Written By: Nishant Parsad

To interpret negative working capital effectively, it’s essential to identify its root cause. The circumstances leading to negative working capital determine whether it reflects operational strength or financial distress.

Negative working capital caused by poor financial management often comes with other warning signs. Take the example of Jet Airways, once one of India’s leading airlines, despite operating in the cash-generating aviation industry, the company’s inability to manage its liabilities and operational expenses led to its downfall in 2019.

In such cases, negative working capital indicates financial instability, especially if:

- Short-term debt grows significantly.

- Projects face delays or budget overruns.

- Cash flow from operations (CFO) is insufficient to cover obligations.

Let’s understand the whole case study of Jet Airways

How Jet Airways Operated with Negative Working Capital

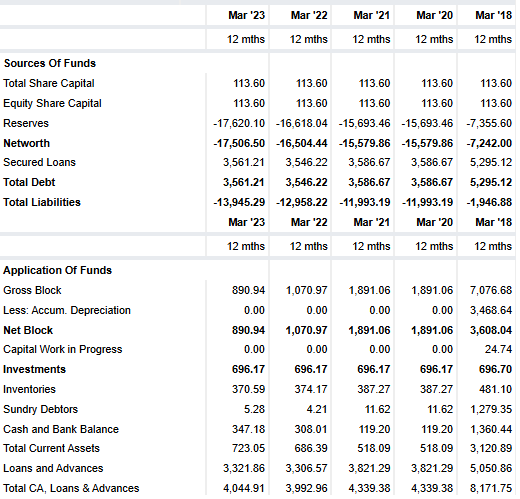

The airline’s liabilities, including lease payments and fuel costs, far outpaced its current assets. By FY2018:

- Current Liabilities: ₹13,983.35 crore (All Time-High)

- Current Assets: ₹3,120.89 crore (Started decreasing)

- Working Capital: -₹10,862 crore

This imbalance reflected liquidity challenges rather than operational strength.

Warning Signs of Financial Stress

- Mounting Debt:

- Total debt reached ₹5,295.12 crore by FY2018, with high interest costs straining cash flows.

- Delayed Vendor Payments:

- Overdue payments to lessors and suppliers led to grounded aircraft and strained vendor relations.

- Weak Cash Flow from Operations (CFO):

- Net CFO turned negative in FY2020 due to rising costs and declining profitability.

- Declining Market Share:

- Competition from low-cost carriers like IndiGo and high fixed costs eroded margins.

Consequences of Poor Working Capital Management

- Operational Disruptions: Grounded aircraft and delayed flights.

- Employee Unrest: Unpaid salaries led to strikes.

- Default and Bankruptcy: Jet Airways ceased operations in April 2019 after defaulting on debt repayments.

Comparative Analysis

Unlike IndiGo, which also operates with negative working capital but maintains strong cash flows and low debt, Jet Airways relied on excessive borrowing and struggled with profitability.

Key Takeaways:

Jet Airways’ case highlights that negative working capital paired with:

- Rising short-term debt,

- Insufficient CFO, and

- Persistent payment delays

…is a clear sign of financial instability. For investors, these red flags emphasize the need for caution when assessing companies with negative working capital.

Negative Working Capital as an Efficiency

On the other hand, in industries like retail or FMCG, negative working capital reflects strategic supplier arrangements and efficient cash flow management. For example, Ion Exchange (India) Ltd has consistently leveraged supplier credit to maintain operations and fund growth. From FY2010-19, Ion Exchange increased trade payables by ₹227 crore, allowing it to reinvest surplus cash into its business.

Such cases demonstrate that negative working capital can be a strength when combined with:

- High inventory turnover.

- Strong profit conversion to cash flow.

- Low reliance on short-term debt.

Let’s talk about the Ion Exchange (India) Ltd in detail for more clarity,

Ion Exchange (India) Ltd, a leader in water treatment and desalination, demonstrates how negative working capital can signify operational efficiency rather than financial distress. Despite current liabilities consistently exceeding current assets, the company has maintained financial health and sustained growth.

How Ion Exchange Operates with Negative Working Capital

The company strategically leverages favorable supplier credit terms, receiving upfront payments for projects while extending payment periods to suppliers. This creates a cash surplus, enabling operations without liquidity concerns.

From FY2010 to FY2019:

- Trade Payables: Increased by ₹227 crore, from ₹188 crore to ₹415 crore.

- Receivable Days: Peaked at 162 days in FY2017 due to client market delays.

- Payable Days: Averaged 220 days, reflecting strong supplier terms.

Supplier credit has been pivotal in offsetting the high receivables and cash-intensive projects.

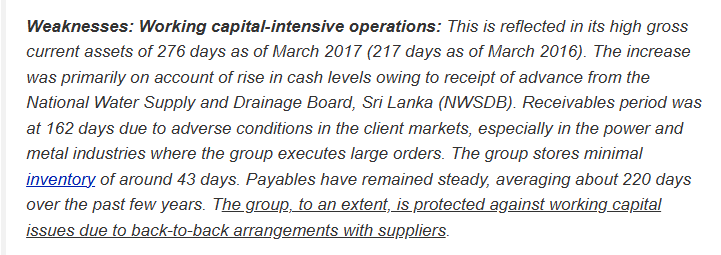

The credit rating agency, CRISIL, in its credit rating report of the company in Aug. 2017 has highlighted that Ion Exchange (India) Ltd is able to control its working capital despite high receivables days because it is able to get back-to-back arrangements from its suppliers.

