1) Supreme Power Equipment Limited

- Business Overview – Incorporated in 1994, Supreme Power Equipment Limited is engaged in manufacturing, upgrading, and renovating various types of transformers such as power transformers, generator transformers, windmill transformers, etc.

- Recent Filings – Company has received new order of worth ₹26 Cr on 19/09/24 from Solar Energy Company, for Manufacturing and Supply of transformers. This order strengthens the company’s position in the renewable energy sector, aligning with growing demand for sustainable infrastructure. This order amounts upto 24% of the company’s annual income, warranting upward adjustments in financial forecasts for FY25, especially in profitability metric.

- Outlook –

- The India transformer market is expected to rise at a CAGR of more than 5% during the forecasted period of 5 years from 2023 to 2028.

- The Budget 2024 also highlights the allocation of funds which are 50% higher, towards green hydrogen, solar power, and green energy corridors in line with the renewable energy target for 2030.

- Current order book stands at approximately ₹48 crores. Management is optimistic about future orders, with tenders worth ₹70-80 crores currently in the pipeline.

- Investment for expansion is projected between ₹60 crores to ₹65 crores, aiming to increase manufacturing output and broaden transformer offerings (25 MVA to 160 MVA).

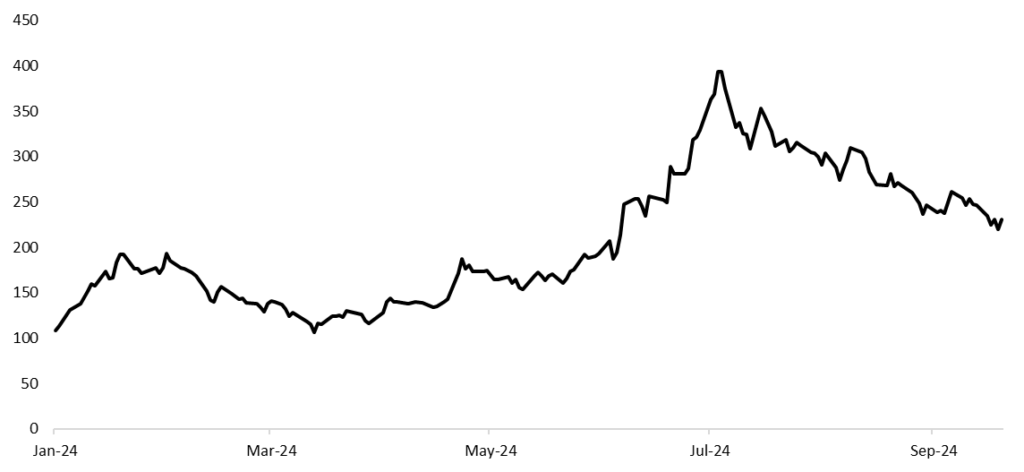

- Price Chart since listing –

2) Interarch Building Products Limited

- Business Overview – Incorporated in 1983, Interarch Building Limited provides turnkey pre-engineered steel construction solutions in India. The company offers Pre-Engineered Steel Buildings (PEBs) through two main services:

- 1. PEB Contracts: Providing complete PEB solutions on a turn-key basis, including on-site project management for installation and erection.

- 2. PEB Sales: Includes the sale of metal ceilings and corrugated roofing, as well as PEB steel structures for both industrial and non-industrial use, such as farmhouses and residential buildings.

- Recent Filings – The company secured total order of ₹293 CR in Q2 FY25, including deals with Amaraja Infra and Ashok Leyland and others , raising the total order book to ₹1,350 CR. These orders, equivalent to 96% of last quarter’s revenue, enhance revenue projections by accelerating expansion into new sectors.

- Outlook –

- Revenue are expected to grow at 10%-15% for the current FY25 and will double it over next 3-4 years.

- Growth rate will be improved to 15%-20% by FY26.

