NSE: HDFCBANK

HDFC Bank is one of India’s leading private banks and was among the first to receive approval from the Reserve Bank of India (RBI) to set up a private sector bank in 1994. Since then, the bank has grown into a trusted financial institution, serving millions of customers across the country.

From pioneering private banking in India to becoming a financial powerhouse with 85 million customers and 47% market share in POS & e-commerce, HDFC Bank’s game-changing mergers and global expansion have solidified its leadership in the banking sector.

As of May 2024, HDFC Bank operates 8,778 branches and 21,132 ATMs/Cash Recycler Machines across 3,836 cities and towns. This extensive network makes it one of the most accessible banks in India, catering to both urban and rural customers.

HDFC Bank’s Global Branch Network and Loan Services Expanded Post-Merger

The Bank’s international operations comprises four branches in Hong Kong, Bahrain, Dubai and an IFSC Banking Unit (IBU) in Gujarat International Finance Tech City. It has five representative offices in Kenya, Abu Dhabi, Dubai, London and Singapore. The Singapore and London offices were representative offices of erstwhile HDFC Limited and became representative offices of the Bank post the merger. These are for providing loans-related services for availing housing loans in India and for the purchase of properties in India.

Strategic Mergers Shaping Growth

1. Centurion Bank of Punjab Merger (2008)

On May 23, 2008, the amalgamation of Centurion Bank of Punjab (CBoP) with HDFC Bank was formally approved by Reserve Bank of India to complete the statutory and regulatory approval process. As per the scheme of amalgamation, shareholders of CBoP received one share of HDFC Bank for every 29 shares of CBoP.

The amalgamation added significant value to HDFC Bank with an increased branch network, geographic reach, customer base, and a larger pool of skilled manpower.

2. First-Ever Merger of New Generation Private Banks: Times Bank and HDFC Bank

In a milestone transaction in the Indian banking industry, Times Bank Limited (a new private sector bank promoted by Bennett, Coleman & Co. or Times Group) was merged with HDFC Bank Ltd., effective February 26, 2000. This was the first merger of two private banks in the new generation private sector banks. As per the scheme of amalgamation approved by the shareholders of both banks and the Reserve Bank of India, shareholders of Times Bank received one share of HDFC Bank for every 5.75 shares of Times Bank.

3. Merger Announced Between HDFC Ltd and HDFC Bank to Create Financial Powerhouse

On April 4, 2022 the merger of India’s largest Housing Finance Company, HDFC Limited and the largest private sector bank in India, HDFC Bank was announced. HDFC Ltd, over the last 45 years has developed one of the best product offerings making it a leader in the housing finance business. HDFC Bank enables seamless delivery of home loans as a part of its wide product suite catering to urban, semi urban and rural India.

Bank Dominates Market with 85 Million Customers and 47% Share in POS & E-commerce

It provides services in different segments: Retail Banking (36.7%), Wholesale Banking (27.5%), Insurance Business/ Third Party Products (17.5%), Treasury (11.6%), Others (6.8%).

Bank has a market share of 11% in advances, 10% in deposits, 47% in Pos & e-com. It has a reach of 85 million customer base with 7.8K+ branches, 23K+ banking outlets.

