1) Shakti Pumps Limited

- Business Overview – Company is involved in the manufacturing of energy-efficient pumps and motors. Its latest series of new advanced solar energy-operated pumps has emerged as a prestigious brand in domestic and international markets. These pumps are used for a variety of purposes including cutting and grinding, fire-fighting, managing sewage, and heating and cooling systems. 67% of revenue is generated from government projects, 24% from exports and 9% from others.

- Recent Filings – Shakti Pumps received its first order from Jharkhand, valued at INR 9.4 crore, for designing and installing a solar water pumping system. The project must be completed within 4 months.

- Outlook –

- Company has Secured contract worth $35.3 (INR 295 Cr) million from Government of Uganda for supplying solar-powered water pumping.

- Company is part of the International Solar Alliance (ISA) which has aggregated demand for more than 2,70,000 solar pumps across 22 countries.

- Company’s board has approved investments of INR 114 Cr in Shakti EV Mobility, its wholly-owned subsidiary engaged in the manufacturing and sale of EV motors and other items.

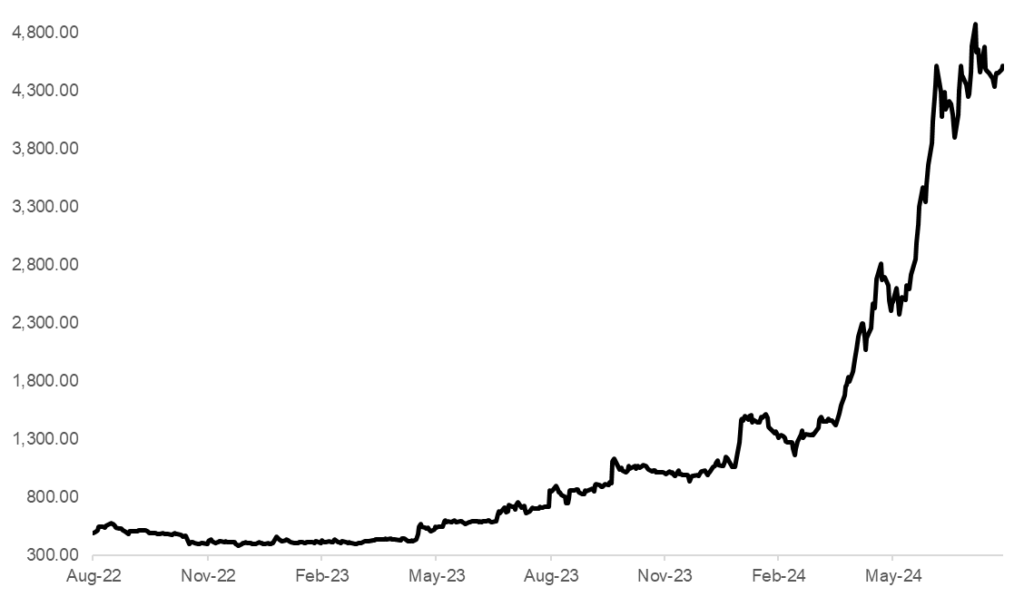

- 2Y Price Chart –

2) MOS Utility Limited

- Business Overview – MOS Utility Ltd is a fintech company which offers a Unified Open API and Wallet platform and is engaged in the business of providing technology enabled digital products and services in the B2C, B2B and financial technology arena through an integrated business model.

- Recent Filings – SKG Asset Management Private Limited bought 1.7L shares of Mos Utility at an average price of INR 196/shares aggregating to INR 3.3 Cr.

- Outlook –

- In H2 FY ’24, the company demonstrated strong financial performance with total income surging to INR 105 crores, EBITDA reaching INR 10.42 crores, and profit after tax standing at INR 6.38 crores. achieving such revenue growth, along with healthy EBITDA and PAT margins, demonstrates the fintech company’s ability to navigate the competitive landscape successfully

- Company anticipates a positive contribution from new services like mutual funds, aiming for a 5% to 10% increase in EBITDA from these segments.

- 2Y Price Chart –

3) Krishna Defence and Allied Industries Limited

- Business Overview – Krishna Defence and Allied Industries Ltd., established in 1996, specializes in developing, manufacturing, and designing Defence Application Products, as well as Kitchen and Dairy Equipment Products. The company operates two manufacturing plants situated in Gujarat, near Vadodara in Kalol and Halol districts. The company derives its revenue from Defence products (71%) and Dairy & Kitchen Equipment (29%).

- Recent Filings – Krishna Defence & Allied Industries Ltd. posted a 2.8x revenue growth in Q1 FY25, reaching INR 45.4 Cr, compared to INR 16.1 Cr in Q1 FY24. With an order book of INR 229 Cr as of June 30, 2024, it has a strong pipeline. Recent ABS and DNV certifications for steel sections will help expand its market beyond naval applications.

- Recent Outlook –

- The company aims to achieve (CAGR) of 40% over the next 3-5 years.

- The company plans to expand its production capacity for key products by 50% in Halol, Gujarat, to meet the rising orders and demand from the defence sector.

- Aiming for revenue to reach 500 crores by the fiscal year 2028.

- The company is allocating resources towards research and development to innovate new products and facilitate growth.

- 2Y Price Chart –

Past Coverages

| Coverage Date | Company | LTP on Coverage Date | Current LTP | % change since coverage | Recent Filings |

| 1/08/24 |

PNGS Gargi Fashion Jewellery Ltd. |

₹841 |

961.1 |

14.3% |

EXCELLENT RESULTS For Q1 FY24, sales surged 2.1x YoY to INR 13.7 Cr (INR 44 Cr under FOFO model), with profit before tax up 93% to INR 2.9 Cr.(01st August) |

|

08/08/24 |

PG Electroplast Ltd. |

₹423 |

₹524 |

23.9% |

ORDER On August 5, 2024, the company allotted 6,56,000 equity shares to the ‘PG Electroplast Limited Employees Welfare Trust’ under the 2020 Employee Stock Options Scheme.(08th August) |

|

13/08/24 |

Hi-Tech Pipes Ltd. |

₹162 |

₹191 |

17.9% |

GOOD TO EXCELLENT RESULTS For Q1 FY24, sales rose 35% YoY to INR 867 Cr, with net profit up 2.3x to INR 18 Cr. QoQ, sales increased 27%, and net profit jumped 64%. (13th August) |

|

14/08/24 |

Bondada Engineering Ltd |

₹3250 |

₹3684.5 |

13.4% |

ORDER For Q1 FY24, sales surged 2.2x YoY, and net profit jumped 3.6x. QoQ, sales were flat, while net profit declined 26%. (14th August) |

|

8/07/24 |

Dynamic Services & Security Ltd |

₹276 |

₹270.6 |

-2.0% |

Share Repurchase Agreement The company has agreed to repurchase 49% of Nacof Nithin Sai Green Energy’s shares from an existing shareholder. |