NSE: MOFSL

Value Chain

• Client Acquisition and Onboarding: Between FY20 and FY24, MOFSL significantly expanded its client base, growing from 14 Lakh retail clients to over 42 Lakh clients by FY24. This growth was driven by an expanded range of products and services, including mutual funds with a 1.5x times increase in the mutual funds AUM alongside offerings such as investment banking with 22 successful deals in the first half of FY25. Acquisitions of regional brokers allowed MOFSL to expand its geographic footprint.25

MOFSL leverages an open architecture distribution model and a strong base of high-net-worth clients, with 75% of the total Depository participant (DP) balance coming from clients holding over ₹1 crore. While the company incurs a client acquisition cost of approximately ₹2,500 per client, it is working to improve its client activation ratio to 23% of their client base.

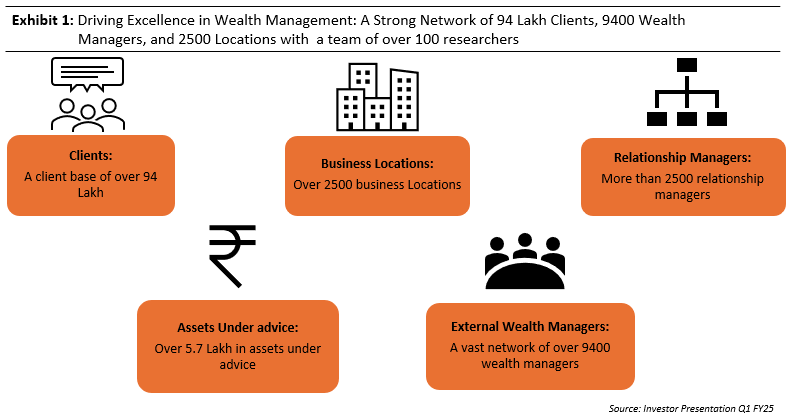

• Research and Analytics: MOFSL offers equity research coverage spanning 21 sectors and serves over 820 institutional clients. With a workforce of more than 11,290 employees and a network of 8,010 external wealth managers across 550+ cities.

MOFSL’s research team also hosts events such as the Ideation Conference, BFSI Day, and Retail Day. Its annual flagship event, AGIC, drew participation from 200+ corporates, over 1,000 institutional investors, and 50+ offshore clients during its 19th edition, emphasizing the company’s strong relationship and loyalty amongst corporate and institutional clients.

• Client Advisory and Relationship Management: As of FY24, MOFSL managed the wealth of over 42 lakh clients and added 6.21 lakh new clients during the year. The company has a network comprising over 2,400 internal relationship managers.

Notably, 31% of its relationship managers have an average tenure of three or more years MOFSL’s research and advisory capabilities. Additionally, the company’s distribution assets under management (AUM) surpassed ₹23,720 crore in FY24 with a 35% YoY growth, highlighting its growing influence in wealth management.

• Trade Execution and Clearing: In FY23-24, the Average Daily Traded Volume (ADTV) for the equity markets was ₹350 Lakh Crore, marking a significant 127% YoY growth from ₹154 Lakh Crore in FY22-23. The futures market volume rose by 18% YoY to approximately ₹1.4 Lakh Crore, reflecting steady growth in derivatives trading activity.

MOFSL has reported a significant increase in its average daily turnover (ADTO), In the fourth quarter of the fiscal year 2024, the company’s ADTO rose by 122% YoY and 26% quarter-over-quarter.26

Revenue from brokerage fees is recognized on a trade date basis, meaning it is recorded as soon as a trade is executed, irrespective of the settlement timing. Additionally, MOFSL provides margin trading facilities (MTF), allowing clients to borrow funds to purchase securities, thereby amplifying both potential gains and risks.

• Technology integration and infrastructure: MOFSL occupies 5,57,720 square feet of office space across major cities in India. In FY24, the company allocated ₹55.56 crore for information technology hardware and software, which accounted for 39.71% of its total capital expenditure of ₹139.91 crore.

