1) Resgen Limited

- Business Overview – Incorporated in 2018, Company is engaged in the process of manufacturing Pyrolysis Oil (a substitute for furnace oil) from all kinds of waste plastics. It’s called PlasEco. PlasEco may use byproducts like Carbon, which replaces coal, and Gas, which replaces LPG.

- Recent Filings – Company has entered a new partnership with Goneutral Technologies Private Limited. This will strengthen company’s EPR services, positioning it as a key provider of compliance solutions for top brands like Microsoft India, Lenovo, and Parle Agro.

- The collaboration boosts ResGen’s competitive edge by expanding its waste-to-oil and EPR compliance offerings, enabling it to cater to both global and Indian brands, fostering growth in the circular economy sector. It is expected to drive revenue growth, necessitating upward revisions in future earnings projections as demand for EPR solutions increases.

- Outlook –

- Company is poised to play an increasingly crucial role in India’s environmental transformation, by projecting to produce 20 million liters of PlasEco by end of 2024.

- The company remains committed to driving innovation in waste management, fostering new partnerships, geographical expansion, product diversification and supporting businesses in their journey towards environmental responsibility.

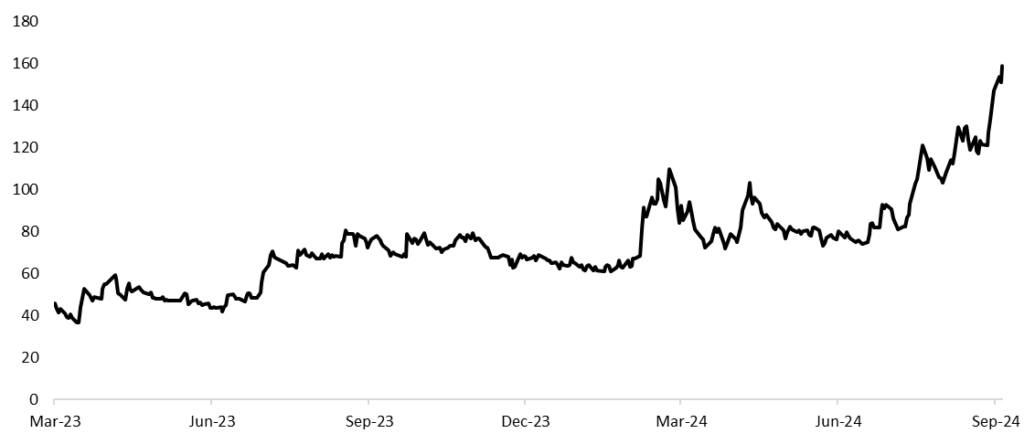

- 2Y Price Chart –

2) Avantel Limited

- Business Overview – Avantel Ltd. is engaged in the business of designing, developing and maintaining wireless and satellite communication products, defence electronics, radar systems (30MHz and 53 MHz) and development of network management software applications for its customers majorly from the aerospace and defence sectors. The company has a strong clientele including the Indian Army, ISRO, and Boeing, the company delivers innovative solutions for military and commercial applications, positioning itself as a key player in India’s defense technology industry.

- Recent Filings – Company has received a purchase order worth ₹9.39 crores, from NewSpace India Limited for the supply, installation, and commissioning of a Ground Segment Hub, which is approx. 4.40% of Avantel’s revenue for FY24, with completion scheduled by November 2025. This will enhance Avantel revenue stream and strengthen its position in the domestic defense and aerospace sectors, contributing to steady business growth.

- Outlook –

- Company has a strong order or FY 2024-25, suggesting continued growth potential.

- Company is establishing a new R&D and Production center (30,000 sq. ft. on 2 acres), expected to be operational by Q3 FY2024-25.

- Company has proposed GSAAS and SATCOM as a Service, pending approval from IN-SPACe, ISRO, and the Government of India under the new space policy.

