Research By: Navya Sinha

Leverage ratios are financial metrics that show how much debt a company or an individual is using compared to their equity or assets. They help measure the level of financial risk, indicating how much a company relies on borrowed money to finance its operations.

Leverage is the use of debt to make investments. The goal is to generate a higher return than the cost of borrowing. Debt is important. When used effectively, it can generate a higher rate of return than it costs. However, too much is dangerous and can lead to default and financial ruin.

Leverage ratios are crucial because companies use a combination of equity and debt to fund their operations. Understanding the amount of debt a company carries is helpful in assessing its ability to meet its debt obligations when they become due. They offer a clear view of how much a company depends on debt to finance its operations and growth.

Some Common Leverage Ratios

1. Debt to Equity Ratio: This compares a company’s total debt to its total equity. A higher ratio means the company is using more debt relative to its own funds, which can be riskier.

Debt to Equity Ratio = Total Debt / Total Equity

For example, we assume a hypothetical financial data for Tata Motors Ltd.

Total Debt: ₹400,000,000

Total Equity: ₹600,000,000

Debt to Equity Ratio = Total Debt / Total Equity = 400,000,000 / 600,000,000 = 0.67

This means the company has ₹0.67 of debt for every ₹1 of equity.

2. Debt to Asset Ratio: This ratio compares a company’s total debt to its total assets. It shows what portion of a company’s assets are financed by debt. A debt-to-assets ratio below 1.0 is generally viewed as relatively safe, while ratios of 2.0 or higher are considered risky.

Debt to Asset Ratio = Total Debt / Total Assets

For example, Total Assets: ₹1,000,000,000

Debt to Asset Ratio = Total Debt / Total Assets= 400,000,000 / 1,000,000,000 = 0.40

This indicates that 40% of the company’s assets are financed by debt.

3. Equity Multiplier: This ratio indicates how much a company is using debt to increase its assets compared to equity. Generally, it is better to have a low equity multiplier, as this means a company is not incurring excessive debt to finance its assets.

Equity Multiplier = Total Assets / Total Equity

Equity Multiplier = Total Assets / Total Equity = 1,000,000,000 / 600,000,000 = 1.67

This means that for every ₹1 of equity, the company has ₹1.67 in assets. A multiplier greater than 1 indicates that the company is using debt to finance some of its assets. In this case, the company has ₹0.67 in assets financed by debt for every ₹1 of equity.

The equity multiplier is a component of the DuPont analysis for calculating return on equity (ROE).

4. Debt to Capital Ratio: The debt-to-capital ratio is a financial metric that measures the proportion of a company’s capital that comes from debt. It helps assess how much of the company’s total capital structure is financed through debt versus equity. This ratio indicates the level of financial leverage and the potential risk associated with the company’s capital structure.

Debt to Capital Ratio = Total Debt / Total Capital

where, total capital = Total Debt + Total Equity

A higher debt to capital ratio indicates that a larger portion of the company’s capital comes from debt, which can signal higher financial risk.

For example, from Tata Motors hypothetical data,

Debt to Capital Ratio = Total Debt / (Total Debt + Total Equity)

= 400,000,000 / (400,000,000 + 600,000,000) = 0.40

This ratio indicates that 40% of the company’s capital is financed by debt.

5. Debt to EBITDA Ratio: This ratio assesses the income a company generates to pay off its debt before accounting for interest, taxes, depreciation, and amortization. Commonly used by credit agencies, it helps gauge the likelihood of the company defaulting on its debt.

A lower Debt to EBITDA ratio generally indicates lower financial risk, as the company has a manageable level of debt relative to its earnings. Conversely, a higher ratio suggests higher financial leverage and risk, as the company may have a more significant debt burden relative to its earnings.

Debt to EBITDA Ratio = Total Debt / EBITDA

For example, Assume EBITDA= ₹150,000,000, Total Debt = ₹400,000,000

Debt to EBITDA Ratio = Total Debt / EBITDA= 400,000,000 / 150,000,000 = 2.67

This means the company’s debt is 2.67 times its EBITDA.