Geographical Presence

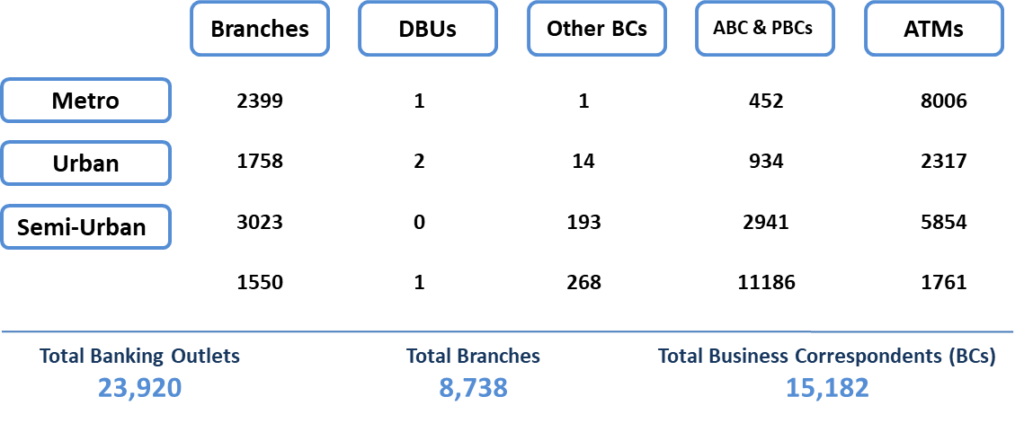

- Bank’s extensive network comprises branches, Business Correspondents (BCs), ATMs, Cash Deposit and Withdrawal Machines (CDMs), and merchants. Through digital platforms and suite of innovative products, bank is able to serve customers beyond the physical network.

- Further, as a part of the Government’s initiative to set up Digital Banking Units (DBUs) across India, we launched four DBUs to connect remote areas in Haridwar, Chandigarh, Faridabad and South 24 Parganas, West Bengal. These units help customers access banking products and services in an efficient, paperless, secure and connected environment.

Pan- India Presence

Source – Investor Presentation FY24

International Presence

- The Bank has a global presence through its representative offices and branches across countries such as India (IBU GIFT City), Bahrain, Hong Kong, UAE, and Kenya.

- The range of products for its NRI clients include offshore deposits, bonds, equity, mutual funds, treasury, and structured products that are offered by third parties from the Bahrain Branch. In addition, our products for corporate clients include trade credits, foreign currency term loans, external commercial borrowings (ECBs) and derivatives for hedging purposes.

- As of March 31, 2023, the Bank’s international business had a balance sheet size of US$7.68 Billion, and the advances made up 2.59% of the Bank’s advances.

Source – Annual Report FY24

Contribution of overseas branches to bank’s total income in FY23 – 1.2

Merger of HDFC Bank & HDFC Limited

HDFC Bank is one of India’s leading private sector banks, established in 1994. Renowned for its extensive range of financial products and services, HDFC Bank offers retail banking, corporate banking, and treasury services.

HDFC Limited is a premier financial services company in India, specializing in housing finance. Established in 1977, it is one of the largest and most respected Non-Banking Financial Companies (NBFCs) in the country. HDFC Limited offers a range of products including home loans, insurance, and investment services, with a strong focus on providing financial solutions to individual and corporate clients.

Reason for merger:

- – HDFC Ltd. used to provide loans to people for purpose of construction of houses but as an NBFC, it cannot take deposits in form of savings/ current account, FD etc. Hence, they raise capital via bonds which led to higher cost of borrowing compared to banks.

- – Another reason was the regulatory changes by RBI like LCR, NPA classification which would be similar to Banks.

- – As the housing sector is on boom in India, and the cost of borrowings is high with not so mature debt market in India, hence merger of HDFC Bank & HDFC Limited will increase the scope of growth with increased customer acquisition & improved profitability.

Challenges after merger :

- – Elevated levels of credit/ deposit ratio beyond RBIs comfort range. This might force bank into margin pressure if it aggressively mobilize deposits. In the third quarter, the bank reported gross loan growth of 4.9% sequentially.

- – Lower LCR, High CD ratio and slow deposit growth could potentially limit NIM expansion going forward. It will exert pressure on bank as NIM has remained flat for the last quarters around 3.6%.

- – Also, the merger has brought with it high-cost borrowing. After the deal, the share of borrowing in total liabilities has risen from 8% pre-merger to 21% post-merger.

=> 42 shares of HDFC bank will fetch 25 HDFC shares. (Share Swap ratio- 42:25)