The Indian two-wheeler industry has witnessed some iconic stories, but none is as fascinating as the tale of Hero and Honda.

What started as a collaborative journey turned into a fierce rivalry.

Let’s explore how this friendship began, why it fell apart, and how these two giants are shaping the future of the two-wheeler market.

How HERO Met HONDA?

The year was 1984, and the demand for motorcycles in India was skyrocketing.

The Hero Group, led by the Munjal family, saw an opportunity but lacked the technical expertise to produce bikes.

Enter Honda, a Japanese automobile giant. Together, they formed a joint venture, creating India’s first affordable and fuel-efficient motorcycle: the Hero Honda CD100.

With its catchy slogan, “Fill it, Shut it, Forget it” the CD100 became a household name, and by 2001, Hero Honda was the largest motorcycle manufacturer in India.

What went wrong?

Despite 26 years of partnership and unparalleled success, cracks began to appear in their relationship. Here’s what led to the split:

Export Limits: Honda allowed Hero to export only to nearby markets like Bangladesh, Nepal, and Sri Lanka but restricted Hero from expanding globally. As the Indian market began saturating, Hero wanted to export to other international markets, which Honda firmly opposed.

Technology Sharing Issues: Hero felt that Honda was holding back critical technology, providing only limited access to innovations.

Royalty Payments: Hero paid significant royalties to Honda for their technology. While this made sense in the early years, Hero felt the fees were unjustifiable as they had grown more independent.

Result?

The disagreements culminated in 2010, with Hero acquiring Honda’s 26% stake and renaming itself Hero MotoCorp. Honda continued to operate independently through its subsidiary, Honda Motorcycle and Scooter India (HMSI).

Market Share: The evolving battle

Hero has held the throne of India’s two-wheeler market for decades, but Honda is quickly closing the gap. Let’s break down how the competition has evolved:

– 2008-09: Hero Honda commanded a 49% market share, and Honda had approx. 14%, market share in the scooter segment. Combined, their partnership held a massive 63%, with Hero Honda being 3.5X bigger than Honda.

– 2014-15: Post-split, Hero had a 40% share, while Honda commanded 27% market share.

– 2024-25: Hero’s share has dropped to 29%, while Honda now stands at 28%—a mere 1% difference. The gap is narrower than ever, signalling a potential shift in leadership.

Infact, in September 2024, Honda overtook Hero, becoming India’s largest two-wheeler maker.

Market Share (FADA, Sept 2024):

Honda: 27.73%

Hero: 22.54%

Strengths and Weaknesses: A Tale of Two Giants

Hero MotoCorp: The King of Entry-Level Bikes

Hero’s biggest strength lies in its affordability and fuel efficiency, making it the go-to brand for entry-level motorcycles. Its flagship product, the Splendor, is the bestselling motorcycle in India and continues to dominate the 100cc-110cc segment.

– In 2012-13, Hero held a 70% market share in this segment, while Honda had a mere 5%.

– By 2024-25, Hero still leads with a 78% share, while Honda has grown to 8%.

Hero’s dominance in this segment is largely due to its low-cost models that cater to India’s mass-market consumers.

Honda: The Scooter Specialist and Rising Mid-Level Leader

Honda has firmly established itself as the leader in scooters, thanks to its iconic Activa. Since its launch in 2000, the Activa has been synonymous with reliability and convenience.

– In 2012, Honda controlled 49% of the scooter market, while Hero held 19%.

– By 2024-25, Honda still leads with 45%, while Hero has dwindled to a mere 5%.

Honda also excels in the growing mid-level 125cc segment, where it holds a 45% market share, followed by Bajaj at 24%. This segment is critical as consumer preferences shift toward higher-powered bikes.

Shifting Preferences of Indian Consumers

The Indian two-wheeler market has evolved significantly over the years. Here’s how consumer preferences have shifted:

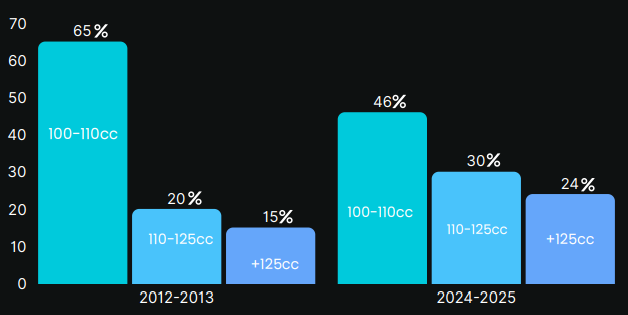

– In 2012-13, 65% of bikes sold were entry-level (100cc-110cc), 20% were mid-level (110cc-125cc), and 15% were premium (above 125cc).

– By 2024-25, entry-level bikes account for only 46%, while mid-level bikes have grown to 30%, and premium bikes make up the remaining 24%.

This shift poses a challenge for Hero, whose strength lies in the entry-level segment.

The Road Ahead: Who Will Reign Supreme?

Hero’s ability to retain its leadership depends on its success in the following areas:

– Capturing the mid-level 125cc segment (Launched XTREME 125CC recently).

– Maintain its dominance in the entry-level segment.

– Expanding its presence in the scooter market.

– Establishing a strong foothold in the EV segment.

On the other hand, Honda’s strategy focuses on:

– Strengthening its scooter dominance.

– Expanding its lead in the mid-level bike segment.

– Challenging Hero in the entry-level segment with competitive models like the Shine 110cc