Research By: Amisha Aggarwal

Free cash flow (FCF) is the cash remaining after a company has covered the expenses required to sustain its operations and maintain its capital assets. Investment bankers and analysts assessing a company’s expected performance under various capital structures often use variations of free cash flow, such as free cash flow to the firm (FCFF) and free cash flow to equity (FCFE), which are adjusted for interest payments and borrowings.

The Free cash flow to the firm (FCFF) calculation serves as a measure of a company’s operational efficiency and overall performance. It accounts for all cash inflows from revenues, all cash outflows from regular expenses, and all funds reinvested to expand the business. The remaining cash after these activities represents the company’s FCFF.

Free cash flow is often regarded as one of the most crucial financial indicators of a company’s stock value. The price of a stock is typically viewed as the sum of the company’s anticipated future cash flows. However, stocks are not always priced accurately. By analyzing a company’s FCFF, investors can assess whether a stock is fairly valued. Additionally, FCFF reflects a company’s capacity to pay dividends, repurchase shares, or repay debt holders. Investors interested in purchasing a company’s corporate bonds or public equity should consider its FCFF. A positive FCFF value indicates that the firm has cash remaining after expenses. A negative value indicates that the firm has not generated enough revenue to cover its costs and investment activities.

How to calculate FCFF

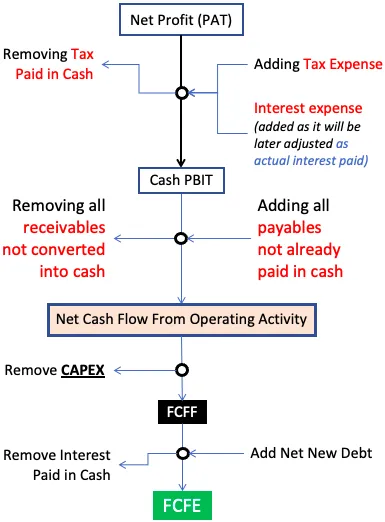

The FCFF can be calculated in several ways, but the most common formula is:

FCFF = Net Income + Non-Cash charges + [Interest x (1- Tax Rate)] – Long Term Investments – Investments in Working Capital

Calculation of FCFF using Cash flow from Operations (CFO), the formulation is as follows:

FCFF = Cash Flow from Operations (CFO) + [Interest Expense x (1-Tax Rate)] – CAPEX

Calculation of FCFF using Earnings before Interest and Tax (EBIT), the formulation is as follows:

FCFF = [EBIT x (1- Tax Rate)] + Depreciation – Long Term Investments – Investments In working capital

Example:

Let’s create a hypothetical situation. Let’s say you’re analysing Apple Inc.’s financial performance and want to calculate its FCFF to understand its operational efficiency and potential for growth:

Net Income: $100Bn

Depreciation & amortization (D&A): $ 10Bn

Capital Expenditure (CAPEX): $20Bn

Change in Working Capital: $ 5Bn

Interest Expense: $ 2Bn

Tax Rate: 25%

Applying Formula:

FCFF = Net Income + D&A (Non-Cash Expenses) + [Interest x (1- Tax Rate)] – CAPEX (Long term Investments) – Change in working Capital

= 100 + 10 + [2 x (1 – 0.25)] – 20 – 5

= 86.5

In this example, Apple’s FCFF is $86.5 billion. This figure represents the cash available to the firm after accounting for operating expenses, capital expenditures, and changes in working capital. It can be used to pay dividends, repurchase shares, or pay down debt, giving investors insight into the company’s financial health and growth potential.