Contents

1) Aimtron Electronics Limited

- Business Overview – Aimtron Electronics Ltd is a leading player in the Electronics System Design and Manufacturing (ESDM) sector, specializing in high-value precision engineering products. The company offers a diversified product portfolio, including Printed Circuit Board Assembly (PCBA), Box Build Assemblies, and End-to-End Design Solutions, serving industries such as Industrial, Gaming, Medical, Automotive, and Drones. With two manufacturing facilities in India and a global footprint across the USA, Europe, and Asia, Aimtron generates 56% of its revenue from the USA. The company is enhancing operational efficiency through backward integration and has a significant client concentration, with 97% of its FY23 revenue derived from its top 10 customers.

- Recent Filings – The company achieved robust revenue growth in Q1 FY25, with a 28% YoY increase, reaching Rs 232.61 Mn from Rs 181.29 Mn.

- Future Outlook –

- Aimtron Electronics Ltd. is strategically expanding into key sectors, including India’s growing medical device market, the rapidly evolving electronics manufacturing industry, and the electric vehicle sector. Leveraging government support, such as PLI schemes, and global investments, Aimtron is also positioning itself to capitalize on the burgeoning UAV market, which is projected to grow at an 18% CAGR.

- Company is enhancing operational efficiency by optimizing production capacity, streamlining supply chain management, and reducing costs. The company is leveraging digital solutions like “Aimnet” to maximize machinery utilization and drive production optimization, thereby strengthening its market position and competitiveness.

- Company is strategically focusing on diverse sectors such as Industrial, Medical, Automotive, Power, Gaming, and UAVs to capitalize on emerging trends. The company plans to enhance manufacturing capabilities through backward integration, including setting up integrated cable assembly lines and expanding SMT capacity. By in-house manufacturing key components, Aimtron aims to reduce dependency on third-party suppliers and boost supply chain efficiency.