Approximately 57% of its retail trading volume is handled through online platforms. MOFSL also launched the RISE Super App, which serves as a centralized hub for clients to manage investments and access various financial products, including mutual funds and US stocks. The company’s annual digital spend is about ₹150 crore.

It introduced StratX, an algorithmic trading marketplace featuring 7 exchange algorithms, offering clients advanced trading strategies.

• Risk Management and Compliance: MOFSL adheres to stringent risk management standards, maintaining a Capital Adequacy Ratio (CAR) of 47.5%, well above SEBI’s regulatory requirement of 15%, reflecting good Capital Adequacy Ratio.

• Post Trade Services: MOFSL offers investor services through the SWAYAM platform introduced by Link Intime. This platform enables investors to manage their demat and physical securities, generate service requests, track corporate actions, and access PAN-linked accounts.

For shareholder communication, the company utilizes electronic platforms such as NEAPS and the Listing Centre for regular compliance filings and communication. Additionally, MOFSL sends annual reminders for unclaimed shares and dividends.

• Client Support and Retention: In the first half of FY25 MOFSL acquired 3,50,000 new clients indicating strong client acquisition and growth in client base, The portion of long-standing clients (3 or more years) increased to 41% in FY23 from 34% in FY22 indicating enhanced satisfaction .

Financials of the company also indicate a client retention ratio of 83.06% and 89.58% in FY23 and FY24 respectively reflecting effective retention rate

The company also complies with the Investor Education and Protection Fund Authority rules, transferring shares with unclaimed dividends for seven consecutive years to the IEPF, after providing shareholders with the opportunity to claim them. In FY24, MOFSL recorded 3,289 customer complaints, with 4 still pending resolution by the end of the year.

Business Model

Capital Market Segment:

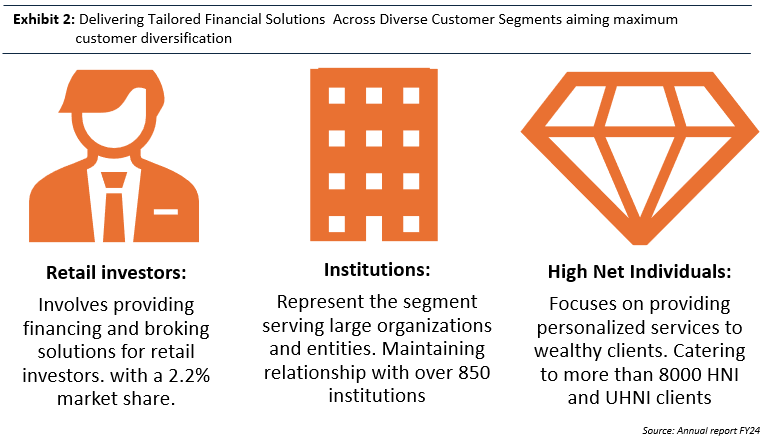

The capital market segment of MOFSL is a crucial contributor to the company’s overall performance as most of the revenue generated by the company is through this source only and this segment caters to many diverse clientele including retail investors, investment banking, etc.

1. Equity Broking and distribution: –

• Retail Broking: MOFSL helps individual investors trade stocks and derivatives by offering retail broking services. With more than 7 Lakh customers, the business has a substantial retail presence throughout India, with its products reaching almost 98% of the nation’s postal codes.

• Institutional Broking: The company holds institutional broking division in high respect. MOFSL was named #1 in Corporate Access and Execution, #2 in Domestic Broking Sales, and #3 in Best Broking Transformation in the 2023 Asia Money Poll.24

• Institutional broking fees typically range from 0.01% to 0.5% of the total transaction value. However, the exact fee can vary depending on the type and value of the trade, as well as the broker’s fee structure.

