Written By: Soumya Singhal

Masala Bonds

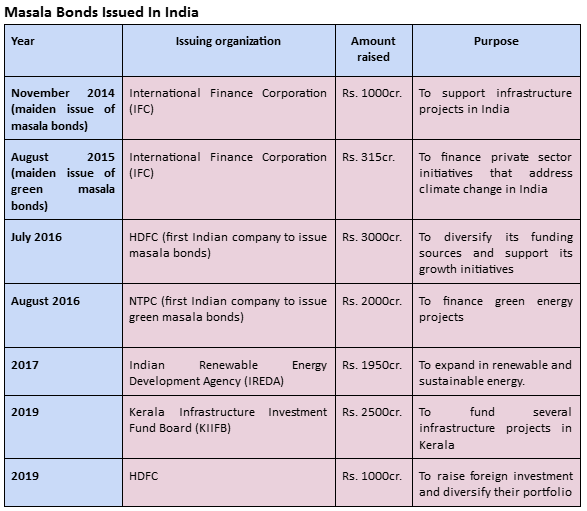

The International Finance Corporation (IFC) introduced masala bonds in India in 2014. It issued the first such bonds to finance infrastructure projects. They can be privately placed or listed on exchanges. The first masala bond was issued in 2014 by the International Finance Corporation to fund an infrastructure project in India

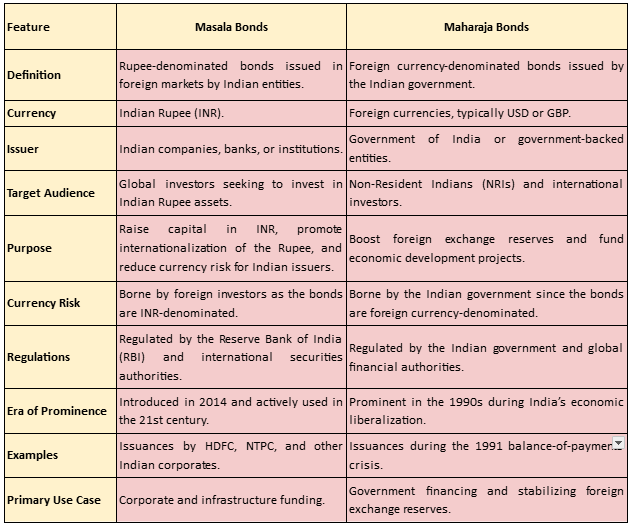

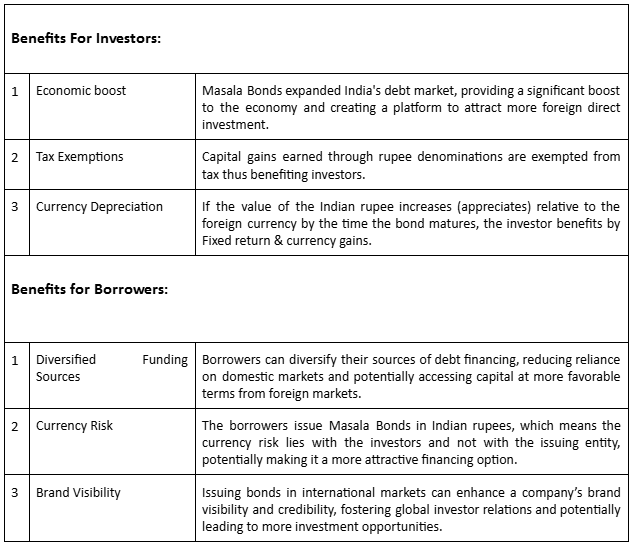

These bonds are issued by Indian entities in overseas markets to raise funds. Unlike traditional bonds, Masala Bonds are denominated in Indian Rupees (INR) rather than the local currency of the issuing market. Consequently, any depreciation in the rupee’s value places the currency risk on the investor.

Characteristics of Masala Bonds

Masala Bonds are rupee-denominated debt instruments issued by Indian entities in foreign markets to attract investment in local currency from international investors. These bonds derive their name from the Indian spice “masala,” signifying their Indian origin.

