Written By: Saizal Agarwal

In the world of finance, managing the balance between short-term liquidity and long-term stability is a delicate art. One key strategy that financial institutions use to achieve this balance is borrowing short-term loans to fund long-term loans. At first glance, this might seem unexpected – why would a bank or lending institution take on short-term debt to finance long-term assets or loan?

The answer lies in the complex dynamics of asset-liability management , a strategy that financial companies use to match their resources with customer needs, helps them manage risks like changing interest rates, liquidity issues, and shifting market conditions. In simple terms, it’s about ensuring that a company has enough short-term funds to support long-term investments.

Now this leads to the question that what exactly is asset-liability management ?

Asset-Liability Mismatch is a term that refers to the misalignment between the assets (loans, investments) and liabilities (deposits, borrowings) in terms of maturity or cash flow timing. This mismatch, commonly seen in financial institutions like banks and NBFCs (Non-Banking Financial Companies), can expose these entities to severe liquidity and interest rate risks, especially during economic downturns.

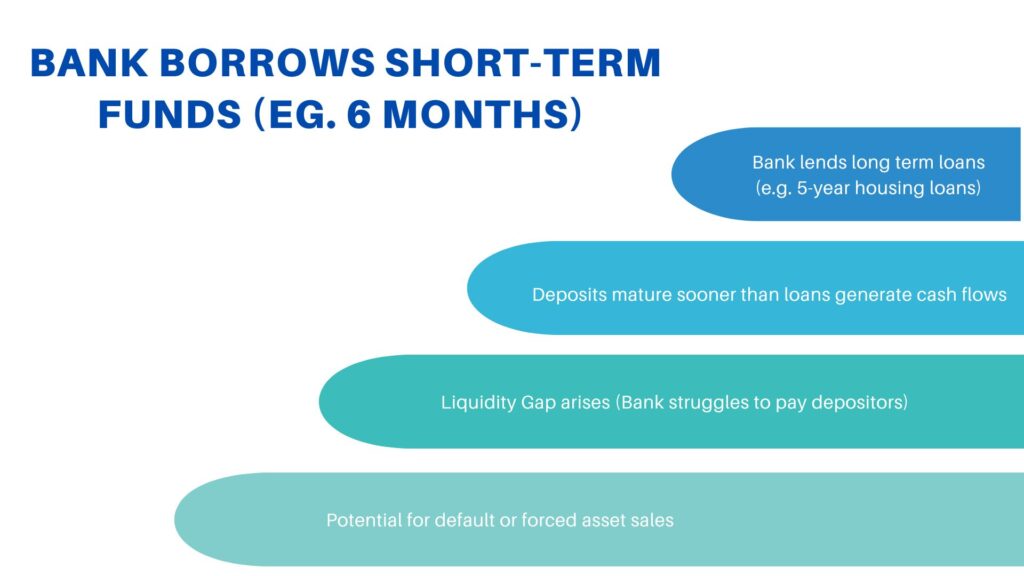

It occurs when the duration, interest rate, or cash flows of assets differ significantly from liabilities. Financial institutions generally borrow funds for the short term (such as customer deposits) but lend for longer periods (such as mortgages or business loans). The returns from these assets often exceed the costs associated with short-term liabilities, creating a profit opportunity. However, if liabilities come due before assets generate cash flow, the institution may face a liquidity shortfall, leading to financial distress. But, despite the risks, banks and NBFCs often engage in to optimize returns or meet specific business objectives.

What are the risks involved in asset-liability mismatches & how can they impact financial institutions?

- Liquidity Risk

It is one of the most immediate and significant concerns in Asset-Liability Management . It refers to the risk that an institution may not have enough liquid assets to meet its short-term obligations when they come due, which can lead to a liquidity crisis.

In the context of financial institutions, liquidity is the ability to quickly convert assets into cash or access funds to meet obligations such as paying off short-term borrowings or other financial commitments.

