Written By: Soumya Singhal

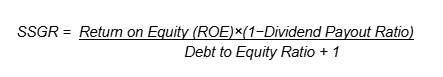

The Self-Sufficient Growth Rate (SSGR) is the maximum growth rate a company can achieve without requiring additional external equity or increasing its debt-to-equity ratio. It is essentially the growth rate that can be sustained through internally generated funds, such as retained earnings while maintaining its existing capital structure.

Formula:

Connecting SSGR with Growth Rate and Sales Growth Rate

The Self-Sufficient Growth Ratio (SSGR) is critical in determining how a company can sustain its sales growth rate using internal resources (retained earnings) without relying on external financing. Let’s explore how these metrics interact:

Relationship Between SSGR and Sales Growth Rate

- SSGR ≈ Sales Growth Rate

The company efficiently utilizes internal resources for growth, and its retained earnings and profitability are sufficient to support its sales growth.

- SSGR < Sales Growth Rate (Funding Gap)

The company’s internal resources are insufficient to fund its growth, leading to a funding gap. External financing is required to maintain growth, leading to potential risks like higher leverage or equity dilution.

- SSGR > Sales Growth Rate (Excess Capacity)

The company generates more internal resources than required to support its sales growth. Offering opportunities for reinvestment, debt reduction, or increased dividends.

Key Factors Affecting SSGR:

- Profitability: Higher net profit margins lead to higher ROE, which improves SSGR.

- Dividend Policy: A lower dividend payout ratio increases the retention ratio, boosting SSGR.

- Leverage: While SSGR assumes no additional external financing, companies with higher leverage may have lower flexibility for self-sufficient growth.

Where:

Return on equity(ROE)

It is a financial ratio that measures how efficiently a company uses its shareholders’ equity to generate profits. It indicates the return that investors are earning on their equity investment in the company.

- Net Income: The company’s profit after taxes and interest, often called “net profit” or “profit after tax (PAT).”

- Shareholders’ Equity: The total equity capital invested by the shareholders, including retained earnings.

Interpretation of ROE:

- High ROE: Indicates the company is generating high returns on shareholders’ investments, suggesting efficient management and profitability.

- Low ROE: Signals inefficient use of equity or poor profitability, which may concern investors.

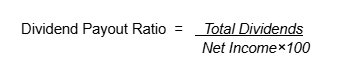

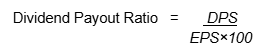

Dividend Payout Ratio

The Dividend Payout Ratio is a financial metric that indicates the proportion of a company’s net income that is distributed to shareholders as dividends. It reflects how much profit is returned to investors versus how much is retained by the company for reinvestment.

Formula:

Or, if Earnings Per Share (EPS) and Dividends Per Share (DPS) are available:

Interpretation:

- High Dividend Payout Ratio (>50%):

Indicates the company distributes a large portion of its earnings as dividends, which is common in mature industries with limited growth opportunities (e.g., utilities or FMCG).

Example: Hindustan Unilever, ITC. - Low Dividend Payout Ratio (<50%):

Suggests the company retains more earnings for growth and expansion. This is typical for companies in high-growth sectors like technology or telecom.

Example: Bharti Airtel, Infosys.

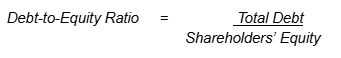

Debt-to-Equity Ratio (D/E Ratio)

The Debt-to-Equity (D/E) Ratio is a financial leverage ratio that compares a company’s total debt to its shareholders’ equity. It indicates how much debt a company is using to finance its operations relative to its equity capital.

Formula:

Total Debt: Includes both short-term and long-term liabilities.

Shareholders’ Equity: Represents the equity capital invested by shareholders, including retained earnings.

Interpretation:

- D/E < 1: The company uses more equity than debt, indicating lower financial risk.

- D/E > 1: The company relies more on debt than equity, which increases financial risk but may also amplify returns in favorable conditions.

Difference Between Self-Sufficient Growth Rate (SSGR) and Sustainable Growth Rate (SGR)

| Aspect | Self-Sufficient Growth Rate (SSGR) | Sustainable Growth Rate (SGR) |

| Definition | The growth rate a company can achieve without raising external equity or increasing its debt-to-equity ratio. | The maximum growth rate a company can achieve while maintaining its existing financial policies (i.e., capital structure and dividend policy). |

| Focus | Focuses on maintaining a constant debt-to-equity ratio and using only internally generated funds. | Focuses on maintaining the current capital structure and profitability without changing leverage. |

| Debt Consideration | Explicitly considers the debt-to-equity ratio in the calculation. | Assumes the company maintains its current debt and equity proportions but does not directly factor in debt. |

| Primary Drivers | Return on Equity (ROE), Dividend Payout Ratio, and Debt-to-Equity Ratio. | Return on Equity (ROE) and Dividend Payout Ratio. |

