NSE: FEDERALBNK

KVS Mainia | Managing Director & CEO

KVS Manian, the new MD & CEO of Federal Bank Ltd, brings over 25 years of banking experience. At Kotak Mahindra Bank, he was instrumental in its transformation from an NBFC to a leading private bank, excelling in Corporate and Consumer Banking. He expanded Kotak from one branch to 600 and led key businesses to profitability. An IIT (BHU) graduate in Electrical Engineering, he also holds a Financial Management degree from Jamnalal Bajaj Institute and is a Cost Accountant.

Shalini Warrier | Executive Director

Shalini Warrier, Executive Director of Federal Bank since 2020, has over 28 years of global banking experience. She joined in 2015 as COO, driving operational excellence and digital innovation, later taking charge of Retail Banking Products. A top-ranked Chartered Accountant and Certified Banker, she previously held key roles at Standard Chartered Bank across multiple countries. At Federal Bank, she leads customer experience, digitalization, and strategic growth initiatives, enhancing operational efficiency and delivering innovative retail products.

Harsh Dugar | Executive Director

Harsh Dugar, Executive Director of Federal Bank since June 2023, has extensive expertise in Wholesale Banking, gained through over 25 years of experience. Before this role, he was Group President and Country Head – Wholesale Banking at Federal Bank, which he joined in 2016 after a 20-year tenure at HDFC Bank. A University of Calcutta topper in Accounting & Finance, he is also a qualified Cost and Works Accountant (CWA) and Chartered Financial Analyst (CFA). Harsh has excelled across Corporate Banking, Capital Markets, and Institutional Banking in diverse geographies

Venkatraman Venkateswaran | Chief Financial Officer

Venkatraman Venkateswaran, CFO of Federal Bank since April 2021, is a Chartered Accountant with over 30 years of experience in Banking and Compliance, including international roles. He has worked with HSBC and Standard Chartered Bank in Global Finance Operations, Compliance, and Technology. He also held senior financial management roles at Indian Rayon (Aditya Birla Group), Kewalram Chanrai Group in Singapore, and as CFO of Invensys India. His expertise spans financial control, reporting, and corporate finance across diverse industries and geographies.

AP Hota | Part Time Chairman & Independent Director

A.P. Hota, Independent Director at Federal Bank since January 2018, has over 27 years of experience at the Reserve Bank of India, primarily in technology and payment systems. He played a key role in shaping India’s digital payments infrastructure as the founding MD & CEO of NPCI (2009–2017). He has also served as Nominee Director on the boards of Vijaya Bank and Andhra Bank. A literature postgraduate from Sambalpur University, he is an Honorary Fellow of the Indian Institute of Banking and Finance.

Board composition:

The Board of Directors has a balanced mix of Executive and Non-Executive members, with Independent Directors making up more than one-third of the total. As of March 31, 2024, the Board includes 11 members: three Executive Directors (one of whom is a woman) and eight Non-Executive Directors. It is led by a Non-Executive Independent Chairman and includes seven other Independent Directors, one of whom is also a woman. The Board brings together a diverse range of skills, knowledge, and experience relevant the banking industry.

*KVS Manian took charge as the Managing Director and Chief Executive Officer of Federal Bank, succeeding Shyam Srinivasan wef September 23,2024.

Board Efficiency:

The Board of Directors meets regularly to oversee the company’s operations. During the year, the board held 21 meetings. The majority of directors attended all board meetings. Additionally, almost all directors attended the Annual General Meeting (AGM).

Director Renumeration:

During the year, FBL paid the following remuneration to its directors:

Mr. Shyam Srinivasan, Managing Director & CEO: ₹299.29 lakh (gross).

Ms. Shalini Warrier, Executive Director: ₹163.48 lakh (gross).

Mr. Harsh Dugar, Executive Director: ₹119.76 lakh (gross).

Mr. Ashutosh Khajuria, Executive Director (till April 30, 2023): ₹22.52 lakh (gross)

*All payments were made as per terms approved by the Reserve Bank of India. Additionally, no loans were advanced to any directors during the financial year 2023-24. Moreover, The Non-Executive Directors are paid sitting fees as per the provisions of Companies Act, 2013 and as per SEBI Listing Regulations.

Nomination and renumeration committee:

The Nomination, Remuneration, Ethics and Compensation Committee, led by Mr. Siddhartha Sengupta, is composed entirely of Independent Directors, with a total of four members. In the financial year 2023-24, the committee convened a total of 15 meetings to address key matters such as board appointments, remuneration structures, and ethical practices. The committee further operates in alignment with SEBI regulations, the Companies Act, 2013, and RBI guidelines.

Audit committee:

The Audit Committee, chaired by CA Manoj Fadnis has in total five members, all of whom are independent directors. showing strong oversight during the financial year 2023-24, It held 22 meetings, ensuring its active role in ensuring financial accuracy and compliance. The committee’s responsibilities follow rules set by SEBI, the Companies Act, 2013, and RBI guidelines, as included in FBL’s governance policy.

Related party transactions:

During the FY 24, all related party transactions were conducted in the normal course of business and on an arm’s length basis. No significant transactions requiring reporting under Section 188(1) of the Companies Act occurred. The Audit Committee approved all transactions, including prior approvals for recurring ones, with quarterly updates provided to ensure compliance and transparency.