Financial institutions like banks or NBFCs often deal with mismatches in the timing of cash inflows and outflows. While they may have long-term assets like loans or investments that will generate returns over time, they must still meet short-term liabilities, such as maturing debt, operational expenses, or customer withdrawals. Basically, when there is a mismatch between the maturity of liabilities and the cash flow generated from assets, liquidity risk arises.

- Example: The IL&FS (Infrastructure Leasing & Financial Services) crisis in India, which came to a head in 2018, was a result of liquidity risk stemming from a classic asset-liability mismatch. IL&FS, a large NBFC, borrowed heavily through short-term debt instruments like commercial papers to finance long-term infrastructure projects, such as highways and power plants. While these projects were expected to generate cash flows over time, they faced delays and cost overruns, preventing IL&FS from meeting its short-term debt obligations. When market conditions tightened, and the company struggled to refinance its debt, IL&FS found itself unable to raise the necessary funds to meet maturing liabilities.

As a result, IL&FS defaulted on payments in 2018, triggering a liquidity crisis. The company’s defaults led to a widespread loss of confidence in the NBFC sector, causing a ripple effect across financial institutions that had exposure to IL&FS’s debt. The crisis ultimately required government intervention to manage the debt restructuring process and stabilize the financial system. This incident highlighted the dangers of relying on short-term financing for long-term investments, exposing the vulnerabilities of financial institutions to liquidity risks.

- Interest Rate Risk

Asset Liability Mismatch exposes institutions to interest rate fluctuations, especially if the cost of borrowing increases faster than the yield on long-term assets. For instance, if a bank funds long-term loans with short-term deposits, a rise in interest rates could increase the cost of deposits, reducing profitability. If not managed well, this could erode the net interest margin and lead to financial strain. - Example: Suppose a bank funds 10-year fixed-rate mortgages using 1-year loan.

- The 10-year fixed-rate mortgage might offer a 7% interest rate to the borrower, which means the bank earns 7% annually for the next 10 years.

- However, the bank uses 1-year loan as its funding source with 5% p.a. interest rate which initially sounds low.

- Now, imagine that interest rates rise due to an increase in inflation or a tightening of monetary policy by the central bank. The cost of the 1-year loan for the bank could increase from 5% to 6% or 7% in the next year. However, the interest rate on the 10-year fixed-rate mortgage remains locked at 7% for the entire loan duration.

- This situation creates a mismatch in the interest rate sensitivity between the bank’s liabilities (the 1-year loan) and its assets (the 10-year fixed-rate mortgage).

This results in a squeeze on profitability, as the bank cannot adjust mortgage rates to reflect the higher funding costs, reducing its net interest margin. The mismatch between rising short-term funding costs and stable long-term asset returns increases interest rate risk, putting pressure on the bank’s financial stability and profitability.

If this risk is not managed effectively, it can lead to financial strain, lower profit margins, and even losses, particularly when the bank’s asset-liability mismatches become more pronounced during periods of fluctuating interest rates. To manage this risk, banks typically use interest rate swaps, hedging strategies, or match the duration of assets and liabilities more closely to avoid such mismatches.

- Reputation Risk

Asset Liability Mismatch-induced liquidity or solvency issues can damage an institution’s reputation. Customers and investors lose confidence in the institution’s stability, leading to withdrawals, reluctance to reinvest, or even a bank run in extreme cases. Reputational damage can be hard to recover from and can affect the institution’s future growth.

- Example: In 2019, YES bank faced a liquidity crisis because of rising bad loans (NPAs), risky investments, and a mismatch between short-term borrowings and long-term loans. The bank relied on short-term deposits and borrowings to fund long-term loans, but as the quality of its loans worsened, the bank couldn’t pay back its short-term debts.

As the bank struggled, many customers started withdrawing their money, and investors lost confidence in the bank, leading to fears of its collapse. This created a bank run, where more people rushed to withdraw their funds. To stop further damage, the Reserve Bank of India (RBI) stepped in, placed Yes Bank under a moratorium, and helped restructure it by bringing in other banks, including the State Bank of India (SBI), to inject capital.

