Research By: Saizal Agarwal

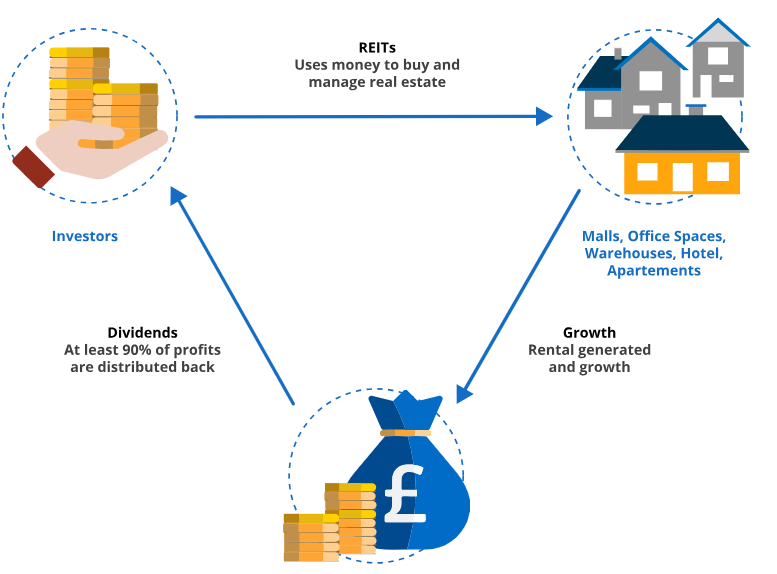

REITS or Real Estate Investment Trust is a company that owns, operates, or finances income-producing real estate properties. They pool money from the investors and invest it in commercial real estate projects like workspaces, malls, etc. Unlike other real estate companies, a REIT does not develop real estate properties to resell them. Instead, a REIT buys and develops properties primarily to operate them as part of its own investment portfolio.

Created by a 1960 law, REITs were designed to make real estate investing without actually having to go out and buy. In REITs, the person does not need to do any big ticket investment and can start by investing a small amount and in return receives rental income from the investment in the form of dividends and interest. REITs are like shares that are listed on the stock exchange, which means one can buy or sell anytime on the exchange.

Also, 80% of the investment must be made in the income-generating property, and the remaining 20% can be invested in any other instruments or under-construction properties and 90% of the total income should be given to the shareholders as dividends. Basically, reit investors can earn from it through dividend yield and capital appreciation.

Why and How REITs were introduced in India?

The concept of REITs was first introduced by the U.S. Congress in 1960 through the Cigar Excise Tax Extension Act with aim to democratize real estate investment by providing a vehicle for small investors to pool their capital and invest in large, income-generating real estate projects.

The first formal discussion on introducing REITs in India began in the mid-2000s. SEBI formed committees to study the feasibility of introducing REITs, taking cues from international markets like the U.S., Singapore, and Australia. But the implementation was unsuccessful due to taxation uncertainty (lack f clarity on capital gains, dividends, and interest income); high stamp duty etc. Also, the 2008 global financial crisis and the subsequent real estate slowdown further delayed the progress of REITs in India.

In October 2013, SEBI took a significant step by releasing draft guidelines for the introduction of REITs in India. But the draft guidelines faced criticism due to: Lack of clarity on taxation, high threshold for minimum investment of 2 lakh, which limited retail participation & high stamp duty costs.

The turning point for REITs in India was the Union Budget 2014, presented by Arun Jaitley (ex Finance minister) in which several crucial announcements were made recognizing the importance of REITs in attracting foreign and domestic investment into the real estate sector:

- Tax Pass-Through Status: The most significant change was the grant of tax pass-through status to REITs. This meant that the income earned by REITs would not be taxed at the REIT level but would be taxed in the hands of the investors, similar to mutual funds. This move provided much-needed clarity and made REITs more attractive.

- Dividend Distribution Tax (DDT): However, REITs were still subject to Dividend Distribution Tax (DDT), which was a point of contention as it reduced the attractiveness of the dividend income for investors.

- Capital Gains Tax: The budget clarified that the sale of units of REITs would be subject to capital gains tax, with long-term capital gains (LTCG) applicable after three years, similar to listed equities.

Following the announcements in the Budget 2014, SEBI formally introduced the REIT Regulations in September 2014. While the 2014 regulations were a significant step, the REIT market in India didn’t take off immediately due to lingering concerns over taxation and the minimum investment requirement. As a result, several amendments were made during 2015-2019:

- Dividend Distribution Tax (DDT) Exemption (2016): One of the most significant amendments came in the 2016 Budget, when the government exempted REITs from Dividend Distribution Tax (DDT). This was a major relief for investors as it removed a key hurdle that had made REITs less attractive. With the removal of DDT, REITs became more tax-efficient, making them competitive with other investment products.