6. Degree of Financial Leverage: The Degree of Financial Leverage (DFL) measures how much a company’s net income or earnings per share (EPS) is affected by changes in its operating income (EBIT) due to the use of debt. It shows how sensitive the company’s profits are to changes in its operating income because of the fixed interest costs that come with debt.

The degree of financial leverage is a method used to measure a company’s financial risk, specifically the risk related to how the company finances its operations. A higher DFL means that small changes in EBIT will lead to larger changes in EPS, indicating higher financial risk due to leverage. Conversely, a lower DFL suggests that earnings are less sensitive to changes in EBIT, implying lower risk. Essentially, DFL shows how much leverage the company has in its financial structure and how that leverage can amplify both gains and losses.

DFL = EBIT / (EBIT − Interest Expense)

For Example, assuming Interest Expense = ₹50,000,000 and EBIT = ₹100,000,000

DFL = EBIT / (EBIT − Interest Expense)

= 100,000,000 / 100,000,000 − 50,000,000 = 100,000,000 / 50,000,000 = 2.00

This indicates that a 1% change in EBIT will result in a 2% change in EPS. If EBIT increases by 1%, EPS will increase by 2%, reflecting that the company benefits from increased operating income & vice versa.

7. Interest Coverage Ratio: The interest coverage ratio measures a company’s ability to pay interest on its outstanding debt. This ratio is important for assessing a company’s financial health and its risk of defaulting on interest payments. A higher ratio indicates that the company has more than enough earnings to cover its interest payments, suggesting lower financial risk and vice versa.

Interest Coverage Ratio = EBIT / Interest Expense

Example from the assumed data,

Interest Coverage Ratio = EBIT / Interest Expense = 100,000,000 / 50,000,000 = 2.00

This means that the company’s EBIT is 2 times its interest expense and the company can comfortably cover its interest expenses.

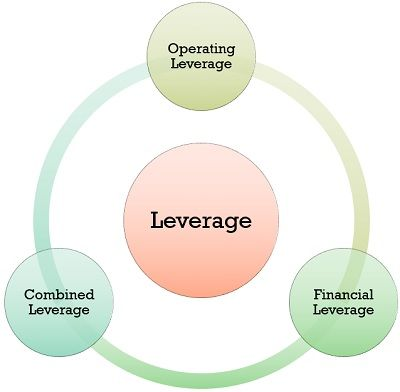

Types of Leverage

- Operating Leverage: Operating leverage measures how much of a company’s costs are fixed versus variable. Companies with high operating leverage have a large proportion of fixed costs, which means the companies are capital-intensive and their profits can change a lot with small changes in sales. A company with more than 50% fixed costs relative to revenue is considered to have high operating leverage, while a company with less than 20% fixed costs has low operating leverage.

- Financial Leverage: Financial leverage refers to how much debt a company uses to fund its operations. By borrowing money, a company can potentially increase its return on equity and earnings per share, as long as the returns on investment are higher than the cost of debt.

- When a company or individual takes on debt, they use borrowed funds to invest in projects or assets. If these investments generate returns that exceed the cost of the debt (i.e., the interest payments), the excess returns enhance the overall profitability. This process amplifies the returns on the equity invested.

Risk – If the return on investment is less than the interest rate on the debt, the company or investor will incur losses. These losses are amplified because the debt must still be serviced, regardless of the performance of the investment.

- Combined Leverage: Combined leverage looks at both operating and financial leverage together. It combines how a company’s fixed costs affect its operating income (operating leverage) with how its debt affects earnings per share (financial leverage). This gives a full picture of how both types of leverage impact the company’s overall financial performance.e of materials and goods held by a company with the intention of selling them to earn profits.

Characteristic of a Good Leverage Ratio

The appropriate level of leverage depends on the specific ratio being analyzed and the type of company. For instance, capital-intensive industries, like manufacturing, typically rely more on debt compared to service-based companies, so they generally have higher leverage. To determine what’s an acceptable level of leverage, it’s helpful to compare ratios within the same industry. It’s also important to note that having very little debt isn’t always ideal; companies can use debt to enhance returns for shareholders.