1) Oriana Power Limited

- Business Overview – Incorporated in 2013, Oriana Power Ltd. is a prominent provider of solar energy solutions to industrial and commercial customers in India and Africa. Oriana Power offers two main business models: CAPEX and RESCO. The Company on an aggregate has implemented 70+ projects, served 30+ clients.

- Recent Filings – Company informed the exchange regarding the receipt of new order of 52 MW solar power plant valued at Rs. 247.88 Cr. under Engineering, Procurement and Construction (EPC) segment from Bharat Petroleum Corporation Ltd.

- Outlook –

- Company aims on achieving 6 GW+ EPC ((Engineering, Procurement & Construction) capacity & 2.5 GW+ IPP (Independent Power Producer) capacity.

- In August 2024, company announced plan to build a Gigawatt scale factory to produce alkaline electrolyzers and Balance of Plant (BOP) modules locally in India, by 2026 with 500 MW.

- Company envisions to be a credible player in Battery Energy Storage with a cumulative capacity of 3.5 GWh by 2030.

- Upscaling of Capacity of Compressed BioGas production substantially with a CAGR of 25% is under process.

- 1Y Price Chart –

2) SAR Televenture Limited

- Business Overview – SAR Televenture Limited was incorporated with an aim to provide the leasing of 4G/5G towers to telecom companies. The company has capability to Construct 4G and 5G Towers which are onward leased to Telecom companies. SAR is also having international operations in Myanmar, ABSA Innovations, a closely held subsidy of SAR in Telecom.

- Recent Filings – Company has entered into a revenue-sharing agreement with Bharat Sanchar Nigam Limited (BSNL) to deliver BSNL telecom services (including fixed, wireless, broadband, etc.) to end users at Noida (Urban and Rural), Lucknow and Faridabad. Company has to create infrastructure for providing BSNL telecom services, revenue sharing will be 50-50%. The agreement is valid for 10 years and is renewable.

- Outlook –

- Company will be investing Rs. 27,300 Lakhs for setting up Fiber-to-the-Home (FTTH) network solutions for 3 Lac Home Passes.

- Company recently entered into agreements with an internet service provider for providing the Fiber-to-the-Home (FTTH) network solutions for 3,00,000 Home Passes.

- The company has already acquired 1,52,212 Home Passes as per the LOIs/ROW.

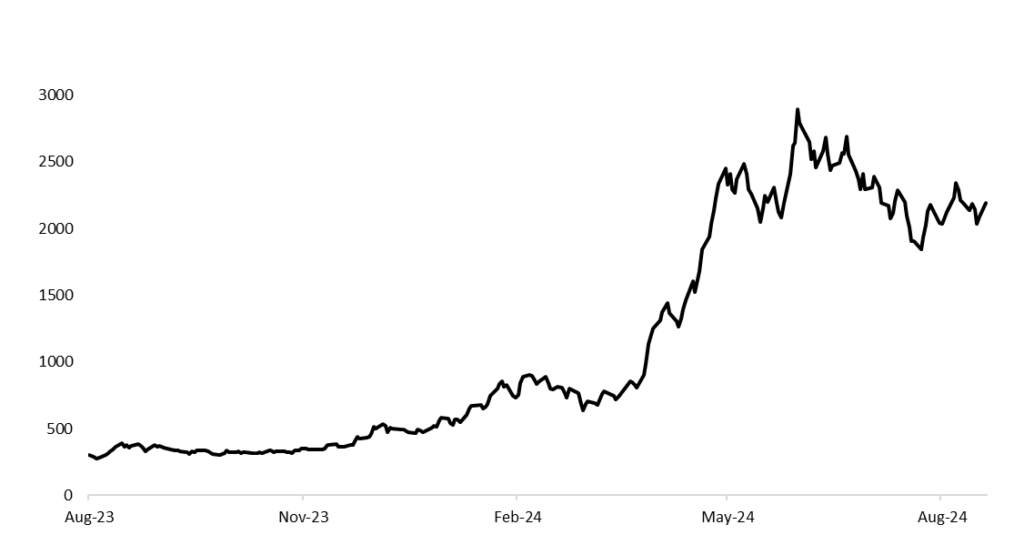

- Price Chart since listing –

3) GPT Infraprojects Limited

- Business Overview – GPT Infraprojects Limited, the flagship of the GPT Group based in Kolkata, is a leading infrastructure company specializing in civil projects and manufacturing concrete sleepers for railways. The company is known for its strong project execution, solid financials, and promising growth prospects. The company’s revenue grew 26% YoY in FY24 to 1025 Cr. and PAT grew 85% YoY in FY24 to 58 Cr.

- Recent Filings – The company has been declared the L1 bidder for a ₹203 crore contract from South Eastern Railway, Kolkata, to construct a 3-lane Road Over Bridge between Nalpur and Bauria stations on the Howrah-Kharagpur route.

- Recent Outlook –

- A revenue increase of 20% to 22% is anticipated over the next three years.

- The management anticipates sustaining a year-on-year growth rate of 20% moving forward.

- The Ghana facility is anticipated to begin generating revenue in the second quarter of the fiscal year.

- Interest expenses for the year are projected to be around Rs 25 to Rs 26 Crores.

- 2Y Price Chart –

Past Coverages

| Coverage Date | Company | LTP on Coverage Date | Current LTP | % change since coverage | Recent Filings |

| 1/08/24 |

PNGS Gargi Fashion Jewellery Ltd. |

₹841 |

₹880.2 |

4.7% |

EXCELLENT RESULTS For Q1 FY24, sales surged 2.1x YoY to INR 13.7 Cr (INR 44 Cr under FOFO model), with profit before tax up 93% to INR 2.9 Cr.(01st August) |

|

08/08/24 |

PG Electroplast Ltd. |

₹423 |

₹537 |

27.0% |

ORDER On August 5, 2024, the company allotted 6,56,000 equity shares to the ‘PG Electroplast Limited Employees Welfare Trust’ under the 2020 Employee Stock Options Scheme.(08th August) |

|

13/08/24 |

Hi-Tech Pipes Ltd. |

₹162 |

₹195 |

20.4% |

GOOD TO EXCELLENT RESULTS For Q1 FY24, sales rose 35% YoY to INR 867 Cr, with net profit up 2.3x to INR 18 Cr. QoQ, sales increased 27%, and net profit jumped 64%. (13th August) |

|

14/08/24 |

Bondada Engineering Ltd |

₹3250 |

₹698 |

1.3% |

ORDER For Q1 FY24, sales surged 2.2x YoY, and net profit jumped 3.6x. QoQ, sales were flat, while net profit declined 26%. (14th August) |

|

8/07/24 |

Dynamic Services & Security Ltd |

₹276 |

₹284 |

-2.9% |

Share Repurchase Agreement The company has agreed to repurchase 49% of Nacof Nithin Sai Green Energy’s shares from an existing shareholder. |