Written By: Soumya Singhal

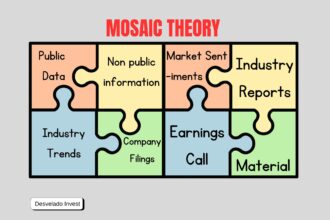

The Mosaic theory is a concept used in the field of security analysis. The analyst gathers information regarding a firm’s public, non-public, material & immaterial information to derive the company’s value or security. Measurement of a business’s economic & financial stability lays this theory’s primary purpose.

The Mosaic Theory assists financial analysts in identifying and recommending securities that offer the best value and high returns to investors. Recognized as a legitimate method by the CFA Institute, it allows analysts to gather and utilize information about a company or investment within legal boundaries. This approach proves especially valuable when a company encounters uncertainties that are not entirely captured in its public disclosures. Consequently, all insights obtained by analysts regarding security are transparently shared with investors.

Understanding the Mosaic Theory

At its core, the Mosaic Theory resembles a puzzle. Each piece of information contributes to a comprehensive assessment, whether a company’s public filings, industry data, Annual reports, earning calls, or even subtle non-public insights (collected legally). The goal is to analyze these fragments and determine a business’s economic and financial stability. This method goes beyond surface-level analysis, diving deeper into factors that may not be readily apparent in publicly disclosed information.

Why Mosaic Theory Matters

Comprehensive Valuation: Analysts can assess securities’ true value by integrating various data points, ensuring robust investment strategies.

Investor Confidence: Transparent disclosure of insights builds trust between analysts and investors, fostering long-term relationships.

Risk Mitigation: This theory helps identify hidden risks, allowing for better portfolio management and allocation.

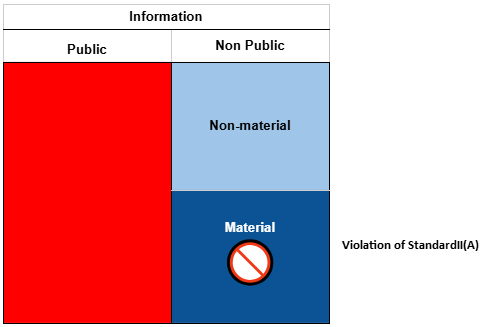

Non-material non-public information VS Material non-public information

Material non-public information refers to information about a company that is significant enough to influence an investor’s decision (material) and not yet available to the public (non-public). Using such information for trading is considered insider trading and is illegal. This type of information can change the company’s stock price. Below are examples of material non-public information:

1. Earnings Results Before Public Release

2. Merger or Acquisition Plans

3.Product Launch or Regulatory Approval which is yet to be announced in public.

4. Leadership changes include the resignation or appointment of key executives.

5. Financial Difficulties or Bankruptcy

6. Major Contract Wins or Losses news

7. Stock Buyback or Dividend Decisions not declared yet

8. Litigation or Regulatory Investigations like Pending lawsuits, and settlements are not disclosed publicly.

Non-material non-public information refers to information about a company that is not yet publicly available but is unlikely to have a significant impact on an investor’s decision or the company’s stock price. While this type of information may be private or internal, it is not considered critical enough to influence market behavior and stock price of the company. Below are examples of non-material non-public information

1. Publicly disclosed internal policy updates with no major impact on strategies.

2. Early-stage research with minimal business implications.

3. Routine discussions in internal meetings on non-strategic matters.

4. Non-critical company events like celebrations or team-building activities.

5. Standard compliance activities, such as license renewals or audits.

6. Minor office relocations or expansions with no effect on core operations.

7. Internal upgrades, such as software implementations or process enhancements.

Example of MOSAIC THEORY

Suppose we are analyzing the watch industry and interviewing several insiders to obtain market trends. We learn from the insiders that the market is beginning to lean towards fitness-centric smartwatches, which can be considered non-material, non-public information. Our research from news coverage also uncovered that XYZ Watches has made heavy investments in smartwatch technologies and has recently hired several fitness experts. You conclude that XYZ Watch stock is currently undervalued and is a strong buy. This is an example of the mosaic theory.

Now, let’s say we are a respected analyst, and our stock recommendation tends to move market prices, so our stock analysis can be said to be material information. Suppose we reserve this for our clients instead of releasing it to the public, in this case, we would not violate Standard II A because all the information used is not material non-public information.

Why is the Mosaic Theory seen as a legal alternative to insider trading for gathering company data?

The Mosaic Theory, endorsed by the CFA Institute, is a legal and ethical approach to gathering and analyzing data. Unlike insider trading, which involves the illegal use of material non-public information, this method relies solely on legally obtained data to derive conclusions. Analysts use insights from market trends, customer behavior, industry dynamics, and management decisions to complement public disclosures. Transparency is ensured as all gathered information is shared with investors, maintaining ethical compliance.

Limitations Of Mosaic Theory

Information Overload

A significant challenge with the Mosaic Theory is managing the overwhelming volume of data available. Analysts may find it difficult to process and analyze the sheer quantity of information effectively.

Confirmation Bias

Analysts may risk falling into the trap of confirmation bias, where they prioritize information that aligns with their pre-existing beliefs, potentially overlooking contradictory evidence and limiting objectivity.

Information Asymmetry

The theory assumes that all relevant information is publicly accessible, but this is not always the case, creating gaps in the analysis.

Incomplete Picture

Despite thorough efforts to gather data from diverse sources, analysts might still end up with an incomplete understanding of a company or industry.

Time-Consuming

The Mosaic Theory requires extensive due diligence, demanding significant time and resources to compile a comprehensive assessment. In some cases, excessive analysis can lead to delays in decision-making, often referred to as “paralysis by analysis.”