1) RBM Infracon Limited

- Business Overview – RBM Infracon Ltd, founded in 2013, provides engineering and maintenance services for industrial equipment across oil & gas, cement, and power sectors. They offer civil and mechanical services for medium to large infrastructure projects, covering structural work, piping, plant maintenance, and specialized tasks. The company serves major clients like Reliance Industries, Nayara Energy and TATA Projects.

- Recent Filings – Order 1: worth ₹1.49 Crs.- from Nayara Energy Limited contributing approximately 1% of the company’s revenue FY24. The scope involves replacing CPP Boiler Bank and Water wall tubes. The long-term execution period (till July 2025) may smoothen revenue recognition and boost future cash flows. (source)

- Order 2: Worth ₹1.31 Crs. from Reliance Industries Limited accounting for about 0.73% of the company’s revenue FY24. This project involves underground piping fabrication and civil work for a manufacturing complex. The short-term timeline(Sept to Nov 2024) ensures quick revenue realization, potentially enhancing quarterly performance. (source)

- Order 3: Worth ₹95 Lakhs represents 1.15% of revenue FY24. The project involves cased crossing work, with a completion period of just 1 month. This swift execution will positively impact near-term revenue and may improve the company’s cash flow and liquidity. (source)

- Outlook –

- Projected CAGR of 57-65% from FY24 to FY26, supported by expansion into high-growth sectors like oil and gas exploration, solar energy, and green hydrogen production.

- Current work order value stands at ₹1,384 crore, providing robust revenue visibility and stability in the near term.

- Entry into new verticals such as green hydrogen (including green and blue ammonia) aligns with India’s long-term energy goals, positioning the company for sustainable growth.

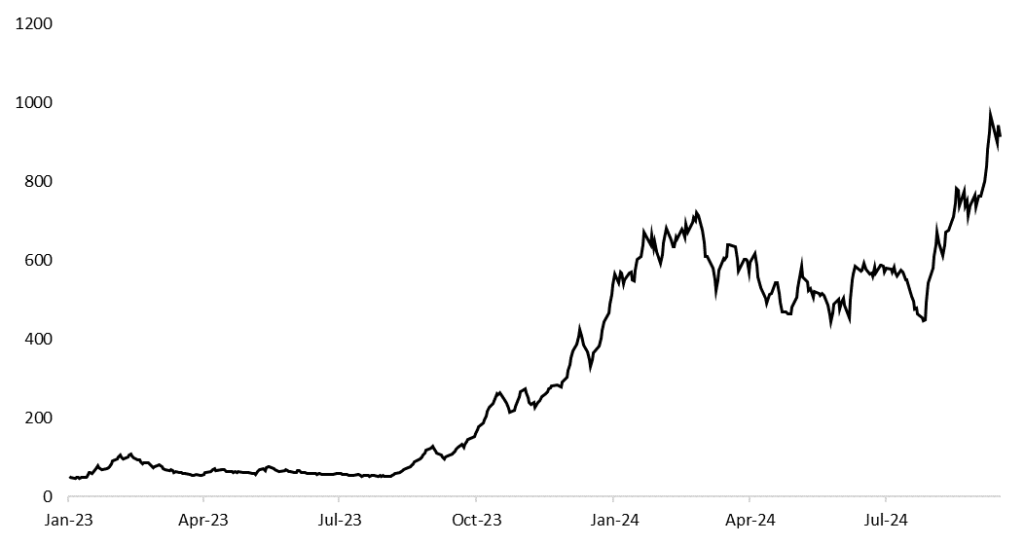

- Price Chart since listing –

2) Jupiter Wagons Limited

- Business Overview – Jupiter Wagons Limited (JWL) offers a wide range of mobility solutions, including freight wagons, locomotives, passenger coaches (LHB), braking systems, metro coaches, commercial vehicles, and ISO marine containers. Their product portfolio also features couplers, draft gears, bogies, and CMS crossings.

- Recent Filings – Jupiter Wagons Limited (JWL) is transforming its subsidiary into Jupiter Tatravagonka Railwheel Factory Ltd. (JTRFL) with a INR 2,500 crore investment, increasing production capacity and expanding global reach. While this boosts growth potential, operational risks need consideration in strategic planning.

- Additionally, JWL’s INR 2,500 crore investment in a new Odisha facility, expected to be operational by 2027, will raise production to 100,000 wheelsets annually, driving market expansion and revenue growth. This development positions JWL for stronger industry competitiveness and long-term success.

- Outlook –

- Aims for a turnover of INR 400 crores from JTRFL for FY ’24-’25.

- The company plans to expand JTRFL’s capacity to machine 28,000 wheelsets in FY 2025, with further growth to 40,000 to 50,000 wheelsets by FY 2026.

