Contents

1) Felix Industries Limited

- Business Overview – Felix Industries is a leading provider of comprehensive water and environmental solutions. The company focuses on environmental conservation through its core philosophy of ‘Recycle – Reuse – Recover – Reduce.’ Felix specializes in water and wastewater recycling systems, e-waste recycling, and industrial piping services. The company offers advanced technologies, including Zero Liquid Discharge, Reverse Osmosis, and Nano Membrane systems. With a diverse portfolio of over 450 proprietary technologies, Felix is committed to sustainable practices that ensure water sufficiency for future generations.

- Recent Filings – The company has announced that it will increase its stake in its subsidiary, Felix Industries LLC, from 55% to 76.50% by acquiring an additional 21.50% stake.

- Revenue Breakup –

- The company saw a significant shift in its revenue composition from FY 2022 to FY 2023. While sales of products decreased from ₹682 crore to ₹512 crore, the company experienced a substantial increase in service revenue, soaring from ₹555.84 crore to ₹1,425 crore. This resulted in a total revenue growth of over 56%, highlighting a strategic pivot towards service-oriented offerings.

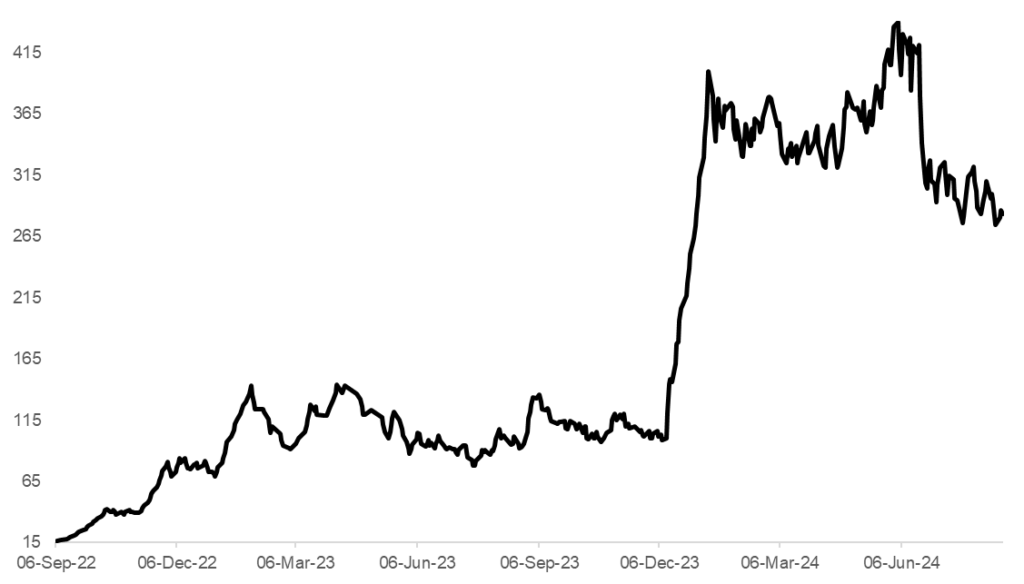

- 2Y Price Chart –

2) Ethos Limited

- Business Overview – Ethos Limited, incorporated on November 5, 2007, and promoted by KDDL Limited, stands as India’s largest luxury and premium watch retailer. The company offers a rich luxury retail experience through both online platforms and physical stores. With an extensive collection of prestigious brands like Omega, IWC Schaffhausen, and Jaeger-LeCoultre, Ethos Limited effectively caters to the high-end watch market in India through its comprehensive omnichannel approach.

- Recent Filings – Ethos Ltd. saw an investment by Bandhan Mutual Fund, which acquired 1.6 lakh shares at INR 3,346 per share, resulting in a total investment of INR 53.5 crore.

- Recent Outlook –

- Ethos Limited remains confident in its growth prospects, with recent boutique openings in Kochi, Dehradun, and Pune, and five more planned for Q2 FY ’25. The company has signed two new watch brands, ID Genève and Singer Reimagined, and will open its first Messika boutique in New Delhi in early 2025. Management expects margin improvements as business normalizes and is optimistic about capturing market share through new brand collaborations and lifestyle segment expansion.

