NSE: MOFSL

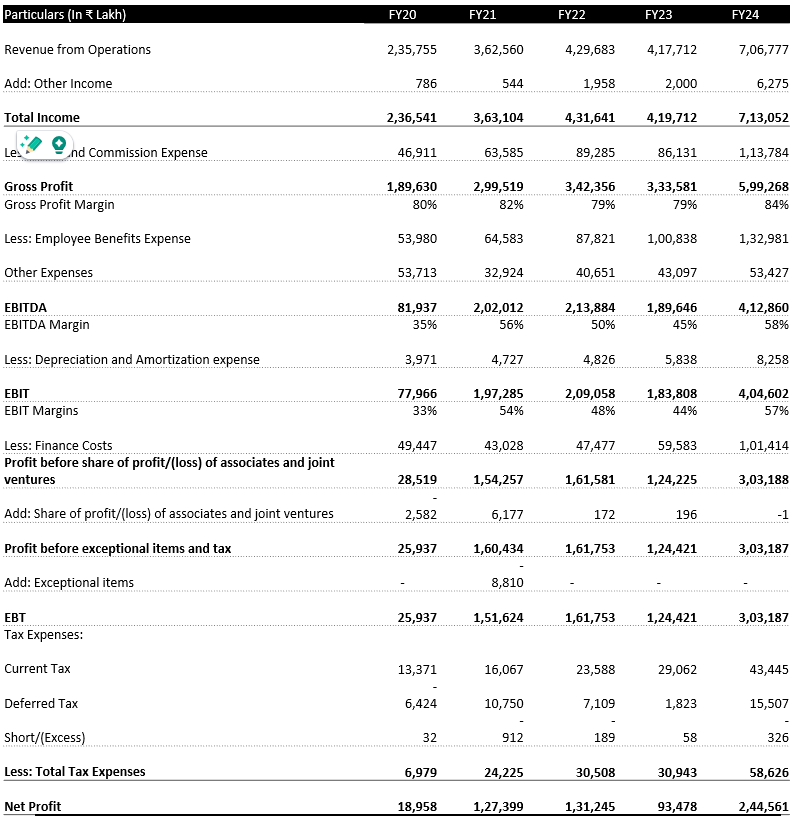

Statement of Profit & Loss

• Revenue

In FY24, MOFSL reported a noticeable increase in revenue from operations and achieved its highest ever total revenue of ₹7,13,052 lakh, up from ₹4,19,712 lakh in FY23- a 70% growth. This growth was recorded because of the significant increase in the fees & commission.

Interest income of the company, Interest income rose to ₹1,89,472 lakh from ₹1,22,829 lakh in the year 2023 to 2024, Fees &commission also increased to ₹3,62,531 lakh from ₹2,73,342 lakh in the year 2024 from 2024, rest of the operations also recorded growth.

Growth in the interest income was driven by the investments of MOFSL in fixed deposits as well as treasury investments it rose to ₹45,777 lakh in the year 2024 and through lending money for margin trading, MTF book grew by 18% QoQ to 3,910 crore in Q4FY24 with 8,000 clients availing the service with an average ticket size of ₹50 lakh to ₹1 crore revealing majority of MTF clients being HNI’s.

The company also earned ₹28,653 lakh. Interest income from delayed payments from clients also saw an increase to ₹18,229 lakh this could also be attributed from the larger client base as well as tight credit situations.

The growth in fee and commission reflected company increasing its customer base by 6.2 lakh in the year 2024, also the growing number of demat accounts was a factor. The IPO market rebound also played a key role in increasing the revenue as in the year 2024 MOFSL successfully carried out 75 IPOs compared to 37 IPOs in the year 2023.

The capital market segment of MOFSL including investment banking and broking experience a 37% YOY increase reaching ₹3,23,500 lakh in FY24.The asset and wealth management business witnessed a 41% YOY revenue surge in FY24.

