NSE: MOFSL

Mr. Raamdeo Agarwal | Chairman

Raamdeo Agarwal is the chairman of MOFSL and the driving force behind the company’s approach to investing. The company is a diversified financial services firm offering a range of products and services in securities, commodities, investment banking, asset management and venture capital. He is a Charted accountant and as the chairman of MOFSL he created the “QGLP” (Quality, Growth, Longevity and favorable price) investment process and its “Buy right and sit tight” investing philosophy. He was a co-promoter when the company first started.

Mr. Motilal Oswal | Managing Director, CEO

Motilal Oswal is the founder and managing director of Motilal Oswal Financial Services Ltd. (MOFSL). He co-founded the company in 1987 with Raamdeo Agrawal. He is a charted accountant After working with a private audit firm for a while, Oswal and Agarwal started their own accounting firm. They later decided to join the BSE as sub-brokers. During those times, the exchange was dominated by Gujarati traders. However, the duo met a broker on the floor who got them a sub-broker position at the BSE. They were issued a badge with the name Motilal Oswal, which subsequently became the name of the company they founded in 1989. Over time, both friends demarcated their responsibilities in their company. While Agarwal investigated finance with his 40-member research team, Oswal took charge of customer support, HR, operations and expansion with franchisee network

Mr. Prateek Agrawal | CEO Asset Management

Mr. Prateek Agrawal holds a PGDM in Finance and Management from the Xavier Institute of Management and a Bachelor of Engineering (B.E.) in Electronics from NIT. With over 30 years of experience in Asset Management, Investment Banking, Advisory Services, and Sell-Side Research, he has had a distinguished career. Before joining Motilal Oswal Asset Management Company Limited, he served as Business Head and Chief Investment Officer at ASK Investment Managers Private Limited, providing leadership across various departments. Earlier, he held roles such as Head of Equity at BNP Paribas Mutual Fund and BOI AXA Mutual Fund, where he was part of the core startup teams, and Head of Research at SBI Capital Market. His key strengths include equity money management and team building.

Mr. Ajay Menon | CEO Wealth Management

Ajay Menon is the Whole-time Director & CEO – Wealth Management business of Motilal Oswal Financial Services Ltd. (MOFSL). Ajay is a member of the Institute of Chartered Accountants of India from November 1997 and is a graduate from N.M. College of Commerce, Mumbai. He is also certified in Series 7, 24 and 63 of FINRA Regulations. Ajay has over 22 years of experience in Indian Capital Markets. He joined the MOFSL Group in 1998 as an Accounts Manager. Soon he was responsible for operations, compliance, legal, risk management, business process excellence and information.

Mr. Himanshu Vyapak | Independent Director

Mr. Himanshu has over 22 years of experience across Asset Management, Banking, and NBFCs. He served as the Deputy CEO of Reliance Nippon Life Asset Management Limited from October 2003 to April 2019, where he played a key role in expanding the company’s presence both domestically and internationally. Prior to this, he held significant positions at ICICI Bank and Escorts Finance. Additionally, Mr. Himanshu is a member of the Board of Studies at Prin. LN Welingkar Institute of Management Development & Research. He is also actively involved in social initiatives through his non-profit company, ID Finexperts Skilling Foundation, which focuses on enhancing employability in the BFSI sector for marginalized communities.

Ms. Swanubhuti Jain | Independent Director

Ms. Swanubhuti Jain has over 18 years of experience in diverse Fintech organizations, including sectors such as Insurance, Stock Broking, Investment Banking, Commodities, and Consulting. She has successfully built businesses from scratch across various organizational types, from startups to global MNCs. Her extensive cross-functional expertise spans Business Development, Operations, and Delivery Excellence. Known for her strong analytical, problem-solving, and leadership skills, Ms. Jain is adept at revitalizing underperforming business units through process improvements, cost optimization, and effective multilateral negotiations.

MR R.S. Sanghai | Independent Director

Mr. R.S. Sanghai brings over 37 years of extensive experience in Auditing, including Internal, Statutory, and Tax Audits, as well as Business Advisory Services focusing on Business Restructuring, cost-cutting strategies, and CxO services for industries like Logistics and Packaging. He has deep expertise in handling Income Tax matters for large industrial houses and providing advisory services in International Taxation. A Fellow Member of the Institute of Chartered Accountants of India (ICAI), Mr. Sanghai is a distinguished Chartered Accountant with an All-India Rank in the CA examinations. He has also pursued advanced proficiencies in areas such as International Taxation and IFRS.

Mr. Vibhul Choksi | Independent Director

Mr. Vipul Choksi, currently the Senior Partner at Shah Gupta & Co., has over three decades of experience specializing in Assurance and Taxation practices. He has extensive expertise in auditing large corporations across sectors such as Banking, Insurance, NBFCs, Mutual Funds, Housing Finance, Steel, Textiles, Cement, and Infrastructure. A former Chairman of the Western Indian Regional Council of the Institute of Chartered Accountants of India (ICAI), he has also contributed to various ICAI committees. Additionally, Mr. Choksi served as the President of the Chamber of Tax Consultants and is currently the Editor of its monthly journal.

1. Remunerations to directors: Mr. Motilal Oswal, Managing Director & Chief Executive Officer (“MD & CEO”), Mr. Ajay Menon, and Mr. Rajat Rajgarhia, Whole-time Directors (“WTDs”), draw remuneration from the Company, apart from the reimbursement of expenses incurred in discharge of their duties.