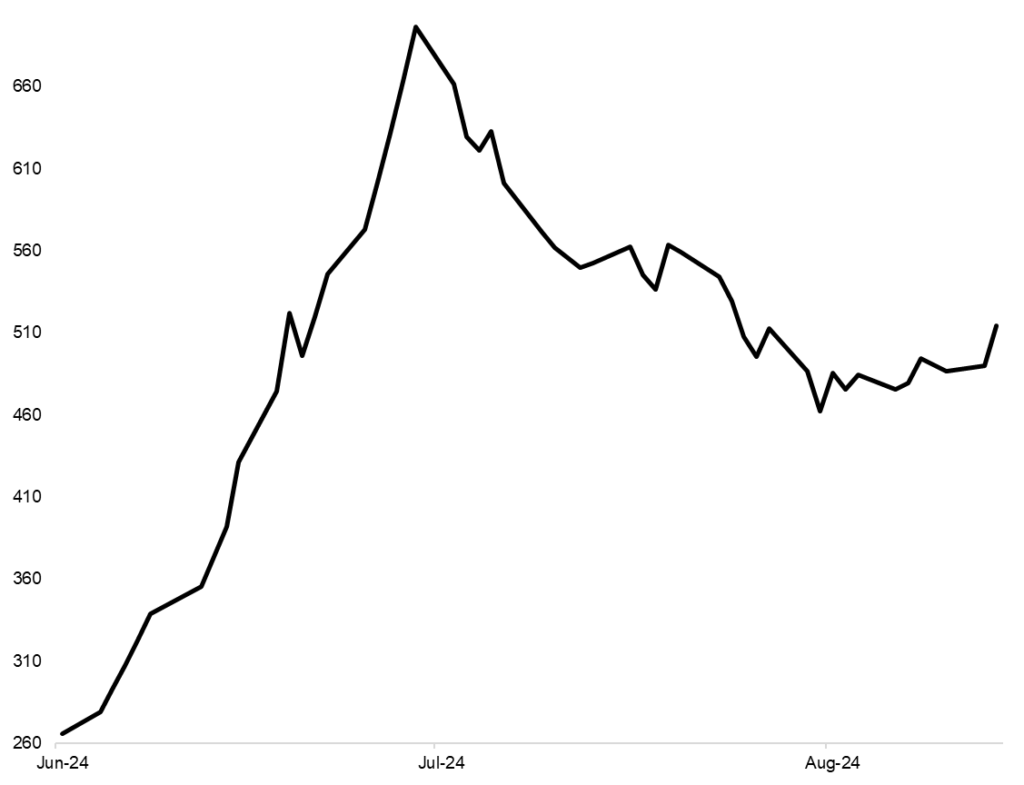

- 3M Price Chart since listing –

2) KPI Green Energy Limited

- Business Overview – KPI Green Energy Ltd, incorporated in 2008, is a part of the KP Group. They develop, build, own, manage, and maintain renewable power facilities (solar and wind solar hybrid power project) as an Independent Power Producer (IPP) and as a service provider to Captive Power Producers (CPPs) under the ‘Solarism’ brand. They derive 85% of their total revenue from Sale of Captive Power Project, 14% from Sale of Power and 1% from other income.

- Recent Filings – Board of Directors (BoD) of KPI Green has approved the issuance and allotment of 1 crore equity shares to Qualified Institutional Buyers (QIBs) at an issue price of INR 935 per share. This move will raise a total of INR 935 crore. Notable subscribers to this issue include Morgan Stanley Asia (Singapore) PTE and Bofa Securities Europe SA.

- Recent Outlook –

- Company has a target of reaching 1000 MW capacity by 2025.

- •Achieving annuity-based income through Own IPP and Cumulative portfolio target of 250 MW by 2025.

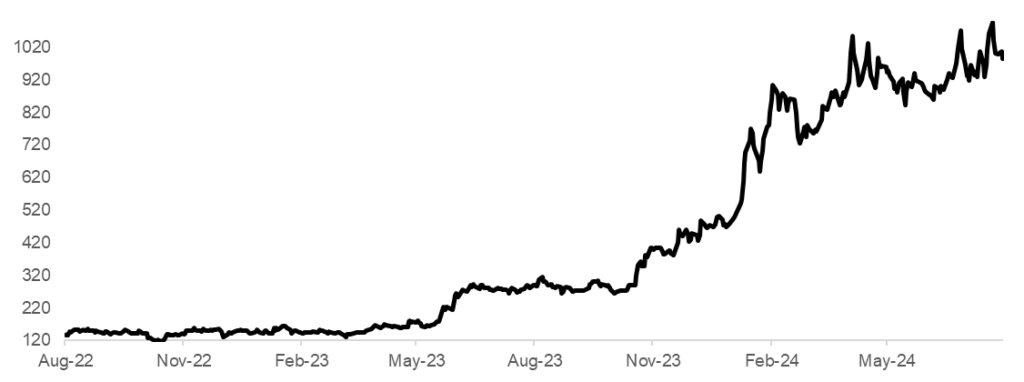

- 2Y Price Chart –

3) Genus Power Infrastructures Limited

- Business Overview – Genus Power Infrastructures Limited, headquartered in India, specializes in manufacturing and providing metering solutions and undertaking turnkey engineering projects. The company operates through two key segments: Metering Solutions and Strategic Investments. Its product portfolio includes various types of electricity meters, transformers, and advanced metering infrastructure (AMI) systems. Additionally, Genus Power is involved in turnkey power projects, including substation erection, transmission line installation, and rural electrification. Its Hybrid Microcircuits find applications across all electronic sectors, underscoring its diversified engineering capabilities.