• Expenses

The total expenses of the company has also increased exponentially reaching ₹4,09,864 lakh from ₹ 2,95,487 lakh from the year 2023 to 2024 recording a 39% increase. This expense hike was observed because of the significant increase in the Financing or interest expense as well as it’s Fees and commission expense, if combined rose to ₹2,15,198 lakh from ₹1,45,714 lakh in the year 2024.

The rise in the financing expense could be increased because of the drastic increase in the debt securities and long-term borrowings of the company the closing long term debt and borrowings of the company in the year 2023 was ₹3,77,942 lakh which grew to ₹6,82,894 lakh in the year 2024, likely to fuel company’s expansion plans and margin funding to clients.

The brokerage shares of MOFSL with its intermediaries and networks also rose to ₹98,682 lakhs in the year 2024 from ₹72,834 lakhs in the year 2023, this suggests the company is reliable on its networks to expand their reach and the increased cost also resulted in growing the customer base. The company can further increase its user base by expanding its networks and justifying the expense.

• Margins

The company displayed a increase in the gross profit over the years with a slight decrease in the year 2023 but in the year 2024 the company recorded a significant 44% increase in the gross profit being at ₹5,99,268 lakh and a promising gross margin of 84%. MOFSL introduction of new real estate fund IREF VI and private equity fund IBEF V could significantly impact future profit.

The total tax expense of the company increased to ₹58,626 lakh from ₹30,943 lakh from the year 2023 to 2024 with a 47% increase, this increase was observed by increase in the deferred tax expense and by increase in the current tax due to increase in profit.

The primary reason for increase was because of the increase in the profit before tax from ₹1,24,225 lakh to ₹3,03,188 lakh from the year 2023 to 2024 and the company’s effective tax rate was 25% for both the years.

The change in deferred tax liabilities was ₹15,507 lakh in 2024, compared to ₹1,823 lakh in 2023. The deferred tax liability increase was primarily due to an unrealized gain on financial instruments and amortization of distribution costs.

Net profit for MOFSL grew by 62% reaching ₹2,44,561 lakh for the year 2024 compared to ₹93,478 lakh during the year 2023.

There were various factors that acted in the favor of the company and help them in their performance. Some of those factors would be Revenue expansion, Expansion of client base, overall favorable market conditions, rebound of IPO market etc.

Outlook: –

• Revenue

The past 5-year CAGR growth of revenue from operations of the company is recorded at 32% While challenges such as regulatory changes, competition, and market cyclicality pose risks and act as an obstacle in growth, still the future revenue is projected to grow at 25% based on this forecast the projected revenue is to be approximately around ₹9,00,000 lakh in FY25, some factors that help us in forecasting they are:

Demat growth: Between January 2023 and August 2024, the number of demat accounts reached 17.10 crore increasing with 6 core demat over this period and the number of accounts are projected to surpass 20 crore by 2025.19

Based on this information we can project that by the year end of 2025 the number of people having a Demat account with MOFSL would surpass the count of 50 lakh based on the assumption of the 2.2% market share that MOFSL controls and with increasing their market share they can aim for even more accounts.

Market Growth: Morgan Stanley has projected a 14 % upside for the BSE Sensex, expecting it to reach 93,000 by December 2025 in its base case. A bullish scenario could push the Sensex to 1,05,000, while a bearish outlook places it at 70,000. 20 Due to the industry being cyclical if the indices perform well, they also facilitate company growth with more people tending to invest in the markets through the companies.

IPO Growth: For 2025, 34 companies have already secured the requisite Securities and SEBI approval for IPOs, targeting a combined ₹41,462 crore. Additionally, 55 firms await regulatory clearance, intending to raise about ₹98,672 crore.21

With use of this information and the data for FY24 MOFSL carried out 75 IPO’s out of the total number of 298 IPO’s listed on the exchange in the year 2024 we can project that MOFSL will carry out more than the 25% of the total IPO deals in the market in FY25 and has already completed 22 deals with an issue size of over 25,000 crore.

