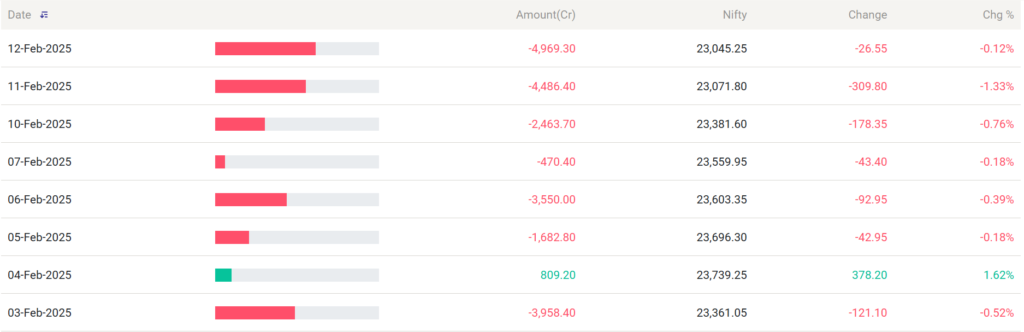

Foreign Institutional Investors (FIIs) play a crucial role in the Indian stock market, influencing liquidity, market trends, and investor sentiment. Currently, FIIs hold approximately ₹83 lakh crore worth of assets in India. If they were to sell their holdings at a rate of ₹5,000 crore per day, how long would it take for them to exit the Indian market completely?

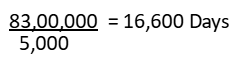

To determine the total time required for a full exit, we divide the total holdings by the daily sell-off amount:

This means it would take 16,600 days to sell all their assets.

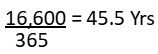

Since a year has 365 days, we convert days into years:

Key Insights:

- The scale of FII Investments: The vast holding of FIIs in India highlights their deep integration with the country’s financial markets. Any major shift in their investment strategy can impact stock prices, investor confidence, and overall market stability.

- Market Impact of a Gradual Exit: Even if FIIs were to sell in a systematic manner over decades, it would still create periodic volatility in the markets. Stock prices would fluctuate based on the pace of their exits and the sectors they target.

- Economic and Policy Factors: FIIs do not operate in isolation. Government policies, global economic conditions, interest rates, and geopolitical developments influence their investment decisions. A sudden change in policies or market conditions can either accelerate or slow down their exit.

- Domestic Investors’ Role: Domestic Institutional Investors (DIIs) such as mutual funds, insurance companies, and retail investors play a key role in absorbing FII outflows. A strong domestic investor base can mitigate the impact of FII selling and stabilize the market.

- Historical Trends: Historically, FIIs have both entered and exited Indian markets based on global macroeconomic trends. While outflows have occurred during financial crises, strong economic performance and policy stability have often led to their return.