- Minimum Investment Reduced (2019): Initially, the minimum investment limit for REITs was set at ₹2 lakh, which was seen as a barrier for small retail investors. In March 2019, SEBI reduced the minimum investment amount to ₹50,000, making it more accessible to a broader base of investors.

- Encouraging Foreign Investment: In addition to allowing domestic investors, the government and SEBI made efforts to encourage foreign investors, such as Foreign Portfolio Investors (FPIs), to invest in Indian REITs. This was critical for attracting global capital into India’s real estate sector.

After years of regulatory changes and amendments, India’s first REIT, the Embassy Office Parks REIT, was listed in April 2019. Embassy Office Parks REIT was a joint venture between Embassy Group and Blackstone, one of the world’s largest real estate investment firms.

Types of REITs:

Based on the type of Real Estate holdings, the following are the different types of REITs available globally:

- Equity REITs: Equity REITs are the most common type of REIT. It invests in and owns income-producing real estate properties. These properties can include commercial properties or office spaces. The revenue generated is generated by rentals and sale transactions, which are distributed to the shareholders as dividends.

Example: Mindspace Business Parks REIT is an equity REIT in India because it directly owns and manages income-producing office spaces and business parks, generating revenue primarily through leasing these properties. Its focus on rental income and property management aligns with the core characteristics of equity REITs.

- Mortgage REITs: Mortgage REITs, also known as mREITs, are basically involved in lending funds to the real estate companies. It earns income through interest payments, which are distributed to the shareholders.

Example: Annaly Capital Management, Inc. (NLY) is a prominent example of a mortgage REIT (mREIT) globally. The company’s revenue is generated from the interest rate spread between the income earned on its mortgage assets and the cost of financing these assets, which is characteristic of mortgage REITs.

- Hybrid REITs: Hybrid REITs offer the combined benefits of Equity and mortgage REITs. They invest in both physical properties and real estate debt instruments. It helps you to diversify your investment across debt and equity. It offers two types of income: rent income and interest income.

Example: Starwood Property Trust, Inc. (STWD) is a prominent example of a hybrid REIT globally. The company’s revenue is generated from rental income on its real estate holdings as well as interest income from its mortgage and loan investments.

- Publicly Traded REITs: Publicly traded REITs are listed on the National Stock Exchange (NSE) and are also registered with the Securities and Exchange Board of India (SEBI). You can buy and sell these REITs’ shares through the stock exchange, making them a highly liquid investment. However, it’s essential to consider that, like any publicly traded security, they are exposed to market volatility also.

Example: Embassy Office Parks REIT (NSE: EMBASSY) is an example of a publicly traded REIT in India. It is listed on both the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE), making it accessible to public investors.

- Public Non-Traded REITs: These are the same as Publicly Traded REITs but are not listed on any stock exchange. They are also registered with SEBI, but you cannot buy or sell these REITs online; hence it has lower liquidity. You can buy and sell shares directly through the REIT company itself or through secondary markets established by broker-dealers.

Example: Blackstone Real Estate Income Trust, Inc. (BREIT), is a large non-traded REIT focusing on diversified real estate assets, primarily in the U.S. market. They aim to offer stable returns with lower volatility compared to their traded counterparts. They often invest in specialized real estate sectors or niche markets and provide investors with regular distributions. These REITs typically offer liquidity through periodic redemption programs or other exit strategies, which can be less frequent compared to the daily trading of listed REITs.

- Private REITs: Private REITs are not listed on the stock exchange and are also not registered with the SEBI. They are often only made available to the selected investors and have less liquidity than publicly traded REITs.

Example: Tata Realty and Infrastructure Limited (TRIL) – Tata Realty Fund, a part of Tata Group, has been involved in private real estate investments, including private REIT-like structures. The fund focuses on commercial real estate, including office spaces and retail properties. It often caters to institutional investors looking for private investment opportunities in real estate. Although not a traditional REIT, Tata Realty Fund operates with a similar investment strategy, pooling funds to invest in real estate assets and providing returns through rental income and property appreciation.

Four REITs currently in India:

- Embassy Office Parks REIT, launched in April 2019, focuses on high-quality office parks across major Indian cities, including Bengaluru and Mumbai.