- Recent Filings – On August 17, 2024, Genus Power Infrastructures Limited, through its wholly owned subsidiary, secured three significant Letters of Award (LOA) totaling Rs. 2,925.52 crore (net of taxes) for the appointment as Advanced Metering Infrastructure Service Providers (AMISPs). These contracts, which include the design, supply, installation, and commissioning of approximately 3.75 million Smart Prepaid Meters and associated infrastructure, underscore the company’s growing order book, which now exceeds Rs. 24,383 crore (net of taxes), providing long-term revenue visibility and reinforcing its leadership position in the sector.”

- Recent Updates –

- Execution is underway for projects in North Bihar and select packages in Chhattisgarh, following the successful launch of all projects in Assam.

- High-end metering projects have commenced in Maharashtra and Uttar Pradesh, signaling expansion into key regions.

- Financial closures for ongoing projects are managed by GIC, with no direct involvement from the company, minimizing financial risk exposure.

- The management anticipates fluctuations in gross margins due to seasonal variability and differing project execution timelines.

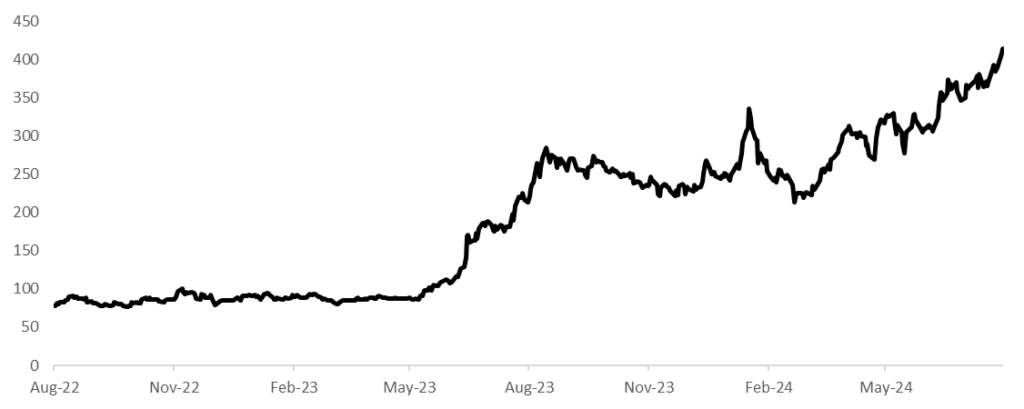

- 5Y Price Chart –

Past Coverages

| Coverage Date | Company | LTP on Coverage Date | Current LTP | % change since coverage | Recent Filings |

| 9/07/24 | Emerald Finance Ltd. | ₹42 | ₹71.2 | 66.7% | Recent Concall Anticipates its book size to grow by 8 to 10 times over the next three years. (16th July) |

| 22/07/24 | EMS Ltd. | ₹684 | ₹837.85 | 18.3% | New Order Company received a LoA worth INR 535 Cr for Development of Water Supply and Sewerage System with 18 years O&M in Vikas Nagar Dehradun, Uttarakhand. (19th July) |

| 8/07/24 | Dhabriya Polywood Ltd. | ₹379 | ₹437.85 | 26.5% | New Order Company received two work orders aggregating to INR 5.2 Cr on 4th July. |

| 19/07/24 | Shakti Pumps Ltd. | ₹3,901 | ₹4276 | 20.1% | EXCELLENT Q1FY25 RESULT For Q1FY25, Sales up 5x YoY and Net Profit up 93x. (20th July) |

| 19/07/24 | Anant Raj Ltd. | ₹480.7 | ₹555 | 10.9% | Entered a MoU Anant Raj Cloud Pvt Ltd, a wholly-owned subsidiary of Anant Raj, entered into a MOU with Google LLC. (20th July) |

| 8/07/24 | Dynamic Services & Security Ltd | ₹276 | ₹275.6 | 5.4% | Share Repurchase Agreement Company has entered a Share Repurchase Agreement with the existing shareholder of Nacof Nithin Sai Green Energy to acquire 49% of the outstanding share capital of the Target Company. |