• Client Acquisition: In FY23–24, the company acquired 6,21,000 new customers, indicating a consistent expansion of its retail clientele. As a result, the total distribution AUM (Assets Under Management has increased by 35% YOY to ₹23,720 crore.1

Brokerage and Charges

• Brokerage: MOFSL also offers brokerage services for trading stocks, bonds, mutual funds and other investments. Brokerage charges vary depending on the segment of the trade. Here are some of the brokerage charges for MOFSL: (I)Equity delivery: 0.20%, (ii)Equity intraday: Free for life, (iii)Equity futures: 0.02%, (iv)Equity options: ₹ 20 per lot, (v)Commodity futures: 0.02%, (vi)Commodity options: ₹ 200 per lot, (vii)Currency futures and options: ₹ 20 per lot.5

• STT/CTT: Security Transaction tax/Commodities Transaction Tax are levied by the Indian government on all the transactions made through the exchanges. It is applicable to both delivery and intraday trades and is charged at different rates for different types of trades. For delivery trades, the STT charge is 0.1% of the total transaction value, while for intraday trades, it is 0.025% of the total transaction value.5

• Transaction charges: Transaction charges are levied by the exchanges (NSE/BSE/MCX etc.) on which a person places a trade and vary with the exchanges and the segment in which a trade is placed. These charges range between 0.002% to 0.05% depending on the segment in which a trade is placed.

• GST: GST is charged at 18% on the brokerage generated and is collected by the Government of India.

• SEBI Charges: Mandatory charges of ₹0.10/crore + GST are payable towards SEBI charges for regulating the Indian markets.

• Stamp Charges: Stamp charges range from 0.002% to 0.015% depending on the segment in which a trade is placed. This tax is charged by Government of India as per Indian Stamp Act of 1899.

• Demat Maintenance: Demat Maintenance Charge (DMC) is a fee charged by the depository participant (DP) to maintain the records of the holdings of the investor in the depository. The maintenance charge is usually levied on a yearly basis and may vary from 1 DP to other. Currently there are 2 Depository Participants in India viz. NSDL and CDSL. The DMC is deducted from the investor’s Demat account every year.5

2. Mutual Funds: –

• Mutual Fund AUM: As of March 2024, the Asset Management Company (AMC) division had increased its mutual fund AUM to ₹48,840 crore. Increased customer participation has been the main driver of this expansion since household investments are encouraged by emphasis on SIPs (Systematic Investment Plans) and financial literacy initiatives.

• Motilal Oswal Flexi Cap Fund: The fund offered by MOFSL has a total AUM of ₹12,023 Cr. With a net asset value (NAV) of 64.48 and a Compounded annual growth rate (CAGR) is 54.35% with the risk associated with the investment is very high, the fund operates at a total expense ratio of 0.88% and delivers a portfolio turnover ratio of 1.55.6

• Motilal Oswal Large and Midcap Fund: The fund offered by MOFSL has the total AUM of ₹6,840 Cr. With a net asset value (NAV) of 33.87 and the Compounded annual growth rate (CAGR) is 60.72% with the risk associated with the investment is very high, the fund operates at a total expense ratio of 0.51% and delivers a portfolio turnover ratio of 0.66.6

• Motilal Oswal Midcap Fund: The fund offered by MOFSL has the total AUM of ₹20,055 Cr. With a net asset value (NAV) of 116.42 and the Compounded annual growth rate (CAGR) is 67.94% with the risk associated with the investment is very high, the fund operates at a total expense ratio of 0.57% and delivers a portfolio turnover ratio of 1.33.6

• Motilal Oswal Nasdaq 100 fund of fund: The fund offered by MOFSL has the total AUM of ₹5138 Cr. With a net asset value (NAV) of 37.25 and the Compounded annual growth rate (CAGR) is 41.8% with the risk associated with the investment is very high, the fund operates at a total expense ratio of 0.24%.6

• The minimum application and redemption amount is ₹500/- and in multiples of ₹1/- thereafter, the fund also charges a 1% exit load if the redemption takes place on or before the period of 1 year.6

3. Investment Banking: –

• Investment Banking Transactions: The investment banking division completed 17 transactions in FY23-24, with a total issue size of approximately ₹19,100 crore. This included managing IPOs and other ECM activities that benefited from a resurgence in the IPO market, which saw 75 IPOs raising ₹61,915 crore.

• In FY25 MOFSL’s Investment Banking team is likely to maintained industry standing and has already completed 22 investment banking deals in the first half with an issue size of over 25,000 crore1.