• Mr. Motilal Oswal: MD and CEO of the company received a total remuneration of ₹2,40,00,000 which includes salary, variables, ESOP and others.

• Mr. Ajay Menon: whole time directors of the company received a total remuneration of ₹16,48,14,100 which includes salary, variables, ESOP and others.

• Mr. Rajat Rajgarhia: whole time directors of the company received a total remuneration of ₹9,09,67,601 which includes salary, variables, ESOP and others.

2. Remunerations to non-executive directors:

• The independent Directors are paid the sitting fees of 40,000/- for every Meeting of the Board and 20,000/- for every Meeting of the Committees of the Board attended by them.

• The Members of the Company at the AGM held on July 11, 2022, approved the payment of Commission up to an amount not exceeding 1% (One Percent) of the Net Profits of the Company computed in accordance with the provisions of Section 198 and other applicable provisions of the Act, to Independent Directors of the Company for period of five years i.e. from FY22-23 till FY 2026-27.

• The Board at its Meeting held on April 26, 2024, has on recommendation of the NRC, approved the payment of Commission of 10,00,000/- each to Mr. Chandrashekhar Karnik, Mr. C. N. Murthy, Mr. Pankaj Bhansali, Mrs. Divya Momaya and Mrs. Swanubhuti Jain, Independent Directors of the Company for the FY23-24.

3. Management Remuneration and employee pay ratio: 15 17 18

• For FY24, the remuneration ratio of the Managing Director of MOFSL, Mr. Motilal Oswal, to the median employee remuneration stands at 58.95:1, reflecting a significant pay disparity in line with industry standards of 89.52:1. Meanwhile, for Mr. Ajay Menon, Whole-Time Director, the ratio is 404.85:1., for Mr. Rajat Rajgarhia, Whole time director, the ratio is 223.45:1 The company employs 7,927 permanent employees.

• The percentage increase in the median remuneration of Employees in the financial year was 26%.

• The average salary increase among managerial personnel is 17.90% and the same for non-managerial personnel was 25%, in comparison to industry peers:

• IIFL Securities: Managing director Mr. R. Venkataraman’s remuneration ratio stands at 71.12:1

• ICICI Securities: Managing Director & CEO Mr. Vijay Chandok has a ratio of 101.8:1, and Executive Director Mr. Ajay Saraf at 54:1.

• Geojit financial services: Managing Director & CEO Mr. C.J. George has a ratio of 115.56:1.

• SMC Global Securities: Chairman & managing director Mr. Subash Chand Aggarwal has a ratio of 69.59, and Vice chairman & Managing director has a ratio of 69.59.

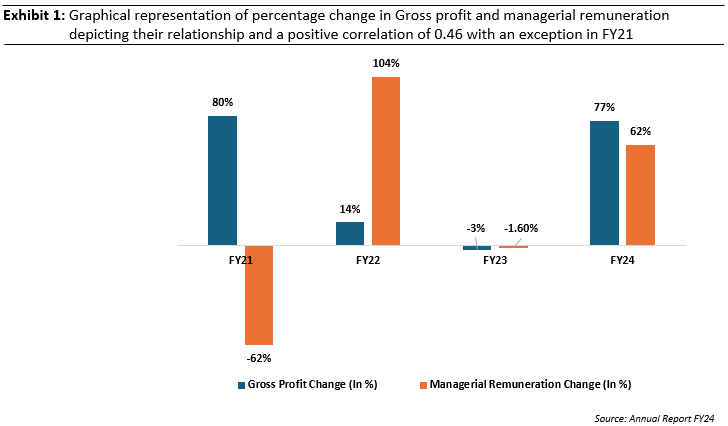

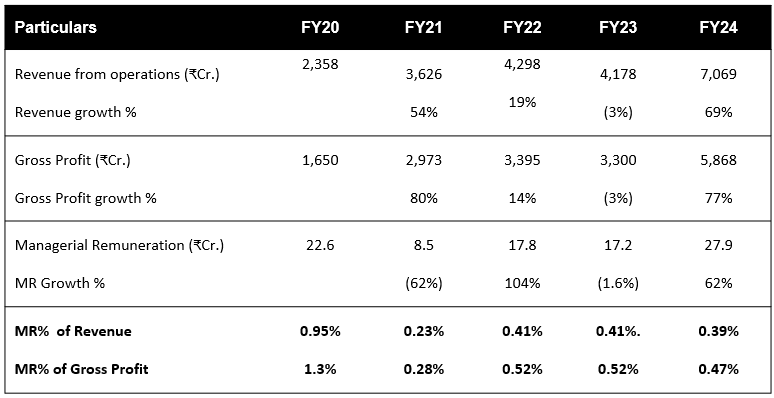

Managerial Remuneration analysis

Commentary:

• The Managerial remuneration of the MOFSL shows a close connection to its revenue and profit performance. While there was a substantial 69% increase in the revenue, the gross profit also showed a 77% increase, and simultaneously the remuneration also showed an increase of 62%, this growth in the remuneration is more significant than the negative growth during FY24.

• Revenue and the managerial remuneration have a positive correlation of 0.502 and the gross profit and managerial remuneration has a positive correlation of 0.463.

• Management remuneration observed a decline in the FY21 because of the resignation of one of the directors and the addition of new director in the following year.

• Though managerial remuneration as a percentage of revenue and gross profit remains within reasonable bounds, at 0.39% and 0.47% respectively in FY24, it will be important for the company to ensure that future remuneration growth remains sustainable, especially if revenue and profit growth were to slow down again.