1) Swaraj Suiting Limited

- Business Overview – Swaraj Suiting Ltd. is a composite textile manufacturing company, with a primary focus on textile manufacturing (Denim & Cotton Fabrics) and trading. The company is engaged in Yarn Dyeing, Weaving, Processing, Finishing of Fabric and Development of Denim Fabric.

- Recent Filings -Company has received INR 2.77 Cr. from the Government of India as Capital subsidy under Amended Technology Upgradation Fund (ATUF) Scheme in respect of investment made by the Company to established the Denim Division-1 at Jhanjharwara, Neemuch, Madhya Pradesh. The Company has pre-paid the Bank term loan with the same. In the coming quarters, this will surely help the company sustain margins and profitability due to reduced debt burden and subsequently, boosting the company’s investment in advanced machinery for better cost efficiency.

- Outlook –

- Company is expecting to sustain margins and profitability through cost-effective measures by targeting 30-40% revenue from exports.

- Company is also entering non-denim segment with capacity of 1.8 Cr metres per annum and plans on increasing denim fabric capacity to 2.52 Cr metres per annum.

- Integrating cotton spinning to enhance control over raw material sourcing.

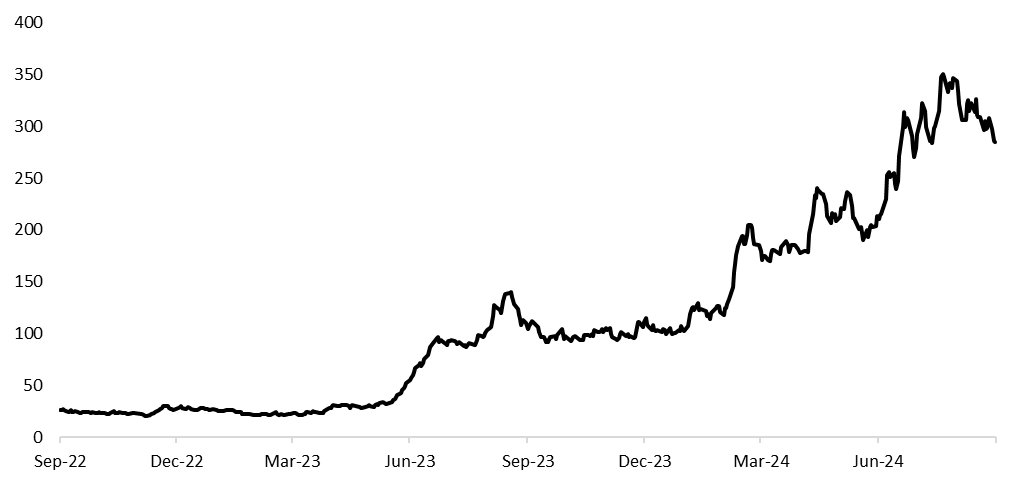

- 2Y Price Chart –

2) Cellecor Gadgets Limited

- Business Overview – CGL is in the electronics device business. It sells products in its own brand, including mobile feature phones, smartwatches, TWS (True Wireless Stereo) earbuds, neckbands, LED TVs, etc. which it outsources from various electronic assemblers and manufacturers.

- Recent Filings – Company is introducing its premium range of smart TVs, specifically targeting metro cities. The range includes models in sizes of 75″, 86″, and 98″, combining cutting-edge technology with elegant design. These smart TVs offer 4K resolution and immersive sound, designed to elevate the luxury home entertainment experience. The launch follows the success of Company’s products in tier 2 and 3 cities, marking a strategic expansion into the high-end market. With partnerships with leading retailers, Company is poised to redefine home viewing for tech-savvy consumers in metropolitan areas.

- Outlook –

- Company is expanding their product range to include air conditioners, Smart TVs, Laptops and other items of home appliances which will derive sales from the households.

- Company is also working on its distribution channel by increasing distributors count from 1,000+ to 1,400+, retail sales points from 32,000+ to 50,000+, ramping up online sales, entering tie-ups with retail chain stores and targeting corporate sales.

- Company also intends on starting its own manufacturing facilities.