Asset and private wealth management:

1. Wealth Management Services: –

• Private Wealth Management (PWM): MOFSL’s Private Wealth Management business serves high-net-worth individuals (HNI) and ultra-high-net-worth individuals (UHNI) with tailored portfolio management, tax advisory, retirement planning, and estate planning.

• The most common fee structure in the industry is, where the wealth manager charges a percentage of the total value of the client’s assets. The average fee is 1–2% annually but can range from 0.20–2.00%. The fee is often scaled down as the amount of assets increases.

• Growth in Assets Under Advice (AUA): As of March 2024, the wealth management division reached an all-time high of ₹1,23,989 crore in AUA, marking a 72% YoY growth. This is driven by the addition of new relationship managers and the enhancement of Ultra HNI offerings.7

2. Alternate investment funds: –

• Alternative Investment Fund (AIF) Offerings: MOFSL’s AIFs primarily target sophisticated investors interested in structured finance and private equity. The company’s Alternate assets AUM reached ₹22,970 crore by March 2024, accounting for a notable 32% of the AMC’s total AUM. The company offers all III categories of alternative investment fund. 1

• Private Equity (PE) and Real Estate (RE) Funds: MOFSL manages three growth capital PE funds and five real estate-focused RE funds with a combined fee-earning AUM of ₹10,050 crore. During FY23-24, the company launched the sixth series of its real estate fund, with a target fund size of ₹2,000 crore and an initial close of ₹1,250 crore.1

• MOFSL is managing and advising 3 growth capital and 4 real estate funds with a combined value of ₹16,200 Cr. With a presence even in tier 2 and tier 3 towns.

• The typical commission for raising capital for a real estate fund is usually between 2% and 5% of the total amount raised. This percentage varies depending on the fund’s complexity, the amount of capital raised, and the negotiations between fund managers and capital raising agents.

• Private equity funds typically charge investors a combination of management fees and performance fees, also known as carried interest: (i) Management fees: Typically, around 2% of the fund’s committed capital annually. These fees cover fund expenses like salaries and rent. (ii) Performance fees: Typically, around 20% of the fund’s profits above a certain threshold. This is known as carried interest. (iii)Other fees: May include transaction and monitoring fees.9

Housing finance:

• Core Market: MOHFL primarily targets the affordable housing finance market, catering to customers with informal incomes and limited access to traditional banking services. This focus is particularly relevant in India, where a large section of the population needs low-cost housing finance solutions.

• Loan Book Size: As of FY23-24, MOHFL’s loan book grew by 6% YoY to reach ₹4,048 crore. This growth reflects the company’s ongoing expansion in the affordable housing segment and its focus on increasing loan disbursements across underserved regions.

• Disbursements: In FY23-24, MOHFL achieved disbursements totaling ₹1,018 crore, highlighting the company’s commitment to supporting India’s affordable housing sector. This reflects a focus on reaching more clients and increasing loan accessibility, driven by MOHFL’s efficient and customer-friendly lending practices.1

• GNPA and NNPA of 0.9% and 0.4%, respectively.

• As of November 2024, Motilal Oswal Home Finance offers home loans at interest rates starting at 11.75% per annum. The loan amount can be up to ₹ 50 lakhs, and the tenure can be up to 25 years. Motilal Oswal Home Finance also offers a balance transfer facility to existing borrowers of other banks and HFCs. This allows them to transfer their loan amount to Motilal Oswal Home Finance at a lower interest rate.10

Treasury Investments:

• “Double-Engine” Business Model: The treasury segment functions as a “second engine” for the company, alongside its operating businesses. Free cash flows generated from MOFSL’s core operations in capital markets, wealth management, and housing finance are systematically plowed back into the treasury portfolio. This model aims to maximize compounding returns by reinvesting operating profits into market-driven investments.

• Size of Treasury Portfolio: As of March 31, 2024, MOFSL’s treasury portfolio stood at ₹6,113 crore, marking a steady increase from previous years. This significant portfolio size highlights the scale and financial strength of the treasury segment, which serves as a backbone of the company’s compounding model.1