Written By: Bhumika Jain

Many people compare a stock’s PE ratio with the average PE ratio of its industry to judge whether the stock is overvalued or undervalued. If the stock’s PE is higher than the industry average, they may think it is overvalued. But this approach CAN BE misleading.

The reality is that even within the same industry, companies can differ very much. For example, one company might focus on premium products, while another targets budget-conscious customers. These differences affect profitability and growth potential, which influence the PE ratio.

Geographical presence also plays a role. A company operating in regions with high demand or lower competition may command a higher PE ratio than one struggling in competitive or low-demand markets.

Additionally, product mix matters. A company with high-margin products is likely to trade at a higher PE than a company offering commoditized or low-margin products.

Another important factor to consider is the growth stage of a company. Mature companies, which have been in the market for a long time, usually have a larger base of revenue and profits. Because of this, their growth rate tends to be slower. These companies often prioritize stability and consistent returns over rapid expansion.

On the other hand, younger or smaller companies in their growth phase might have a smaller base, allowing them to grow revenues and profits at a much faster pace. Investors often pay a premium for such growth potential, which is reflected in a higher PE ratio.

Comparing a stock’s PE with the industry average doesn’t account for these differences. A mature company with a lower PE ratio may seem undervalued but could simply be growing slower. Similarly, a high PE for a growing company might reflect its future potential rather than overvaluation.

Instead of relying only on PE comparisons, investors should assess the company’s growth prospects, market position, and future potential alongside its valuation. This approach provides a clearer picture of whether the stock is a good investment.

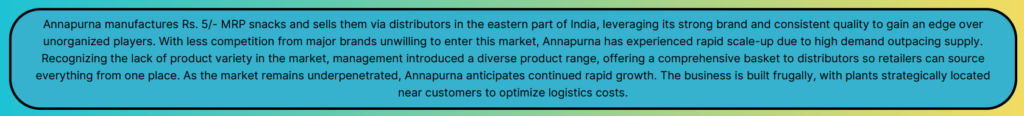

Let’s take the example of Annapurna Swadist, a West Bengal-based small FMCG company. They target rural customers and sell affordable products like biscuits at just ₹5 per packet. They also sell higher value products of Rs.20 per packet but, it is a very small portion of the product portfolio and not counted. Their revenue and earnings have been growing at a much higher pace than traditional big FMCG players due to their small base and rural demand recovery. Naturally, the company’s PE ratio is trading higher than the industry average.

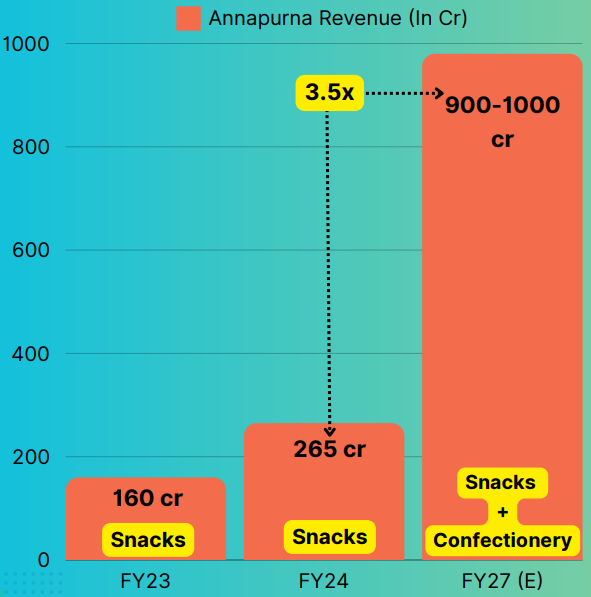

Source: Investor Presentation FY24, Page-9

In FY24, their revenue was ₹265 crores, but for FY27, it’s projected to be around ₹900-1000 crores which is almost 3.5x. This growth is driven by selling 27 lakh packets daily and targeting affordable pricing. When a company achieves such rapid sales and earnings growth, it’s normal for its stock to trade at a premium P/E because investors value the strong growth potential.

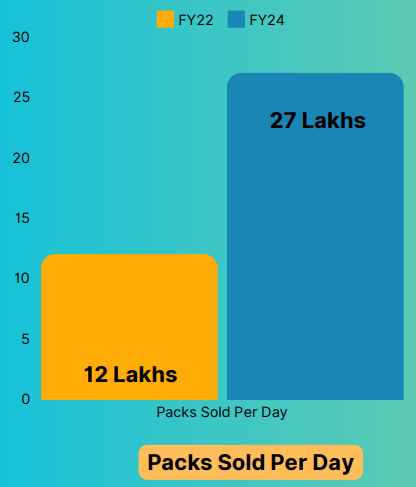

Source: Investor Presentation FY24, Page-15

Source: Investor Presentation FY24, Page-7

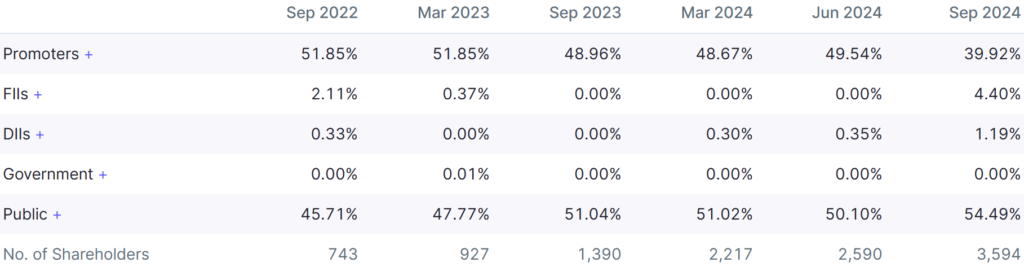

Adding to this, institutional investors like FIIs and DIIs have started increasing their stake in Annapurna Swadist. For example, FIIs went from 0% to 4.4%, and DIIs raised their stake from 0.3% to 1.19%. This shows growing confidence in the company’s future performance.

Source: Screener

Valuation cannot be judged in isolation. A higher PE doesn’t necessarily mean overvaluation; it could reflect strong growth potential, increasing investor interest, or competitive advantages. Always analyze valuations IN CONTEXT of growth, market position, and broader business fundamentals to make a well-informed investment decision.