Growth of UHNWI’s: There is a predicted significant 50% increase in the number of UHNWI’s in India between 2023 to 2028 reaching to around 20,000 UHNWI’s (Individuals with a net worth exceeding ₹25 crore).22

Currently MOFSL’s Broking and distribution business serves over 8,000 HNI and UHNI families, managing a DP balance of approximately ₹45,000 crore catering to a significant market and share and also shifting their focus towards it. According to increase of the market size and company focus it is projected to increase its private wealth management by 1.5x times in the next 3-4 years

Increasing market share of MOFSL in both asset management and institutional broking will help the profits margin as well as they are primarily more profitable than broking services due to the ticket size also being bigger.

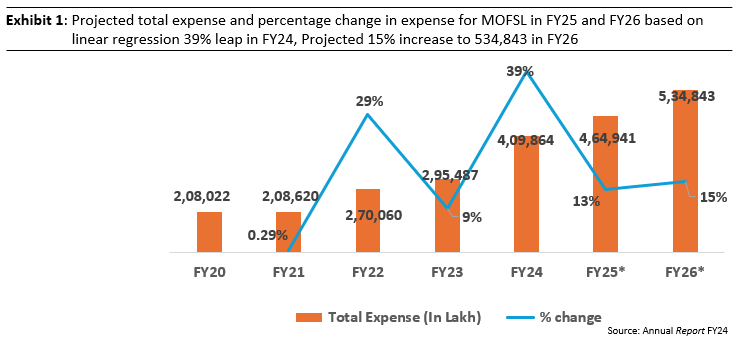

• Expense

Total Expense of the company is likely to increase in FY25 and FY26,The company is likely to keep spending on the fees and commission and other expansionary expense as they were able to increase their customer base by making such expense and expanding their channel networks in the past year.

Expenses of the company will facilitate their effort in expanding the asset and wealth management segment by increasing their customer base and developing more products and services and target even tier 2 and tier 3 cities.23

Projected expense in FY25 is estimated at ₹4,64,941 lakh with a 13% increase from the previous year and for FY26 it is estimated to be at ₹5,34,843 lakh with a 15 % increase from the previous year. The total expense of the company for the next 5 years is to grow by 12.5% CAGR.

• Margins

The gross profit margin of the company is expected to be maintained around 80% as the company is inclined towards increasing their high margin business prospects.

MOFSL is most likely to maintain its high PAT margin with the increased revenue resulting in increased profit after tax as well, The Company’s increased focus on High-Margin businesses like Asset & private wealth management combined with emphasis on High-ARPU (Average Revenue per Unit) Clients will play a crucial role.

The CAGR growth of the PAT over the last 5 years is 84% and with that projection the forecasted Profit After Tax for FY25 is ₹4,49,994 lakh being 48% of the forecasted revenue, Maintaining the strong margin.

