Written By: Rhythm Garg

Hey there! Ever heard of a magical ticket that lets you choose whether to buy a candy at a set price, but only if you want to? Well, in the world of stocks, we have something similar called options!

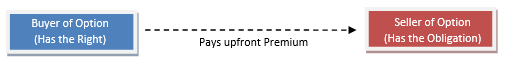

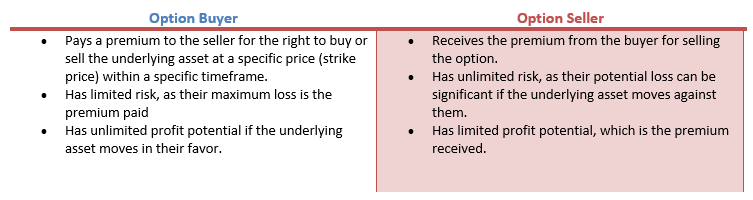

Imagine you’re at a carnival, and you see a vendor selling tickets for a game of chance. You can buy a ticket that gives you the right, but not the obligation, to play the game at a certain price within a specific timeframe. This ticket is like an option in the financial market. In financial terms, an option is a derivative contract that gives the buyer the right to buy or sell an asset at a set price by a set date. The buyer pays a premium for this right. Here Premium is the price of option which the buyer needs to pay upfront. There are basically 2 parties in this contract which are:

- Buyer: Also known as the option holder.

- Seller: Also known as the option writer.

Let’s break down their roles:

Types of Options:

- Call Option (CE): This is like a ticket that gives you the right to buy a specific asset (like a stock or commodity) at a predetermined price (strike price) before a certain date (expiration date). If you think the price of the asset will go up, you can buy a call option and exercise it to buy the asset at a lower price than the market price.

- Put Option (PE): This is like a ticket that gives you the right to sell a specific asset at a predetermined price before a certain date. If you think the price of the asset will go down, you can buy a put option and exercise it to sell the asset at a higher price than the market price.

Why Use Options?

Hedging: Options can be used to protect you from potential losses. For example, if you own a stock and are worried about its price falling, you can buy a put option to sell the stock at a certain price, even if the market price is lower.

Speculation: Options can also be used to make a profit by betting on the direction of the market. For example, if you think a stock price will go up, you can buy a call option and hope to sell it at a profit before the expiration date.

Now, as you know the basic difference between an Option buyer and Option seller, types and the usage of options; you should know some basic terminology that revolve around options in order to trade in it.

Option terminology: There are several terms used in the options market. Let us understand those terms with the help of the following example: Quote for a Nifty call option as on Nov 25, 2024:

| Instrument type: | Option Index |

| Underlying asset: | Nifty 50 |

| Expiry date: | Nov 28, 2024 |

| Option type: | Call European |

| Strike Price: | 23900 |

| Open price: | 125.7 |

| High price: | 130.8 |

| Low price: | 93.5 |

| Close price: | 126.5 |

| Traded Volume: | 1,50,000 contracts |

| Open Interest: | 16,80,820 |

| Underlying value (Spot Value): | 23850.2 |

Features of options

- Underlying Asset: Options are contracts that derive their value from an underlying asset. It’s the real asset that gives the derivative its value. This asset could be a stock, index, commodity, currency, or even another option. Example- Individual stocks (like Apple, Google, or Reliance Industries) ,Stock indices (like the Nifty 50, Sensex, or S&P 500), Agricultural products (like wheat, corn), Metals (like gold, silver, or copper), Energy products (like crude oil), Foreign currencies (like US Dollar, Euro, or Japanese Yen), Government bond yields.

These underlying assets are the foundation of various derivative instruments like options, futures, and swaps.

2. Strike Price or Exercise Price (X): A strike price is the predetermined price at which the holder of an option can buy (for a call option) or sell (for a put option) the underlying asset. It’s like a fixed price tag attached to an option contract. It’s like a fixed price tag attached to an option contract.

Example – Imagine you’re at a grocery store. You see a special offer on apples: you can buy a coupon that allows you to buy a basket of apples at a fixed price of ₹ 500, regardless of the current market price. The apple basket is the underlying asset. The ₹ 500 price is the strike price.

3. Spot Price (S): It refers to the current market price of the underlying asset. This is the price at which the asset can be bought or sold immediately. For example, if you’re trading options on a stock like Apple, the spot price would be the current market price of Apple’s stock.

Why is the strike price important?

- Moneyness: The relationship between the strike price and the current market price determines whether an option is in-the-money, out-of-the-money, or at-the-money.

- Option Pricing: The strike price is a key factor in determining the option’s premium or price.

- Profit and Loss: The strike price plays a crucial role in calculating the potential profit or loss from an option position.

4. Option Premium: The buyer of an option pays a premium to the seller for the right to exercise the option. This premium is the cost of the option.

