1) Yatharth Hospital and Trauma Care Services Limited

- Business Overview – Yatharth Hospital and Trauma Care Services Limited, founded in 2008, operates three super specialty hospitals in Noida and Greater Noida, Uttar Pradesh. Accredited by NABH and NABL, these hospitals offer advanced medical technology, including an Azurion catheterization lab and a 1.5 Tesla MRI, alongside modern patient facilities.

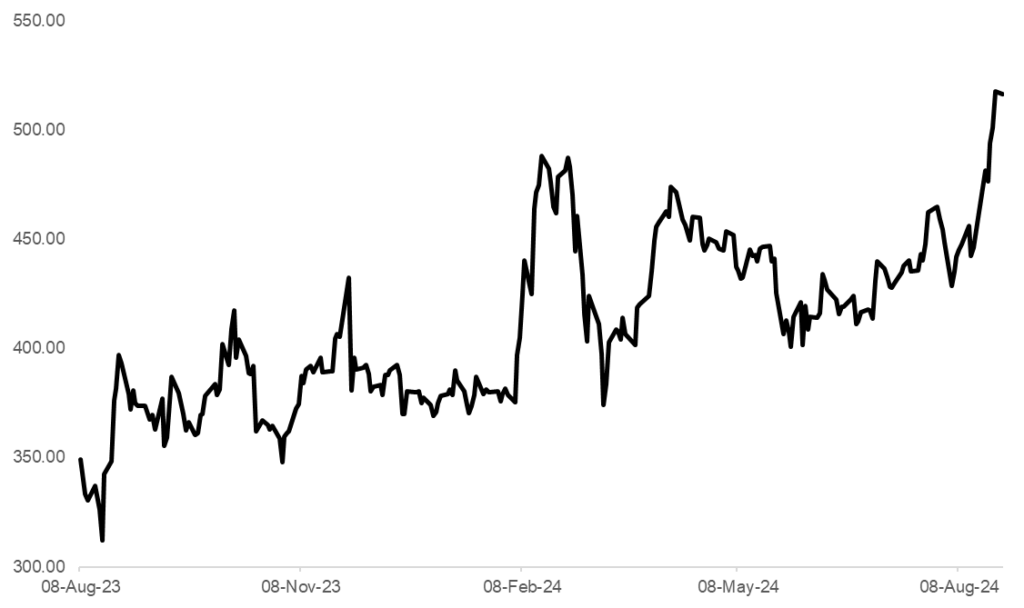

- Recent Filings – Yatharth Hospital’s shares have recently demonstrated a significant 6-month breakout, indicating a strong upward momentum in the stock’s performance. This breakout suggests growing investor confidence and potential positive developments within the company.

- Outlook –

- Yatharth Hospital plans to expand bed capacity to 2,800-3,000 by FY28, including 450 new beds in Noida Extension and Greater Noida. The company is pursuing mergers and acquisitions in North India for growth. To enhance governance and finance operations, it is adding key management personnel and has signed an NDA with a top auditing firm. Additionally, Yatharth aims to reduce debtor days to about 100 by year-end.

- 1Y Price Chart –

2) Zen Technologies Limited

- Business Overview – Zen Technologies designs develop and manufacture combat training solutions and Counter-drone solutions for defense and security forces. It is actively involved in the indigenization of technologies, which are beneficial to Indian armed forces, state police forces, and paramilitary forces.

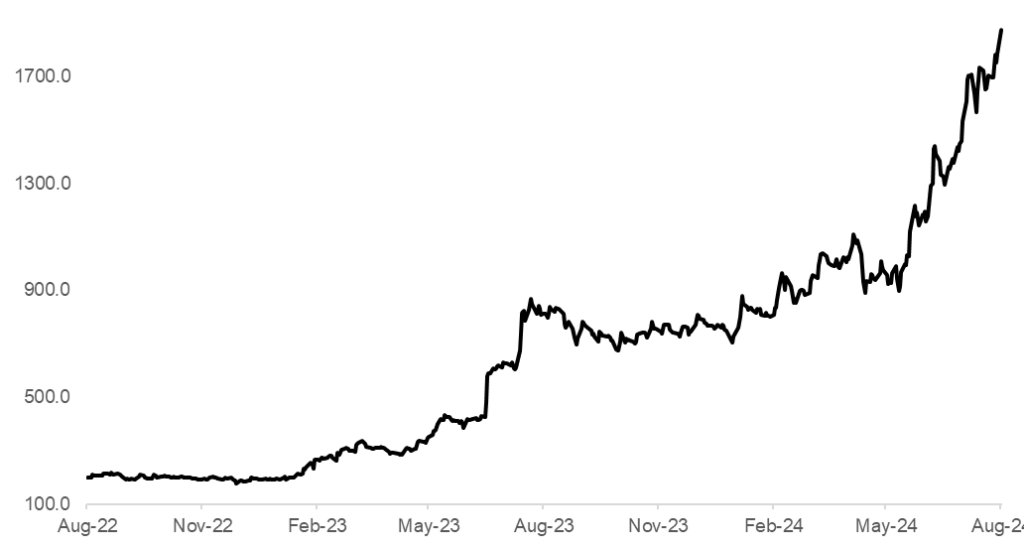

- Recent Filings – Zen Technologies Ltd. introduced a Qualified Institutional Placement (QIP) with an initial issue size of Rs. 800 crore, with the potential to grow to Rs. 1,000 crore. Multiple people familiar with the development say that the base issue represents 5.95% of the company’s equity, with the possibility of it rising to 7.43%.