Even after the restructuring, Yes Bank’s reputation suffered greatly. Customers were reluctant to deposit money, and investors were afraid to invest again because of the bank’s previous troubles. This damaged the bank’s image and made it difficult for it to recover. Even with the rescue plan, Yes Bank found it challenging to rebuild trust and regain its place in the market.

- Systemic Risk

It refers to the risk that the failure of a large financial institution or a significant event in the financial system can cause widespread instability, affecting other institutions, markets, and even the entire economy. Essentially, it’s the risk that the collapse of one major player in the financial system could lead to a chain reaction, where other companies, banks, or sectors are affected, and this can snowball into a larger financial crisis.

- Example: When Lehman Brothers, one of the largest investment banks in the world failed due to excessive risk-taking, particularly in the subprime mortgage market, and high leverage, which made them vulnerable when the housing market collapsed. They couldn’t recover from huge losses in mortgage-backed securities and lacked the liquidity to meet their obligations. When they couldn’t secure a government bailout, Lehman filed for bankruptcy in 2008, triggering a global financial crisis.

Its collapse caused massive panic because Lehman Brothers had strong connections with many other financial institutions and investors. As a result, its failure created a domino effect, where other banks and financial companies also started facing financial problems. This, in turn, led to stock market crashes, reduced lending, and even a global recession.

The collapse of Lehman Brothers showed how one institution’s failure could trigger a crisis, making the entire financial system vulnerable. This is why financial regulators and governments try to prevent institutions from becoming “too big to fail” and implement rules to reduce the risk of such systemic problems, such as requiring banks to have stronger financial buffers.

To avoid this risk, financial institutions ideally should fund their long-term loans with long-term sources of money:

1. Equity

Equity is the longest-term source of money. In theory, if financial institutions used only equity to fund long-term loans, they would avoid any mismatch risk. But relying on equity alone limits growth, as it’s more expensive and slower to raise compared to debt. If a financial institution relies only on equity, it may lose business to competitors who can lend faster and more affordably with debt.

2. Long-term debt

Another solution is to use long-term debt to fund long-term loans. But long-term borrowing usually costs more than short-term borrowing because it carries a higher risk. So, using long-term debt raises the cost of loans, impacting profits.

In summary, financial institutions have to balance stability and cost when deciding how to fund long-term loans. Using long-term sources (like equity and long-term debt) is safer but costlier, reducing profits. On the other hand, short-term funding is cheaper and boosts profits but increases the risk of a liquidity crisis if lenders suddenly want their money back.

But, to maximize profits, financial institutions prefer using cheaper short-term funds when possible.

Given the risks involved, why do financial institutions choose to use short-term funding to finance long-term investments through asset-liability management ? What drives them to adopt this strategy despite the potential challenges?

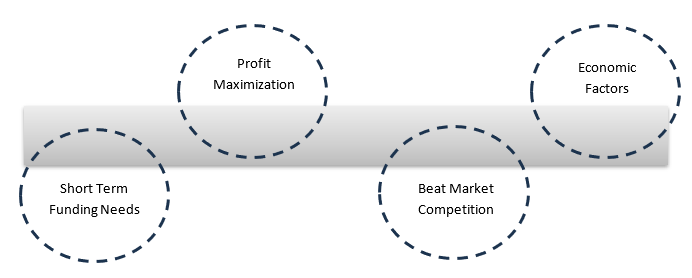

Asset-Liability Mismatch primarily occurs when financial institutions choose to finance long-term investments with short-term funding, creating a gap between the cash flows of their assets and liabilities. This practice, though risky, often happens due to the following reasons:

- Short-Term Funding Needs

Financial institutions, such as banks and NBFCs, often rely on short-term funding sources due to their lower costs. For instance, they might borrow funds through short-term instruments (Commercial Papers, Treasury Bills, Certificate of Deposits etc) or attract deposits with high liquidity requirements from customers.