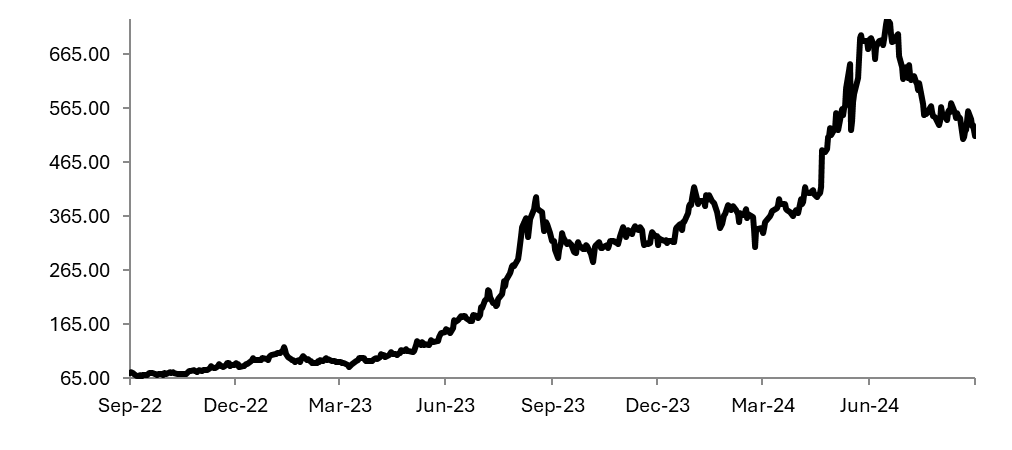

- 2Y Price Chart –

3) Viviana Power Tech Limited

- Business Overview – Company specializes in power transmission, distribution, and industrial EPC projects. They offer services like power transmission lines, EHV substations, testing, and commissioning. The company undertakes turnkey jobs for all types of electrical systems and caters to state government power utilities, private power entities, and renewable energy developers.

- Recent Filings – The Company has acquired 7,500 Equity shares of Rs. 10/- each at par. of Aarsh Transformers Private Limited equity shares. This acquisition is expected to boost Viviana’s revenue and market presence by enhancing its technical expertise and client base, though integration challenges may arise.

- Outlook –

- Company expects Rs. 200 Cr. Orders in Pipeline in the next 12 months.

- Company targets Revenue income of Rs. 120-140 Cr. in FY25 from Power EPC. •

- Company’s targeting Rs. 7-8 Cr. Revenue in FY25 from Distribution Transformer Manufacturing

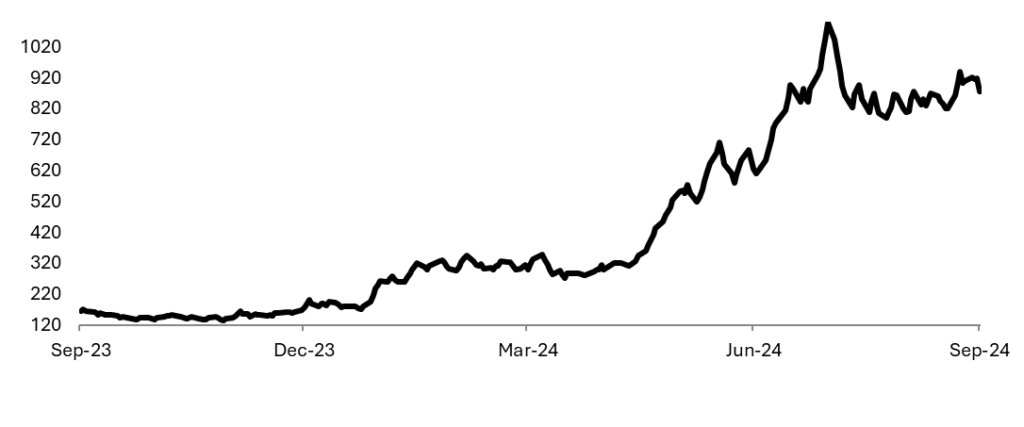

- 1Y Price Chart –

Past Coverages

| Coverage Date | Company | LTP on Coverage Date | Current LTP | % change since coverage | Recent Filings |

| 1/08/24 |

PNGS Gargi Fashion Jewellery Ltd. |

₹841 |

₹84 |

0.7% |

EXCELLENT RESULTS For Q1 FY24, sales surged 2.1x YoY to INR 13.7 Cr (INR 44 Cr under FOFO model), with profit before tax up 93% to INR 2.9 Cr.(01st August) |

|

08/08/24 |

PG Electroplast Ltd. |

₹423 |

₹618.9 |

46.3% |

ORDER On August 5, 2024, the company allotted 6,56,000 equity shares to the ‘PG Electroplast Limited Employees Welfare Trust’ under the 2020 Employee Stock Options Scheme.(08th August) |

|

13/08/24 |

Hi-Tech Pipes Ltd. |

₹162 |

₹197.4 |

21.8% |

GOOD TO EXCELLENT RESULTS For Q1 FY24, sales rose 35% YoY to INR 867 Cr, with net profit up 2.3x to INR 18 Cr. QoQ, sales increased 27%, and net profit jumped 64%. (13th August) |

|

14/08/24 |

Bondada Engineering Ltd |

₹3250 |

₹580.3 |

-16.8% |

ORDER For Q1 FY24, sales surged 2.2x YoY, and net profit jumped 3.6x. QoQ, sales were flat, while net profit declined 26%. (14th August) |

|

8/07/24 |

Dynamic Services & Security Ltd |

₹276 |

₹277 |

-0.36% |

Share Repurchase Agreement The company has agreed to repurchase 49% of Nacof Nithin Sai Green Energy’s shares from an existing shareholder. |