Written By: Rhythm Garg

Once upon a time, in a bustling metropolis called Dalal Street, there existed a grand bazaar where people gathered to trade not spices or silks, but pieces of ownership in companies. This magical marketplace was known as the Indian Stock Market.

When you hear the term Stock Market, one subject that definitely comes to mind is buying and selling of stocks. Think of the stock market as a marketplace where companies sell pieces of ownership, called shares or stocks. When you buy a stock, you become a part-owner of that company. The stock market is where these shares are bought and sold.

There are 2 main Key Players in this grand bazaar which are –

1. The Companies: These are the businesses, big, medium and small, that offer a piece of their pie (i.e ownership in their company) to the public. They use this money raised from public by selling these pieces to fuel their growth, innovation, and expansion.

2. The Investors: These are the wise folks who buy these pieces of ownership in the company, hoping they’ll grow in value over time. They could be seasoned veterans or newcomers looking to secure their financial future.

The Language of the Bazaar

To navigate this bustling market, you’ll need to learn a few words:

- Shares: These are the individual pieces of ownership which company makes it available for public to buy.

- Stock Exchange: This is the physical or virtual marketplace where shares are bought and sold. In India, the two main exchanges are the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE).

- Stock Market Index: An index is a portfolio of securities that represent a particular market or a portion of a market. This is a measure of the overall performance of a group of stocks which serves as a benchmark. Sensex and Nifty 50 are the two most popular indices in India.

- Ask Price: This is the lowest price at which a seller is willing to sell the stock. It’s like the shopkeeper saying, “I won’t sell this stock for less than this amount.”

- Bid Price: This is the highest price a buyer is willing to pay for the stock. It’s like a customer saying, “I’m willing to pay this much, but no more.”

- Bid- Ask Spread: The difference between the ask price and the bid price is called the spread. It’s like a bargaining range, where the buyer and seller try to negotiate the best deal.

- Volatility: Imagine the stock market as a rollercoaster. Sometimes it’s smooth sailing, gliding gently up and down. Other times, it’s a wild ride, full of twists, turns, and sudden drops. This rollercoaster-like behavior is what we call volatility. It is essentially the measure of how much a stock’s price swings up and down over a certain period.

- Liquidity: Imagine you’re trying to sell your old bicycle. You could put up a sign in your neighborhood or post it online. The faster you can find a buyer and sell your bike, the more liquid your bike is. Similarly, a liquid stock is one that can be easily bought or sold without significantly affecting its price, thus having price stability.

- Volume: Imagine a busy marketplace. Some stalls are crowded with buyers and sellers, while others are relatively quiet. The number of people buying and selling at a particular stall determines its activity level. In the stock market, this activity level is measured by volume. It represents the number of shares of a particular stock that are traded over a specific period, usually a day.

- Market Capitalization: Imagine a delicious apple pie. The whole pie represents a company. You can cut that pie into smaller slices, and each slice is like a share of the company. Now, the value of the entire pie, or the entire company, is its market capitalization. It’s calculated by multiplying the number of slices (shares) by the price of each slice (share price). So, a bigger, more valuable company, like a giant apple pie, will have a higher market capitalization than a smaller, less valuable one.

Market cap = No. of outstanding shares * Current market price

The Bull and the Bear

The mood of the market is often described in terms of two mythical creatures:

- The Bull: A bullish market is when prices are rising, and investors are optimistic about the future.

- The Bear: A bearish market is when prices are falling, and investors are pessimistic about the future.

Long and Short: The Two Sides of the Market

- Long (Bullish): When you’re long on a stock, you’ve bought shares of a company, hoping that the price of those shares will go up over time. You’re betting that the company will do well and that other people will want to buy its shares too. If the price does go up, you can sell your shares for a profit. It’s like buying a valuable toy and hoping it will become even more valuable in the future. If you’re right, you can sell it for a higher price and make money. But if the toy becomes less popular, you might have to sell it for less than you paid for it.

That’s the risk of being long on a stock. The price could go down instead of up. But if you choose good companies and are patient, being long can be a great way to grow your money over time.

Example- If you buy 100 shares of ITC at ₹ 450 then the amount invested will be ₹ 45000 and if you are bullish on the stock and expect the price to rise to ₹ 500 then you can sell your shares at a value of ₹50000, i.e.₹50000 – ₹45000 = ₹5000 will be your profit.