| Formula | SSGR=ROE×(1−Dividend Payout Ratio)/Debt-to-Equity Ratio+1 | SGR=ROE×(1−Dividend Payout Ratio) |

| Capital Structure | Maintains or stabilizes the debt-to-equity ratio. | Assumes the company will not issue new equity or significantly alter its financial leverage. |

| Applicability | Useful for companies with significant debt or those focused on capital structure optimization. | It is useful for companies that aim to grow organically while maintaining current financial policies. |

| Industry Example | Capital-intensive industries like telecom, manufacturing, and utilities (e.g., Bharti Airtel, which has high leverage). | Consumer goods or tech companies with stable financials and low debt (e.g., Hindustan Unilever, Infosys). |

Case Study: Bharti Airtel

Bharti Airtel is one of India’s largest telecom operators. The company has a significant amount of debt on its balance sheet due to capital-intensive network expansion, spectrum acquisition, and 5G rollouts. Its ability to grow sustainably without additional financing is critical for maintaining financial health.

- Return on Equity (ROE):

In FY24, Bharti Airtel’s ROE stood at approximately 15% (hypothetical value for illustration). - Dividend Payout Ratio:

Airtel’s dividend payout ratio is moderate, say 25%. This implies it retains 75% of its earnings for reinvestment. - Debt-to-Equity Ratio:

Bharti Airtel has a relatively high debt-to-equity ratio of around 1.5 due to its infrastructure investments.

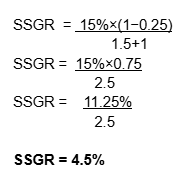

Calculating SSGR for Bharti Airtel:

Interpretation:

Bharti Airtel can achieve a self-sufficient growth rate of 4.5% without taking on additional debt or equity financing. If it wants to grow beyond 4.5%, it would need to:

- Increase its ROE by improving operational efficiency or increasing profitability.

- Lower the dividend payout to retain more earnings.

- Reduce its debt-to-equity ratio by repaying debt or issuing more equity.

Relevance of SSGR for Bharti Airtel:

- Capital-Intensive Industry: With significant capital required for network expansion and 5G deployment, understanding SSGR helps Airtel assess its ability to grow organically.

- Debt Management: As a company with high debt, growing beyond its SSGR may put pressure on its financial structure, increasing interest costs and risk.

- Investor Perspective: A sustainable growth rate without excessive debt is attractive to investors looking for financially stable companies in the telecom sector.

Sales Growth Rate vs. SSG in Bharti airtel

Sales growth rate = 11.1% in FY24

Bharti airtel SSGR = 4.55

This shows The company’s internal resources are insufficient to fund its growth, leading to a funding gap. External financing is required to maintain growth, leading to potential risks like higher leverage or equity dilution.

Importance of SSGR

- Internal Funding Capacity: Helps investors and management understand how much a company can grow without seeking external debt or equity.

- Capital Structure Planning: Assists in determining if and when external financing will be needed.

- Dividend Policy Impact: Demonstrates the effect of dividend payouts on growth potential. Higher dividends reduce retained earnings and lower SSGR.

- Sustainability: Companies with higher SSGR are typically more sustainable as they rely less on external funding, reducing financial risk.

Limitations of SSGR

- Ignores External Growth Opportunities: Companies might forego higher growth if they rely solely on internal funds.

- Static Assumptions: SSGR assumes a constant ROE and retention ratio, which might change due to market conditions.

- Leverage Risk: While higher leverage can improve ROE and SSGR, it also increases financial risk.

SSGR can used in Peer Comparison:

- Which company is better positioned for self-funded growth?

- How do dividend policies affect internal financing?

- Which firm may need to raise external capital to maintain or accelerate growth?

SSGR in Mergers & Acquisitions (M&A)

- Companies with a high SSGR are often acquisition targets because they can self-finance growth post-acquisition, reducing the need for capital infusion by the acquirer.

- In contrast, a company with a low or negative SSGR may require additional debt or equity post-acquisition, making the deal riskier.

SSGR and Startups: A Unique Case

- For startups, SSGR is often negative or close to zero, as they reinvest all their earnings (if profitable) and still require external funding for hyper-growth.

- However, once they mature and stabilize, SSGR becomes a critical indicator of their ability to grow organically.

- Think of companies like BYJU’s or Paytm—they initially operate with negative SSGR but aim to improve it as they reach profitability.

- Fun Fact: Warren Buffett and SSGR

- Warren Buffett prefers companies with a high SSGR because they can reinvest profits efficiently without diluting shareholder value.

- One of his favorite holdings, Coca-Cola, maintained a high SSGR for years due to its ability to generate substantial cash flows with minimal capital expenditure.