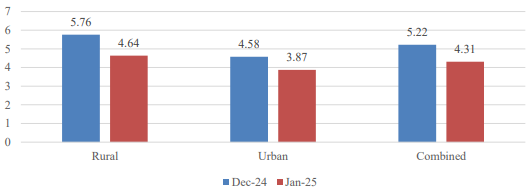

The Consumer Price Index (CPI) for India in January 2025 revealed a notable decline in inflation. The overall inflation rate dropped to 4.31%, the lowest since August 2024, showing an improvement from 5.22% in December 2024.

Key Highlights from the CPI Report

1. Overall Inflation Trends

– The YoY CPI inflation stood at 4.31% in January 2025, down from 5.22% in December 2024.

– Rural inflation dropped to 4.64%, while urban inflation stood at 3.87%.

– The decline in inflation strengthens the case for the RBI to maintain or even reduce interest rates, which could boost equity markets and improve investor sentiment.

2. Sectoral Impact on the Stock Market

– Lower inflation could lead to a softer interest rate environment, positively impacting banking stocks and financial institutions.

– Easing inflation boosts consumer spending power, benefiting companies in the fast-moving consumer goods (FMCG) sector.

– With housing inflation stable at 2.76%, lower inflation could encourage homebuyers and provide a boost to real estate developers and housing finance companies.

– Lower fuel prices (-1.38% in fuel & light inflation) and stable inflation could support auto demand, benefiting automobile manufacturers.

– A stable inflationary environment, coupled with RBI’s potential rate stance, may impact currency fluctuations, which could be crucial for IT and export-driven businesses.

What This Means for the Indian Economy

The drop in inflation is a positive sign for businesses and investors. Lower inflation reduces cost pressures on companies, supports consumer demand, and provides room for the RBI to adopt a more accommodative monetary policy. If this trend continues, it could drive positive momentum in equity markets, attract foreign investments, and improve GDP growth prospects.

The next CPI data release, scheduled for March 12, 2025, will provide further insights into whether this declining trend continues.