While these short-term sources are less expensive, institutions often channel this money into long-term investments, such as mortgages or infrastructure projects, that take time to generate returns. This mismatch between short-term funding and long-term asset durations creates and increases the likelihood of a liquidity shortfall when liabilities come due.

- Example: Many Indian NBFCs like IL&FS Financial Services invested heavily in long-term infrastructure projects but relied on short-term commercial paper (CP) funding, which exposed them to liquidity risk. When CP markets tightened especially during 2018 liquidity crisis, NBFCs struggled to meet obligations.

- Profit Maximization

Financial institutions engage in to increase profitability. By borrowing short-term funds at lower interest rates and lending long-term at higher interest rates, banks can expand their net interest margin (the difference between income from loans and the cost of funds). This approach can lead to significant profits, but it also introduces risk if interest rates or market conditions change.- Example: During the pre-2008 financial crisis, investment banks like Lehman Brothers took on short-term liabilities to fund long-term mortgage-backed securities (MBS). These MBS were expected to generate higher returns over time, allowing the banks to benefit from the difference between the low short-term borrowing costs and the higher long-term returns.

However, when the housing market collapsed and the value of MBS plummeted, the banks were left with assets that could no longer generate expected returns. At the same time, their short-term debts came due, and they could not refinance them, leading to massive losses and ultimately Lehman Brothers’ bankruptcy.

- Market Competition

The financial sector is highly competitive, with institutions often taking on to maintain or grow their market share. Engaging in allows banks and NBFCs to offer lower loan rates and attractive lending products, drawing in more customers and expanding their loan book. However, this competitive advantage comes at the cost of increased liquidity risk if market conditions deteriorate.- Example: In India, financial institutions, particularly HDFC Ltd. and LIC Housing Finance, have used asset-liability management strategies to grow their market share in the competitive housing finance sector. These institutions often offer long-term mortgage loans at attractive interest rates to homebuyers, even though these loans are funded primarily through short-term deposits or short-term borrowings like commercial papers. By doing this, they can provide more competitive loan offerings than their rivals, thereby attracting a larger customer base and expanding their loan books.

However, this strategy also introduced liquidity risks. If there was a downturn in market conditions or a sudden rise in interest rates, the cost of rolling over short-term debt could exceed the returns generated from the long-term mortgages. Additionally, if the housing market slowed and cash flows from mortgages were delayed, institutions could face difficulties in meeting their short-term obligations, potentially leading to liquidity shortfalls.

- Economic Factors

Asset Liability Mismatch practices are influenced by economic conditions, particularly in stable, low-interest-rate environments. When rates are low, institutions may find it more feasible to fund long-term loans with short-term liabilities, expecting they can refinance or roll over short-term funding as needed. However, if interest rates rise or the economic environment shifts, the cost of short-term funding can increase unexpectedly, causing distress.- Example: During periods of stable economic growth, banks are often comfortable extending long-term loans, relying on the availability of short-term funding to cover obligations. However, in a downturn or during rising rates, this strategy can backfire, as seen with several regional banks in the U.S. after the Federal Reserve raised rates.

As rates rose, the cost of short-term borrowing increased significantly, while the value of long-term assets, like mortgage-backed securities, dropped, leaving these banks unable to refinance their short-term debt. This mismatch between the rising costs of short-term liabilities and the declining value of long-term loans led to significant financial distress for many banks.

In conclusion, Asset-Liability Mismatches are a double-edged sword for financial institutions. On one hand, they can help institutions maximize profits, stay competitive, and expand their market share. On the other hand, these mismatches expose them to significant risks, such as liquidity shortages, rising interest rates, damage to their reputation, and even broader systemic issues. The failures of IL&FS, Lehman Brothers, and Yes Bank serve as stark reminders of how poor management of these mismatches can lead to serious financial problems. To avoid such outcomes, financial institutions must carefully manage and balance their assets and liabilities, as mismanagement can not only harm the institution but also disrupt the entire economy and erode public trust in the financial system.