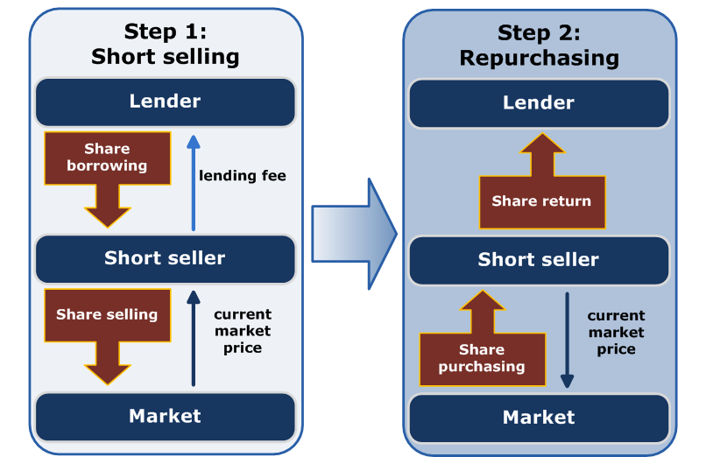

- Short (Bearish): Now the question arises how you can sell something when you don’t own it in the first place right? To answer this, what one does is that an investor borrows shares of a stock they believe will decline in value, sells those shares on the open market, and then buys them back at a lower price to return to the lender. The difference between the selling price and the buying price is the profit made by the short seller. Basically, you are selling the shares first at higher prices, (it’s called borrowed shares because you can’t sell something if you don’t own it), then you are buying back those shares at lower prices and returning these shares back to the owner (who lent you the shares) and keeping the difference with you, whether profit or loss.

- Fun Fact: Here, the lender is safe as he will get back his exact quantity of shares, but your risk is unlimited, as there is a limit to the stock’s value falling i.e. it can go maximum to zero, but for upside, the sky is the limit. This is called shorting also known as short selling.

Example- If you sell/short 100 shares of ITC at ₹500 after borrowing them from the broker, then the value of borrowed shares will be ₹ 50000 and you expect the price to fall to ₹ 450 ultimately buying back these shares at a value of ₹ 45000, then you can return the 100 shares to the broker, making yourself ₹5000, i.e.₹50000 – ₹45000 = ₹5000 will be your profit.

Types of Orders in Stock Market

Let’s imagine you’re shopping for a new Smartphone. You’ve set a budget and have your eye on a specific model. Here’s how different order types would apply to your Smartphone purchase:

- Market Order – When you want to buy a stock right away, you buy it at the best available price. Example: You’re in a hurry and need the phone immediately. You go to the store and buy it at the current market price, without negotiating.

2. Limit Order – You set a maximum price you’re willing to pay for a stock. Your order will only be executed if the stock price reaches or falls below your specified limit price. Example: You’re willing to wait for a better deal. You tell the store you’ll only buy the phone if the price drops below a certain amount.

3. Stop-Loss Order – You set a price at which you want to sell a stock if its price falls below a certain level. This helps limit potential losses. Example: You’re worried the phone’s price might drop significantly. You set a price alert with the store, and if the price falls below that point, you’ll automatically sell it.

4. Stop-Limit Order – A combination of a stop-loss and a limit order. It’s a more controlled way to limit losses. Example: You’re worried about the price drop, but you don’t want to sell at any price. You set a stop price and a limit price. If the stock price reaches the stop price, a limit order is triggered, allowing you to sell at your specified limit price or better.

5. Good-Till-Canceled (GTC) Order – Your order remains active until it’s either executed or canceled by you. This is useful for long-term investors. Example: You’re patient and willing to wait for the right price. You tell the store to hold your order until the phone reaches your desired price, even if it takes weeks or months.

orders

orders

Who determines the Price in the Stock Market?

Imagine you’re in a market selling apples. You start with 10 apples, and you’re willing to sell each for ₹ 100. Now, if 20 people come to the market and want to buy your apples, the demand is high. To meet this demand, you might increase the price to ₹ 150 per apple.

Similarly, if only 5 people want to buy your apples, you might lower the price to ₹ 80 to attract more buyers.

In the stock market, it’s the same principle. If many investors want to buy a particular stock (high demand), the price of that stock will rise. Conversely, if many investors want to sell a stock (high supply), the price will fall.

For example, let’s consider a popular tech company like Apple. If Apple announces a groundbreaking new product, many investors will want to buy its stock, increasing demand. This increased demand will drive up the price of Apple’s stock.

On the other hand, if Apple reports disappointing earnings, investors may lose confidence in the company and start selling their shares. This increased supply will drive the price of Apple’s stock down.

Factors influencing supply and demand:

While the basic principle is supply and demand, many factors can influence these forces, including:

- Company performance: Good earnings reports, new product launches, and strong management can increase demand for a stock.

- Economic conditions: Interest rates, inflation, and overall economic growth can affect investor sentiment and influence stock prices.

- Industry trends: New technologies, changing consumer preferences, and regulatory changes can impact entire industries and the stock prices of companies within them.

- News and events: Company announcements, geopolitical events, and even social media trends can create short-term volatility in stock price.

Now you understand the basic terminologies and orders that run around the market. The stock market is a powerful tool for wealth creation. By understanding its intricacies, you can unlock your financial potential.