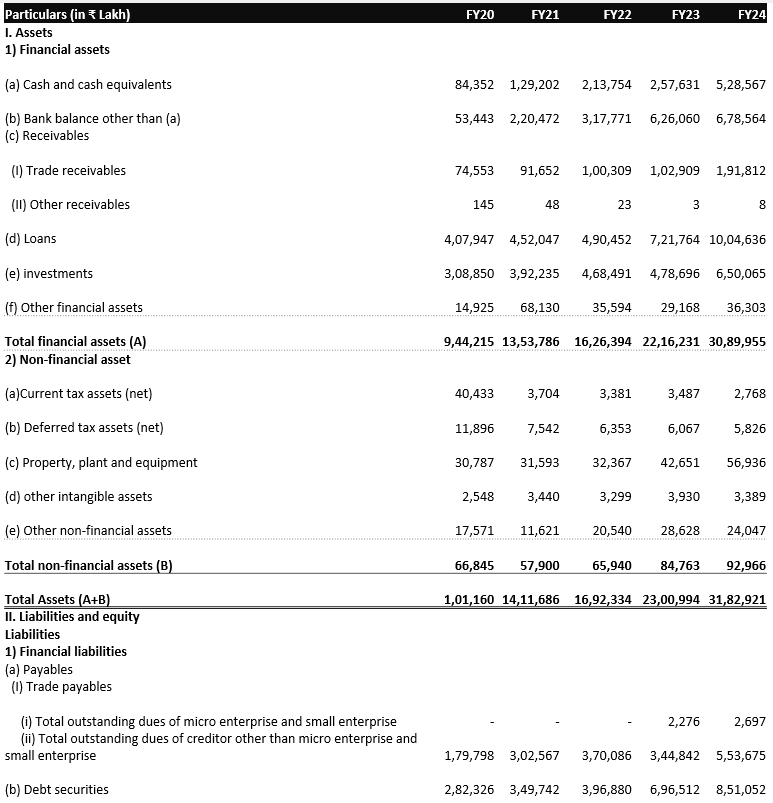

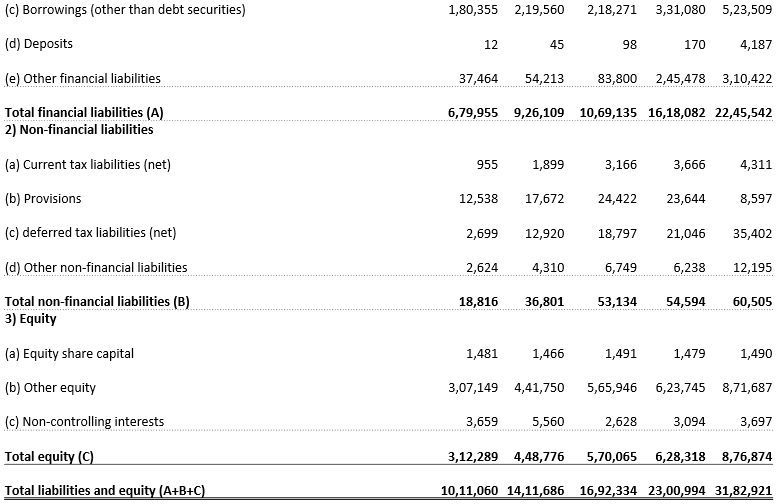

Balance Sheet

• MOFSL reported a substantial increase in combined Cash & Cash equivalents and Bank balance reaching up to ₹12,07,131 lakh in FY24, up by 37% compared to ₹8,83,691 lakh in FY23, primarily due to a significant rise in the Fixed deposits with banks which have a maturity of within 3 months.

• The fixed deposits component increased significantly from ₹54,944 lakh in FY23 to ₹2,17,181 lakh in FY24. This high liquidity might be because of the company’s conservative investment strategy or to maintain their lending capacity especially in the margin trading segment and finding new options for short term investments. The company also maintain liquidity to fuel their growth as well as expansion plans.

• The Total financial assets also displayed growth by 39% reaching to ₹30,89,955 lakh in FY24 from ₹22,16,231 lakh in FY23 other than cash and bank balance other assets like Loans, Investment and Receivables increased by significant amounts adding to the growth.

• The significant increase in the loan amounts lend is mostly comprised of money lend to investors for margin trading this also helps the company in boosting investor confidence and increase investor participation in the capital market, Loans given to employees are also a part of these. The increase in equity fundraising also indicates positive investment climate for investments.

• The non-financial assets also showed marginal growth of 10% reaching ₹92,966 lakh in FY24 from ₹84,763 lakh in FY23 these assets are comprised of Building, land and plant, and machinery, these assets growing operations of the company and establishment of new offices.

• MOFSL may continue investing in property, plant, and equipment to enhance its operations and support future growth. The scale of these investments will depend on its strategic priorities, business performance, and market conditions.

