Contents

1) E2E Networks Limited

- Business Overview – E2E Networks Ltd., listed on the NSE, is an AI-focused hyperscale cloud platform specializing in advanced cloud GPUs and a robust ecosystem for AI/ML applications. Founded in 2009 as ‘E2E Networks Private Limited,’ the company provides cloud infrastructure and managed services (Cloud Ops) in India, with a strong emphasis on technical innovation in cloud migration and deployment.

- Recent Filings – E2E Networks Ltd. approved issuing 24.8 lakh shares at INR 1,695 each, raising INR 420 crore. Subscribers include the Promoter Group, Ashish Kacholia, RBA Finance, and NAV Capital VCC.

- Outlook –

- E2E Networks Ltd. is poised for growth in the cloud GPU industry, driven by strong demand and evolving software solutions. The company expects sustained margins due to its scalable platform. After a ₹185 crore capex, it is acquiring 256 H100 units, with over 90% of current inventory already utilized..

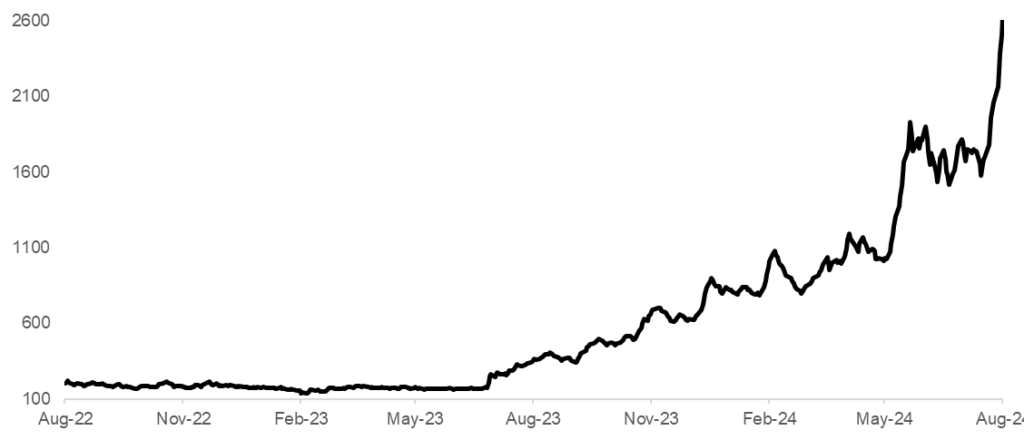

- 2Y Price Chart –

2) Loyal Equipments Limited

- Business Overview – Loyal Equipments Limited is engaged in the business of manufacturing, design, supply and commissioning/erection of process equipment like Pressure Vessels, Air Cooled Heat Exchangers, Storage Tanks, Chimneys and various other items for Oil & Gas, Petroleum, Chemical, Sugar, Steel, Fertilizers and Power Plant sector.

- Recent Filings – Board of directors of Loyal Equipments has considered and approved the issuance of 600,000 common equity shares at INR 211/each, aggregating to INR 12.7 Cr, on a Preferential basis to Promoters and Non-Promoters on August 20, 2024.

- Outlook –

- Company’s focus on increased market presence and demand for its products was reflected by its recent revenue growth of a 43.5% increase in FY 2024, reaching ₹71.15 crores compared to ₹49.63 crores in FY 2023.

- The company has a strong order book driven by demand from key sectors such as oil & gas, power, and petrochemicals.

- The company’s recent recognition, such as the “Fastest Growing Company” award in the engineering category, underscores its strong market position and potential for future growth.

