Written By: Nishant Parsad

Imagine you’re at a grand banquet. The food on the table represents a company’s profits, while the guests are its shareholders. At first glance, the banquet looks well-stocked, and everyone appears to get a generous serving. Now, imagine if some additional guests holding “special invitations” (stock options, convertible bonds, etc.) arrive, claiming their share of the feast. Suddenly, everyone gets a smaller piece. That’s essentially what happens with Diluted Earnings Per Share (Diluted EPS)—a more conservative measure of a company’s profitability that accounts for all potential claims on its earnings.

Let’s dive deep into Diluted EPS, unpacking it step by step so you not only understand what it is but why it matters to investors and companies alike.

What is EPS and How Does Diluted EPS Fit In?

To understand Diluted EPS, let’s first tackle its simpler sibling, Basic EPS (Earnings Per Share).

Basic EPS tells you how much profit is available for each outstanding share. It’s calculated using this formula:

Basic EPS = (Net Income – Preferred Dividends) / Weighted Average Shares Outstanding

For example, if a company earns ₹100 crore in net income and has 10 crore outstanding shares, the Basic EPS is ₹10.

But here’s the catch: companies often issue securities like stock options, convertible bonds, or warrants that, if exercised, could increase the number of outstanding shares. This dilutes the profit available to existing shareholders. That’s where Diluted EPS comes into play. It assumes all these potential shares have been issued, providing a clearer, worst-case scenario of profitability per share.

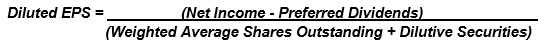

Diluted EPS Formula:

This approach helps investors understand the potential impact of dilution and decide whether a stock’s current price is justified.

Why Diluted EPS is Crucial for Investors

Let’s say you’re investing in a company, and its Basic EPS is ₹15. That’s impressive, right? But what if the company has issued convertible bonds that could add 5 crore shares? Suddenly, your slice of the earnings pie shrinks, and the Diluted EPS drops to ₹12.

This is why Diluted EPS is important:

– Transparency: It prevents surprises by showing how earnings might be diluted in the future.

– Realistic Valuation: Investors use Diluted EPS to calculate ratios like the Price-to-Earnings (P/E) ratio. A lower EPS might indicate the stock is overvalued.

– Forward Planning: Companies with many convertible securities might need to rethink their financing strategies if Diluted EPS significantly undercuts Basic EPS.

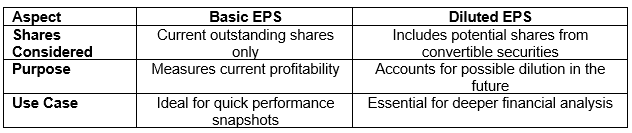

EPS vs. Diluted EPS: What’s the Difference?

Here’s a relatable analogy:

Basic EPS is like taking a family portrait where only immediate family members are present. Diluted EPS, on the other hand, includes the extended family—cousins, in-laws, and even neighbors who might join in later!

What Affects Diluted EPS?

Several factors can influence Diluted EPS, making it dynamic and complex:

1. Convertible Securities

These include convertible bonds or preferred shares, which holders can convert into common shares. For instance, if a company issues bonds worth ₹200 crore that can be converted into 1 crore shares, the Diluted EPS must account for these extra shares.

2. Stock Options and RSUs

Many companies, especially tech firms, grant stock options or restricted stock units (RSUs) to employees. When exercised, these add to the share pool, diluting earnings.

3. Warrants

Warrants are similar to options, giving holders the right to buy shares at a specific price. If exercised, they increase the number of shares outstanding.

4. Share Buybacks

On the flip side, if a company repurchases its shares, the total outstanding shares decrease, potentially improving both Basic and Diluted EPS.

Practical Example: Calculating Diluted EPS

XYZ Corp. has the following data for 2024:

- Net Income: ₹200 crore

- Preferred Dividends: ₹10 crore

- Outstanding Shares: 50 crores

- Convertible Bonds: ₹100 crore convertible into 10 crore shares

- Stock Options: 5 crore shares

Step 1: Calculate Basic EPS

Basic EPS = Net Income – Preferred Dividends/Outstanding Shares

Basic EPS = 200−10 /50 = ₹3.80

Step 2: Account for Convertible Securities

Total potential shares = 50 crores (current shares) + 10 crores (convertible bonds) + 5 crores (stock options) = 65 crore shares.

Step 3: Calculate Diluted EPS

Diluted EPS = Net Income – Preferred Dividends/Total Shares

Diluted EPS = 200−10 /65 ≈ ₹2.92

This shows that Diluted EPS is lower than Basic EPS, providing a more cautious estimate of profitability.

Dilution Isn’t Always a Bad Thing

The word “dilution” often triggers negative reactions from investors, but context matters. Dilution, in some cases, can signal growth and value creation:

- Strategic Capital Raising: Companies may issue convertible bonds or stock options to fund high-growth projects or acquisitions. While this dilutes EPS in the short term, the long-term gains from such investments can outweigh the impact.

- Employee Incentives: Stock options are often used to attract and retain top talent. A slightly diluted EPS might be worth it if the company’s performance improves due to a strong management team.

Investor Insight: Evaluate why dilution is happening. If it’s funding growth or incentivizing key employees, it could be a positive indicator rather than a red flag.

Limitations and Risks of Diluted EPS

While Diluted EPS is a valuable metric, it’s not perfect:

- Complexity: Companies with multiple convertible securities can make calculations challenging for investors.

- Overestimated Dilution: Not all securities will be exercised, meaning the actual dilution might be less severe.

- Potential Misuse: Companies might issue convertible securities strategically to inflate Basic EPS while downplaying Diluted EPS.

Key Takeaways for Investors

– Always compare Basic EPS and Diluted EPS to assess dilution risk.

– Look beyond Diluted EPS—combine it with other metrics like the Price-to-Earnings (P/E) ratio for a complete picture.

– Analyze the company’s capital structure to identify potential dilution triggers, like stock options or convertible bonds.

Conclusion

Diluted EPS is more than just a number—it’s a lens that helps you see a company’s profitability in its truest form, considering all potential claims on earnings. For investors, it’s an essential tool for making informed decisions and avoiding unpleasant surprises.

Next time you analyze a company, think of Diluted EPS as your “zoom-out” function, showing you how the earnings pie might look if more people show up to claim a slice. After all, the more informed you are, the better your investment decisions will be!