1) Maxposure Limited

- Business Overview – Incorporated on August 17, 2006, Maxposure Ltd. is a diverse new-age media and entertainment company offering 360-degree services across multiple distribution platforms.

- Recent Filings – Company has informed the Exchange regarding the filing of Patent for Innovative Auto PA Pause in Wireless Inflight Entertainment System Using Electromagnetic Field. to enhance the passenger experience by seamlessly integrating real-time PA (Public Address) announcement detection into inflight entertainment systems. This is a strict requirement of Civil Aviation bodies like DGCA, FAA & EASA.

- Outlook –

- Company has won the RFP for Maharashtra Tourism Social Media, and it plans to activate the same in the coming year.

- Company plans to start offering inflight entertainment services to airlines outside India.

- Company believes that service innovation will be a key factor going forward and continued investment in technology and innovation will help to take advantage of any future opportunities.

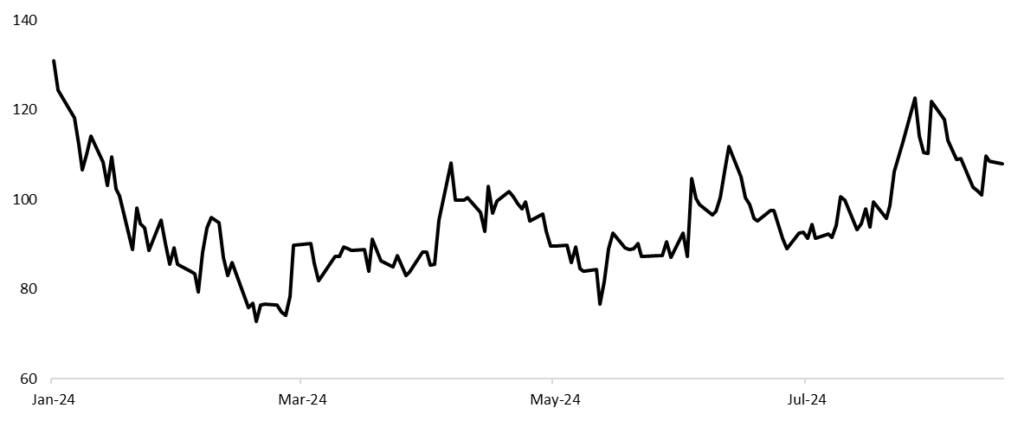

- Price Chart since listing –

2) Kontor Space Limited

- Business Overview – Incorporated in 2018, KSL is the first co-working space company to be listed on the Indian stock market. It is in the business of acquiring, leasing and managing commercial properties. It also invests in refurbished properties to meet their client requirements which mainly comprise startups, SMEs, and independent professionals.

- Recent Filings – Company has informed the Exchange regarding the successful execution of an LOI to lease the entirety of an independent building in Andheri’s MIDC, is poised to accommodate approximately 1,000 bailable seats.

- Outlook –

- This strategic move will help Company to meet the specific needs of our built-to-suit, managed office clients and represents a significant milestone in Company’s growth strategy.

- Company is optimistic about doubling revenue in FY ‘25.

- Company plans on bridging the gap in funding through internal accruals, IPO proceeds, and promoter investments.

- Company also considering strategic partnerships and geographical diversification for future growth.

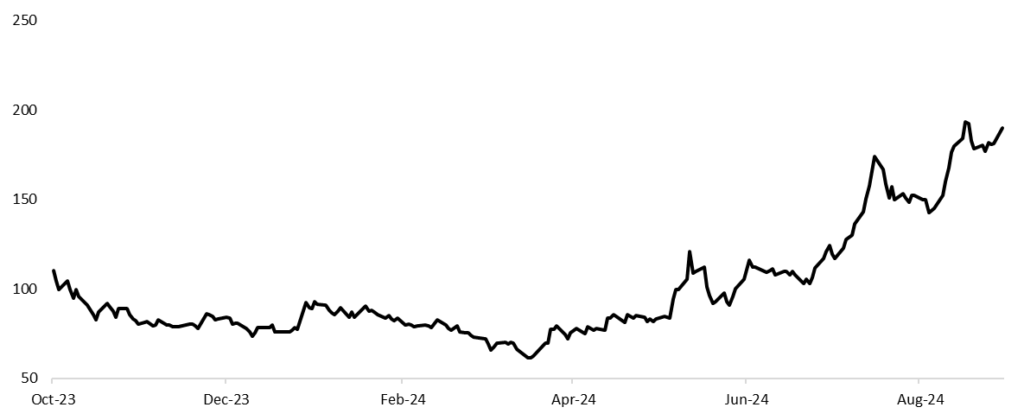

- 1Y Price Chart –

3) Oriana Power Limited

- Business Overview – Incorporated in 2013, Oriana Power Ltd. is a prominent provider of solar energy solutions to industrial and commercial customers in India and Africa. Oriana Power offers two main business models: CAPEX and RESCO. The Company on an aggregate has implemented 70+ projects, served 30+ clients.

