Stock Broking

• In FY24, India saw a notable increase in demat accounts, with an average of ₹3 Lakh new accounts being added each month. This growth was reflected across both major depositories, CDSL and NSDL, which experienced a 32% YoY increase, bringing the total number of demat accounts to ₹151 Lakh – up from ₹114 Lakh in the previous year.

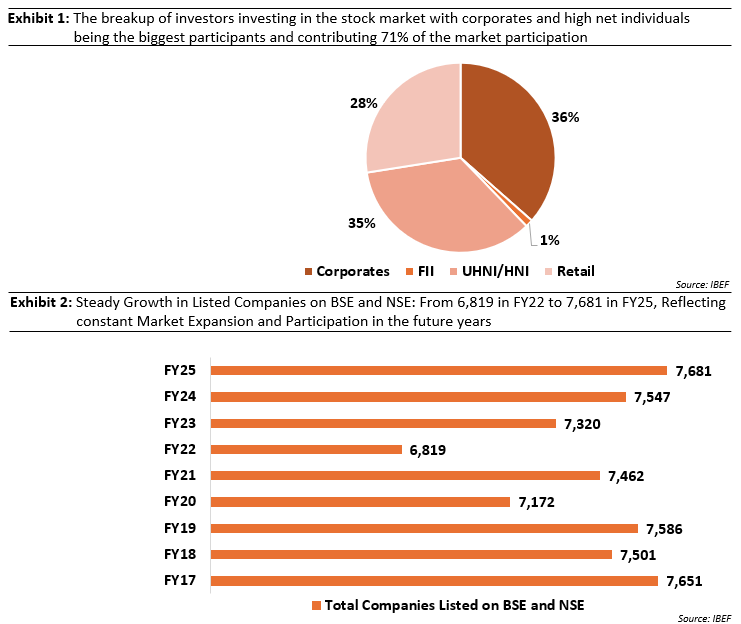

• Domestic institutional investors (DII) and foreign institutional investors (FII) have increased their investments in India. In FY24, DII investments rose from ₹864 crore in FY19 to ₹1,535 crore, while FII investments reached ₹2,048 crore.11

Mutual Funds

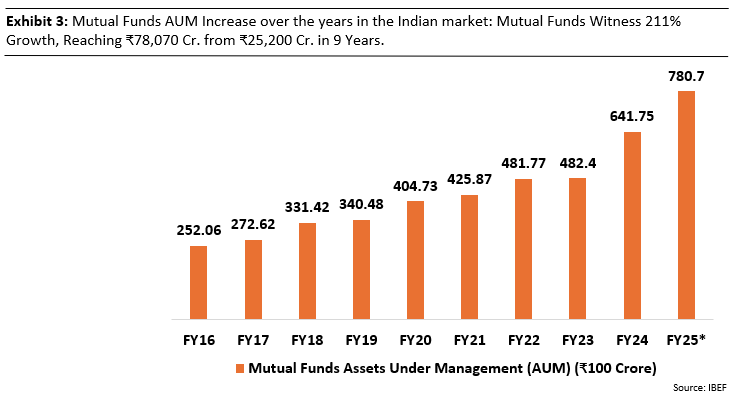

• In FY24, the mutual fund industry’s assets under management (AUM) surged to ₹53.4 lakh crore, marking a substantial 35% YoY growth. The equity mutual fund segment (excluding arbitrage) accounted for ₹29.2 lakh crore of the total AUM, representing a notable 51% YoY increase and contributing 55% to the overall AUM net inflows of ₹2.4 lakh crore into the equity category in FY24 underscored strong investor confidence, reflecting a 46% YoY growth.1

• The net inflow received by mutual funds is ₹5.1 lakh crore in FY24 (till February). Assets managed by domestic mutual funds (MFs) grew by 34% in FY24, the highest increase since 2016-17, driven by a strong equity market rally and substantial inflows.11

Wealth Management

• In wealth management, India’s market is projected to reach ₹53,990 crore in AUM by 2024. The country saw a 6.1% annual increase in ultra-high-net-worth individuals (UHNWIs) in 2023, outpacing the global growth rate of 4.2% to reach 626,619 individuals. India is expected to lead globally with a 50.1% growth in UHNWIs from 2023 to 2028, driven by urbanization, regulatory reforms, technological advancements, and demographic shifts.