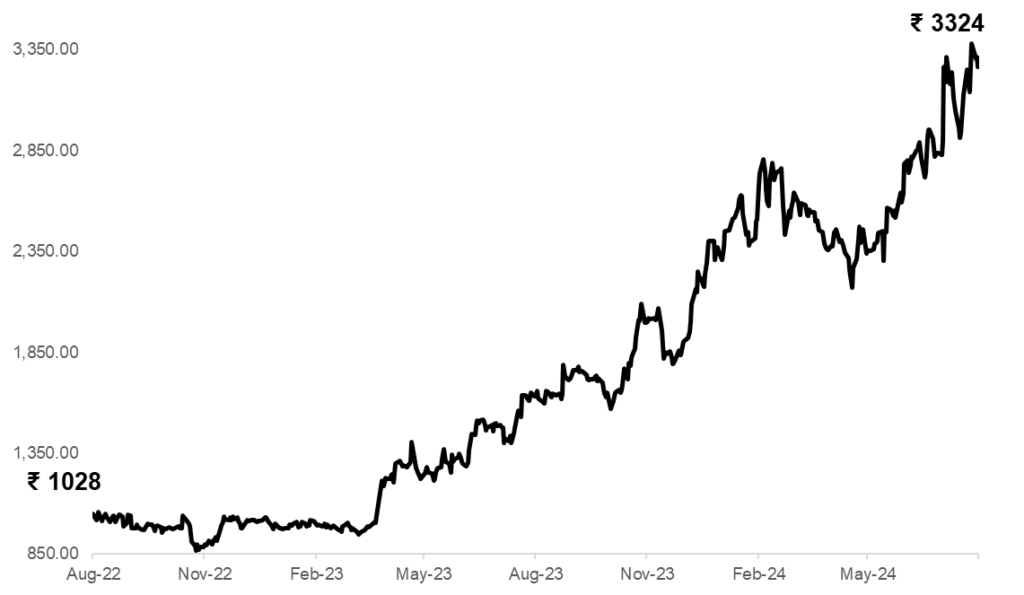

- 2Y Price Chart –

3) Electronics Mart India Limited

- Business Overview – Electronics Mart India Limited, founded in 1980, is India’s fourth-largest consumer durable and electronics retailer. Offering over 6,000 SKUs across large appliances, mobiles, small appliances, and IT products from more than 70 brands, the company operates retail stores in Telangana, Andhra Pradesh, and Delhi NCR, along with an online platform. It transitioned from M/s Bajaj Electronics in 2018, with offices located in Saifabad and Punjagutta, Hyderabad.

- Recent Filings – SBI Mutual Fund, FTIF – Templeton Asian Smaller Companies Fund, and Norges Bank – Government Pension Fund Global have acquired 25 million shares of Electronics Mart at an average price of INR 230 per share, totaling an investment of INR 575 crore.

- Recent Outlook –

- Electronics Mart opened 10 new stores, increasing its total to 170 across 66 cities in four states. The company plans to add approximately 25 more stores in FY25, aiming for robust double-digit revenue growth. Its strategy focuses on strengthening its presence in existing markets before venturing into new territories. Despite competitive pressures, Electronics Mart anticipates maintaining gross margins by leveraging selective brand partnerships and enhancing store displays.

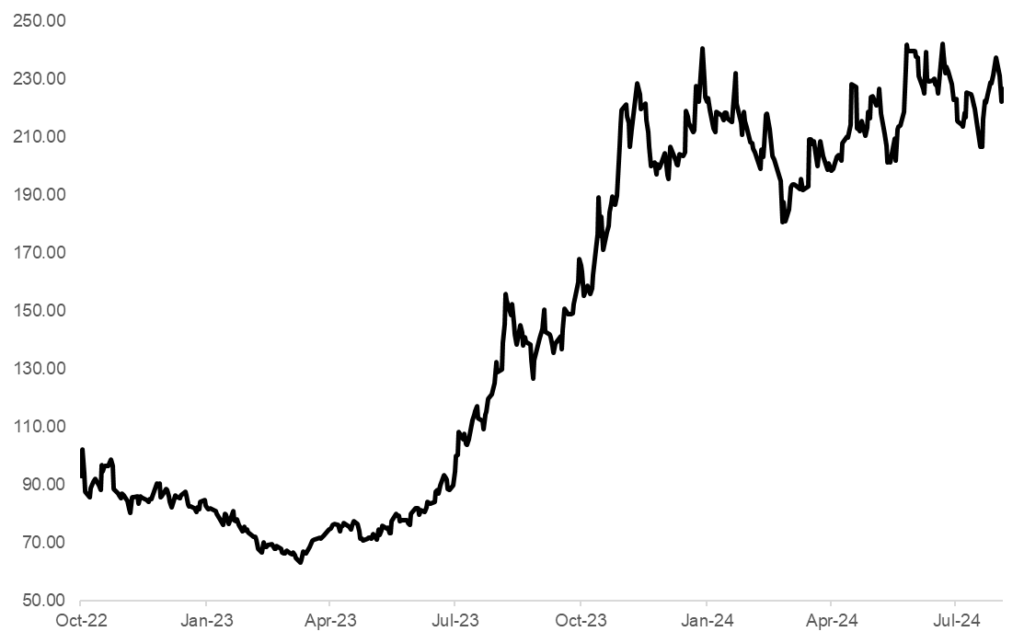

- 2Y Price Chart –

4) Nibe Limited

- Business Overview – The company specializes in manufacturing critical components for the Defence sector, E-Vehicles, and Software Development. The company’s Defence division produces assemblies for missile systems like BrahMos and MRSAM, while its E-Motor subsidiary focuses on E-Bicycles, E-Rickshaws, and related components. NIBE also operates the BVM Research Center, developing advanced technologies such as Hybrid PCUs and Lithium-ion batteries. With a client base including Indian defence forces and L&T Defence. NIBE’s revenue is predominantly domestic (94%). Recent expansions include new production facilities in Pune and advanced machinery for large-scale components.

