Written By: Abhay Khurana

In the landscape of financial reporting, accurately reflecting asset values is of great importance to stakeholders. Revaluation reserves play a crucial role in this context, ensuring that a company’s financial statements mirror the true market value of its assets. Recent developments, such as the RBI’s decision to exclude revaluation reserves from transferable funds, display their significance in financial management. [1]

A revaluation reserve is an equity account that records the surplus created when a company’s asset is revalued upwards to reflect its current fair market value, surpassing its historical cost. This practice is common for long-term tangible assets like property, plant, and equipment, especially when their market values experience fluctuations.

How Revaluation Reserves Are Created?

Under the revaluation model, revaluations must be performed regularly to ensure that the carrying amount of an asset aligns closely with its fair value at the balance sheet date.

If a revaluation increases an asset’s value, the increase should be credited to other comprehensive income and accumulated in equity under the “revaluation surplus” heading. However, if the increase reverses a previous revaluation decrease for the same asset that was recorded as an expense, it should instead be recognized in profit or loss.

In contrast, if a revaluation results in a decrease in asset value, it should be recorded as an expense, except for any portion that reverses a prior revaluation surplus for the same asset, which should be debited from the revaluation surplus.

When a revalued asset is sold or otherwise disposed of, any remaining revaluation surplus may either be transferred directly to retained earnings or remain in equity under the “revaluation surplus” heading. Transfers to retained earnings should bypass the profit or loss statement. [3]

Subsequent Depreciation: The revalued amount becomes the new basis for depreciation, affecting future financial statements. [4]

Purpose and Importance

In practice, companies across various industries utilize revaluation reserves to maintain accurate financial records. For instance, The Enron scandal (2001) exemplifies how improper accounting practices can lead to corporate fraud. Enron used mark-to-market (MTM) accounting to artificially inflate earnings by recording projected future profits as current income. The company also created Special Purpose Entities (SPEs) to hide debt and fabricate profitability, misleading investors and inflating its stock price.

The scandal highlighted the dangers of recognizing unrealized gains directly in the income statement. Proper use of revaluation reserves – where unrealized gain.

Reserves are isolated under equity rather than impacting profits—could have prevented the artificial inflation of earnings and ensured accurate financial reporting.

Enron’s collapse spurred regulatory reforms like the Sarbanes-Oxley Act of 2002, which strengthened corporate governance and enhanced transparency in financial reporting. This case is an example of the importance of ethical accounting practices and the role of mechanisms like revaluation reserves in maintaining financial integrity. [5] [6]

Its impact on Valuation Ratios vs. Financial Ratios

A revaluation reserve prevents an inflated P/E ratio by ensuring unrealized gains from asset revaluations are excluded from the profit and loss account. These gains are credited directly to the reserve under equity, leaving the earnings (used in EPS calculations) unaffected. This ensures that the P/E ratio reflects the company’s true operational performance, maintaining its integrity and avoiding misleading signals to investors. By isolating these gains, the reserve safeguards against overvaluation and adheres to accounting standards like IAS 16, which mandate transparency in financial reporting.

It’s important to understand how earnings manipulation can occur and how revaluation reserves play a role in maintaining financial integrity.

Earnings Manipulation and P/E Ratio Distortion

Companies may engage in practices that artificially inflate earnings to present a more favorable P/E ratio. For instance, they might recognize revenue prematurely, capitalize expenses that should be expensed, or engage in “earnings smoothing” to show consistent profits. These actions can mislead investors about the company’s true financial health.

Revaluation reserves can be used to manipulate a company’s debt-to-equity ratio by inflating the equity portion of the balance sheet through the upward revaluation of assets. When an asset is revalued, the increase in its value is credited to the revaluation reserve, which is part of shareholders’ equity. This increase in equity reduces the debt-to-equity ratio, as the ratio is calculated by dividing total debt by total equity.

Companies can also offset the higher depreciation caused by revaluation against the revaluation reserve, avoiding a negative impact on profits.

For instance, if a company has ₹100 crore in debt and ₹50 crore in equity, its debt-to-equity ratio would be 2.0. However, if the company revalues an asset, say real estate, by ₹30 crore, this value is added to the revaluation reserve, increasing equity to ₹80 crore. As a result, the debt-to-equity ratio would drop to 1.25, giving the impression of a healthier financial position without any actual reduction in debt.

They can also offset the higher depreciation caused by revaluation against the revaluation reserve, avoiding a negative impact on profits.

This manipulation of financial ratios can improve the company’s perceived financial stability, potentially attracting investors or securing better financing terms. However, this practice can be misleading if the revaluation is done solely for the purpose of manipulating ratios rather than reflecting the true market value of the assets. Therefore, proper disclosure of revaluation reserves and adherence to accounting standards are essential to prevent such manipulations and ensure transparency in financial reporting. [8]

Regulatory Considerations

Regulatory bodies often have specific guidelines regarding revaluation reserves:

- Accounting Standards: International standards like IAS 16 and local standards such as Ind AS 16 provide frameworks for asset revaluation and reserve accounting.

- Limitations on Use: Revaluation reserves are typically not distributable as dividends since they represent unrealized gains.

- Regulatory Decisions: The RBI’s decision to keep revaluation reserves out of transferable funds reflects a cautious approach to maintaining financial stability.

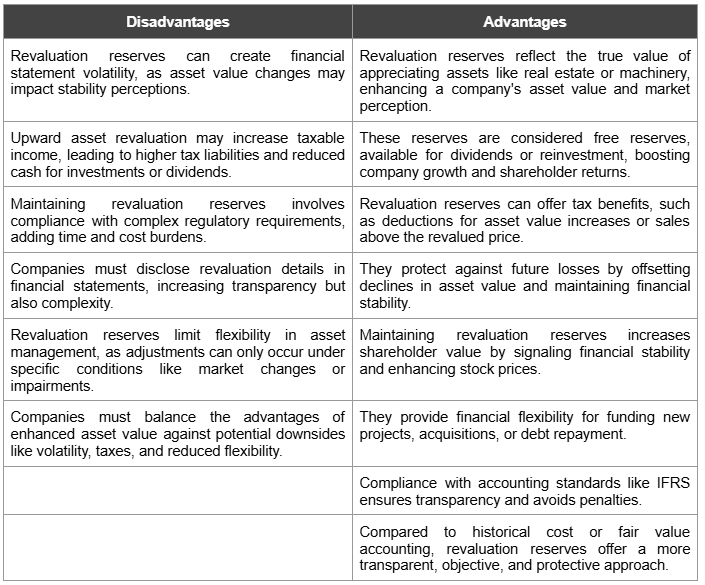

Advantages and Challenges [10]