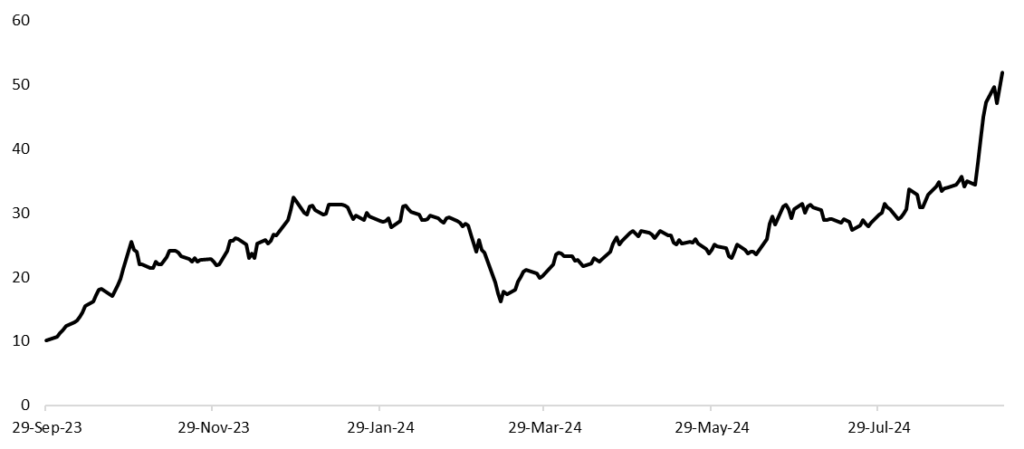

- 1Y Price Chart –

3) Z-Tech Limited

- Business Overview – Z-Tech (India) specializes in delivering innovative and environmentally friendly engineering solutions across various sectors, including Sustainable Theme Park Development, Industrial Waste Water Management, and Geotechnical Specialized Solutions. Their offerings encompass everything from creating beautification artworks and infrastructure to converting waste materials into aesthetically appealing showpieces.

- Recent Filings – The Company has secured a significant INR 12 Cr. project for designing and developing the Waste to Wonder Park at Khanpur, Jammu, on a 20-year PPP (Public-Private Partnership) model, including operation and maintenance. This order, accounting for 74% of the Company’s Q1FY25 revenue, highlights its importance. Along with other secured orders, it is expected to drive substantial revenue growth this quarter, boosting investor confidence.

- Outlook –

- A burgeoning middle class with a taste for entertainment is a key driver of growth of the Indian theme park market, which is expected to grow at a rate of 15%.

- The Council on Energy, Environment, and Water (CEEW), in collaboration with the 2030 Water Resources Group, is working to enhance wastewater management in India and promote private investment in wastewater treatment plants. The industry is projected to grow to INR 14 Cr. by FY29.

- India’s Geosynthetics Industry size is projected to reach ₹ 15,523.8 cr by 2033 at CAGR of 8.4%.

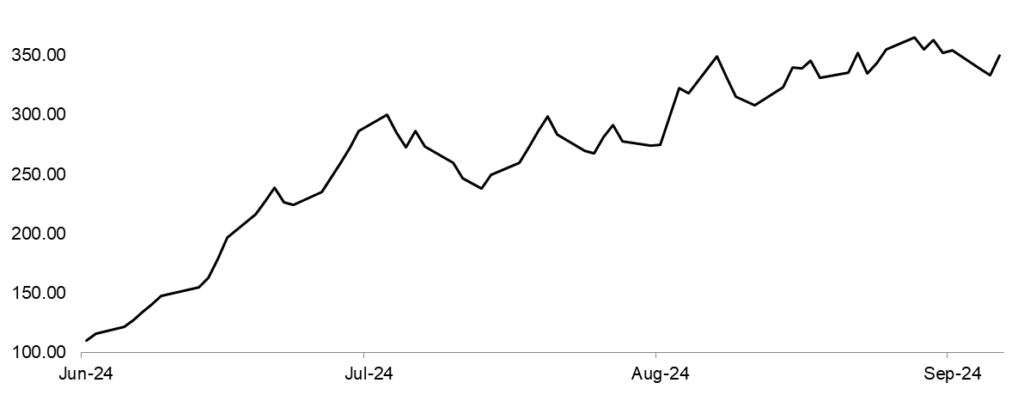

- Price Chart since listing –

Past Coverages

| Coverage Date | Company | LTP on Coverage Date | Current LTP | % change since coverage | Recent Filings |

| 1/08/24 |

PNGS Gargi Fashion Jewellery Ltd. |

₹841 |

₹871 |

3.6% |

EXCELLENT RESULTS For Q1 FY24, sales surged 2.1x YoY to INR 13.7 Cr (INR 44 Cr under FOFO model), with profit before tax up 93% to INR 2.9 Cr.(01st August) |

|

08/08/24 |

PG Electroplast Ltd. |

₹423 |

₹572 |

35.2% |

ORDER On August 5, 2024, the company allotted 6,56,000 equity shares to the ‘PG Electroplast Limited Employees Welfare Trust’ under the 2020 Employee Stock Options Scheme.(08th August) |

|

13/08/24 |

Hi-Tech Pipes Ltd. |

₹162 |

₹187.9 |

16.0% |

GOOD TO EXCELLENT RESULTS For Q1 FY24, sales rose 35% YoY to INR 867 Cr, with net profit up 2.3x to INR 18 Cr. QoQ, sales increased 27%, and net profit jumped 64%. (13th August) |

|

14/08/24 |

Bondada Engineering Ltd |

₹3250 |

₹700 |

-0.3% |

ORDER For Q1 FY24, sales surged 2.2x YoY, and net profit jumped 3.6x. QoQ, sales were flat, while net profit declined 26%. (14th August) |

|

8/07/24 |

Dynamic Services & Security Ltd |

₹276 |

₹267 |

-3.3% |

Share Repurchase Agreement The company has agreed to repurchase 49% of Nacof Nithin Sai Green Energy’s shares from an existing shareholder. |