Financial Strength Indicators (FY2010–FY2019)

- Cash Flow from Operations (CFO): ₹616 crore, exceeding PAT of ₹202 crore, showing strong profit-to-cash conversion.

- Free Cash Flow (FCF): Positive at ₹404 crore after ₹212 crore in capex.

- Debt-to-Equity Ratio: Incremental debt was just ₹51 crore, showcasing low reliance on borrowing.

- Cash Reserves: Grew by ₹273 crore, ensuring financial flexibility.

Supplier Arrangements & Challenges

CRISIL (2017) credited Ion Exchange’s ability to control its working capital cycle by ensuring payables exceeded receivables. However, constraints remain:

- Blocked Cash Reserves: ₹158 crore in escrow accounts tied to large projects like the NWSDB in Sri Lanka.

- Working Capital Intensity: High gross current assets (276 days in FY2017) due to delayed payments, particularly in power and metal industries.

Conclusion

Ion Exchange’s negative working capital reflects financial prudence, driven by efficient supplier credit management, strong cash flow generation, and low debt levels. For investors, it underscores the importance of analyzing CFO, FCF, and payables terms to differentiate efficiency from distress. Ion Exchange turns liabilities into a strategic advantage, funding growth without relying heavily on debt.

Industries where Negative Working Capital is Normal

Negative working capital isn’t always a red flag. In some industries, it’s a natural outcome of their operating models.

1. Retail and E-commerce

Retailers like DMart and global giants like Walmart operate on low-margin, high-turnover models. Customers pay at checkout, providing immediate cash inflow, while suppliers often offer extended credit terms (e.g., 30-60 days). This creates a situation where liabilities (supplier payables) exceed assets (inventory and cash).

For these businesses, negative working capital reflects operational efficiency. For instance, DMart consistently reinvests its surplus cash into opening new stores, maintaining growth without relying heavily on debt.

2. FMCG (Fast-Moving Consumer Goods)

FMCG companies like Hindustan Unilever (HUL) and Nestlé also rely on high inventory turnover and favorable supplier terms. These businesses operate in highly competitive markets, ensuring products sell quickly, generating immediate cash flow.

HUL, for example, uses its market dominance to negotiate long payment cycles with suppliers. This allows it to maintain liquidity while reinvesting in product innovation and marketing.

3. Subscription-Based Businesses

Subscription services such as Netflix and Spotify collect payments upfront from customers, providing a steady stream of cash. Their expenses, such as content creation or licensing fees, are deferred over time.

This upfront cash allows these companies to invest in growth initiatives, such as expanding content libraries or acquiring new subscribers, without holding large amounts of cash or assets.

4. Airlines

Airlines like IndiGo and Ryanair operate on negative working capital by selling tickets months in advance. This provides immediate cash flow while payments for aircraft leases, fuel, and services are often deferred.

IndiGo, for example, uses the cash generated from advance ticket sales to fund operational costs and manage growth efficiently.

5. Grocery Chains and Quick Service Restaurants (QSRs)

Chains like McDonald’s or Zomato collect cash upfront from customers while paying vendors and suppliers later. For grocery chains, rapid inventory turnover and daily cash sales ensure liquidity despite liabilities exceeding assets.

In all these industries, negative working capital results from high cash inflow and favorable payment terms rather than liquidity issues.

Is Negative Working Capital Sustainable?

Once the cause of negative working capital is understood, the next step is to evaluate whether it’s sustainable. This requires a thorough analysis of financial parameters, management practices, and industry norms.

- Profit-to-Cash Conversion

A company’s ability to convert profits (PAT) into operating cash flow (CFO) is one of the most critical indicators of financial health. Companies like HUL and Ion Exchange excel in this area, with robust cash flow even when liabilities exceed assets.

For instance, Ion Exchange reported cumulative profits of ₹202 crore from FY2010-19, but its CFO during the same period was ₹616 crore—an indication of exceptional cash flow management.

If a company reports high profits but weak CFO, it may struggle with receivables collection or inventory turnover, signaling inefficiencies.

- Free Cash Flow (FCF)

FCF is another crucial metric for evaluating negative working capital. A company with strong FCF can fund its capital expenditure and manage liabilities without external borrowing.

DMart, for instance, generates positive FCF consistently, using it to open new stores and expand its footprint. Conversely, companies with persistent negative FCF often struggle to sustain operations or fund growth initiatives.

- Debt Management and Interest Coverage

Companies with negative working capital should maintain low debt levels and strong interest coverage ratios to ensure financial stability. For example, Infosys operates on tight working capital cycles but maintains a low debt-to-equity ratio, reflecting prudent financial management.

High debt-to-equity ratios, on the other hand, increase the risk of insolvency, especially in industries where negative working capital is uncommon.

- Supplier Credit Terms

One of the defining factors of healthy negative working capital is favorable supplier credit terms. Retailers like DMart negotiate extended payment periods with suppliers, ensuring liabilities exceed assets without impacting liquidity.

However, persistent delays in supplier payments, as seen in struggling real estate companies, indicate liquidity challenges rather than efficiency.

Conclusion: Distinguishing Between Efficiency and Distress

Negative working capital is neither inherently good nor bad—it depends on the context and the company’s ability to manage its cash cycle effectively. For industries like retail and FMCG, it can signal operational efficiency and strong supplier relationships, while in capital-intensive sectors, it may highlight liquidity issues.

By examining real-world examples like DMart, HUL, and Ion Exchange, we see how companies can use negative working capital to fuel growth. At the same time, cases like IL&FS remind us that negative working capital, when paired with weak cash flow or high debt, can spell trouble. A careful, in-depth analysis is the key to making informed investment decisions.