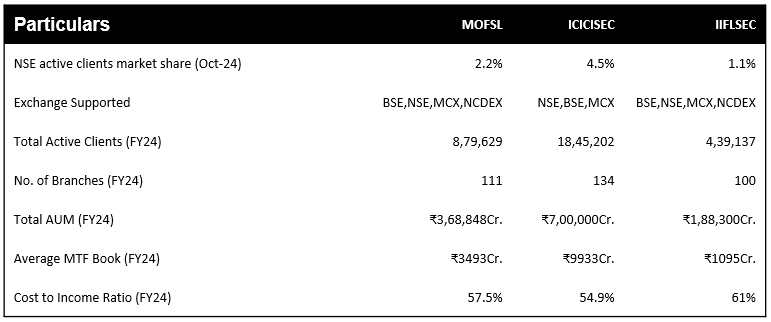

Comparison of Key metrics of MOFSL with its top peers15 18 1

• MOFSL holds a considerable number of active NSE clients of 8,79,629 with a market share of 2.2% as of October 2024, trailing behind only one of its peers ICICI Securities which holds a total of 4.5% percent of the market share with over 18,45,202 active NSE clients. The company provides services throughout all the major exchanges like BSE, NSE, MCX, and NCDEX and appeals to diverse client’s needs.

• With 8,79,629 active clients in FY24, MOFSL’s client base is significantly lower than ICICISEC’s 18,45,202 highlighting room for growth in capturing a larger customer base. MOFSL operates 111 branches across India more than IIFLSEC whereas ICICISEC operates 134 branches over the nation suggesting a potential to expand their physical presence and accessibility.

• MOFSL’s Total Assets Under Management (AUM) stand at a significant ₹ 3,68,848 Cr. Falling short of ICICISEC with ₹7,00,000Cr but more than IIFLSEC with ₹1,88,300Cr. this also signals that the company has a great spectrum of growth in all the segments of financial services. Additionally, MOFSL also maintains an average Margin Trading Facility (MTF) of ₹3493 Cr., though notably smaller than ICICISEC but more than that of IIFLSEC. Indicating the potential to increase its MTF offerings.

• MOFSL’s cost-to-income ratio is approximately 57.5% slightly higher than ICICISEC’s 54.9% but less than IIFLSEC’s 61%. This reflects operational efficiencies to be leveraged for potential margin improvements in an area where ICICISEC has an edge. In summary, MOFSL demonstrates strength in market share, presence, and operational efficiency but faces competition in AUM. Strategic expansion with an increased client base and increasing AUM could position its competitive standing in the sector.

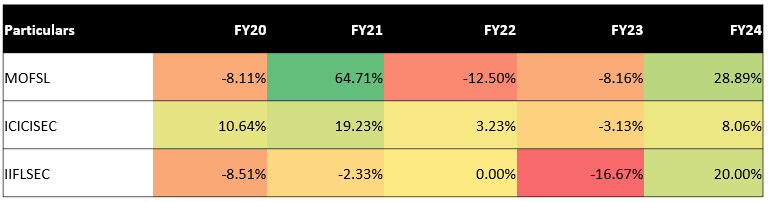

Operating Profit Margin Growth (%)

• MOFSL showed an exceptional growth of 64.70% in FY21 ending with 28.89% in FY24 while experiencing a decrease of 12.50% in FY22 and 8.16% in FY23 reflecting overall improved operating efficiency.

• Among peers, ICICISEC showed a stable growth of 10.64% in FY20 ending with 19.23% in FY21. IIFLSEC despite showing a negative trend over the time period of FY2020-FY2023 rebounded and recorded a margin growth of 20% in FY24. MOFSL’s recent growth signals their competence in operational efficiency among their peers.

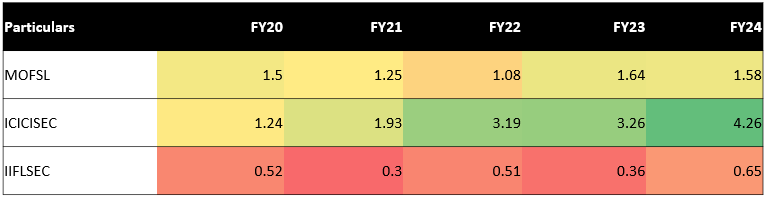

Debt To Equity Ratio (Times)

• MOFSL maintained a relatively higher debt to equity ratio, starting from 1.5 times in FY20 to 1.58 times in FY24 with a stable movement. This indicates a more leveraged position to with each year.