- Outlook –

- Company reported results in line with expectations and target revenue set for FY2025 is ₹900 Crores, with management confident in achieving this goal. Expected EBITDA margin around 35% and PAT around 25%, subject to product and market mix.

- Expected EBITDA margins: 30% for anti-drone systems and 40% for training simulators, averaging around 35%.This new facility is expected to generate revenue of ₹100 crores with a CapEx of ₹22 crores.

- 2Y Price Chart –

3) Sathlokhar Synergys E&C Global Limited

- Business Overview – Sathlokhar Synergys E&C Global Limited provides specialized engineering, procurement, and construction (EPC) services for the construction of buildings and infrastructure facilities

- Recent Filings – Company has successfully bagged an Order worth INR 13.3 Cr from AAA Blue Chip Projects Pvt Ltd., Coimbatory, for Construction of New Warehouse for GE Oil & Gas India Private Limited (Building area 4.2 Acres). Delivery completion is by April 2025.

- Recent Outlook –

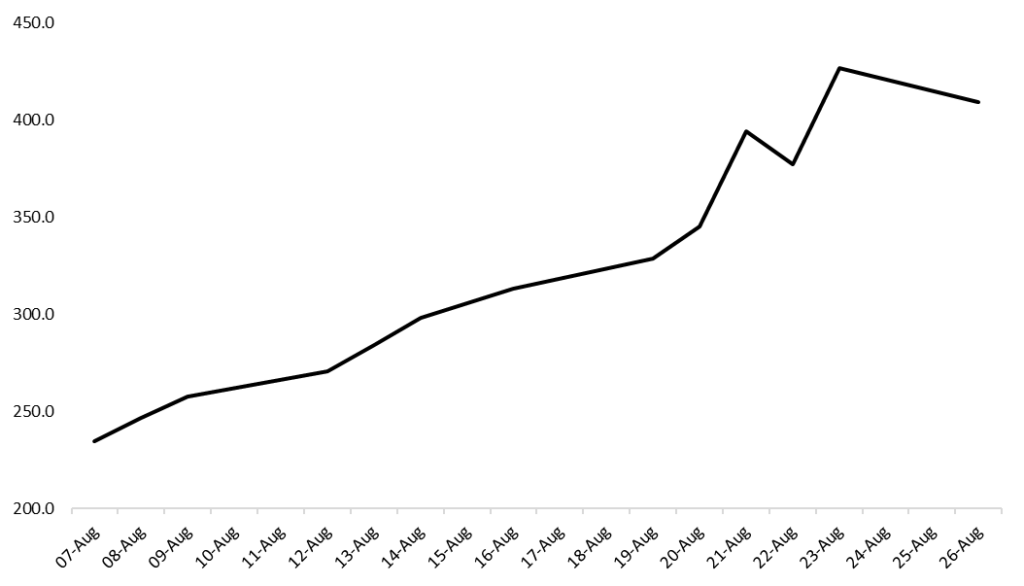

- Co. raised 93 Crs through the IPO and got listed on August 5, 2024. The fresh issue is being utilized for Working Capital requirements and General Corporate Purposes

- The company has completed projects in 4 Indian states, namely Tamil Nadu, Karnataka, Uttar Pradesh, and West Bengal.

- Price Chart Since Listing –

Past Coverages

| Coverage Date | Company | LTP on Coverage Date | Current LTP | % change since coverage | Recent Filings |

| 1/08/24 |

PNGS Gargi Fashion Jewellery Ltd. |

₹841 |

983.8 |

17% |

EXCELLENT RESULTS For Q1 FY24, sales surged 2.1x YoY to INR 13.7 Cr (INR 44 Cr under FOFO model), with profit before tax up 93% to INR 2.9 Cr.(01st August) |

|

08/08/24 |

PG Electroplast Ltd. |

₹423 |

₹521.2 |

23.2% |

ORDER On August 5, 2024, the company allotted 6,56,000 equity shares to the ‘PG Electroplast Limited Employees Welfare Trust’ under the 2020 Employee Stock Options Scheme.(08th August) |

|

13/08/24 |

Hi-Tech Pipes Ltd. |

₹162 |

₹187.4 |

15.7% |

GOOD TO EXCELLENT RESULTS For Q1 FY24, sales rose 35% YoY to INR 867 Cr, with net profit up 2.3x to INR 18 Cr. QoQ, sales increased 27%, and net profit jumped 64%. (13th August) |

|

14/08/24 |

Bondada Engineering Ltd |

₹3250 |

₹3509 |

8% |

ORDER For Q1 FY24, sales surged 2.2x YoY, and net profit jumped 3.6x. QoQ, sales were flat, while net profit declined 26%. (14th August) |

|

8/07/24 |

Dynamic Services & Security Ltd |

₹276 |

₹281 |

-6.6% |

Share Repurchase Agreement The company has agreed to repurchase 49% of Nacof Nithin Sai Green Energy’s shares from an existing shareholder. |