• The debt securities reported a significant increase by 22%, reaching ₹8,51,052 lakh in FY24 from ₹6,96,512 lakh in FY23. The debt securities consist of unsecured commercial paper from non-banking institutions which is a short-term unsecured debt typically issued by corporations to finance short-term liabilities, the increase suggests the company’s need for short-term financing.

• The rest of it is other secured debt securities which decreased to ₹2,840 lakh in FY24 from ₹4,420 lakh in FY23 reflecting the company’s shift towards unsecured short-term debt. Another significant reason for its increase is the issuance of non-convertible debenture in FY24 leading to a potential total issue size of ₹1,00,000 lakh.

• Borrowings for the year 2024 increased to ₹5,23,509 lakh from ₹3,31,080 lakh from the year 2023 reporting a 58% increase they are comprised of secured demand loans from banks and unsecured demand from related parties, demand loans are the loans that can be called for repayment by the lender at any time, demand loans from banks increased significantly from ₹99,387 lakh to ₹2,17,919 lakh and the loans from related parties were non-existent earlier but is introduced in FY24 with a balance of ₹1,100 lakhs. The surge in demand for loans suggests the company’s requirement for flexible financing options to support its operations.

• Other equity of MOFSL also grew by 40% from the last year reaching ₹8,71,687 lakh in FY24 from ₹6,28,318 lakh in FY23 the most significant contributor to equity growth is the retained earnings which surged from ₹3,44,331 lakh in FY23 to ₹4,67, 850 lakhs in FY24.

• Retained earnings represent the accumulated profit of the company not distributed as dividends, this significant increase suggests profitability during the fiscal year further supported by incthe rease. The company issued dividend from a part of the retained earnings ₹14 per share and ₹25,233 lakh for FY24. The rest of the funds can be used by the company for expansion of the housing finance sector or potential acquisition and investment in subsidiaries.

Cash Flow Statement

Cash Flows from operating activities:-

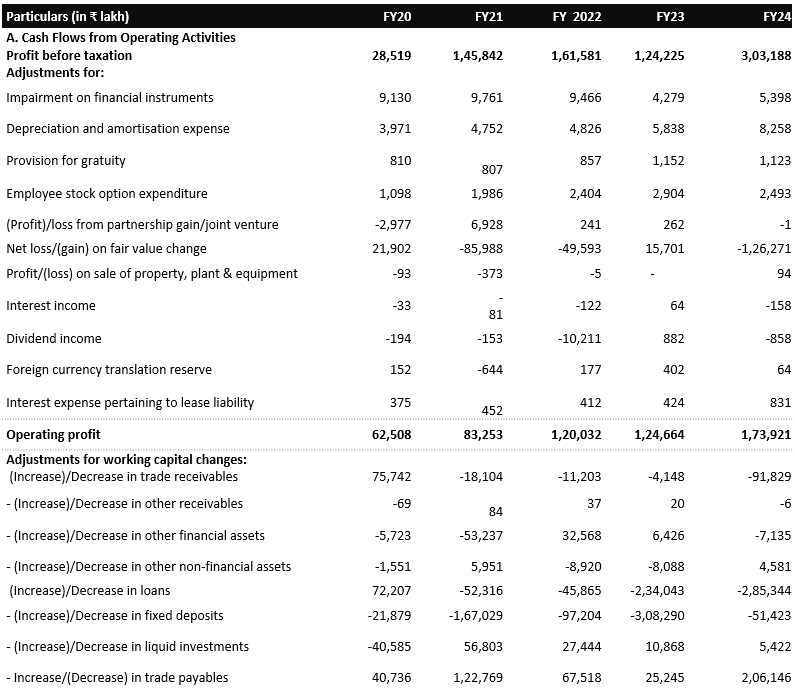

• In FY24, net cash used from operating activities was ₹34,964 lakh a notable improvement compared to ₹3,05,790 lakh from the year 2023. this shift was primarily driven by substantial growth in the operating profit before working capital changes, which rose from ₹1,24,664 lakh in FY23 to ₹1,73,921 lakh in FY24 reflecting a strong increase in profitability.