• In comparison to ICICISEC started with a high ratio and showed a sharp increase in each financial year with the ratio being 4.26 times in FY24, this indicates an aggressive and excessive use of leverage and indicates an imprudent management.

• IFLSEC’s ratio remained conservative over the years with a ratio of 0.52 in FY20 with a very slight increase to 1.64 in FY23, this indicates an inefficient use of leverage.

• Overall, MOFSL’s moderate debt-to-equity ratio positions well in its peers with limited reliance on debt making it a relatively safer option than ICICISEC.

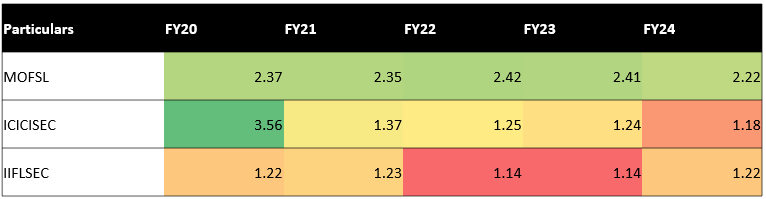

Current Ratio (Times)

• MOFSL maintained a strong and stable current ratio over the years starting with 2.37 times in FY20 to 2.22 times in FY24, this highlights a strong liquidity buffer and ability to meet its current liability consistently.

• In comparison IIFL maintained a satisfactory current ratio from 1.22 times in FY20 to 1.22 times in FY24. ICICISEC having a high ratio of 3.56 times in FY20 register a sharp decrease after that and being at 1.18 times in 2024.

• In summary, MOFSL recorded the best current ratio among the peers with a stable capability to pay off their short-term liability consistently.

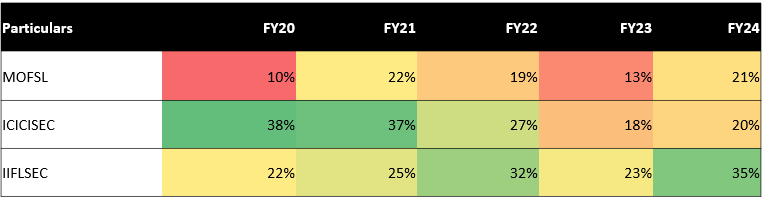

ROCE (%)

• MOFSL improved its ROCE from 10% in FY20 to 21% in FY24 showcasing improves capital efficiency and increased profitability.

• In comparison ICICISEC reported high 38% ROE in FY20 to a consistent and gradual decrease to 20% in FY24, on the other hand IIFLSEC reported a gradual and consistent growth.

• Overall MOFSL’s ROE is strong and improving with IIFLSEC being the leader in ROE among peers.

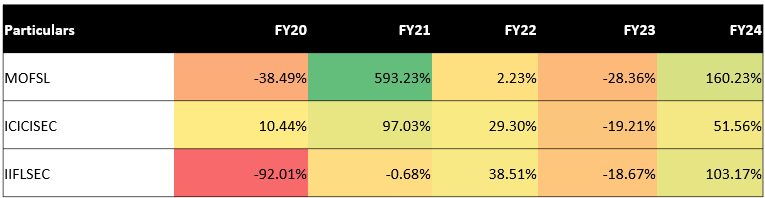

Earnings per Share (EPS) Growth (%)

• MOFSL exhibit fluctuations peaking with a dramatic 593.23% in FY21 and 160.23% in FY24 being the best performing among the industry indicating a strong recent financial performance and operational improvement.

• Among its peers ICICISEC also showed growth from FY20 from 10.44% to 97.0.% in FY21, IIFLSEC’s EPS performance also showed growth from a negative -92.01% change in FY20 to 103.17% in FY24.

• Overall, MOFSL displays the most consistent and high growth rate amongst its peers being the leader in terms of EPS.