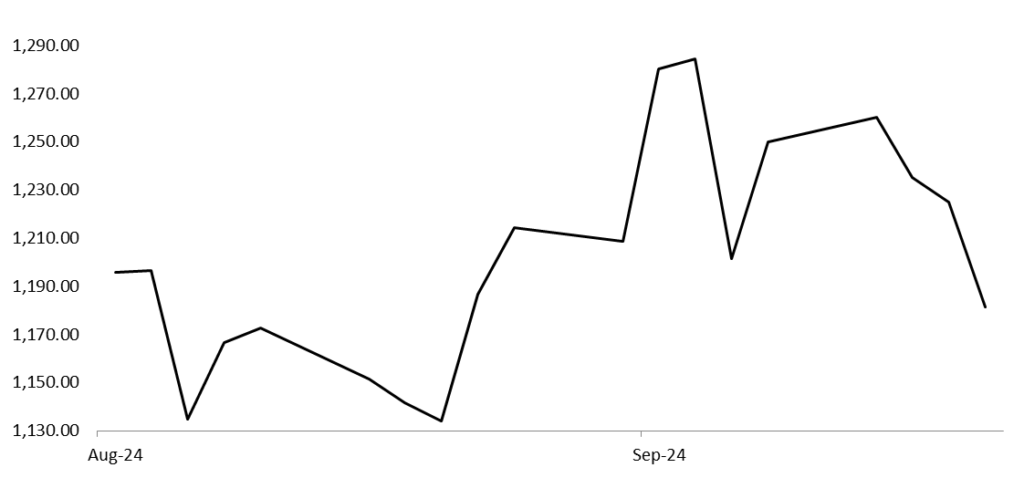

- Price Chart since listing –

3) Chavda Infra Limited

- Business Overview – Chavda Infra Limited, established in 2012, provides construction and allied services in Gujarat, with a strong presence in residential, commercial, and institutional projects. The company has completed over 100 projects worth ₹670 Cr and operates in three business verticals: Contracting Services, Development Services, and Commercial Renting. Company maintains ISO 9001:2015 certification for quality management. As part of the Chavda Group, it leverages synergies with its sister companies, Chavda RMC and Chavda Developers.

- Recent Filings – Company secured a ₹30.05 Cr work order from HN Safal Infra Developers for a residential project in Ahmedabad, with a completion timeline of 27 months. This order represents 12.41% of the company’s FY24 revenue, making total order book of ₹1,093.11 Cr. This new order strengthens revenue visibility and order book position, enhancing its project pipeline and long-term growth potential.

- Outlook –

- Company is working on 5 out of 10 approved skyscraper projects in the Ahmedabad and Gandhinagar region, significantly increasing its market share in high-rise construction.

- Company has a robust order book of ₹879.05 crore, with 61% in residential projects, 28% in commercial projects, and 11% in institutional projects. This provides a solid foundation for future growth.

- The company is well-positioned to benefit from various government initiatives promoting urban development, such as the Smart Cities Mission and infrastructure development projects.

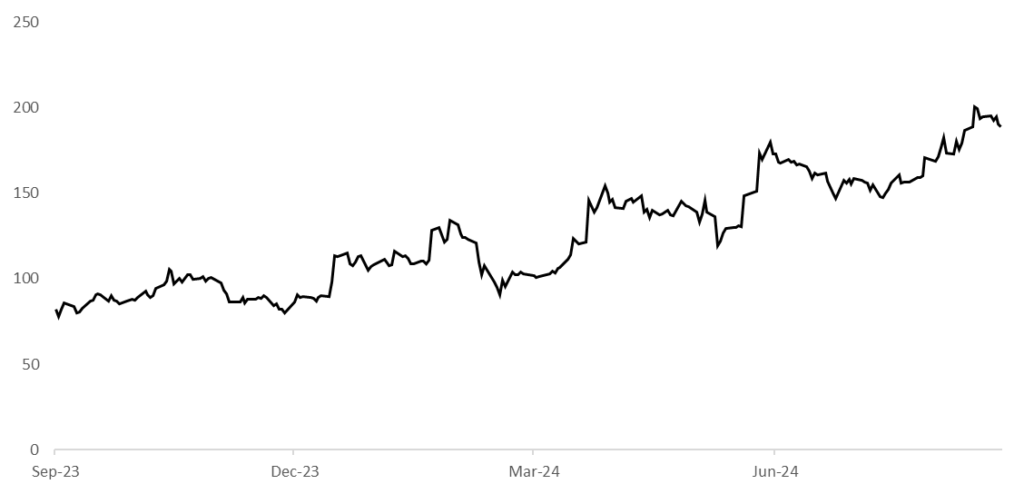

- Price Chart since listing –

Past Coverages

| Coverage Date | Company | LTP on Coverage Date | Current LTP | % change since coverage | Recent Filings |

| 1/08/24 |

PNGS Gargi Fashion Jewellery Ltd. |

₹841 |

₹84 |

0.7% |

EXCELLENT RESULTS For Q1 FY24, sales surged 2.1x YoY to INR 13.7 Cr (INR 44 Cr under FOFO model), with profit before tax up 93% to INR 2.9 Cr.(01st August) |

|

08/08/24 |

PG Electroplast Ltd. |

₹423 |

₹618.9 |

46.3% |

ORDER On August 5, 2024, the company allotted 6,56,000 equity shares to the ‘PG Electroplast Limited Employees Welfare Trust’ under the 2020 Employee Stock Options Scheme.(08th August) |

|

13/08/24 |

Hi-Tech Pipes Ltd. |

₹162 |

₹197.4 |

21.8% |

GOOD TO EXCELLENT RESULTS For Q1 FY24, sales rose 35% YoY to INR 867 Cr, with net profit up 2.3x to INR 18 Cr. QoQ, sales increased 27%, and net profit jumped 64%. (13th August) |

|

14/08/24 |

Bondada Engineering Ltd |

₹3250 |

₹580.3 |

-16.8% |

ORDER For Q1 FY24, sales surged 2.2x YoY, and net profit jumped 3.6x. QoQ, sales were flat, while net profit declined 26%. (14th August) |

|

8/07/24 |

Dynamic Services & Security Ltd |

₹276 |

₹277 |

-0.36% |

Share Repurchase Agreement The company has agreed to repurchase 49% of Nacof Nithin Sai Green Energy’s shares from an existing shareholder. |