• In FY24 MOFSL experienced a significant decrease in the amount invested in fixed deposits in the FY24 at ₹51,423 compared to ₹3,08,290 in FY23, this indicates the company’s future approach of expansion and maintaining higher liquidity to facilitate the operations. The company’s plans could be funded by maturing these fixed deposits.

• There was an increase in the loans, lending to an increase of ₹2,85,344 lakhs in cash flow from operating activities in 2024, as the financial statements signal significant lending for a “margin trading facility” This suggests that the company is considering it a core revenue-generating business activity.

• Trade payables also recorded a significant growth to ₹2,06,146 lakh in FY24 from ₹25,245 lakh in FY23, the increase is mainly attributed to the rise in outstanding dues to creditors and other small and micro enterprises. As the company plans expansion across all segments and engages with more vendors and businesses their trade payables are to be grown.

• Outlook: According to our analysis, MOFSL operational cash flows are positioned to improve as it continues managing working capital effectively, supported by its expanding revenue base, The companies cash retention strategy to facilitate growth seems to sustain but the company should limit to using most of its borrowings for margin trading facility because of the industry being cyclical its risky.

Cash Flows from investing activities:-

• In FY24 Net cash used from investing activity was ₹24,679 lakh, being marginally better than FY23 net cash used from investing activity was ₹27,372 lakh.

• The cash flow for investing activity remained the same for both years were because of the high volume of cash invested in the purchase of plant, property and for purchase of investments. The company investing heavily signals that they are expanding their physical infrastructure and presence, upgrading technology, and boosting operational capacity. The purchase of investments that align with the company’s business model is to be equity and debt instruments and strategic acquisition for acquiring stakes in other companies to expand their market reach and acquire new capabilities.

• Sale of investment recorded a steady growth in the investing activity as well from ₹35,346 lakh in FY23 to ₹42, 891 lakhs in FY24 this increase highlights a more radical approach to short-term investments maintaining high liquidity in the form of cash for different growth resorts and funding the growth and operations of the company.

• Outlook: According to our analysis MOFSL investing cash flows may continue to be outflowing in the near term as the company continues to invest in tangible as well as intangible infrastructure to facilitate their expansion plans as well as operational proficiency.

Cash Flows from financing activities:-

• The net cash generated from financing activity in FY24 was recorded at ₹3,30,578 lakh with a slight decrease compared to ₹3,77,039 lakh in FY23. this trend shows the company’s increased reliance on short-term debt and long-term borrowings, alongside strategic equity issuance to support client’s margin trading as well as to fund future growth activities.

• In FY24 MOFSL experienced a slight increase in proceeds from the issue of share capital, resulting in an inflow of ₹7,728 lakh compared to ₹1,034 lakh in FY23. The company allotted 10,60,165 equity shares upon the exercise of employee stock option (ESOP) this increased the cash flow for the company, also a small part of the promoter’s holdings was liquidated directing fundraising or need for funds. The company plans future fundraising for IREF VI and IBEF V, a real estate fund targeting ₹20 billion and a private equity buyout fund are to be launched in January FY25 this would further bring cash flow into the company.

• Proceeds from commercial paper in FY24 were recorded at ₹96,960 lakh with a significant decrease compared to ₹ 2,68,391 lakh in FY23, reflecting the company’s lack of reliance on short-term unsecured loans due to a shift towards long-term financing and other secure options which will ultimately decrease their financing cost and improve profitability.

• In FY24 proceeds from other borrowings observed an increase at ₹1,92,429 lakh compared to ₹1,12,809 lakh in FY23, most of the borrowings consist of secured demand loans from banks, reflecting the company’s reliance on secured borrowings for future growth.