Terminal value is a critical component in valuation models, representing a substantial portion of a company’s total value. Understanding its impact is essential for accurate financial analysis.

Understanding Terminal Value and the Role of Weightage in Valuation Models

When assessing the long-term financial value of a company, especially for purposes like investment analysis or company valuation, two critical concepts often come into play: Terminal Value (TV) and the weightage of short-term fluctuations. These elements are crucial in building sophisticated financial models that provide investors and analysts with a nuanced view of a company’s worth. This detailed article explores the terminal value, its significance in valuation models, and how the weighting of short-term fluctuations can impact stock price evaluations.

What is Terminal Value?

Terminal value (TV) represents the estimated value of a business beyond the forecast period when future cash flows can be predicted with reasonable accuracy. It assumes a business will generate cash flow at a constant growth rate indefinitely, starting from the end of the last projected period. TV is a vital component in financial models like the Discounted Cash Flow (DCF) analysis because it often accounts for a significant portion of the total value of the business, especially when that business is expected to continue generating revenue well into the future.

There are primarily two methods to calculate the terminal value:

- Gordon Growth Model (Perpetuity Method):

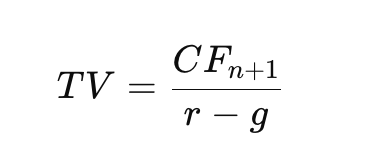

This method assumes that the company will grow at a constant rate forever. The formula used is:

where CF{n+1} is the cash flow for the first year beyond the forecast period, ( r ) is the discount rate, and ( g ) is the perpetual growth rate.

2. Exit Multiple Method:

- This method calculates TV based on a multiple of some key financial statistic, usually taken from company earnings, such as EBITDA, at the end of the projection period. The chosen multiple is typically derived from comparable company analysis.

Importance of Terminal Value in Valuation

Terminal value is crucial for several reasons:

- Long-term Perspective: It provides a way to estimate the long-term financial performance of a company beyond the typical forecast period.

- Major Value Component: In many cases, especially for companies with significant growth potential or stable, mature industries, the terminal value can constitute a large proportion of the total business valuation.

- Sensitivity to Assumptions: Because it involves projections into the distant future, terminal value is highly sensitive to assumptions about growth rates and other factors, making it a critical focus point for analysts.

Weightage of Short-Term Fluctuations in Valuation Models

Short-term fluctuations such as quarterly earnings reports, market sentiment shifts, and economic news can significantly impact a company’s stock price. However, when building a valuation model, especially for the purpose of long-term investment, it is essential to determine the appropriate weight these fluctuations should carry. Overemphasizing short-term movements can lead to a distorted view of the company’s true long-term value.

Incorporating Weightage in Valuation Models:

- Discount Factors: One approach is to use different discount rates to adjust the weight of nearer-term cash flows versus more distant ones. Nearer-term cash flows might be discounted at a slightly lower rate to reflect their higher certainty and relevance.

- Adjusting Cash Flow Projections: Analysts may choose to moderate the projected near-term earnings to smooth out unusual spikes or drops due to non-recurring events or market anomalies.

- Scenario Analysis: Using scenario analysis to model various short-term outcomes based on different assumptions can help gauge how sensitive the company’s valuation is to short-term fluctuations.

- Comparative Analysis: Comparing the impact of short-term events on similar companies can provide a benchmark for understanding their effects and help in assigning a reasonable weight to these fluctuations in the valuation model.

Conclusion

Terminal value is a cornerstone of financial valuation, especially in DCF models, as it captures the bulk of value in many long-term investments. Accurately calculating and integrating terminal value requires careful consideration of the company’s growth prospects and the economic environment. Moreover, understanding how to weigh short-term fluctuations within valuation models is essential to avoid overreacting to temporary market movements and maintain focus on a company’s long-term potential. By mastering these concepts, financial analysts can provide more accurate and meaningful valuations, aiding investors in making informed decisions.