- Recent Filings – The company has received Two Purchase orders worth INR 79.6 Cr from one of the leading Infra and Defence Company for supply of FCR Trailers and Shelters including surface treatment and Air Conditioning, needs to be completed by January 31, 2028.

- Recent Outlook –

- The company has a substantial order book of ₹6,239.67 lakhs and strategic expansion into the defense and aerospace sectors. The formation of Nibe Defence and Aerospace Limited, along with MOUs signed with major defense entities like Goa Shipyard and Hindustan Shipyard, positions the company to capitalize on India’s push for defense indigenization.

- The company’s strategic partnerships, including a long-term agreement with Larsen & Toubro Limited for defense components and a license manufacturing deal with Nivetti Systems Pvt. Ltd., underscore its commitment to becoming a key player in defense manufacturing. Additionally, collaborations with ArcelorMittal Nippon Steel India Limited and JSW Steel Limited for steel trading highlight NIBE’s diversification efforts, which are likely to contribute to stable revenue growth and profitability.

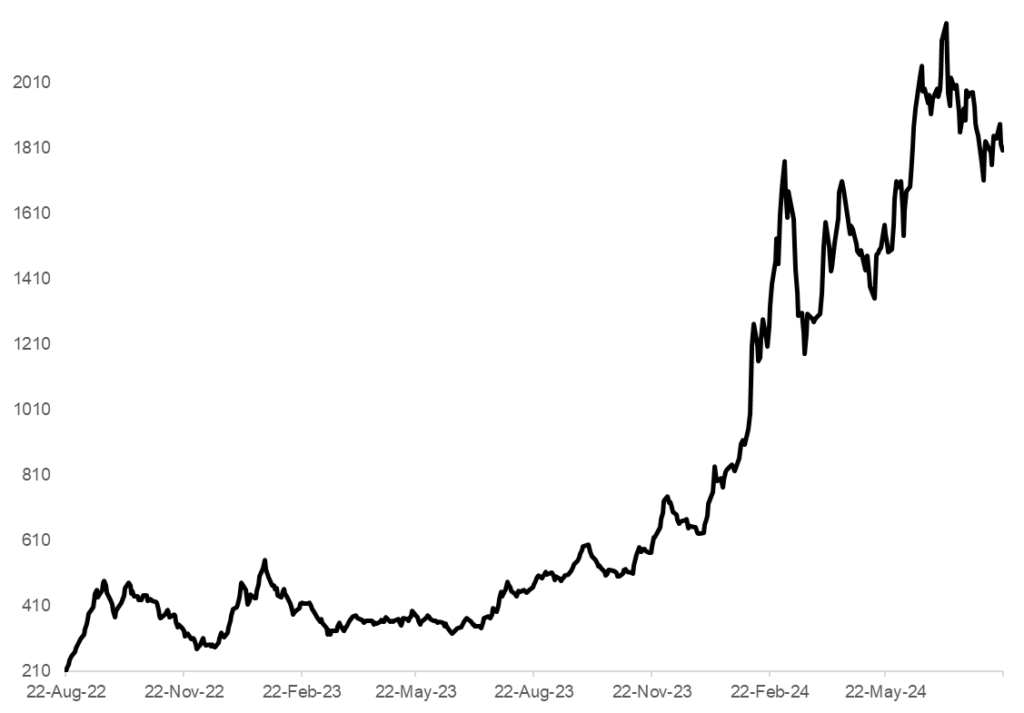

- 2Y Price Chart –

Past Coverages

| Coverage Date | Company | LTP on Coverage Date | Current LTP | % change since coverage | Recent Filings |

| 9/07/24 | Emerald Finance Ltd. | ₹42 | ₹71.2 | 66.7% | Recent Concall Anticipates its book size to grow by 8 to 10 times over the next three years. (16th July) |

| 22/07/24 | EMS Ltd. | ₹684 | ₹837.85 | 18.3% | New Order Company received a LoA worth INR 535 Cr for Development of Water Supply and Sewerage System with 18 years O&M in Vikas Nagar Dehradun, Uttarakhand. (19th July) |

| 8/07/24 | Dhabriya Polywood Ltd. | ₹379 | ₹437.85 | 26.5% | New Order Company received two work orders aggregating to INR 5.2 Cr on 4th July. |

| 19/07/24 | Shakti Pumps Ltd. | ₹3,901 | ₹4276 | 20.1% | EXCELLENT Q1FY25 RESULT For Q1FY25, Sales up 5x YoY and Net Profit up 93x. (20th July) |

| 19/07/24 | Anant Raj Ltd. | ₹480.7 | ₹555 | 10.9% | Entered a MoU Anant Raj Cloud Pvt Ltd, a wholly-owned subsidiary of Anant Raj, entered into a MOU with Google LLC. (20th July) |

| 8/07/24 | Dynamic Services & Security Ltd | ₹276 | ₹275.6 | 5.4% | Share Repurchase Agreement Company has entered a Share Repurchase Agreement with the existing shareholder of Nacof Nithin Sai Green Energy to acquire 49% of the outstanding share capital of the Target Company. |