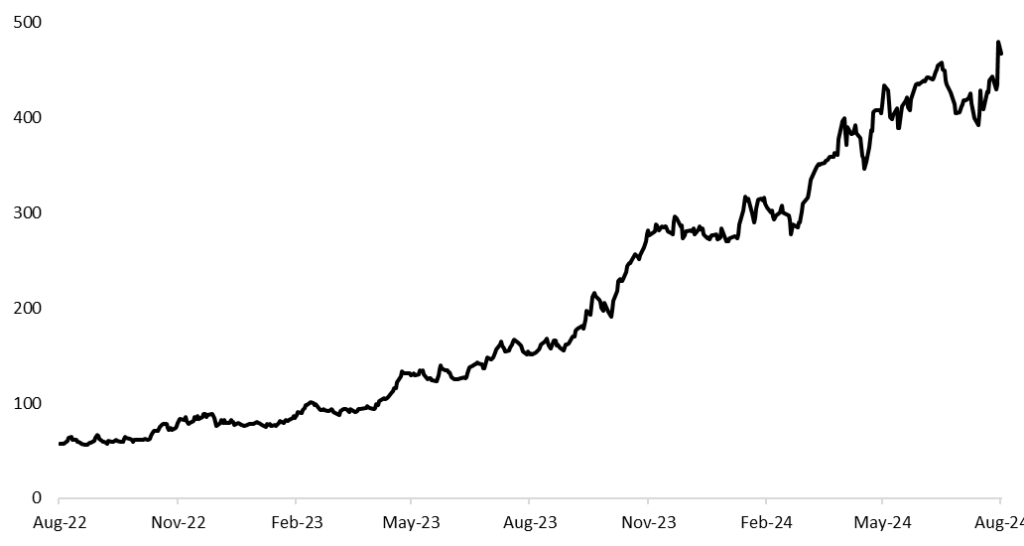

- 2Y Price Chart –

3) Kilburn Engineering Limited

- Business Overview – Kilburn Engineering Ltd. is engaged in designing, manufacturing and commissioning customized equipment / systems for critical applications in several industrial sectors like Chemical, Steel, Nuclear Power, Petrochemical and Food Processing etc.v

- Recent Filings – On August 21, 2024, Kilburn Engineering Ltd announced its plan to acquire Monga Strayfield Pvt Ltd for up to ₹123 crore, pending adjustments based on due diligence and final agreements. By acquiring Monga Strayfield, Kilburn aims to boost its drying solutions capabilities, particularly in radio frequency drying and heating, and to enter new markets such as textiles and packaged foods.

- Recent Outlook –

- Company plans on announcing the proposal of raising of funds at the meeting scheduled on 26 August 2024

- Executed a term sheet for acquiring an existing factory in MIDC Ambernath, spanning 5,000 square meters, which will enhance manufacturing capabilities.

- This new facility is expected to generate revenue of ₹100 crores with a CapEx of ₹22 crores.

- Company is targeting an order intake of ₹500 crores for FY25 and consolidated revenue of ₹500 crores for the current financial year.

- 2Y Price Chart –

Past Coverages

| Coverage Date | Company | LTP on Coverage Date | Current LTP | % change since coverage | Recent Filings |

| 9/07/24 | Emerald Finance Ltd. | ₹42 | ₹77 | 83.8% | Recent Concall Anticipates its book size to grow by 8 to 10 times over the next three years. (16th July) |

| 22/07/24 | EMS Ltd. | ₹684 | ₹840.7 | 22.9% | New Order Company received a LoA worth INR 535 Cr for Development of Water Supply and Sewerage System with 18 years O&M in Vikas Nagar Dehradun, Uttarakhand. (19th July) |

| 8/07/24 | Dhabriya Polywood Ltd. | ₹379 | ₹471 | 24.5% | New Order Company received two work orders aggregating to INR 5.2 Cr on 4th July. |

| 19/07/24 | Shakti Pumps Ltd. | ₹3,901 | ₹4544.95 | 16.5% | EXCELLENT Q1FY25 RESULT For Q1FY25, Sales up 5x YoY and Net Profit up 93x. (20th July) |

| 19/07/24 | Anant Raj Ltd. | ₹480.7 | ₹587 | 22.1% | Entered a MoU Anant Raj Cloud Pvt Ltd, a wholly-owned subsidiary of Anant Raj, entered into a MOU with Google LLC. (20th July) |

| 8/07/24 | Dynamic Services & Security Ltd | ₹276 | ₹281 | 1.8% | Share Repurchase Agreement Company has entered a Share Repurchase Agreement with the existing shareholder of Nacof Nithin Sai Green Energy to acquire 49% of the outstanding share capital of the Target Company. |