Bharti Airtel’s ability to manage cash flow in a cash-intensive industry like telecom is a fascinating case study. Over the years, its working capital trends reveal how the company has adapted to market challenges and capitalized on growth opportunities.

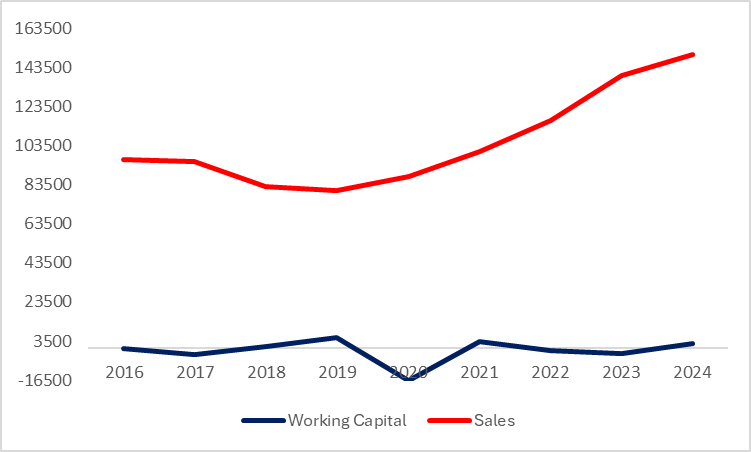

Between 2016 and 2020, Airtel faced many headwinds. Its sales declined sharply from ₹96,532 crores in 2016 to ₹80,780 crores in 2019. This period coincided with Reliance Jio’s disruptive entry into the telecom market, offering free internet and calling services that intensified competition. To stay competitive, Airtel had to sustain high capital expenditures (Capex), which likely contributed to its increasingly negative working capital. During this time, Airtel was essentially leveraging its operations to maintain liquidity while balancing heavy investments in infrastructure.

The company began turning around in 2020. By 2021, its sales had recovered to ₹1,00,616 crores, up from ₹87,539 crores the previous year. This rebound was accompanied by a remarkable improvement in working capital, which shifted from -₹16,596 crores in 2020 to ₹3,043 crores in 2021. This positive shift indicates that Airtel worked on optimizing its cost structures and improving operational efficiency. Even small improvements in manufacturing and other operational costs made a noticeable impact on the company’s financials.

From 2022 to 2024, Airtel’s sales grew consistently, increasing from ₹1,16,547 crores in 2022 to ₹1,49,982 crores in 2024. However, working capital fluctuated during this period, turning negative in 2022 and 2023 before recovering to a positive ₹2,414 crores in 2024. The negative working capital during these years was likely influenced by increased Capex, particularly investments in 5G network rollout and other infrastructure projects. Despite the fluctuations, the positive working capital in 2024 signals improved cash flow management and better operational practices.

In summary, Bharti Airtel’s financial trends demonstrate its resilience and ability to adapt in a competitive industry. While high Capex and market disruptions have created challenges, the company has shown strong recovery through efficient cost management and strategic investments. The recent improvement in working capital reflects a healthier cash flow position, which bodes well for sustaining growth in the future.