The quick commerce sector in India is growing fast, but at a huge cost. Companies are spending massive amounts of money to expand, capture market share, and stay ahead of the competition. Every quarter, the industry burns through nearly ₹5,000 crore, making it one of the most expensive business battles in the country.

Zepto spends the most among the leading players, contributing to more than half of the total cash burn. On the other hand, Blinkit, owned by Zomato, has a much lower burn rate, accounting for just 2-3% of the industry’s total spending. Despite spending less, Blinkit holds a strong market position, with a 40-45% share.

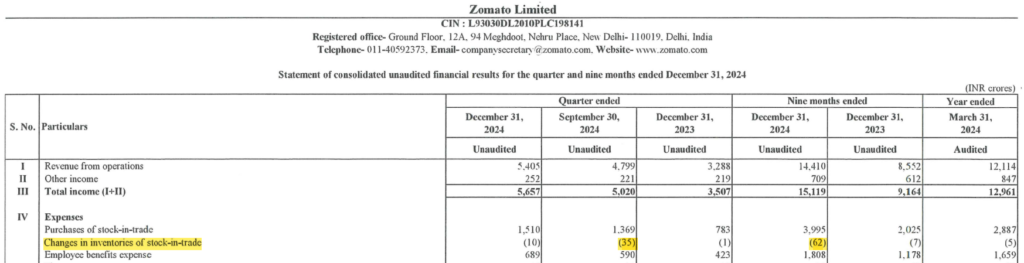

Blinkit currently burns around ₹35 crore per month. While this may seem small compared to others, its losses are rising. In the October-December quarter, Blinkit’s EBITDA loss jumped from ₹8 crore in the previous quarter to ₹103 crore.

Zepto, meanwhile, has been aggressively spending to expand its customer base. In the last quarter alone, the company burned around ₹2,200-2,300 crore. However, its strategy seems to be working, as it has gained market share and now leads in Monthly Active Users (MAUs), according to a report by Bank of America Research.

Other competitors, such as Swiggy Instamart, Flipkart Minutes, Tata’s BigBasket, and Amazon, are also competing in this space, each trying to attract more customers and build their network of dark stores – small warehouses used for quick deliveries. Swiggy Instamart holds around 23% of the market, making it another key player in the battle.

The Strategy Behind Blinkit’s Growth

Despite the rising competition, Blinkit is sticking to a disciplined approach. Unlike Zepto, which relies heavily on discounts, Blinkit focuses on efficiency and execution. Instead of offering big price cuts, it aims to grow by improving service quality and expanding its reach.

One of its major strategies is expanding dark stores (mini warehouses that are 3,000-4,000 square feet in size). The company has already crossed 1,000 dark stores ahead of schedule and is now pushing even further. It plans to reach 2,000 dark stores by December 2025, a year earlier than originally planned. This rapid expansion is expected to strengthen its presence across major cities and improve delivery speed.

How This Affects Zomato

Zomato, the parent company of Blinkit, is feeling the impact of this high cash burn. In Q3, Zomato’s overall profits declined, largely due to Blinkit’s rising losses. As a result, Zomato’s stock price dropped, affected by both Blinkit’s spending and a broader market correction. Investors are closely watching how the company balances growth with financial stability.

Zepto’s Future Plans

While Blinkit and Swiggy focus on expansion, Zepto has been aggressively raising funds. In the past year alone, the company has secured $1.3 billion from investors. This funding has allowed it to sustain its high cash burn while continuing to grow.

Zepto is also planning to go public in 2025, which means it will launch an Initial Public Offering (IPO) to raise more money from the stock market. This move could help Zepto strengthen its financial position and compete even more aggressively in the coming years.

The Road Ahead for Quick Commerce

The quick commerce industry is at a crucial stage. While companies are spending huge amounts to expand, the challenge is to find a balance between growth and profitability. Investors are looking for signs that these businesses can become financially sustainable in the long run.

For now, the race continues, with Blinkit, Zepto, and Swiggy Instamart leading the charge. The companies that manage to grow efficiently, control spending, and keep customers happy will emerge as winners in this high-stakes competition.