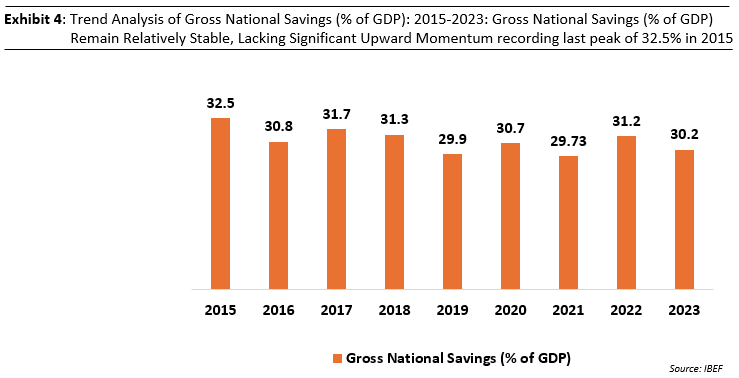

• The UHNI segment, with average household financial assets exceeding ₹25 crore, is projected to grow at an 8.5% CAGR from 2022 to 2027, while the HNI segment, with assets surpassing ₹85 Lakh, is expected to grow at around 15% CAGR over the same period. As of FY23, India’s gross financial household savings totaled approximately ₹3,28,921 crore, with bank deposits accounting for 42% of this amount. 1

Industry Tailwinds

• Economic Growth

India’s economy has shown remarkable resilience and strong growth, achieving an impressive 8.2% GDP growth in fiscal year 2024, consistently outperforming global counterparts despite significant uncertainties. The IMF, which initially projected India’s GDP growth at 5.8% for fiscal year 2021 before revising it to 1.9% due to the COVID-19 pandemic, has acknowledged India’s ability to adapt and benefit from global volatility.

The World Bank revised its fiscal year 2022 growth estimate from 11.2% to 8.3% due to the second COVID-19 wave but continues to emphasize India’s strong potential for long-term growth. This performance, coupled with a favorable shift in global manufacturing and economic dynamics, positions India as a significant beneficiary and a driver of increased demand for financial services.

• Capital Market growth

The equity markets in India have witnessed substantial growth in Average Daily Traded Volumes (ADTO) and a surge in retail investor participation.

ADTO grew from ₹9.93 lakh crore in fiscal year 2019 to ₹14.44 lakh crore in fiscal year 2020, marking a 45% YoY increase. This growth accelerated significantly in fiscal year 2021, reaching ₹27.41 lakh crore—a 90% YoY rise—and further soared to ₹69.5 lakh crore in fiscal year 2022, reflecting a remarkable 161% YoY increase.

• Manufacturing Shift to India

Global MNCs are increasingly relocating their manufacturing operations to India, driven by factors like cost efficiency, infrastructure development, and a favorable business environment. This shift presents significant opportunities for the financial services sector, particularly in investment banking, corporate advisory, and financing. As MNCs expand, the demand for services such as mergers and acquisitions, regulatory guidance, and funding solutions is expected to rise, offering new avenues for growth.

Industry Headwinds

• Global Macroeconomic Uncertainty

With global GDP growth slowing to 3% in 2023 compared to 6% in 2021 (IMF estimates) and ongoing geopolitical challenges, foreign capital inflows into India have been affected. In fiscal year 2023, Foreign Portfolio Investments (FPI) recorded outflows of approximately ₹25,000 crore, reflecting heightened market volatility and reduced investor confidence.

• Inflationary Pressures and Interest Rates

Retail inflation in India averaged 6.6% in fiscal year 2023, exceeding the RBI’s target range of 2-6%. To combat this, the RBI raised the repo rate by 250 basis points between May 2022 and February 2023, leading to higher borrowing costs. As a result, credit growth slowed to 15.3% in Q2 FY24 from 17.5% in the previous quarter, and investment activity in interest-sensitive sectors faced notable challenges

• Regulatory Challenges

The regulatory landscape also presents significant hurdles. SEBI’s tightening measures, such as larger derivative contract sizes and stricter intraday margin requirements, are expected to reduce speculative trading activity, potentially leading to a 30% decline in F&O trading volumes. This disproportionately affects discount brokers, who derive 70-80% of their revenues from this segment. Furthermore, the mandatory adoption of the UPI Block Mechanism limits brokers’ access to client cash floats, historically a key source of interest income, adding further pressure to revenue models.

• Global Economic Risks

Global economic headwinds further compound the industry’s challenges. Escalating trade tensions, fueled by recent U.S. tariff announcements, threaten export-driven sectors such as IT and pharmaceuticals, reducing investor interest and trading activity in these areas.