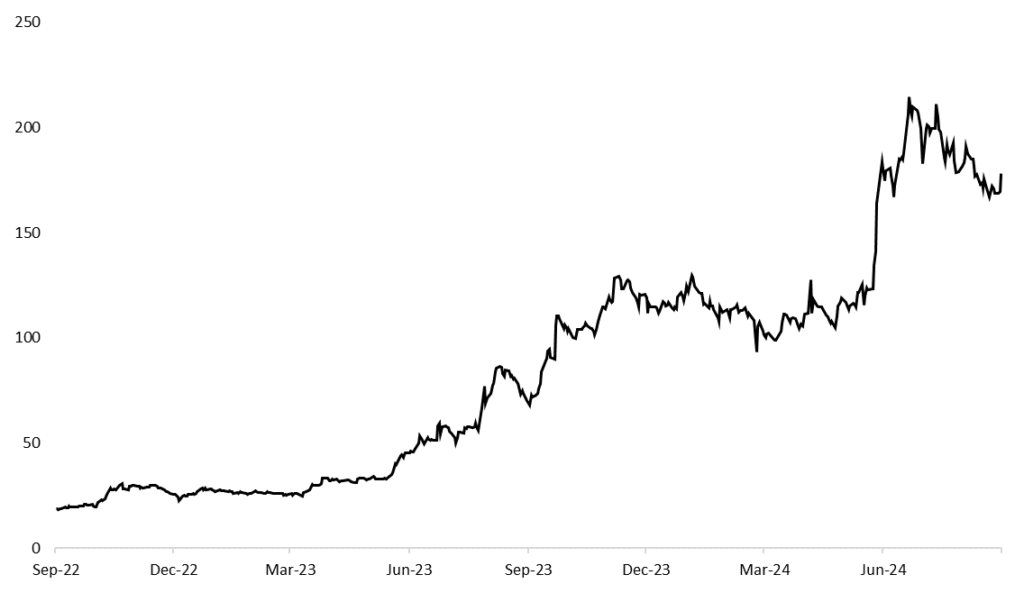

- 2Y Price Chart –

3) Chamanlal Setia Exports Limited

- Business Overview – Having substantial cash and liquid investments with mininal debt and sufficient inventory the company completed the Extinguishment of 20.7 lakhs fully paid up equity shares of INR 2 each worth at Rs. 60.24 Cr. at Rs. 300 per share, demonstrates commitment to enhance shareholder return and reflects confidence in the company’s future prospects.

- Recent Filings – Chaman Lal Setia Exports Ltd milling and processing of raw and of parboiled Basmati Rice.The company’s product portfolio includes Maharani Basmati rice,Parboiled (converted/muzza) Basmati rice,Raw (polished) Basmati rice and Basmati health rice

- Outlook –

- CLSE’s business risk profile will continue to improve over the medium term driven by strong presence in exports market.

- Expecting better EBITDA margins in the near future.

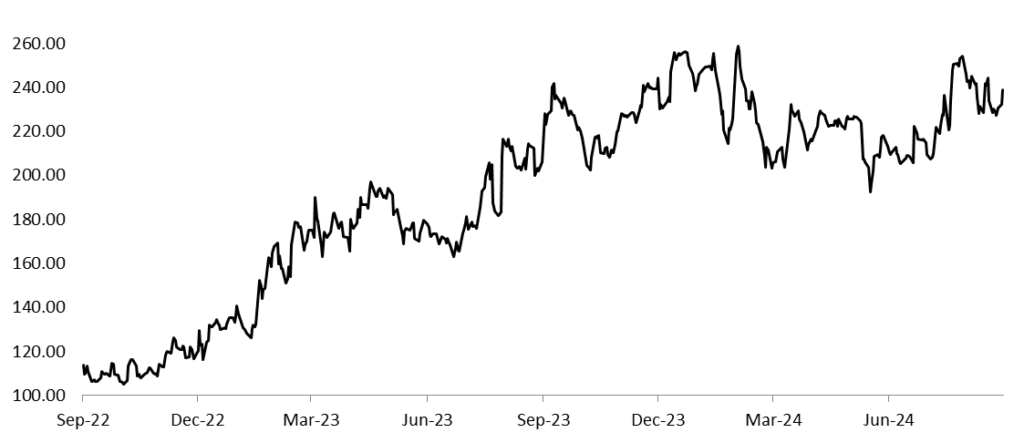

- 2Y Price Chart –

Past Coverages

| Coverage Date | Company | LTP on Coverage Date | Current LTP | % change since coverage | Recent Filings |

| 1/08/24 |

PNGS Gargi Fashion Jewellery Ltd. |

₹841 |

₹878 |

4% |

EXCELLENT RESULTS For Q1 FY24, sales surged 2.1x YoY to INR 13.7 Cr (INR 44 Cr under FOFO model), with profit before tax up 93% to INR 2.9 Cr.(01st August) |

|

08/08/24 |

PG Electroplast Ltd. |

₹423 |

₹612.95 |

45% |

ORDER On August 5, 2024, the company allotted 6,56,000 equity shares to the ‘PG Electroplast Limited Employees Welfare Trust’ under the 2020 Employee Stock Options Scheme.(08th August) |

|

13/08/24 |

Hi-Tech Pipes Ltd. |

₹162 |

₹170.7 |

4.93% |

GOOD TO EXCELLENT RESULTS For Q1 FY24, sales rose 35% YoY to INR 867 Cr, with net profit up 2.3x to INR 18 Cr. QoQ, sales increased 27%, and net profit jumped 64%. (13th August) |

|

14/08/24 |

Bondada Engineering Ltd |

₹3250 |

₹601 |

-81.5% |

ORDER For Q1 FY24, sales surged 2.2x YoY, and net profit jumped 3.6x. QoQ, sales were flat, while net profit declined 26%. (14th August) |

|

8/07/24 |

Dynamic Services & Security Ltd |

₹276 |

₹271 |

-2% |

Share Repurchase Agreement The company has agreed to repurchase 49% of Nacof Nithin Sai Green Energy’s shares from an existing shareholder. |