- Recent Filings – Oriana Power Limited has informed the Exchange regarding ‘Intimation of receiving new order of 128 MW solar power plant under Open Access Captive Power Plant segment’.

- Recent Outlook –

- Company aims on achieving 6 GW+ EPC (Engineering, Procurement & Construction) capacity & 2.5 GW+ IPP (Independent Power Producer) capacity.

- In August 2024, company announced plan to build a Gigawatt scale factory to produce alkaline electrolyzers and Balance of Plant (BOP) modules locally in India, by 2026 with 500 MW.

- Company envisions to be a credible player in Battery Energy Storage with a cumulative capacity of 3.5 GWh by 2030.

- Upscaling of Capacity of Compressed BioGas production substantially with a CAGR of 25% is under process.

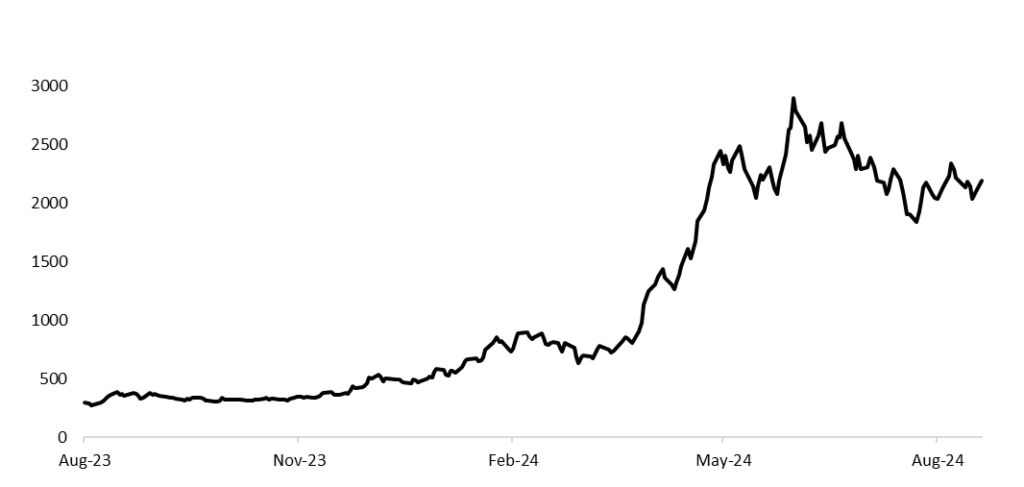

- Price Chart since listing –

Past Coverages

| Coverage Date | Company | LTP on Coverage Date | Current LTP | % change since coverage | Recent Filings |

| 1/08/24 |

PNGS Gargi Fashion Jewellery Ltd. |

₹841 |

₹871 |

3.6% |

EXCELLENT RESULTS For Q1 FY24, sales surged 2.1x YoY to INR 13.7 Cr (INR 44 Cr under FOFO model), with profit before tax up 93% to INR 2.9 Cr.(01st August) |

|

08/08/24 |

PG Electroplast Ltd. |

₹423 |

₹572 |

35.2% |

ORDER On August 5, 2024, the company allotted 6,56,000 equity shares to the ‘PG Electroplast Limited Employees Welfare Trust’ under the 2020 Employee Stock Options Scheme.(08th August) |

|

13/08/24 |

Hi-Tech Pipes Ltd. |

₹162 |

₹187.9 |

16.0% |

GOOD TO EXCELLENT RESULTS For Q1 FY24, sales rose 35% YoY to INR 867 Cr, with net profit up 2.3x to INR 18 Cr. QoQ, sales increased 27%, and net profit jumped 64%. (13th August) |

|

14/08/24 |

Bondada Engineering Ltd |

₹3250 |

₹700 |

-0.3% |

ORDER For Q1 FY24, sales surged 2.2x YoY, and net profit jumped 3.6x. QoQ, sales were flat, while net profit declined 26%. (14th August) |

|

8/07/24 |

Dynamic Services & Security Ltd |

₹276 |

₹267 |

-3.3% |

Share Repurchase Agreement The company has agreed to repurchase 49% of Nacof Nithin Sai Green Energy’s shares from an existing shareholder. |