- Mindspace Business Parks REIT, introduced in July 2020, invests in office spaces and IT parks primarily in Mumbai, Hyderabad, Pune, and Chennai.

- Brookfield India Real Estate Trust, which began in February 2021, holds commercial properties in key locations such as Mumbai, Noida, and Gurugram.

- Nucleus Office Parks REIT, recently launched, focuses on high-quality office spaces in key Indian cities, including Mumbai and Bengaluru.

Key Parties Involved in REIT Investment Process:

Several parties are involved in the REIT process to ensure the smooth functioning of operations, governance, management, and investor protection. These entities play crucial roles in setting up, managing, and regulating REITs. The key parties include:

a. Investors (Unit Holders): Investors, also known as unit holders, are individuals or institutional investors who purchase units of REITs and thus own a proportionate share in the real estate assets of the REIT. Investors provide capital to REITs through the purchase of units. In return, they receive dividends from the rental income generated by the REIT’s properties, as well as any capital appreciation from an increase in property value.

b. Sponsors: The sponsor is the entity (usually a real estate developer) that sets up the REIT. Sponsors play a vital role in identifying and transferring assets to the REIT. They provide the initial real estate assets that form the REIT’s portfolio. The sponsor is typically the main real estate developer or promoter who owns the initial properties in the REIT portfolio. Sponsors also appoint the REIT manager and trustee, ensuring that the REIT is launched with quality assets.

c. REIT Manager: The REIT manager is responsible for the day-to-day operations of the REIT. This includes managing the real estate properties, leasing them to tenants, maintaining the assets, and ensuring compliance with regulatory requirements. The REIT manager plays a critical role in enhancing the value of the properties, optimizing rental income, and ensuring that the REIT’s financial and operational goals are met. The manager is typically compensated through management fees.

d. Trustee: The trustee holds the real estate assets on behalf of the investors. The trustee is responsible for ensuring that the REIT is managed in the best interests of the investors and complies with the regulatory framework. The trustee acts as a fiduciary for the investors and oversees the activities of the REIT manager. The trustee ensures that the REIT’s assets are used solely for the benefit of the investors and that all rules and regulations are followed.

e. Special Purpose Vehicle (SPV): In many cases, REITs do not directly own real estate properties. Instead, they invest in properties through Special Purpose Vehicles (SPVs). These are subsidiary companies that own the properties, and the REIT holds controlling stakes in the SPVs.SPVs are created to minimize tax liability and protect the REIT from direct exposure to real estate ownership risks. The income generated by the properties owned by the SPV flows back to the REIT, which is then distributed to investors.

i. Tenants: Tenants are the occupants of the properties owned by the REIT. The rental income generated from tenants is the primary source of income for REITs.Tenants lease space in the commercial properties owned by the REIT. The REIT manager manages tenant relationships, rental agreements, and ensures that properties are leased at competitive market rates.

Benefits & Risks of REITs:

| Benefits | Risks |

| Diversification: REITs allow an investor to diversify the investment portfolio through exposure to Real Estate without the hassles related to owning and managing commercial property. This diversification allows the investor to go beyond the usual asset classes of Equity, Debt, and Gold as part of overall Asset Allocation Strategy. Small Initial Investment: As mentioned earlier, one of the key problems associated with making Real Estate investments is the large ticket size, especially in the case of commercial properties. REITs require a much smaller initial investment of around Rs. 50,000 to provide similar portfolio diversification benefits. Professional Management: Properties owned by a REIT are managed professionally. This ensures smooth operations with no effort on investor’s part toward managing Commercial Real Estate. Regular Income Generation: REITs generate income from rental collections and are required to mandatorily distribute 90% of this income to investors as dividends and interest payments. In this way, REITs provide regular income to investors. Capital Gains: REITs are listed and traded on Stock Markets and their price depends on their performance. A REIT that performs well can thus potentially increase in value over time and be sold at a profit. This provides Capital Gains to the investor. | Limited Options: Currently, there are only 4 REITs in India. This significantly limits the choices for investors. Low Liquidity: While REITs are listed and traded on Stock Markets, the number of market participants is currently low especially with respect to retail investors. As a result, selling REIT investments profitably might be a challenge, especially in an emergency. This results in low liquidity of the investment. Taxable Dividend: Any dividend or interest earned from REITs is completely taxable in the hands of the investor according to the applicable slab rate. Thus those in the 30% tax slab will lose a substantial portion of their dividend income as taxes. Another important aspect to consider before investing in REITs is the taxation rules and that is discussed next. |