Example – Let’s say the current Nifty 50 index is trading at 24,000. You believe the index will rise in the next month. To capitalize on this belief, you can buy a call option on the Nifty 50 with a strike price of 24,500 and an expiration date of one month. The price you pay to buy this call option is the option premium. Let’s say the premium for this option is Rs. 200.

What does this mean?

- Right, Not Obligation: By paying Rs. 200, you’ve bought the right, but not the obligation, to buy the Nifty 50 at 24,500, regardless of its market price on the expiration date.

- Potential Profit: If the Nifty 50 rises above 24,500, you can exercise your option, buy the index at 24,500, and sell it at the higher market price. Your profit would be the difference between the market price and the strike price, minus the Rs. 200 premium you paid.

- Potential Loss: If the Nifty 50 remains below 24,500 on the expiration date, your option will expire worthless. Your maximum loss is limited to the Rs. 200 premium you paid.

5. Expiration Date: Every option contract has a specific expiration date. After this date, the option becomes worthless. The day on which a derivative contract ceases to exist is known as the expiration date. It is the last trading date/day of the contract.

Example – The Nifty and Bank Nifty option contracts expire on the last Thursday of the expiry month (or, on the previous trading day, if the last Thursday is a trading holiday). The weekly and monthly options on the Nifty Financial Services index expire on the Tuesday of the expiry week and the last Tuesday of the expiry month respectively.

Why is the expiration date of an option important?

- Time Value: The time value of an option decreases as the expiration date approaches. This is because there’s less time for the underlying asset’s price to move in a favourable direction.

- Option Pricing: The expiration date is a key factor in determining the option’s premium. Options with longer expiration dates typically have higher premiums.

- Investment Strategy: The choice of expiration date can influence the risk and reward profile of an options strategy. Shorter-term options offer higher volatility but lower time value, while longer-term options have lower volatility but higher time value.

6. Time Value and Intrinsic Value: The price of an option is composed of two components:

Intrinsic Value: This is the immediate profit or loss that can be realized if the option is exercised immediately.

Time Value: This is the potential for the option to increase in value as the expiration date approaches.

7. Open Interest (OI): It is a crucial metric in the options market. It represents the total number of outstanding option contracts that have not yet been exercised, expired, or offset. In simpler terms, it’s the total number of contracts that are still “open” or active.

How does it work?

- New Contracts: When a new option contract is created, it adds to the open interest.

- Closing Positions: When an existing option contract is closed or expires, it reduces the open interest.

Example: If the open interest for a particular Nifty 50 call option is 10,000 contracts, it means that 10,000 contracts of that specific option are still active and have not been closed or expired.

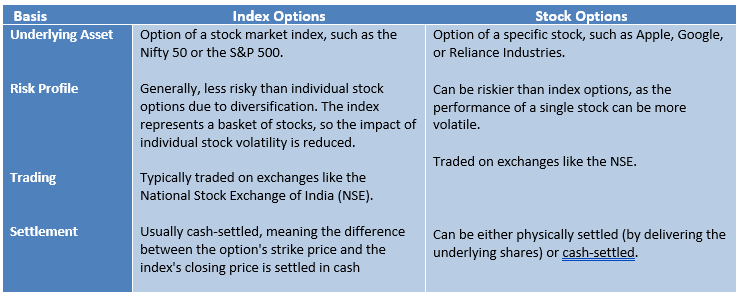

Index Options vs. Stock Options: A Quick Comparison

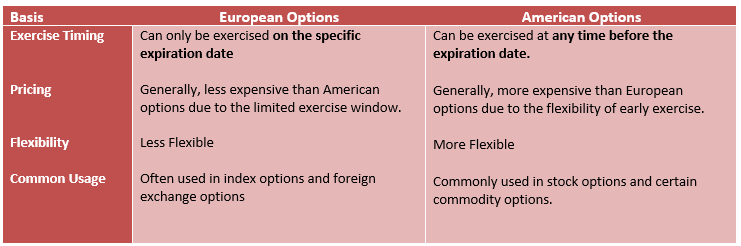

European vs. American Options: A Quick Comparison

India primarily follows the European style of options. This means that options contracts in India can only be exercised on their specific expiration date. By understanding this distinction, traders can better assess the potential risks and rewards associated with options trading in the Indian market.

Why the Difference in Pricing?

Early Exercise: American options offer more flexibility, which can be valuable in certain situations, such as when the underlying asset pays dividends. This increased flexibility is reflected in the higher premium.

Now that know the basics of options trading, you’re equipped with the knowledge to embark on an exciting adventure in the financial world. From understanding the basics of call and put options to knowing the intricacies of strike prices, expiration dates, and open interest, you’ve taken the first step towards mastering this powerful tool.