The World Bank has reduced India’s GDP growth forecast for FY26 to 6.3%, lower than its earlier prediction of 6.7%. Even after this cut, India remains the fastest-growing large economy in the world, ahead of China, the US, and Europe.

Why Did the World Bank Lower the Forecast?

Export Growth Has Slowed

India’s exports are being affected by weak global trade. Demand from big buyers like Europe, the US, and East Asia has come down. On top of this, shipping troubles in the Red Sea and Suez Canal have made it harder to export goods smoothly. Rising trade barriers and global uncertainties have also held back India’s export growth just when it was starting to pick up again.

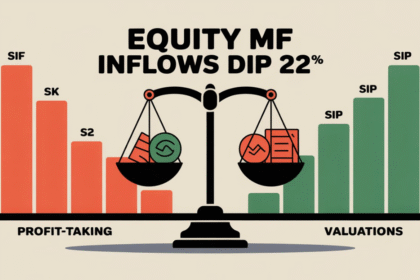

Private Investment Is Slowing

While the government is still spending a lot on infrastructure, private companies are not investing as much. Global investors are being careful because of uncertain policies, high interest rates, and expensive raw materials. This has slowed down overall investment growth in India, even though reforms are still happening.

The Global Economy Is Weak

The world economy is having a tough time. The World Bank expects global growth to be only 2.3% in FY26, one of the lowest rates since 2009 (except during recessions). This weak global demand is also affecting India’s exports and foreign investments, limiting short-term growth.

What’s Keeping India Strong?

Even with these problems, India’s domestic economy is still solid.

– People are spending more because of growing incomes, more people living in cities, and strong demand for goods and services.

– The services sector (like IT, healthcare, fintech, and consulting) is doing well and helping balance the slower growth in exports.

– The government is still spending a lot on big projects like railways, highways, defense, renewable energy, and manufacturing. Programs like the PLI (Production-Linked Incentive) scheme are helping build stronger growth for the future.

What’s the Outlook for the Coming Years?

Even though growth may slow in FY26, the World Bank expects India’s economy to pick up again:

– Growth of 6.5% in FY27

– Growth of 6.7% in FY28

These stronger numbers depend on global trade getting better and private investment returning. India’s long-term strengths — like its young population, ongoing reforms, digital growth, and strong financial system — will keep supporting growth.

What Are the Main Risks?

There are still some dangers that could hurt growth:

– Worsening global conflicts (Middle East, Russia-Ukraine, Taiwan)

– Oil and raw material prices rising sharply

– Financial market ups and downs

– Higher borrowing costs globally

– More trade wars and new trade restrictions

The Bottom Line

The cut in India’s FY26 growth forecast shows global troubles, not big problems at home. India needs to keep strengthening its internal engines — like consumption, services, infrastructure, and reforms — to stay steady even when the world economy is shaky. FY26 will test how well India can stay on track while global challenges continue.