Management Remuneration and Employee Pay Ratio: 1

As of November 2024, FEDERALBNK has 14658 permanent employees on the rolls of the company. The average percentage increase made in the Salary of total employees for the financial year is around 3.19%, while the average increase in the remuneration of KMP, director, Chief Financial Officer, Company Secretary or Manager, if any are as follows:

• Shyam Srinivasan, MD & CEO : 0.95%

• Shalini Warrier, ED : -3.51%

• Harsh Dugar, ED : -32.18%

• Venkatraman Venkateswaran, CFO: 15.21%

• Samir Pravin Bhai Rajdev, CS: 8.97%

The percentage increase in the median remuneration of employees in the financial year was around 1.02%.

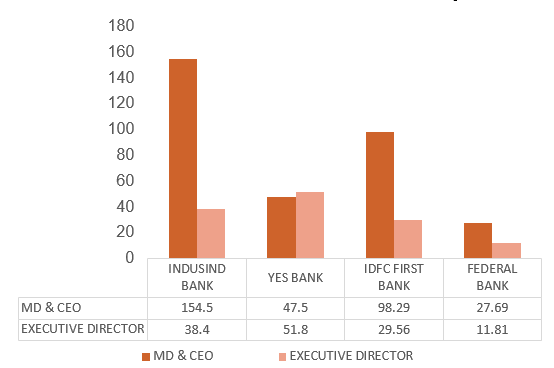

Ratio of the remuneration of each director to the median remuneration of the employees of the company for the financial year 2023-24:

• Shyam Srinivasan, MD & CEO: 27.69x

• Shalini Warrier, ED: 11.81x

• Harsh Dugar, ED: 7.97x

• Ashutosh Khajuria: 0.78x

Exhibit 14: FBL Has the one of the lowest Management-to-Employee Pay Ratio among Its Mid-Size Banking Peers. 1 9 10 11 (Figures in ₹ crore)

Source: Annual report

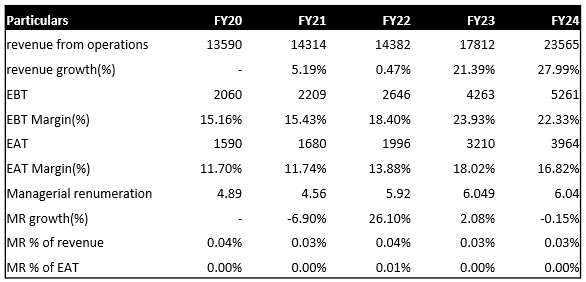

Managerial renumeration analysis 4

• There is a clear positive correlation of 0.63 between the company’s revenue and managerial pay, which shows that as the revenue has grown over recent years, the managerial pay has also increased. This suggests that the company’s approach to remuneration aligns with its financial performance and growth.

• The managerial pay is within the permissible limits set by the Companies Act, 2013. This ensures that the company follows all legal and regulatory requirements, reflecting its commitment to compliance and responsible governance.

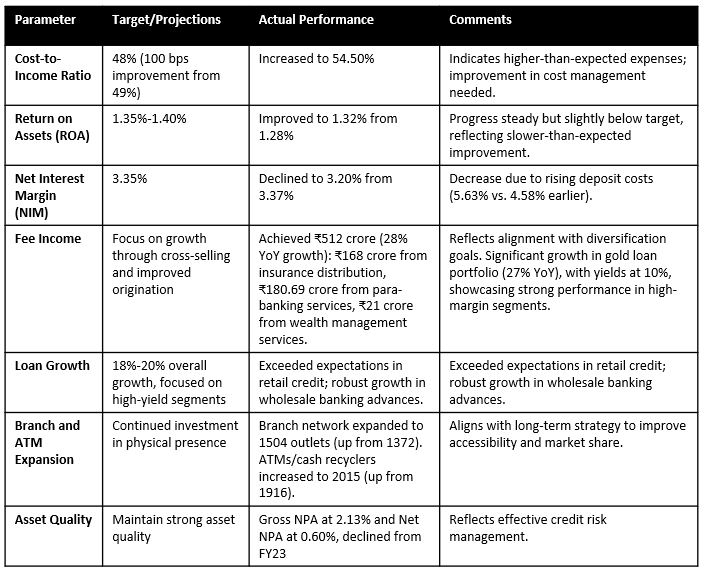

Management performance review : 1 12

FBL’s performance in FY 2024 showed a mix of successes and areas needing improvement when compared to management’s earlier projections.

FBL achieved strong growth in fee income, rising 28% year-on-year to ₹512 crore, driven by insurance distribution, para-banking, and wealth management services. Gold loans grew 27% year-on-year with yields of 10%, while retail credit increased 25% to ₹1,19,493 crore, and wholesale advances grew 15% to ₹95,083 crore. However, the cost-to-income ratio rose to 54.50% instead of improving to 48%, and NIM declined to 3.20% against a target of 3.35%, due to higher deposit costs of 5.63%. ROA improved to 1.32% but fell short of the 1.35%-1.4% target. While management demonstrated success in driving growth, areas like cost management and NIM optimization require closer attention to ensure future profitability.