyclical businesses.

LBOs can happen when private equity firms identify chances to uncover a company’s hidden potential or when businesses that fit the description above start looking for a means to restructure or sell themselves. This can happen if a significant stakeholder wants to leave the firm or take it private, as in the situation of Dell:

Example:

In 2013, Dell Inc. underwent a significant leveraged buyout (LBO) led by its founder, Michael Dell, and private equity firm Silver Lake Partners. The $24.9 billion deal was financed through a combination of equity contributions from Michael Dell and Silver Lake, along with approximately $19.4 billion in debt.

The buyout enabled Dell to go private, allowing the company to focus on long-term strategic shifts, including a transition from PC manufacturing to enterprise solutions and services. Despite initial shareholder opposition, the LBO ultimately proved successful, with Dell returning to the public markets in 2018 after a period of substantial growth and transformation.

LBOs became particularly popular in the 1980s, fueled by the availability of junk bonds, which allowed firms to borrow substantial amounts of money at high interest rates. They remain a key tool in private equity firms’ strategies for acquiring and restructuring companies.

Types/ Ways of Leveraged Buyouts (LBOs)

1. Management Buyouts (MBOs):

In an MBO, the company’s existing management team acquires the business, typically with the help of a private equity firm or other external financiers. MBOs often occur when the management team believes in the company’s future prospects and wants greater control and ownership.

2. Management Buy-Ins (MBIs):

In an MBI, an external management team, often in collaboration with a private equity firm, buys into the company and replaces the existing management team. This occurs when the investors believe that the current management is not maximizing the company’s potential, and an external team with specific expertise can improve operations.

3. Secondary Buyouts:

A secondary buyout is the sale of a company by one private equity firm to another.This is often done when the first private equity firm has maximized its investment return but the company still has growth potential that another firm can capitalize on.

4. Public-to-Private (P2P) Buyouts:

In a P2P buyout, a publicly traded company is acquired and taken private. The shares are purchased from public shareholders, and the company is delisted from the stock exchange.P2P buyouts allow companies to operate without the pressures of quarterly earnings reports and public scrutiny, enabling long-term strategic changes.

5. Dividend Recapitalization LBOs:

In this type of LBO, the company takes on additional debt to pay a dividend to the private equity owners, effectively extracting capital from the company. Dividend recaps allow private equity firms to recover some of their investment before selling the company, reducing risk.

Risk associated with LBO:

- High Debt Levels: With the widespread use of debt-dependent Leveraged Buyouts, corporations may face financial difficulties if their cash flow turns negative as the economy deteriorates or an industry’s demand declines.

- Operational Challenges: The implementation of success plans or growth initiatives following an acquisition is not guaranteed to be successful, may result in operational risk, and should be carried out with extreme caution, execution, and continuous monitoring to avoid operational risk and ensure long-term sustainability.

- Market Volatility: Leveraged buyouts slide under the wheels of market fluctuations and economic downturns, and those elements may have a consequence on the quality and valuation of the targeted firm; then the whole transaction and the expectations to maximize the leverage returns may confront.

- Regulatory and Legal Risks: Because LBO is involved with rules and legislation, it is subject to antitrust laws, environmental restrictions, and certain contractual duties. An LBO might operate as a variable in the deal process, posing numerous risks to the transaction’s success.

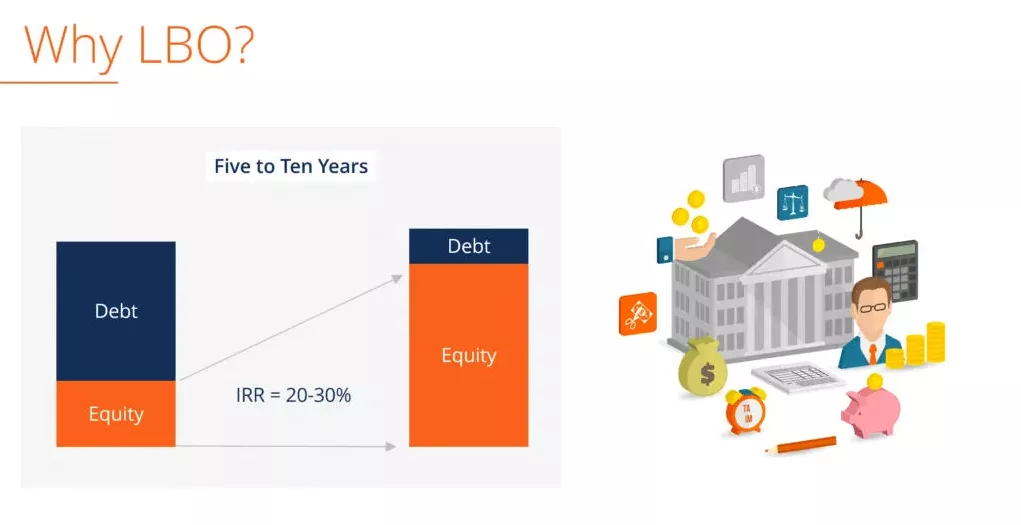

Advantages of leveraged buyouts (LBOs):

- Smaller equity raise is required relative to deal size.

- Opportunity for returns of 20-30% annualised.

- Target company is generally identified to investors up-front.

- Can represent an attractive exit option for major shareholders of some public companies.

- Creates a leaner, more efficient company with higher returns for shareholders.

How do leveraged buyouts (LBOs) create value:

- Enhancing the value of portfolio companies through increased productivity and general efficiency is the main goal of operational improvements.

- In order to promote strategic growth, portfolio companies must be reshaped through the sale of non-core businesses and the pursuit of new business ventures.

- The goal of talent enhancements is to maximize human resources in businesses by encouraging the growth of pertinent competencies and abilities.

- Reorganizing portfolio companies such that their strategic objectives are in line with their organizational structures.

- Improved capital structure, describes changing the ratio of debt to equity in portfolio companies in order to maximize value and optimize leverage.

- Multiple expansion involves enhancing a company’s valuation multiples through improved financial performance.