The bonds are denominated in Indian Rupees (INR), rather than the foreign currency of the country where they are issued. Since the bonds are in INR, foreign investors bear the exchange rate risk. If the Indian rupee depreciates against the investor’s home currency, they may incur losses.

These bonds can be issued by both government and private entities, allowing non-resident investors to participate in India’s financial growth. Eligible subscribers include residents of countries that are members of the Financial Action Task Force (FATF). These securities market regulators are part of the International Organization of Securities Commissions (IOSCO), and multilateral or regional financial institutions in which India holds membership.

The bonds were introduced to address the challenges faced by Indian corporations in raising foreign capital, such as the Taper Tantrum in 2013. The Taper Tantrum was a period when the U.S. Federal Reserve announced that it would scale back its bond-buying program, which caused a significant outflow of foreign capital from emerging markets. This bond also promotes domestic growth, helps internationalize the Indian rupee & helps mitigate currency exchange risk for issuers.

Here’s how Masala Bonds work

Imagine a company called XYZ Ltd. in India wants to raise ₹4,000 crores. Since XYZ Ltd. has already raised substantial funds from Indian investors, they decided to issue bonds overseas.

They list their rupee-denominated bonds on the US Stock Exchange, meaning the debt will be raised in Indian currency.

So, XYZ Ltd. raises the equivalent of ₹4,000 crores in Indian rupees from foreign investors.

Now, you might wonder how they repay their investors if the currency differs.

Suppose after a few years they need to repay ₹4,200 crores to their investors, At that point of time they will repay the equivalent amount in Dollars, as the bonds were issued on the US Stock Exchange.

Depreciation of INR: If the rupee weakens against the dollar, the repayment in USD will be lower, benefiting XYZ Ltd. Like If the rupee depreciates from ₹80/USD to ₹100/USD, the company would need only $420 million (₹4,200 crores ÷ ₹100) to repay, compared to $525 million (₹4,200 crores ÷ ₹80), reducing the repayment burden.

Appreciation of INR: If the rupee strengthens, the repayment in USD will increase, raising the company’s costs. If the rupee appreciates from ₹80/USD to ₹60/USD, the company would need $700 million (₹4,200 crores ÷ ₹60), significantly increasing its repayment cost in dollars.

This benefited the company by eliminating currency risk and helped diversify its financing sources.

Benefits of Masala Bonds

The Reserve Bank of India (RBI) has specified the following maturity periods for Masala Bonds:

- A three-year maturity for bonds issued up to the rupee equivalent of USD 50 million in a financial year.

- A five-year maturity for bonds issued above the rupee equivalent of USD 50 million in a financial year.

The bond conversion and settlement processes, including servicing interest, are carried out at the prevailing market rate on the transaction date.

Kerala: The First Indian State to Issue Masala Bond

Recently, the state-owned Kerala Infrastructure Investment Fund Board (KIIFB) debuted its ‘masala bond’ issue of ₹ 2,150 crore on the London Stock Exchange.

Maharaja Bonds

- Maharaja Bonds were prominent in the early 1990s when India was trying to liberalize its economy and needed foreign exchange to stabilize its balance of payments.

- A foreign currency-denominated bond issued by the Indian government during the 1990s. They were designed to attract non-resident Indians (NRIs) and other international investors to boost foreign exchange reserves and fund infrastructure development.

- Maharaja Bonds were a specific class of bonds issued by the Indian government in the 1990s, particularly to raise funds for government projects. They were named after India’s royal family, symbolizing prestige.

- These bonds were usually issued in foreign currencies like USD, GBP, EUR, and AED., with the repayments made in the same currency.

- The funds from Maharaja Bonds were typically raised for large infrastructure and development projects. These bonds were part of India’s broader strategy to tap into global capital markets during economic reform and fiscal challenges.

- The bond provides an annual interest rate of 6%. With a 5-year tenure and semi-annual interest payments, it requires a minimum investment of $1,000 and has no maximum subscription limit.

Comparison: Masala Bonds vs Maharaja Bonds